The Eurozone’s Preliminary GDP rate for Q4 is due to be released in a few hours. According to estimates, the Eurozone’s economy as a whole is expected to stagnate at around 0%. Should such an event occur, it could spark concerns that the Eurozone may be nearing recession territory and as such could weigh on the common currency. Should it come in higher than expected it could provide support for the common currency.

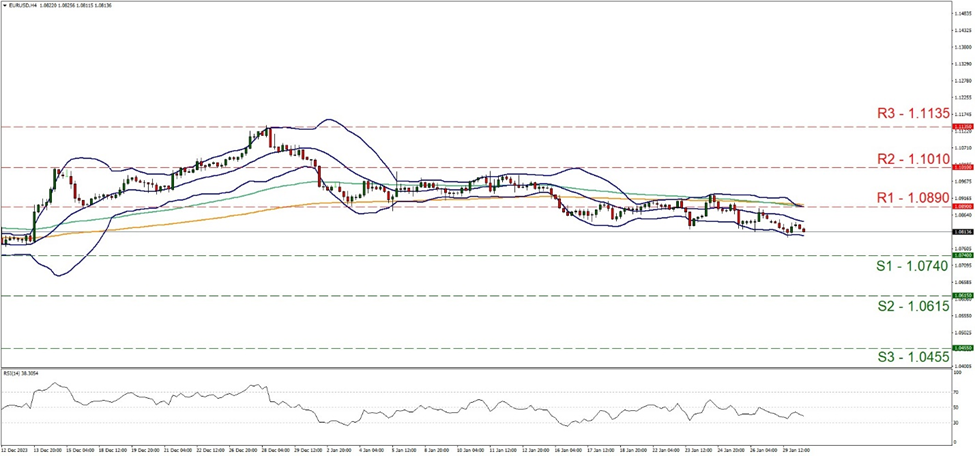

EUR/USD seems to have started to build up some bearish tendencies as lower peaks and troughs have started to form and the pair is currently aiming for the 1.0740 (S1) support line. For the time being though, we tend to maintain our bias for the sideways motion to continue, yet at the same time also note that the RSI indicator remains between the reading of 50 and 30 implying a residue of a bearish sentiment in the market and if it intensifies may drag the pair lower. In case an intense selling interest is expressed by the market, we may see EUR/USD breaking the 1.0740 (S1) support line and aim for the 1.0615 (S2) support level. On the flip side, should the pair find extensive buying orders along its path we may see EUR/USD breaking the 1.0890 (R1) resistance line and aim for the 1.1010 (R2) resistance nest.

