US stock markets seem to have decided on a direction since last week and appear to be moving higher. In today’s report, we would like to address what fundamentally seems to be driving them, and then narrow our focus on Intel and Amazon’s recent developments. We conclude our report with a technical analysis of Nasdaq’s daily chart.

The Fed’s interest rate decision

The Fed during their monetary policy meeting last week remained on hold as it was widely expected by market participants. The bank in its accompanying statement highlighted the solid pace of expansion in economic activity, in addition to a strong labour market, but the progress of inflation easing back towards the designated target has been slower than anticipated. Hence despite the relatively hawkish statements, market participants appear to have interpreted the Fed’s accompanying statement and Fed Chair Powell’s press conference on a positive light, as they may have anticipated a more hawkish tone. Therefore, during Fed Chair Powell’s press conference, the S&P500, NASDAQ 100 and Dow Jones 30 all appear to have moved higher. Hence, despite the relatively hawkish tone, the markets appear to have been emboldened by the lack of clear conviction by Fed policymakers to wholly embrace a “full frontal assault” against inflation.

US Employment data

The US Employment data for April which was released last Friday came in lower than expected in terms of the NFP figure which came in at 175k , whilst the Unemployment rate ticked up to 3.9%, thus implying a loosening labour market. Hence, with the implications of a loosening US labour market, pressure on Fed policymakers to maintain their hawkish stance may ease, which in turn could imply that the restrictive monetary policy in the US may slow begin to unwind, which weighed on the dollar and on the contrary provided support for US Equities.

US Commerce Department revokes licenses of US companies to sell to Huawei

According to Reuters, the US Government has revoked licenses that allowed companies including Intel (#INTC) to ship chips used for laptops and smartphone devices to Chinese telecoms equipment maker Huawei Technologies. Per the same report, the affected companies were notified on Tuesday that their licenses were revoked by the US Commerce Department and although the department did not state which companies saw their licenses revoked, the move comes after it was announced that Huawaei’s first AI-enables laptop was powered by Intel’s new Core Ultra 9 processor. Thus, with the report citing sources claiming that Intel (#INTC) was one of the affected companies it could potentially decrease its sales to China, which in turn could lead to lower future revenue and thus may weigh on the company’s stock price.

Amazon (#AMZN) strikes a deal for its AWS services in Europe

According to Reuters, Amazon (#AMZN) has managed to reach a deal with Telefonica Germany which will move one million of their 5G customers to Amazon Web Services (AWS) cloud later this month. The move could potentially increase Amazon’s revenue as the telecommunications sector is considered to be worth billions of dollars in potential revenue. Therefore, the implications of an increase in future revenue for Amazon (#AMZN) through this deal, could provide support for the company’s stock price.

テクニカル分析

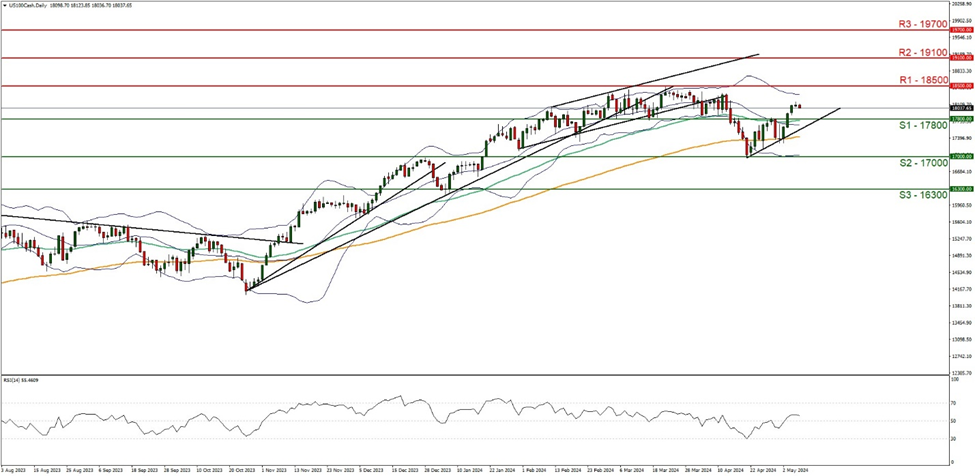

#US100 Cash Daily Chart

Support: 17800 (S1), 17000 (S2), 16300 (S3)

Resistance: 18500 (R1), 19100 (R2), 19700 (R3)

Nasdaq since our last report has managed to break the former 17800 resistance level which has now turned to support line (S1). We tend to maintain a bullish bias for the index and supporting our case is the upwards moving trendline which was incepted on the 19 of April. In addition the formation of a morning star pattern on the 1 of May serves also as a legitimate bullish indication for the index’s direction. For our bullish outlook to continue, we would like to see a clear break above the 18500 (R1) resistance line with the next possible target for the bulls being the 19100 (R2) resistance level. On the flip side for a sideways bias we would like to see the index remain confined between the 17800 (S1) support line and the 18500 (R1) resistance level. Lastly, for a bearish outlook we would require a clear break below the 17800 (S1) support level, with the next potential target for the bears being the 17000 (S2) support base.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。