US stock markets remain in the green for the current week ahead of the highly anticipated US CPI print expected to hit the markets tomorrow Thursday the 10 of November. The observed rally of all three major indices for the past few days has been supported by the recent shortcomings in the dollar, which edged lower mainly due to the uptick of the unemployment rate and the expectations of the market towards the US midterm elections. In this report we aim to present the recent fundamental and economic news releases that impacted the US stock markets, look ahead at the upcoming events that could affect their performance and conclude with a technical analysis.

Disney misses EPS and Revenue estimates

The Walt Disney Company, (#DIS) the communication services colossus, famous for its amusement theme parks across the world as well as its online streaming platform Disney+, was in the reds yesterday, closing the day at near the $100 mark. Disney is down by more than -36% on a year-to-year basis, while its 52-week trading range is between $90 and $177. Yesterday, in the aftermarket session the company released its fourth quarter earnings, with the results missing both revenue 、 EPS expectations, causing its share price to fall by more than 8% and in today’s premarket session, its share price hovers around the $92 level paring some losses. In regard to the figures released, Disney missed revenue projections by $1.3billion in the fourth quarter, with the main culprit accounting for the miss being the direct-to-consumer and theatrical businesses (DTC) division. More specifically, the division dragged down the headline figure due to the heavy strategic investments poured into this business segment, in an attempt to remain competitive, and is expected to yield fruitful results by the end of 2024, should global economic conditions allow it. Amusement parks once again saved the day, or the quarter if you prefer, which reported a jump of revenue in the vicinity of 70% alongside Disney Experiences and Products divisions which also rose by 36%. As a result, the operating income for the entire segment accounted for a whopping 137% increase indicating that clearly the Parks are the main driver of the company’s profitability, keeping the boat afloat. When it comes to the entertainment and the online streaming business Disney+, the company reported increases in subscriber accounts with the company reporting strong subscription growth with the addition of 14.6 million total subscriptions, including 12.1 million Disney+ subscribers. Disney is set to launch its ad supported subscription plans as early as December and CEO Bob Chapek stated that a “key component to our total property advertising portfolio, and advertiser interest has been strong”, pointing out that the company is expected to make up for the lost ground via advertisement deals with major players but the impact will be more meaningful later in the fiscal year, added the company’s CFO.

Meta announces layoffs

Meta Platforms, Inc. (#FB) the social media giant and digital world creator, famous for its metaverse project and social media networking platform Facebook, came under significant pressure lately following its anticlimactic earnings report for Q4 and more recently the announcement of mass layoffs of its workforce. Meta was in the reds yesterday’ closing the day around the $96 mark and is down by an astonishing -70% on a year-to-year basis, while its 52-week trading range is between $88 and $353. During the past weekend, a Wall Street Journal report surfaced, citing that the company plans to lay off thousands of employees and today Wednesday, the implementation plan is to be put in motion. According to estimates Meta’s employees as of September were approximately 87,000 and the layoffs are estimated to be the biggest since the inception of company, with the recruiting and business teams expected be hit the most. In an open call the Mark Zuckerberg stated that the company will cut 11,000 jobs, just shy off 13% of its total workforce. He stated “We are also taking a number of additional steps to become a leaner and more efficient company by cutting discretionary spending and extending our hiring freeze through Q1. I want to take accountability for these decisions and for how we got here. I know this is tough for everyone, and I’m especially sorry to those impacted”. The decision brought heavy criticism on the company’s CEO challenging his steadfast aggressive approach at expanding metaverse’s strategy by spending excessively on the project, contributing negatively to the recent shortcomings.

テクニカル分析

US 100 Cash 4時間チャート

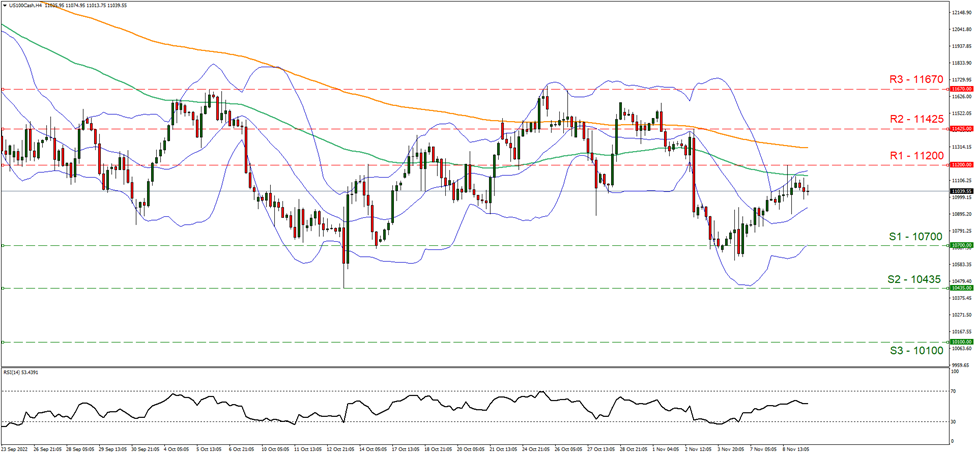

Support: 10700 (S1), 10435 (S2), 10100 (S3)

Resistance: 11200 (R1), 11425 (R2), 11670 (R3)

Looking at US100 4-hour chart we observe the upward movement of the index reaching the 11200 (R1) level failing to break above 、 retreating lower. We hold a sideways bias for the price action of the index and supporting our case is the RSI indicator below the 4-hour chart which currently registers a reading of 53 showcasing indecision surrounding the index. Should the bulls take control over the direction of the index, we may see the break above the 11200 (R1) resistance level and the price action moving closer to 11425 (R2) resistance barrier. Should the bears overpower the bulls, we may see the break below the 10700 (S1) support level and the price action moving closer to 10435 (S2) support base. We should note however, that tomorrow’s CPI print release could influence the direction of the index should there be substantial deviation of the reading either to the upside or the downside of the market’s expectations.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。