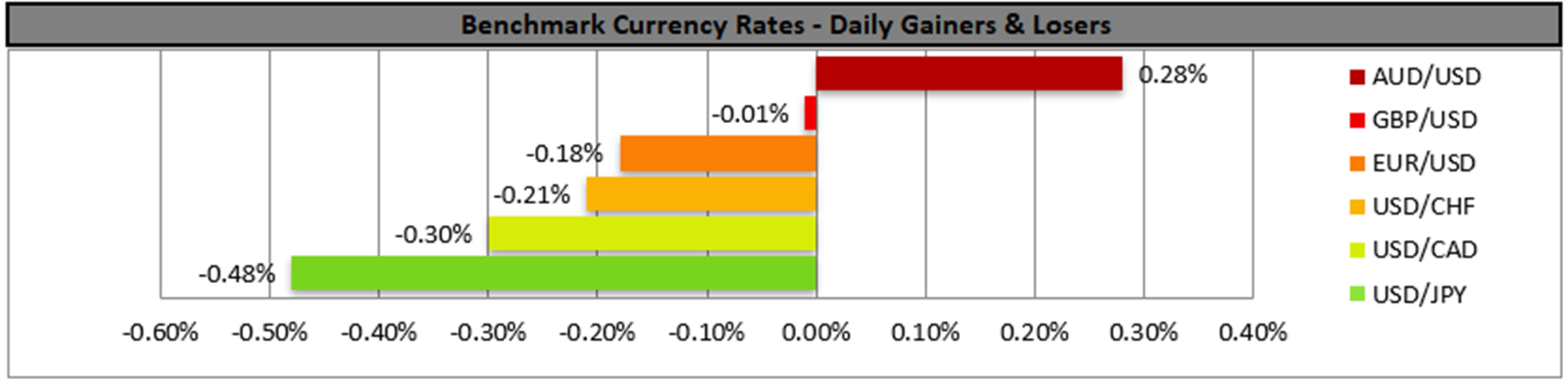

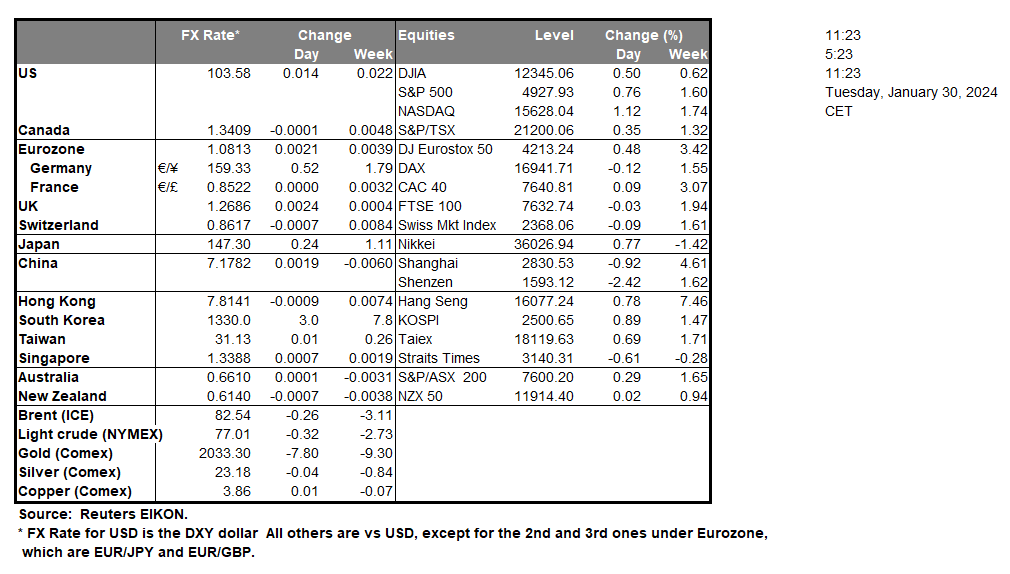

US stock markets tend to focus on the earnings releases today as we get the earnings reports of Pfizer (#PFE), General Motors (#GM), Microsoft (#MSFT), and Google (#GOOG). Our main point of interest is currently the tech sector given also that more high-profile Mega Tech companies are to release their earnings reports in the following days. As for precious metals, we highlight the risk factor for Gold’s price as on a fundamental side the increased tensions in the Middle East could spark a wave of buying interest for the precious metal, as a safe haven instrument, should the tensions escalate further. Furthermore, we note the Fed’s interest rate decision on Wednesday as another critical point for gold’s price, as should the Fed sound more hawkish than expected we may see the USD gaining some ground and thus gold’s price weakening, given the perceived negative correlation of the two trading instruments. Similarly the release of January’s US employment report could pose another serious test for gold’s price on Friday.

