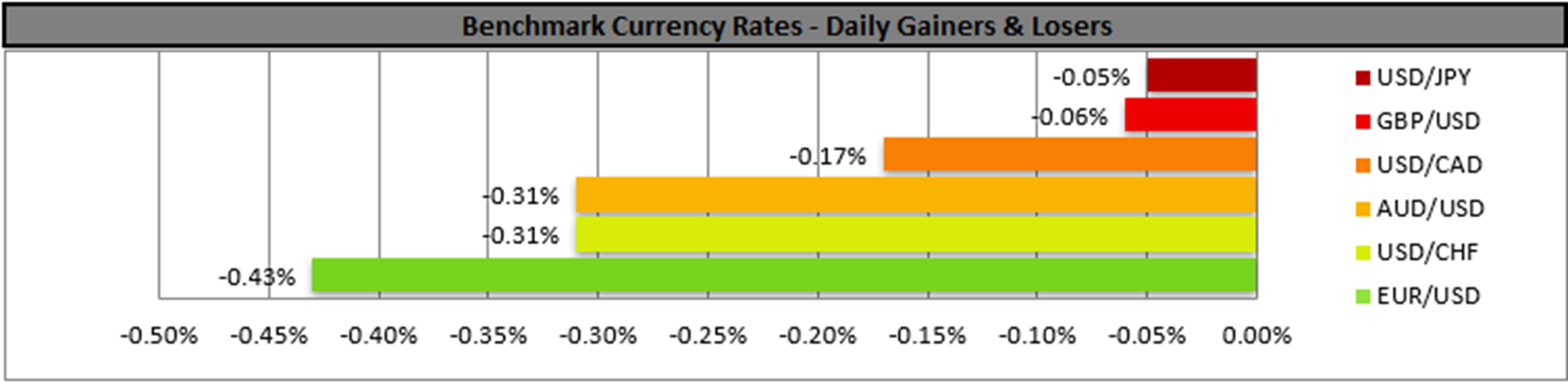

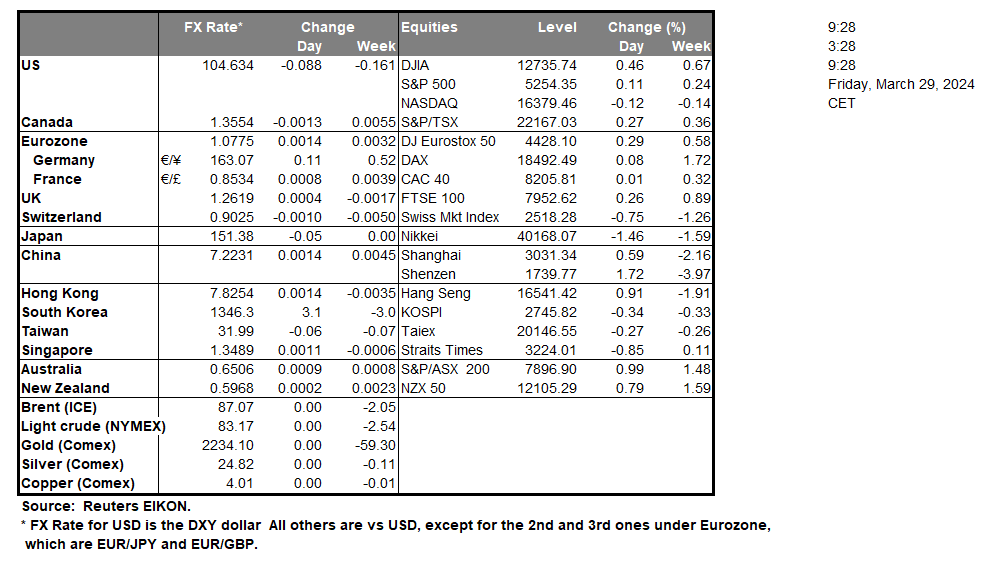

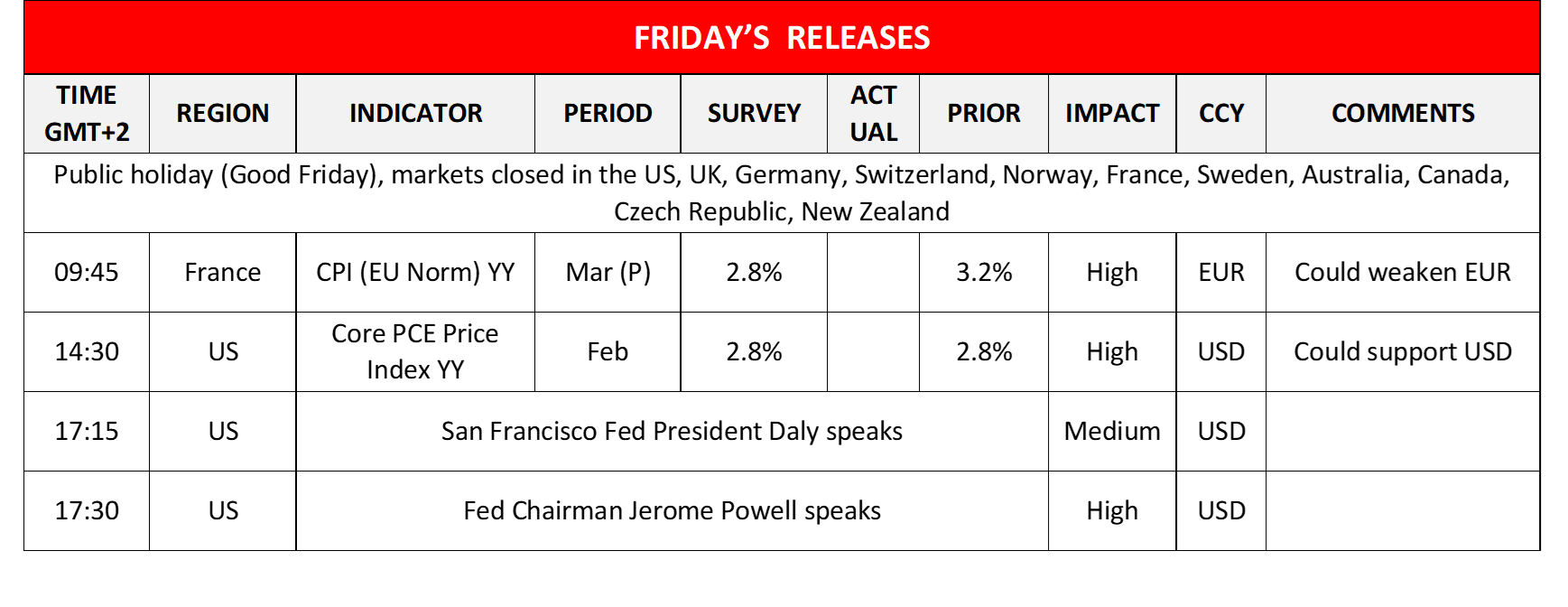

The USD edged higher yesterday as greenback traders may have been encouraged by the acceleration for the final GDP rate for Q4, but also the lower-than-expected weekly initial jobless claims figure and the higher-than-expected final University of Michigan consumer sentiment indicator for March. Today we highlight the release of the Core PCE price index for February, which is the Fed’s favorite inflation metric. Should the rates fail to slow down, it could imply the persistence of inflationary pressures in the US economy and thus could provide some support for the USD. On the monetary front we note the planned speech of Fed Chairman Powell later on and should he push back against the market expectations for the Fed to cut rates three times in 2024, we may see the USD gaining some support as the market may be forced to reposition itself.

