The release of China’s CPI and PPI rates for September enhanced the worries for the recovery of the Chinese economy. The CPI rate slowed down while the PPI rate contracted even deeper into the negatives underscoring the deflationary pressures troubling the Chinese economy alongside a weak growth for economic activity in the manufacturing sector. The Chinese government and central bank have announced stimulus both on a fiscal and monetary level, yet they still have to come into effect, while the fiscal stimulus’ crucial details are still missing. Overall, should we see market worries for the recovery of the Chinese economy be enhanced further we may see a risk-off sentiment covering the markets which could weigh on riskier assets such as equities and commodity currencies, especially the Aussie.

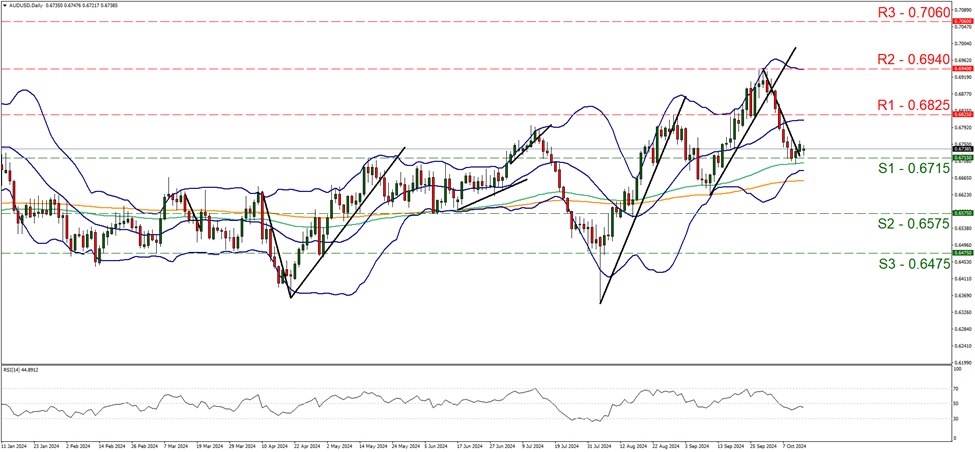

AUD/USD seems to have hit the floor at the 0.6715 (S1) support line. Given that the downward trendline has been interrupted on Friday, we switch our bearish outlook in favour of a sideways motion bias initially. Yet the RSI indicator remains below the reading of 50, implying the presence of a slight bearish predisposition of the market for the pair. For a bearish outlook we would require a clear breaking of the 0.6715 (S1) line and AUD/USD to start aiming if not reaching the 0.6575 (S2) support base. Should the bulls take over we may see AUD/USD reversing course and start aiming for the 0.6825 (R1) resistance line.

In the US the earnings season began on Friday with major banks showing improved results on Friday both on a revenue and earnings level, which was encouraging. Tomorrow we note the earnings releases of Citygroup, Goldman Sachs and Bank of America. We expect that should the earnings reports continue to be improved the market sentiment may get a boost, while increased attention may be placed on US stock markets.

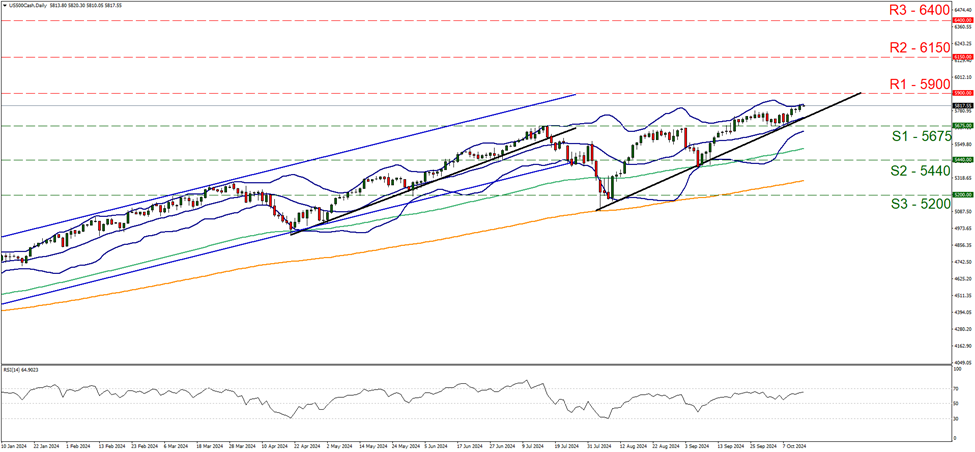

For a rounder view and on a technical level we note that S&P 500 continued to be on the rise on Friday aiming for the 5900 (R1) resistance line. We note that the RSI indicator remains in an upward motion nearing the reading of 70, implying a strong and growing bullish sentiment for the index. We tend to maintain a bullish outlook for the index, given also that the upward trendline guiding the index since the 5 of August remains intact. As a small warning for buyers, we also note that the index is at record high levels and the price action has reached the upper Bollinger band which may slow down the bulls if not cause a correction lower for the index’s price action. Should the bulls maintain control over the index we set as the next possible target the 5900 (R1) resistance line. A bearish outlook seems remote yet for such an outlook we would require the index’s priceaction to reverse direction, break the prementioned upward trendline but also break the 5675 (S1) support line clearly, which could open the gates for the 5440 (S2) support barrier.