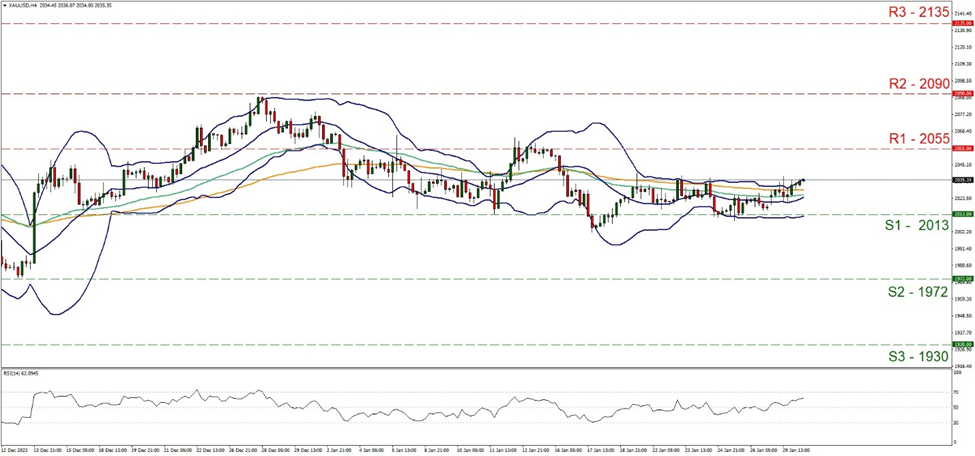

On a technical level, we note gold’s slight bullish tendencies as the price action forms higher peaks and troughs, aiming for the 2055 (R1) resistance line. For the time being we tend to maintain our bias for the sideways motion of the precious metal’s price, to continue, yet highlight the upward potential for gold’s price. Similarly, the RSI indicator has been rising, aiming for the reading of 70, implying the build-up of a bullish sentiment in the market for the precious metal. Should the bulls take charge of the precious metal’s direction, we may see gold’s price breaking the 2055 (R1) resistance line and aim for the 2090 (R2) resistance nest. On the flip side, should the bears take over we may see gold’s price breaking the 2013 (S1) support line and aiming for the 1972 (S2) support hurdle.

