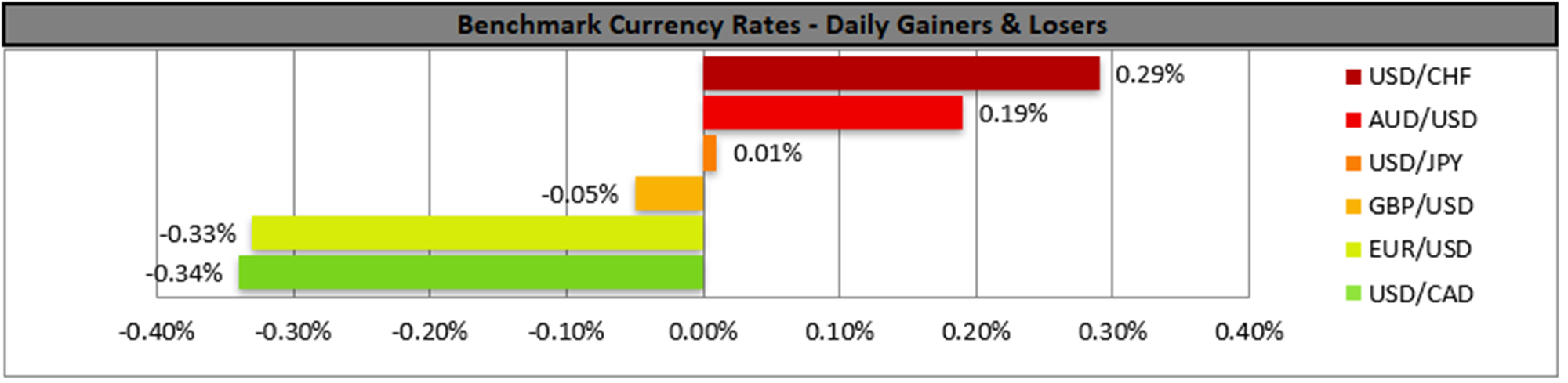

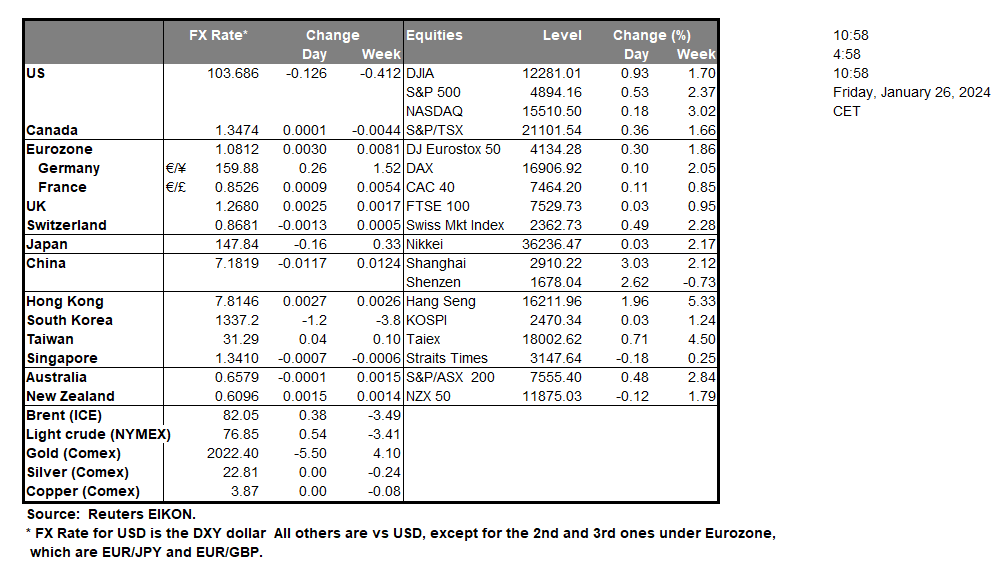

The USD edged lower against its counterparts yesterday even though the preliminary US GDP rate for Q4 slowed down less than what the market expected. The release tended to underscore the possibility of a soft landing for the US economy. The durable goods orders for December slowed down more than expected, signaling a possible hesitancy on behalf of US businesses to actually invest in the US economy, while the weekly initial jobless claims figure rose more than expected, implying the possibility of a slack being built in the US economy. With ECB Holds Rates developments also shaping broader market sentiment, today’s market attention falls on the US Core PCE price index for December, the Fed’s favorite inflation measure, and a possible failure to slow down may provide some support for the USD. US stock markets ended the day rather mixed on Thursday, with the earnings season in full force. Today we note the release of the earnings reports of Caterpillar (#CAT), American Express (#AXP) and Colgate-Palmolive (#CL) which could shake the markets.

