US equities gained ground since our last report, as all major indexes related to US stock markets were on the rise. Today we are to discuss fundamentals related to US equities such as the US-Sino trade talks, the release of May’s US CPI rates, the developments in the Fed and also have a look at Oracle’s earnings release and Meta’s acquisition of Scale AI. On a technical level, we are to provide an analysis of S&P 500’s daily chart.

US-Sino trade talks provide little clarity

US-Sino trade talks are continued ion London, capturing traders’ attention. In latest news, US and China are reported to have agreed on a framework of a deal for the trade relationship. The framework is to be presented to the leaders of the two countries for approval. The result of the agreement as per US Commerce Secretary Lutnick, should be an easing of the Chinese restrictions on exports of rare earth and magnets. On the other hand, we suspect that the US will be easing their restrictions on the exports of US chips to China. For the time being and with the risk of sounding pessimistic the announcements tend to provide little clarity in assessing the possible outcome of the negotiations. Hence not only the stakes are high but the uncertainty remains high as well, with the issue remaining fundamental to the direction of US equities. Should we see the negotiations resulting in a thawing of the tensions in the US-Sino trading relationship it could support US equities. On the flip side should the negotiations fall through and the tensions in the US-Sino relationships escalate further, we may see the issue having a strongly bearish effect on US stock markets.

May’s US CPI rates and the Fed

As these lines are written, the US CPI rates for May are still to be released and could potentially shake US stockmarkets. Should the rates imply a persistence of inflationary pressures, or even show an acceleration beyond market expectations, we may see the release weighing on US equities as the release may enhance the Fed’s doubts for further rate cuts, hence the bank’s monetary policy may remain tight for longer. Such a development may force the market to lessen its expectations, which currently seem to imply two rate cuts, one in September and one in December, as per Fed Fund Futures. On the other hand, a possible slowdown of the rates would imply an easing of inflationary pressures in the US economy thus supporting US equities. Please note that the Fed, is to release its next interest rate decision, next Wednesday and is expected to be closely watched by traders and we’ll be covering it in our next Equities outlook. Furthermore in regards to the Fed, we note that US President Trump was reported stating that he will name a successor “very soon” to replace Fed Chairman Powell, whose term ends in May 2026. Suspicions seem to be concentrating around US Treasury Bessent but in any case we would like to remind our readers of US President Trump’s wishes for an extensive dovish policy of the bank so that the fiscal policy of the US Government could be enhanced. Should we see the US President naming a person that could serve such a direction, we may see US stock markets getting some support, while a candidate that will be deemed as more hawkish could weigh on US stock markets.

Oracle’s earnings release and Meta’s acquisition of Scale AI

We make a start with the release of Oracle’s earnings report in today’s aftermarket hours. The current expectations are for the company to raise its EPS figure from prior 1.02 to 1.64 and revenue figure to rise to 15.58B if compared to prior figure of 14.39B. Overall we see the expectations as being a bit optimistic, yet should the company be able to reach it or even surpass it we may see its share price getting some support. But it’s not all going to be about the figures, we intend to keep a close eye on the Oracle Cloud infrastructure growth which tends to be fuelled by AI demand.

We also note that as per Reuters, Meta has agreed to take a 49% in artificial intelligence startup Scale AI for $14.8 billion. It should be noted that the release and performance of Meta’s Llama 4 large language models, last April, may have disappointed market participants while the release of its flagship “Behemoth” AI model was delayed, both issues enhancing market worries that the company may be falling behind in the AI race. Let’s not forget that Meta is also facing legal issues related to its acquisition of Instagram and WhatsApp, which also tend to weigh fundamentally on its share price. The acquisition of Scale AI could be supportive for Meta’s share price as it could enhance expectations for an acceleration of the company’s AI transformation.

テクニカル分析

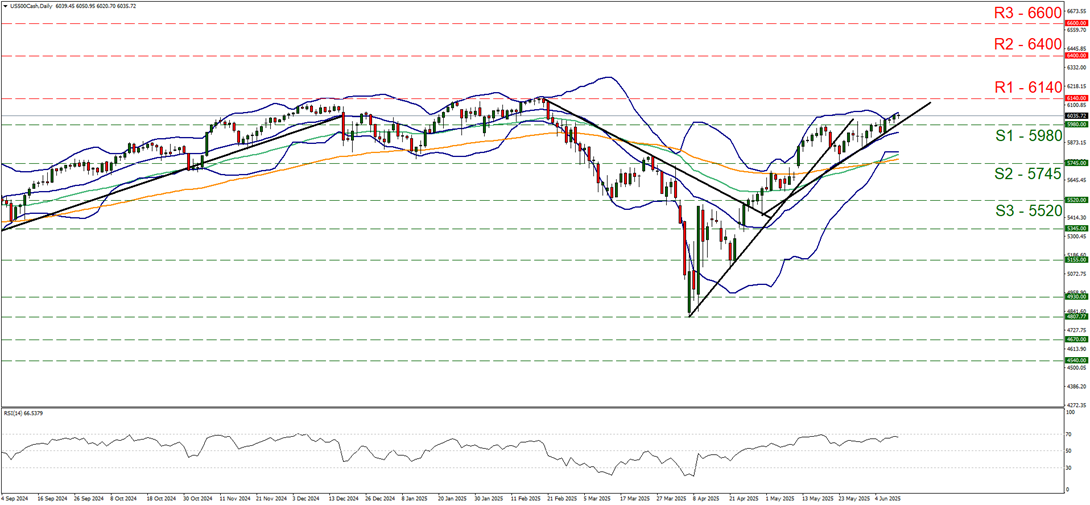

US500 Daily Chart

- Support: 5980 (S1), 5745 (S2), 5520 (S3)

- Resistance: 6140 (R1), 6400 (R2), 6600 (R3)

S&P 500 continued to rise over the past week, breaking the 5980 (S1) resistance line, now turned to support. We maintain for the time being our bullish outlook given that the upward trendline supporting its remains intact. Furthermore we note that the RSI indicator continues to remain just below the reading of 70, implying a strong bullish market sentiment on behalf of market participants. Also despite a narrowing of the Bollinger bands, their median maintains an upward direction. Both indicators imply a bullish perspective for the index. Should the bulls maintain control over the index’s price action we may see it breaking the 6140 (R1) resistance line that marks the latest All Time High level for the index, with the next possible target for the bulls being set at the 6400 (R2) resistance level. A bearish outlook currently seems to be remote at the current stage and for its adoption we would require the index’s price action to initially break the prementioned upward trendline, signalling an interruption of the index’s upward movement, and continue to break the 5980 (S1) support level, and start aiming the 5745 (S2) support base.

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。