All three major US stock market indexes, moved higher last week, yet at the time of this report appear to be in the reds since Monday. Furthermore, the earnings season seems to be slowly driven to a close. On a fundamental level, we discuss Google’s recent AI controversy, Microsoft’s AI investment investigation by the EU and finish off with Apple’s refocusing towards AI development. In this report, we intend to have a look at these issues and also discuss the latest AI buzz and conclude our report with a technical analysis of Apple’s (#AAPL) stock price.

Google’s AI headache

Google’s Gemini AI service is under fire, following accusations that the company’s image-generating service, produced racially inaccurate depictions of historical figures, in addition to its chatbot also producing controversial statements according to various media outlets. The public backlash against the company appears to have weighed on the company’s stock price which closed lower on Monday, by roughly 3%. Furthermore, the alleged bias in the company’s AI, could prove to be a setback to Google’s efforts to rival other AI such as ChatGPT. Moreover, the accusations leveraged against the Gemini AI, could result in delays for Google’s AI development, which could allow its rivals to leap ahead in terms of development. As such, should Google be forced to play “catch-up” with its competitors, it could lead to a smaller share of the “AI market share”, thus potentially resulting in lower “AI revenue” for the company in the future.

Microsoft under investigation

According to Bloomberg, Microsoft’s (#MSFT), Mistral AI investment is set to be examined by the EU’s competition watchdog. On Monday the French company Mistral AI announced a “strategic partnership” with Microsoft which appears to have amounted to €15 million, in which the Mistral AI’s artificial intelligence models, would be made available to customers of Microsoft’s Azure cloud. Should the preliminary examinations by the EU lead to a full investigation by regulators, it could potentially weigh on the company’s stock price, in the event that improprieties are discovered or in the scenario that the investment is blocked. However, should the deal be allowed to proceed, Microsoft’s stock price, could potentially find support as the company’s association to AI developments, may boost optimism surrounding the company’s future outlook.

Apple allegedly cancels its EV car plan and opts for AI development

According to various media outlets, Apple (#AAPL) is scrapping its plans to build its own EV car and instead opting to allocate more resources to its AI development according to Bloomberg. The switch in focus from Apple could allow the company to capitalize on the ongoing AI rally and as such, could boost market optimism for the company’s stock price, in the expectation that future revenue stemming from AI services may increase. However, there appears to be some concern that the company is already behind its rivals when it comes to incorporating AI technology into its products and as such, the potential boost to the company’s stock price may be muted.

テクニカル分析

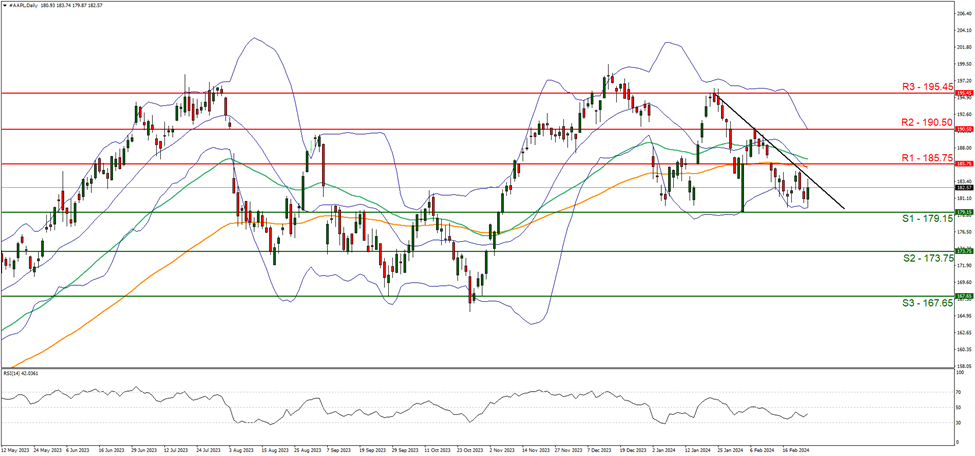

#AAPL Daily Chart

Support: 179.15 (S1), 173.75 (S2), 167.65 (S3)

Resistance: 185.75 (R1), 190.50 (R2), 195.45 (R3)

Apple (#AAPL) on a technical level, appears to be moving in a downwards fashion. We maintain a bearish outlook for the company’s stock price and supporting our case is the downwards-moving trendline which was incepted on the 24 of January, in addition to the RSI indicator below our 4-hour chart which currently registers a figure near 40, implying some bearish tendencies. For our bearish outlook to continue, we would like to see a clear break below the 179.15 (S1) support level, with the next possible target for the bears being the 173.75 (S2) support line. On the other hand, for a sideways bias, we would require a break above our downwards moving trendline, in addition to the stock fluctuating within the range defined by the 179.15 (S1) support level and the 185.75 (R1) resistance level. Lastly, for a bullish outlook, we would like to see a clear break above the 185.75 (R1) resistance level, with the next possible target for the bulls being the 190.50 (R2) resistance line.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。