The bullish tendencies for US stock markets seem to have eased as the price action of major indexes has stabilised somewhat and are sending out mixed signals. It’s characteristic that in the past week Dow Jones, Nasdaq and S&P 500 were all in the greens yet since Monday, Dow Jones is still rising, Nasdaq is correcting lower and S&P 500 remains relatively unchanged. The main issue today seems to be the release of NVIDIA’s earnings report, an issue that we discussed in last week’s report, but nevertheless we are to add a technical analysis of the share’s 1 hour chart. Also we are to discuss fundamental challenges ahead for US stockmarkets as well as financial releases and Apple which reached the headlines today. We may see US stock market’s bullishness being somewhat saturated in the coming days unless the hopes for an extensive easing of financial conditions in the US economy are enhanced. Please note that we have some Fed policymakers which are scheduled to speak in the following days and could sway the market’s opinion for the bank’s intentions.

The release of the US Core PCE price index

On coming Friday we highlight the release of July’s Core and headline PCE price index rates. The release gains on attention as the rate is the Fed’s favorite measure and is considered as a key test for the US economy along with the CPI rates and the US employment report of each month. The core rate is expected to tick up and reach 2.7% yoy if compared to June’s 2.6% yoy. Should the rate accelerate as forecasted it would signal a persistence of inflationary pressures in the US economy that may force the market to reposition itself in regards to its extensive dovish expectations in regards to the Fed’s intentions. Please note, that currently the market prices in the scenario that the bank will proceed with a 25-basis points rate cut in the September meeting, a double 50-basis rate cut in November and another 25-basis points rate cut in the December meeting, implying a full 1% reduction of interest rates before Christmas. Should the Core PCE rates accelerate we may see the market readjusting its expectations and thus weighing on the US stockmarkets. On the flip side, we have to note that Fed Chairman Powell in his speech at the Jackson Hole Economic Symposium, mentioned the shift in the bank’s attention from curbing inflationary pressures on the weakening US labour market, which in turn could lower the impact of the release. Also please note that the earnings season is slowly coming to an end, which in turn tends to enhance the importance of general market fundamentals for the direction of US equities.

Developments in Apple

Apple’s (#AAPL) share price seems to be edging higher over the past few days. Please note that the company is to have the 2024 Apple event on the 9th of September, when the company is expected to debut the first generative AI iPhone, yet we are to discuss that issue in next week’s release. In the current report we note that Apple announced that Chief Financial Officer Luca Maestri will transition from his role on January 1, 2025. Kevan Parekh, Apple’s Vice President of Financial Planning and Analysis, will become Chief Financial Officer and join the executive team. It should also be noted that the company proceeded with layoffs of around 100 people in the digital services group. The step was characterised as rare. Layoffs are considered unusual in Apple, despite the fact that the company has made cuts, especially in the self-driving car section. The lay-offs tend to signal a shift in the company’s priorities. The biggest cuts seem to be affecting the team responsible for its Apple Books app and Apple Bookstore, Bloomberg News reported. Also it seems that some engineering roles and other services teams like the one that runs Apple News. We tend to view the situation as possibly beneficial for the company’s share price, given that the recent developments tend to clear up the situation in the company further, especially for its intentions and could provide a boost to investor’s confidence in the company’s prospects. In the bigger picture we note the problems of the company regarding its sales in China, which may weigh on its share price. Yet on the flip side market expectations for the company’s AI prospects, seem to be great and tend to offset any market worries for the revenue figure for now.

テクニカル分析

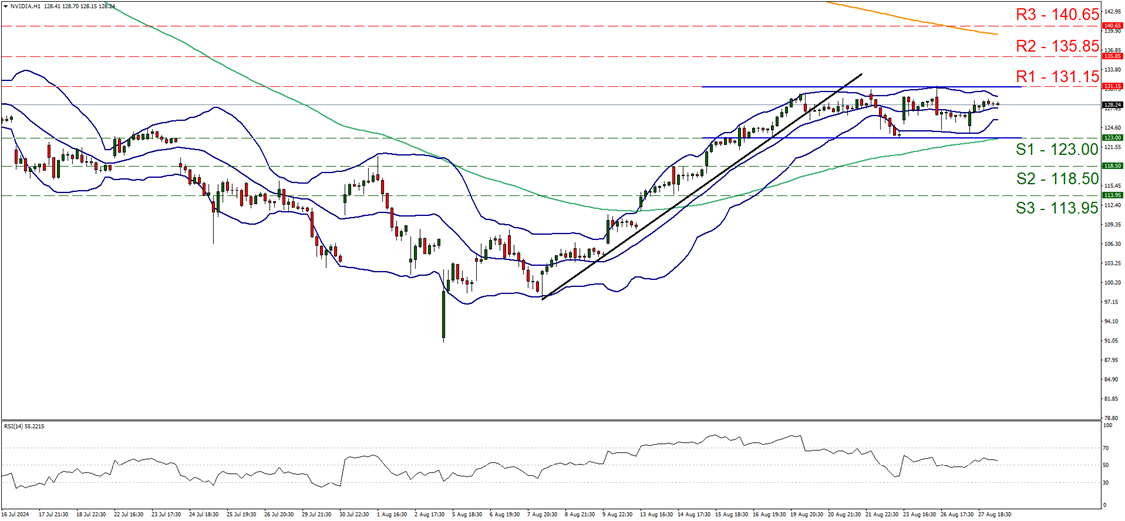

NVIDIA 1H Chart

- Support: 123.00 (S1), 118.50 (S2), 113.95 (S3)

- Resistance: 131.15 (R1), 135.85 (R2), 140.65 (R3)

On a technical level, NVIDIA’s share price has been moving in a sideways manner between the 131.15 (R1) resistance line and the 123.00 (S1) support level, since the 16 of August. We tend to maintain our bias for the sideways motion, between the prementioned levels to continue for the time being. It’s characteristic that the Bollinger Bands have narrowed signaling an easing of volatility for the share’s price, which could allow the rangebound motion to be maintained. Similar signals are also being sent by the RSI indicator which seems to be flattening just above the reading of 50, implying a relative indecisiveness on behalf of market participants for the direction of the share price’s next leg. Yet the release of NVIDIA’s earnings report may alter the direction of the share’s price. For a bullish outlook we would require NVIDIA’s share price to breach the 131.15 (R1) resistance line clearly and start aiming if not breaching also the 135.85 (R2) resistance base. Even higher we note the 140.65 (R3) resistance barrier, which please note is a record-high level, for the share’s price. Should the bears take over we may see the share’s price action breaking the 123.00 (S1) support line, with the next possible target for the bears being the 118.50 (S2) level. In an ultimate bearish scenario we may see the share’s price reaching the 113.95 (S3) support hurdle.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。