As we are currently halfway through the second week of the year, there have been relief signals from US stock markets with all three major indexes moving slightly higher since last week. Yet, we note that despite the relief to the markets, the NASDAQ 100 and Dow Jones 30, are still below their all-time high figures. In this report, we are to discuss Boeing and Nvidia, and finally conclude with a technical analysis of Boeing (#BA).

Screws, Nuts and Bolts, how Boeing’s (#BA) 737 Max entered the spotlight once again

Boeing (#BA) has been embroiled in controversy since Saturday. The company’s 737 Max 9, has faced heightened scrutiny from the National Transportation Safety Board (NTSB) and the Federal Aviation Administration (FAA), following an incident during an Alaska Airlines flight on Saturday. During a routine flight, the door located in the middle of the airplane ejected mid-flight, causing the flight to undertake an emergency landing. Following the incident, the NTSB found that a door “plug” unexpectedly blew off at around 16,000 feet, in addition to four bolts that were meant to keep the door fastened in place. As a result, United Airlines along Alaska airlines conducted preliminary checks on other 737 Max’s in which it was found that other planes had loose bolts installed, prompting the FAA to ground more than 170 planes belonging to the same type. The startling revelation has caused outcries from customers, such as RyanAir whose CEO stated that Boeing needs to increase their quality assurance checks, as this is not the first time the particular line of aircraft has been placed under scrutiny. Moreover, Boeing’s CEO David Calhoum stated on Tuesday that “we’re going to approach this, number one, acknowledging our mistake”, essentially admitting the company’s own forthcomings to quality and assurance controls that have plagued the 737 Max family over the past few years. The incident resulted in Boeing shedding as much as 20% of its stock price in the past few days, as the possibility of a wider grounding of Boeing’s planes by numerous airlines, may further weigh on the company’s stock price. Lastly, Boeing’s largest competitor Airbus, demonstrated that unlike its American counterpart, that is newer model planes and in particular the A350, which was involved in a collision with another aircraft in Japan, performed as was expected, and was touted for its design which aided the evacuation of its occupants. In conclusion, with these two events happening so close to each other, the comparison between Boeing and Airbus could lead to airlines looking to update or add to their fleet, opting for Airbus in the future, thus potentially weighing on Boeing’s stock price in the long run, whilst aiding to Airbus’s (#Airbus) stock price.

NVIDIA (#NVIDIA) AI graphics card hype

Nvidia earlier on this week, announced at CES 2024, a tech conference, it’s new widely anticipated RTX 40 Super GPUs. The new series according to NVIDIA provide a greater gaming and generative AI performance with the GeForce RTX 4080 super being able to power fully traced games at 4k. The company’s announcement appears to have been well received by market participants, with the company’s stock price moving higher since the unveiling of the new RTX 40 Super GPU series. Moreover, it appears that the company is embracing the AI hype, with its new GPUs being a “launching pad for Generative AI” according to the company. Overall, it appears that the company is placing a greater emphasis on AI creators and as such could increase the company’s sales over the long run, which in turn could boost the company’s stock price as Nvidia continues to impress with its advancements in the gaming/AI industry.

Earnings Season

We highlight this week’s earnings by big banks such as JP Morgan (#JPM),Wells Fargo (#WFC) and Citigroup (#C), which are expected to release their earnings on Friday. All three banks are expected to report lower earnings per share and revenue figures since the last quarter, which could potentially weigh on their stock prices respectively. The lower EPS and revenue figures could potentially spell trouble for the banking sector, which has greatly benefited from the higher interest rate levels and as such, as monetary policy returns to normality, the bank’s supernatural profits could diminish, thus weighing on their stock prices.

テクニカル分析

Boeing (#BA) 4-Hour Chart

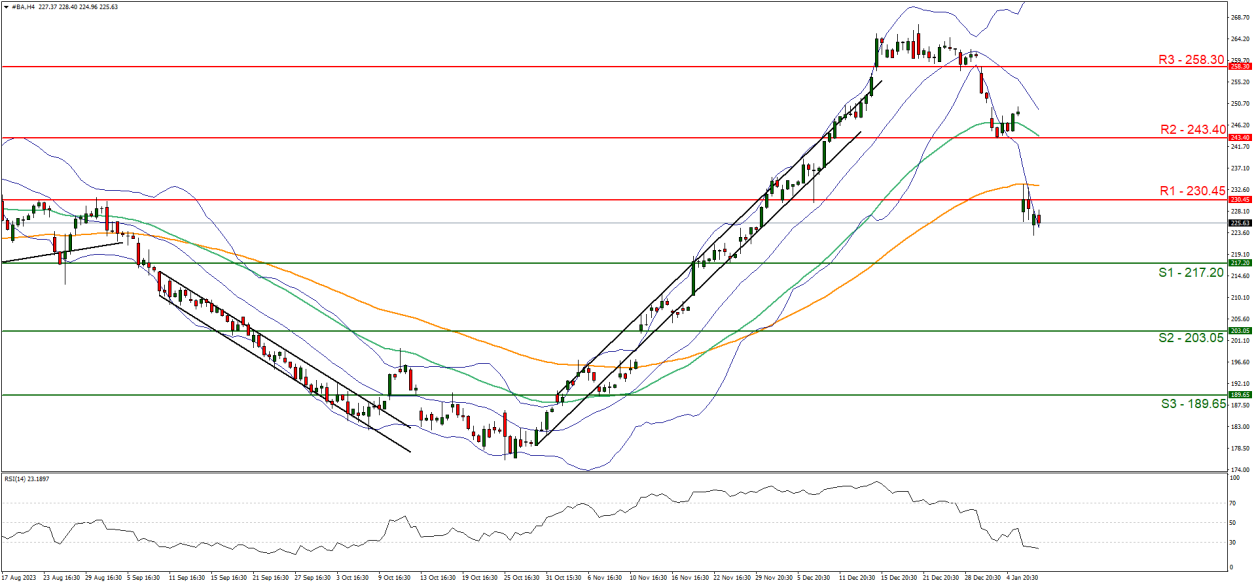

BA H4 Chart

Support: 217.20 (S1), 203.05 (S2), 189.65 (S3)

Resistance: 230.45 (R1), 243.40 (R2), 258.30 (R3)

Boeing (#BA) appears to be moving lower due to its fundamentals. The company stock price appears to be aiming for the 217.20 (S1) support level. We maintain a bearish outlook for the company’s stock price and supporting our case is the RSI indicator below our 4-Hour chart which is currently below the figure of 30 implying a predominantly strong bearish market sentiment. Yet, the current figure of 23 may also imply that the stock is oversold and as such

may be due a market correction to higher ground. Nonetheless, for our bearish outlook to be maintained, we would like to see a break below the 217.20 (S1) support level, with the next possible target for the bears being the 203.05 (S2) support base. On the other hand, for a sideways bias, we would like to see the stock remain confined between the 217.20 (S1) support line and the 230.45 (R1) resistance level. Lastly, for a bullish outlook, we would like to see a clear break above the 230.45 (R1) resistance level, with the next possible target for the bulls being the 243.40 (R2) resistance ceiling. We would like to note that the Bollinger bands have widened significantly, reflecting the high volatility for the share’s price.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。