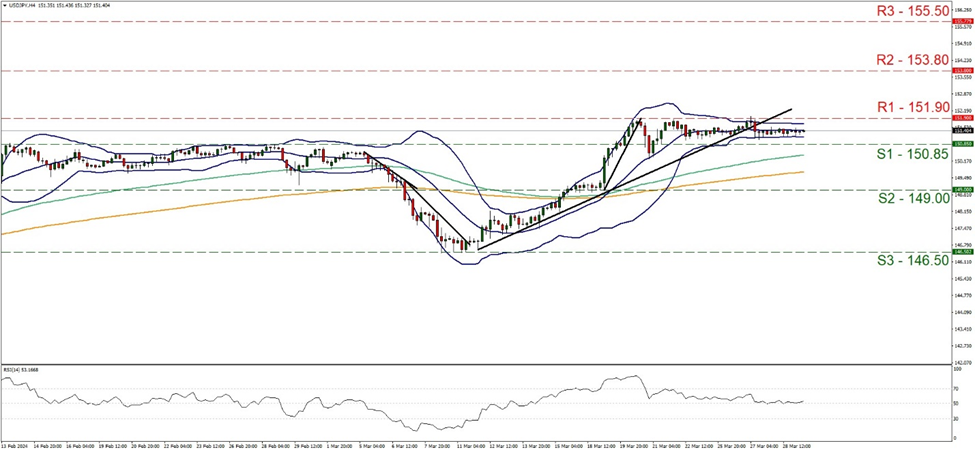

USD/JPY maintained a sideways motion yesterday between the 151.90 (R1) and the 150.85 (S1) levels. Overall we tend to see the case for the pair continue its sideways motion for the time being given also that the RSI indicator continues to run along the reading of 50. On a more fundamental level, though we tend to maintain our worries for a possible market intervention for JPY’s support, by the Japanese Government, especially given that Japan’s Finance minister Suzuki repeated his warnings, as they see the weakening of JPY to be due to speculative reasons. Should the Japanese government actually proceed with such an operation, we may witness an abrupt and intense movement downward of USD/JPY. Yet under more normal market conditions for a bearish outlook we would require the pair’s price action to break the 150.85 (S1) support line and aim for the 149.00 (S2) support level. Should the bulls take over, we may see the pair breaking the 151.90 (R1) resistance line and aiming for the 153.80 (R2) resistance base.

Across the pond, EUR traders are expected to keep a close eye over the release of the preliminary HICP rate of France for March. The rate is expected to slow down to 2.8% yoy if compared to February’s final release which was at 3.2% yoy. Should the rate slow down as expected or even more we may see the common currency slipping as the easing of inflationary pressures in the second largest economy of the Eurozone may act as a prelude for the Eurozone as a whole and enhance market expectations for the ECB to start cutting rates early. It should be noted that yesterday, ECB’s Panetta flagged the easing of risks related to price stability in the Zone, thus the conditions necessary for the bank to start cutting rates seem to have started to form. The Governor of Bank of Italy highlighted that ECB’s restrictive monetary policy is dampening demand and thus contributing to a rapid fall in inflation.

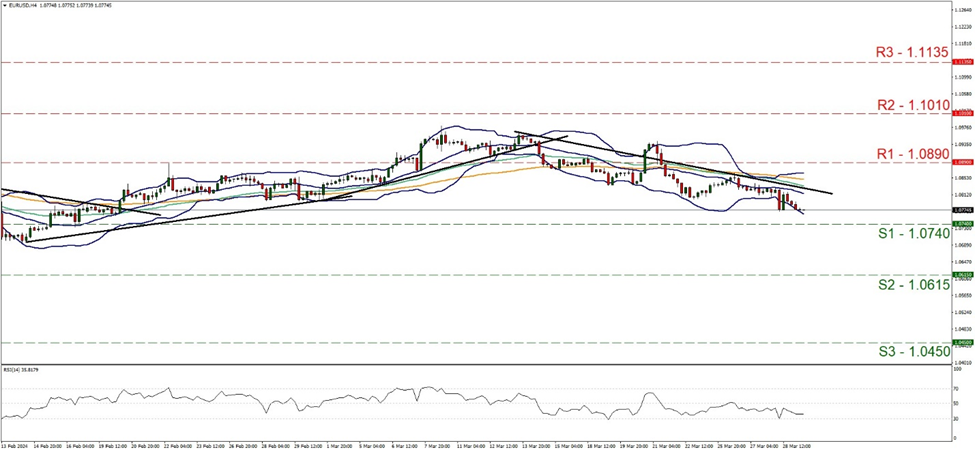

On a technical level, EUR/USD continued to fall yesterday aiming for the 1.0740 (S1) support line. we tend to maintain our bearish outlook as long as the downward trendline remains intact and given that the RSI indicator is below the reading of 50, aiming for the reading of 30, thus implying the presence of a bearish sentiment among market participants. Should the selling interest be extended we may see the pair breaking the 1.0740 (S1) support line and aiming for the 1.0615 (S2) support level. Should buyers be in charge for the pair’s direction, we may see EUR/USD reversing course and breaking initially the premenetioned downward trendline in a first signal that the downward motion has been interrupted, and continue to break the 1.0890 (R1) resistance line thus paving the way for the 1.1010 (R2) resistance level.