その他の注目材料

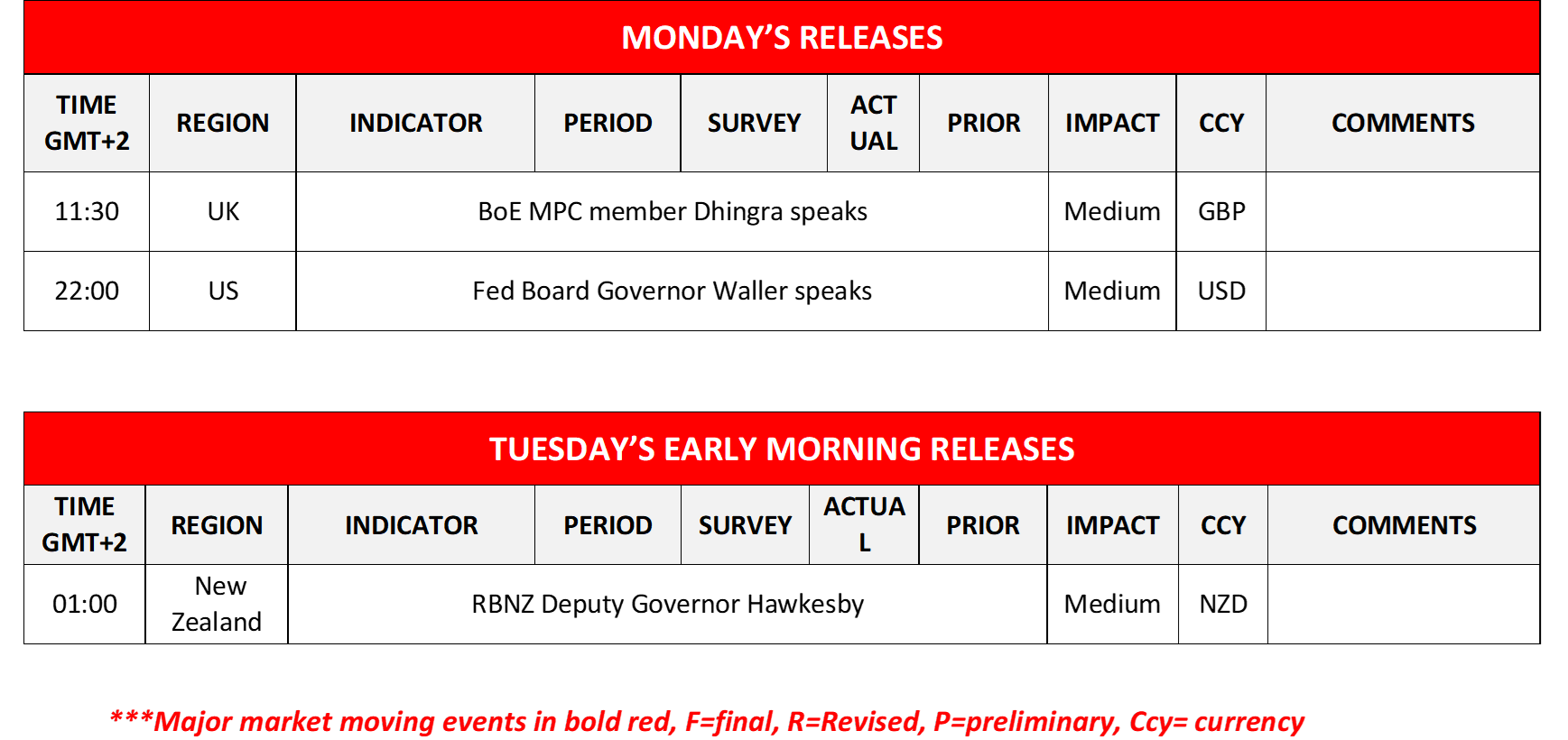

Today no high-impact financial releases are in the calendar, which could allow for fundamentals to lead.

今週の指数発表:

On Tuesday we get the UK’s employment data for August, Sweden’s CPI for September, the Eurozone’s industrial production rate for August, Germany’s ZEW figures, the US NY Fed Manufacturing figure, both for October and Canada’s CPI rates for September. On Wednesday we get New Zealand’s CPI rate for Q3, Japan’s machinery orders rate for August and the UK’s CPI rate for September. On Thursday we get Japan’s trade balance figure and Australia’s employment data both for September, followed by the US weekly initial jobless claims figure, the Philly Fed business index figure for October and the US Retail sales rate for September, while on the monetary front we get from Turkey CBT’s interest rate decision while we highlight from the Eurozone the release of ECB’s interest rate decision. Lastly, on Friday we get Japan’s CPI rates, China’s urban investment, industrial output and retail sales all for September, followed by China’s GDP rate for Q3 and UK’s retail sales for September.

AUD/USD デイリーチャート

- Support: 0.6715 (S1), 0.6575 (S2), 0.6475 (S3)

- Resistance: 0.6825 (R1), 0.6940 (R2), 0.7060 (R3)

US500 Cash Daily Chart

- Support: 5675 (S1), 5440 (S2), 5200 (S3)

- Resistance: 5900 (R1), 6150 (R2), 6400 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。