その他の注目材料

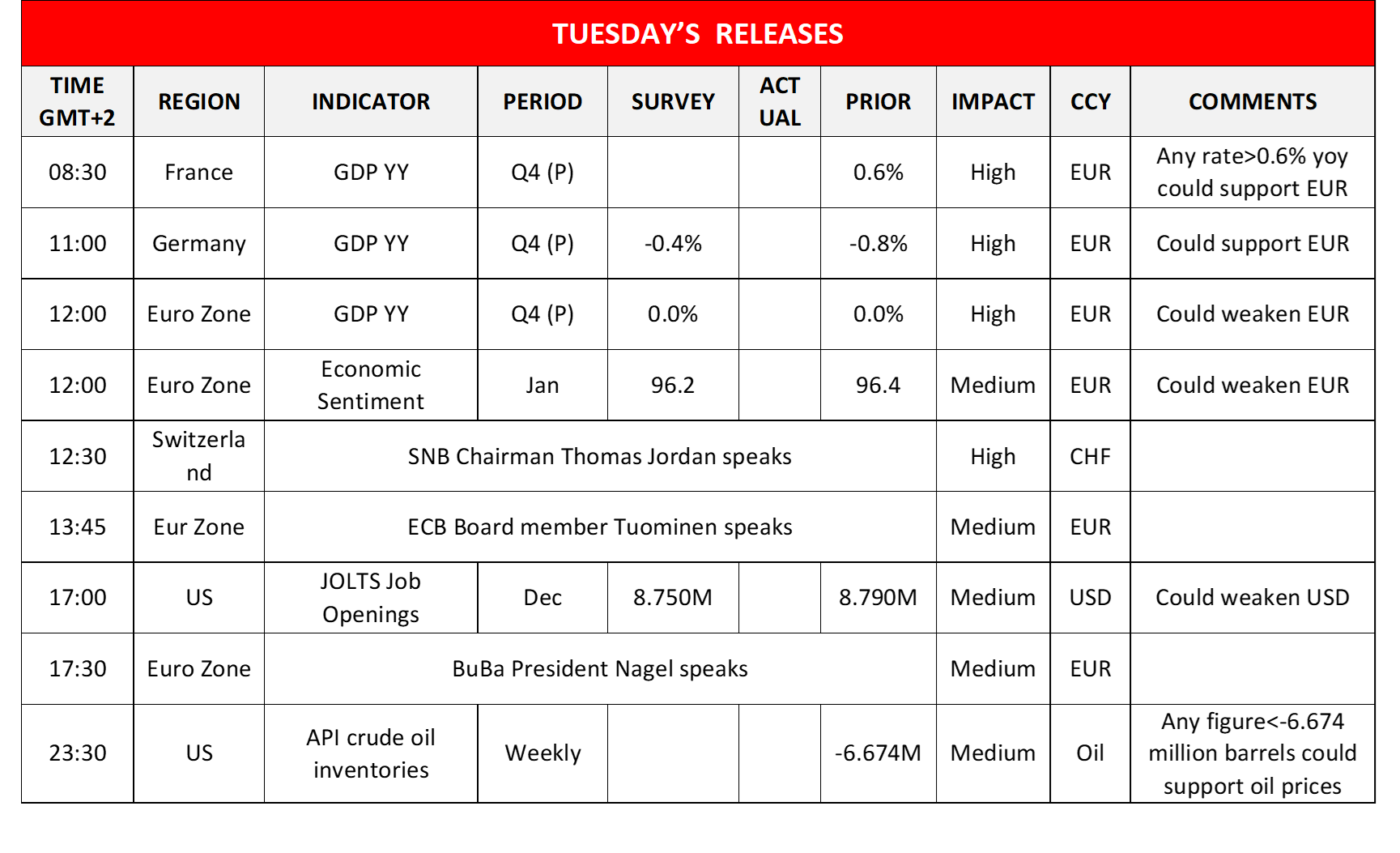

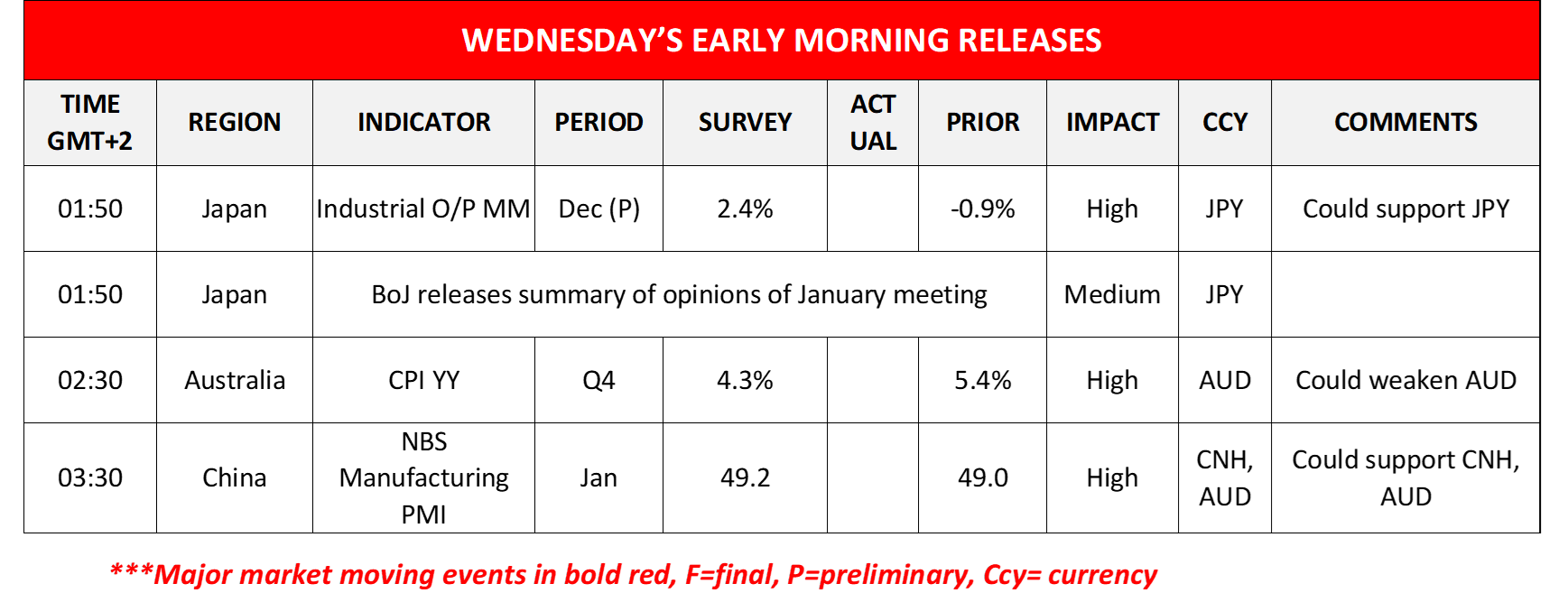

In the European session today, we highlight the release of France’s, Germany’s and the Eurozone’s preliminary GDP rates for Q4, while from the Eurozone we also get January’s economic sentiment. On the monetary front, we note that SNB Chairman Thomas Jordan and ECB Board member Tuominen are scheduled to make statements. In the American session, we note the release of the US JOLTS job openings figure for December, while oil traders may be more interested in the release of the weekly API crude oil inventories figure and EUR traders in BuBa President Nagel’s comments. During the Asian session, we note the release of Japan’s preliminary industrial output for December, Australia’s CPI rate for Q4 and China’s NBS manufacturing PMI figure for January. On the monetary front, we note for JPY traders the release of BoJ’s summary of opinions for the January meeting.

EUR/USD 4時間チャート

Support: 1.0740 (S1), 1.0615 (S2), 1.0455 (S3)

Resistance: 1.0890 (R1), 1.1010 (R2), 1.1135 (R3)

XAU/USD 4時間チャート

Support: 2013 (S1), 1972 (S2), 1930 (S3)

Resistance: 2055 (R1), 2090 (R2), 2135 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。