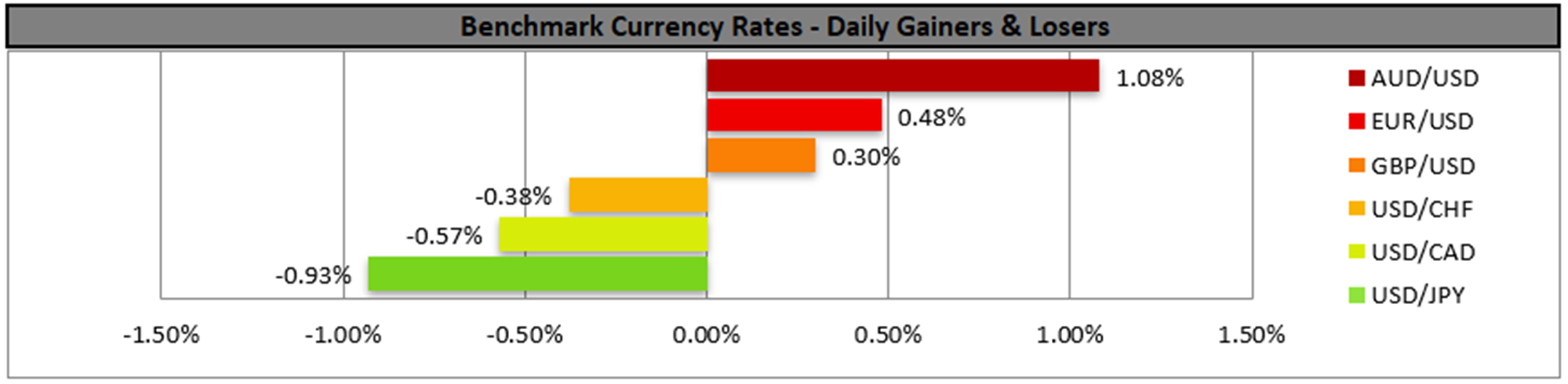

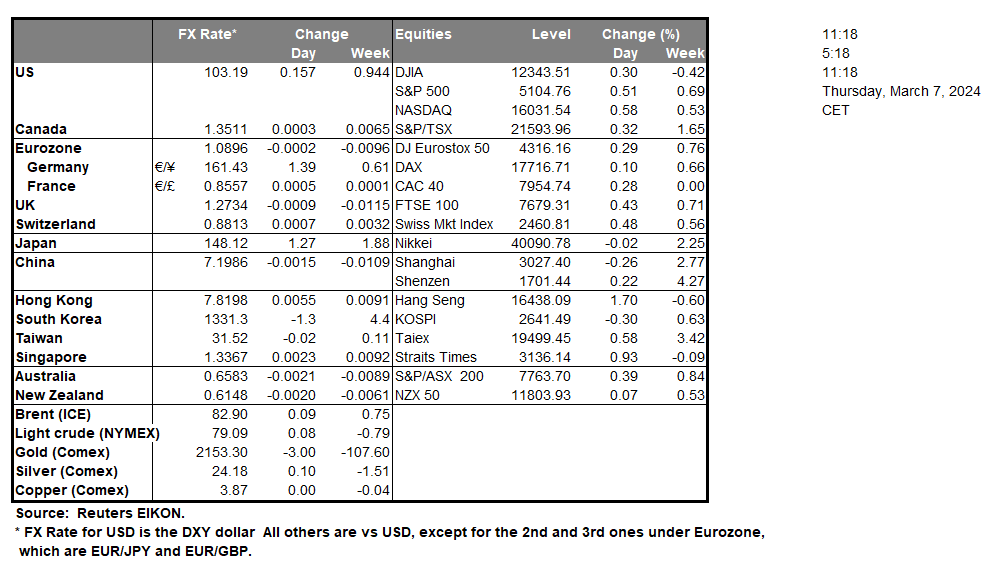

The USD weakened yesterday as Fed Chairman Powell in his testimony before the US Senate recognized the need for rate cuts within the year, confirming the market’s expectations. Also, the Fed Chairman stated that progress for inflation towards the bank’s 2% target is not assured, casting some doubt on the number and timing of possible rate cuts to come and at the same time displaying some hesitance on behalf of the bank to cut rates possibly too early. Overall, the release seemed to find stock market participants unimpressed, yet USD’s weakening allowed for gold’s price to reach new record highs.

