US stockmarkets seem to have edged higher since our last report as all three major US stockmarket indexes, Dow Jones, S&P 500 and Nasdaq, edged higher, yet a relative decisiveness to push them to new all-time high levels, seems to be lacking. In this report we are to discuss some fundamental issues and continue to have a look at NVIDIA’s stocksplit and Microsoft’s movement and finish off the report wit a technical analysis of Dow Jones’ daily chart.

Financial data ahead

In the coming days, we get a number of financial data releases which could have a bearing on the direction of US stock markets. We highlight the release of the US employment report for May with its NFP figure on Friday. The Non-Farm Payrolls figure is expected to rise from 175k in April to 185k, the unemployment rate to remain unchanged at 3.9% and the Average earnings growth rate also to remain unchanged at 3.9% yoy. Overall the forecasts tend to note a pause in the easing of the US employment market if not a slight tightening, given the expected rise of the NFP figure. Should the actual rates and figures meet their respective forecasts, we may see the release weighing on US stock markets, as the release may allow the Fed to maintain rates high for longer. Yet the uncertainty regarding the actual rates and figures is high given that past releases had disproven forecasts a number of times and given that the stakes are rather high we may see volatility being on the rise at the time of the release. Furthermore let’s not forget that the market may start preparing itself ahead of the release hence we may see the market’s expectations starting to affect the path of US stock markets from Thursday onwards. Yet besides the release of the US employment report for May we would also like to note the release of the ISM non manufacturing PMI figure for the past month later today, given the wide and unexpected drop of the sister PMI indicator for the US manufacturing sector, implying a deeper contraction of economic activity for the sector that may have darkened the economic outlook of the US.

NVIDIA’s stocksplit

NVIDIA (#NVDA) is to proceed with a stocksplit this week and at the end of Friday’s session, NVIDIA shareholders are expected to get an additional nine shares for each share they hold. Hence the stocksplit is to divide the value of the share by ten in the following session. That would practically mean that should NVIDIA’s share price close on Friday at around $1170 it would open on Monday at around $117. On a technical level, the change does not make NVIDIA’s shareholders any richer or poorer as the drop of the share’s price is to be compensated by the increase of the number of shares held by each shareholder. On a fundamental level though, that would mean that the reduced price of NVIDIA’s shares could make them far more attractive and especially given the AI frenzy in US stockmarkets could intensify demand for NVIDIA shares in the long run.

Microsoft’s shift towards AI intensifies

The release of the latest earnings report of Microsoft (#MSFT) tended to highlight the shift of the company’s focus towards AI. It was characteristic that Amy Hood, MSFT’s chief financial officer stated that “Currently, near-term AI demand is a bit higher than our available capacity,”. So it should be no surprise for the markets that the company cut hundred of jobs from its Azure cloud business, to support investment in AI, as per the email sent to employees. We expect the shift in the company’s orientation towards AI to have a positive effect on the company’s share price in the longer run, given also the market’s focus on the sector as mentioned in the NVIDIA comment as well.

テクニカル分析

#US100 Daily Chart

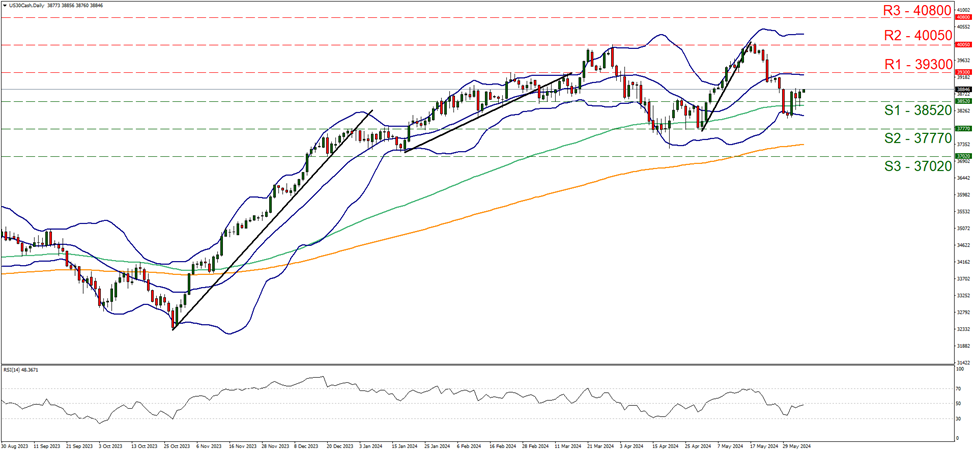

Support: 38520 (S1), 37770 (S2), 37020 (S3)

Resistance: 39300 (R1), 40050 (R2), 40800 (R3)

US30 edged higher since our last report breaking the 38520 (S1) resistance line now turned to support, yet the bullish tendencies for the index remain unconvincing for the time being. We note that the RSI indicator below our daily chart is nearing the reading of cut-off point of 50 yet remains still below it, which on the one hand tends to imply that the bearish sentiment is fading away yet a bullish sentiment has still to evolve among market participants. The 20 moving average (MA, blue line) which is also the median of the Bollinger bands seems to be flattening out, while the Bollinger Bands remain pretty wide which could allow for the possibility of increased volatility. Overall we tend to maintain a bias for a sideways motion, yet at the same time issue a warning for some bullish tendencies. For a bullish outlook we would require the index to break the 39300 (R1) resistance line and take aim for the 40050 (R2) resistance base which is practically an all time high for the index. Should the R2 be broken we set the 40800 (R3) as the next possible target for the bulls. On the flip side for a bearish outlook we would require a clear break below our 38520 (S1) support level, with the index aiming for the 37770 (S2) support line. Even lower we note the 37020 (S3) support barrier that has not seen any price action since late December last year.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。