その他の注目材料

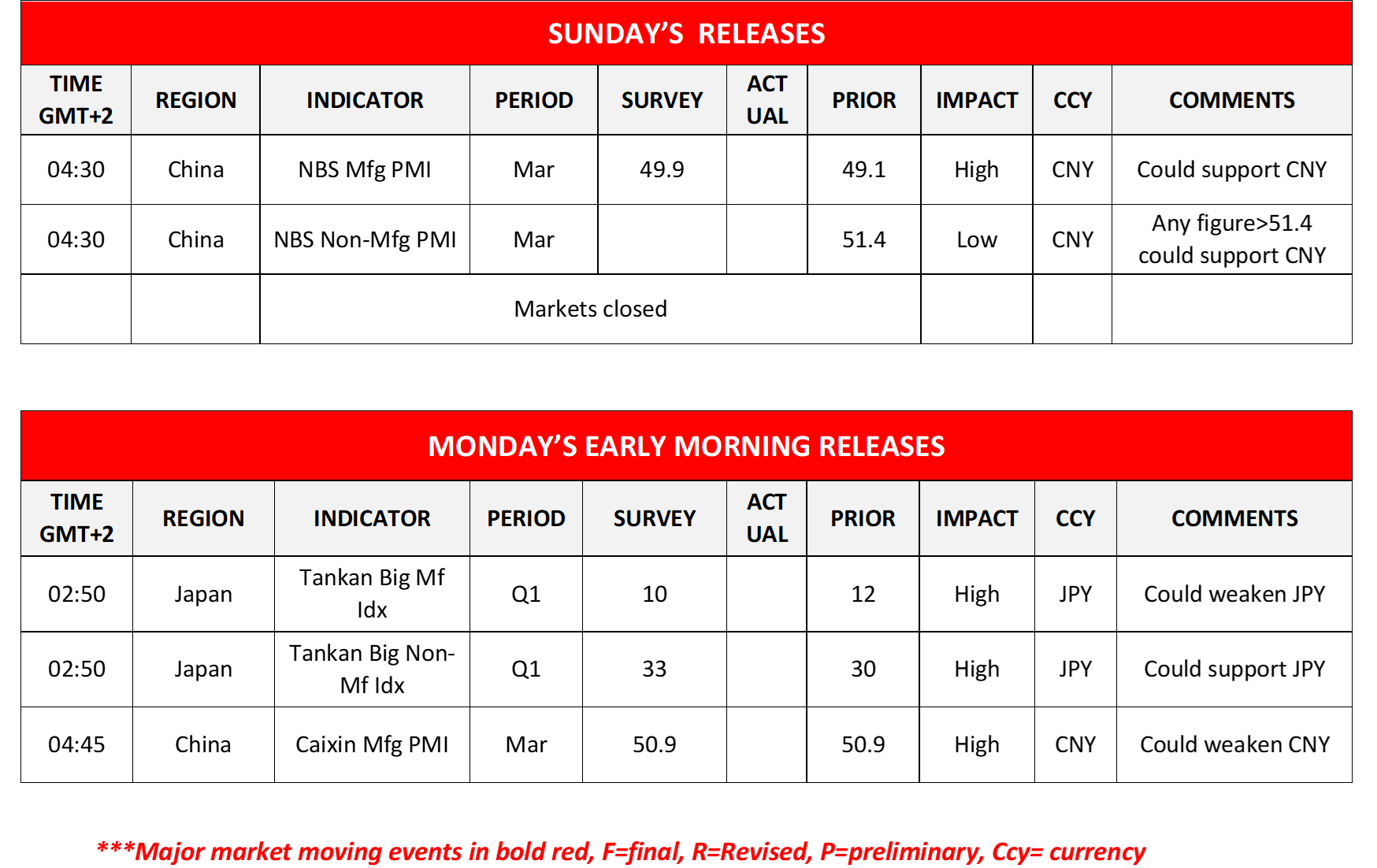

For today we note that it’s a Public holiday in many countries and markets are to be closed in the US, UK, Germany, Switzerland, Norway, France, Sweden, Australia, Canada, Czech Republic, New Zealand, so some thin trading conditions may be present. On Monday’s Asian session, we get Japan’s Tankan indexes for Q1 and China’s Caixin manufacturing PMI figure for March.

USD/JPY 4時間チャート

Support: 150.85 (S1), 149.00 (S2), 146.50 (S3)

Resistance: 151.90 (R1), 153.80 (R2), 155.50 (R3)

EUR/USD 4時間チャート

Support: 1.0740 (S1), 1.0615 (S2), 1.0450 (S3)

Resistance: 1.0890 (R1), 1.1010 (R2), 1.1135 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。