North of the US border BoC remained on hold at 5.00% as was widely expected and in its maintained its hawkishness by expressing its concerns regarding the outlook of inflation and the persistence of underlying inflation supporting the Loonie.

While in Asia we highlight two events. The first would be the wider-than-expected trading surplus of China for February, which highlighted the prospects for the recovery of the Chinese economy and tended to improve the market sentiment. The second would be the strengthening of JPY as BoJ policymakers stressed the possibility to start normalizing the bank’s ultra-loose monetary policy and at the same time there was a verbal market intervention from Japan’s Finance Minister Suzuki to the Yen’s support.

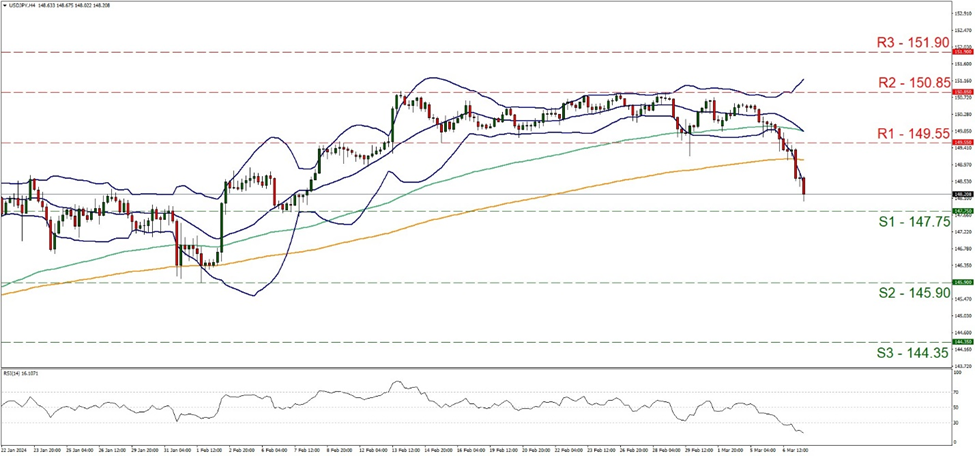

USD/JPY dropped yesterday and during today’s Asian session, breaking the 149.55 (R1) support line, now turned to resistance and continued lower aiming for the 147.75 (S1) support line. We maintain a bearish outlook for the pair yet note that a correction higher could be in the cards for the pair as the RSI indicator dropped below 30, implying that the pair may be in oversold territory and price action has breached the lower Bollinger band sending similar signals. Should the bears maintain control over the pair we may see it breaking the 147.75 (S1) support line aiming for the 145.90 (S2) level. For a bullish outlook we would require the pair the reverse its losses by breaking the 149.55 (R1) level and aiming for the 150.85 (S2) line.

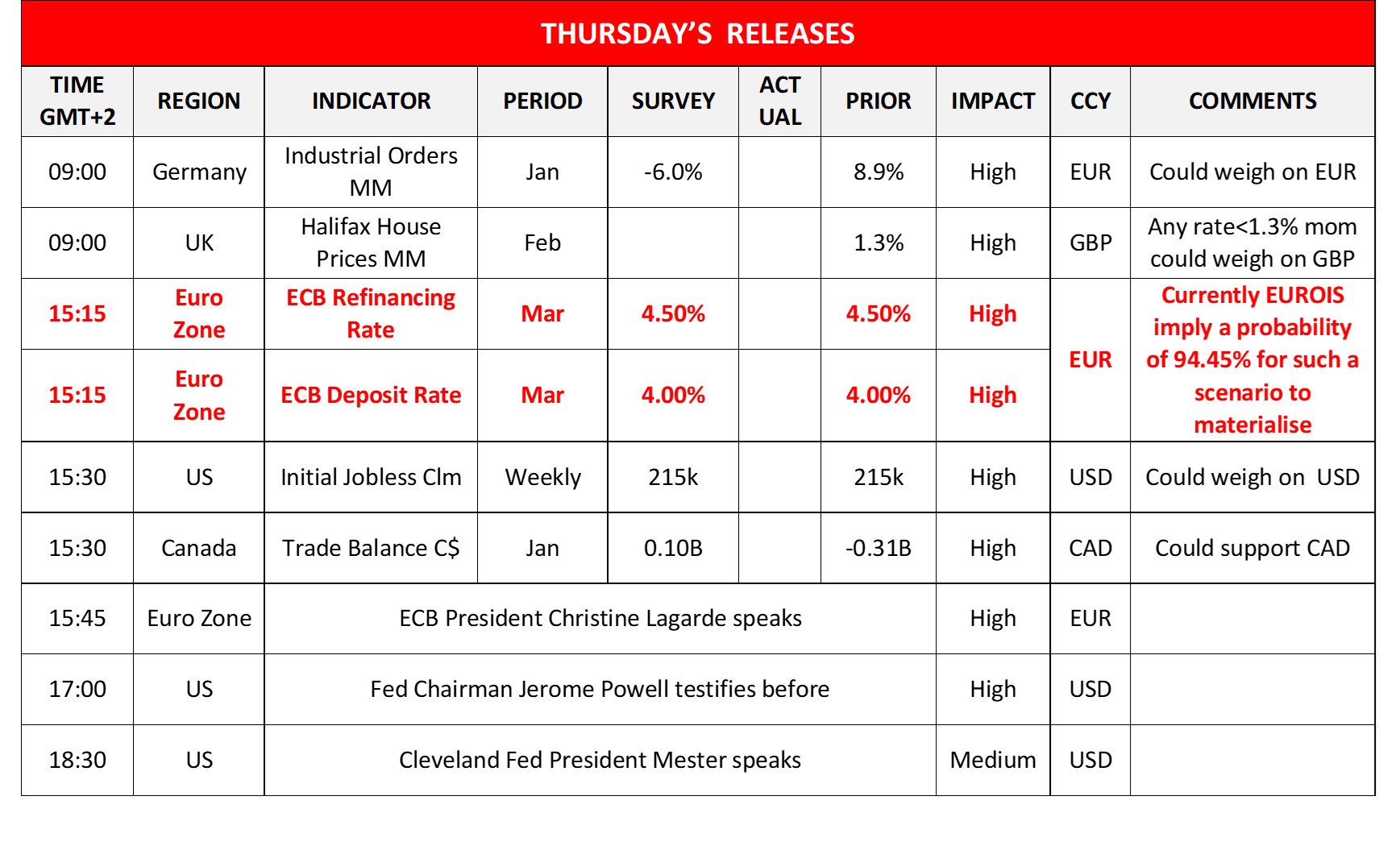

ECB’s interest rate decision is due out today and the bank is widely expected to remain on hold keeping the refinancing rate at 4.50%. Currently EUR OIS imply a probability of 94% for such a scenario to materialise. We expect the market to turn its attention towards the bank’s forward guidance and ECB President Lagarde’s press conference half an hour later. For the time being EUR OIS also tend to imply that the bank is expected by the market to deliver four rate cuts in total in the current year, starting from the June meeting. Should the bank actually show an inclination towards starting to cut rates early, enhancing the market’s expectations we may see the event weighing on the common currency. Should the bank maintain its hawkish tone pushing back against market expectations we may see EUR strengthening. Also please note that volatility for EUR pairs could be extended during ECB President Lagarde’s press conference.

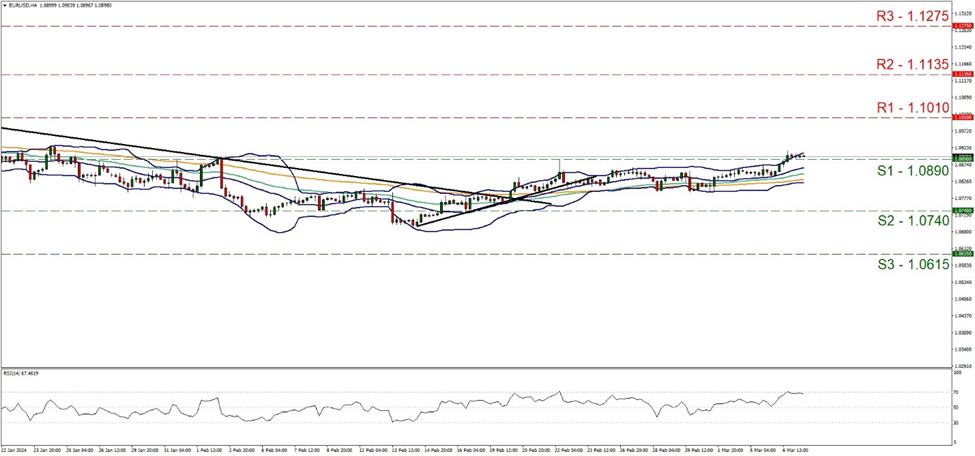

EUR/USD edged higher breaking the 1.0890 (S1) resistance line, now turned to support. We tend to maintain a bullish outlook given the direction of the price action and the fact that the RSI indicator has reached the reading of 70 and stabilised, implying a strong bullish market sentiment for the pair. Yet we expect that ECB’s interest rate decision may be the catalyst for EUR/USD’s direction in the next 24 hours. If the bulls maintain control we may see EUR/USD continuing to slowly make its way towards the 1.1010 (R1) resistance base. If the bears take over, we may see the pair breaking the 1.0890 (S1) level and aim for the 1.0740 (S2) line.

その他の注目材料

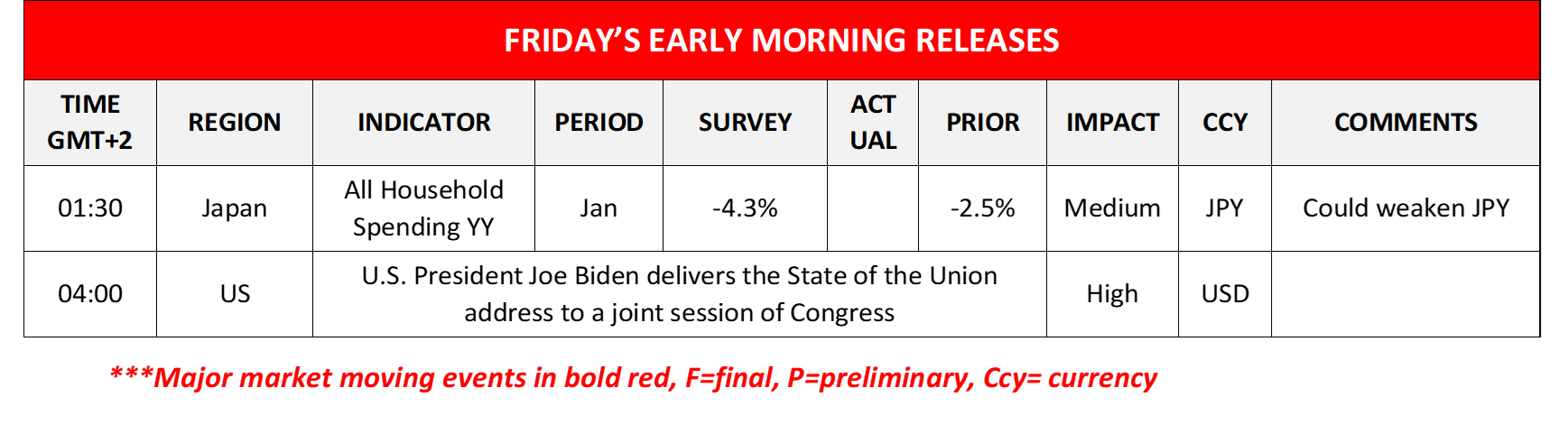

Today we note in the American session the release of the US weekly initial jobless claims figure, Canada’s trade balance for January while Cleveland Fed President Mester is scheduled to speak. In tomorrow’s Asian session, we get U.S. President Joe Biden’s State of the Union speech.

USD/JPY 4時間チャート

Support: 147.75 (S1), 145.90 (S2), 144.35 (S3)

Resistance: 149.55 (R1), 150.85 (R2), 151.90 (R3)

EUR/USD 4時間チャート

Support: 1.0890 (S1), 1.0740 (S2), 1.0615 (S3)

Resistance: 1.1010 (R1), 1.1135 (R2), 1.1275 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。