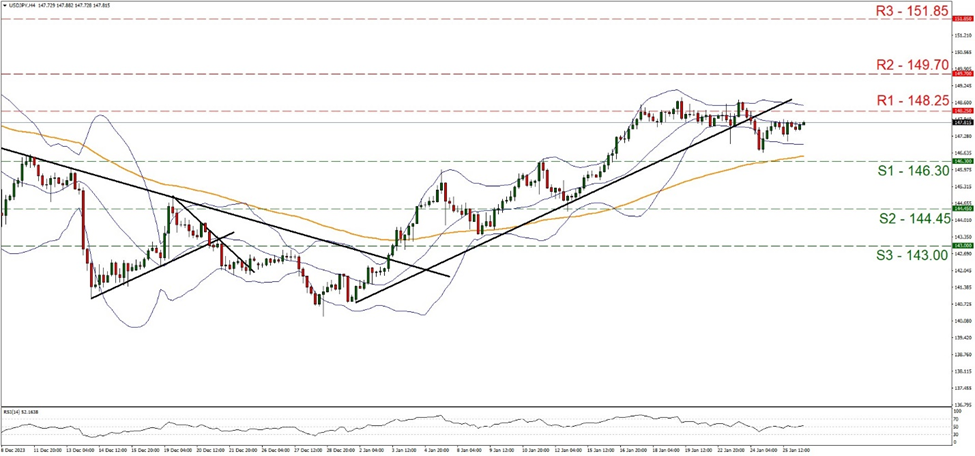

USD/JPY remained in a tight sideways motion yesterday. We tend to maintain our bias for the sideways motion between the 146.30 (S1) support line and the 148.25 (R1) resistance line to continue for now. We note that the RSI indicator continues to run along the reading of 50, implying a rather indecisive market which may allow the sideways motion to continue. Should the bulls take over, we may see the pair breaking the 148.25 (R1) resistance line and aiming for the 149.70 (R2) resistance nest. Should the bears be in charge of the pair’s direction, we may see the pair breaking the 146.30 (S1) support line and aiming for the 144.45 (S2) support base.

Across the Atlantic, ECB as was widely expected remained on hold, keeping the refinancing rate at 4.5% and the deposit rate at 4.00%. In the bank’s accompanying there were no major surprises, yet the bank mentioned that “Tight financing conditions are dampening demand, and this is helping to push down inflation” which may imply that the bank is to continue to keep monetary policy conditions tight. It’s characteristic that in her press conference, ECB President Christine Lagarde stated that there was a consensus at the table that it’s premature to talk about rate cuts. Overall, we tend to see the case for the bank to push any rate cuts for a later stage than what was expected by the market, possibly around summer. For the time being the market, seems to remain unconvinced and expects the bank to deliver 5, even maybe 6 rate cuts within the year which may preserve any bearish tendencies of the EUR on a monetary level.

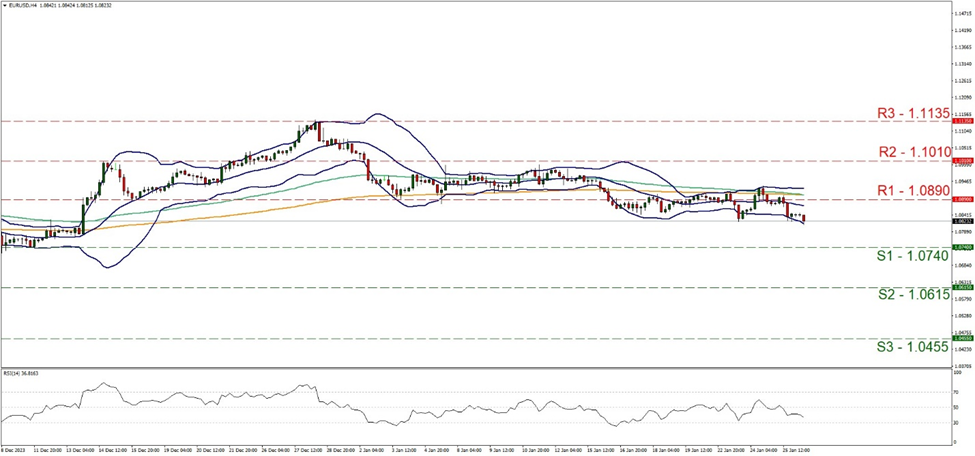

EUR/USD edged lower from the 1.0890 (R1) resistance line yesterday. We tend to maintain our bias for the sideways motion of the pair to be maintained between the 1.0890 (R1) resistance line and the 1.0740 (S1) support line. Yet we note that there seem to be some bearish tendencies in the pair’s price action and note that the RSI indicator is aiming for the reading of 30, implying a build-up of a bearish sentiment for the pair among market participants. On the other hand, the pair’s price action is flirting with the lower Bollinger band, which may slow down the bears somewhat. Should an intense selling interest be expressed we may see EUR/USD breaking the 1.0740 (S1) support line and aim for the 1.0615 (S2) support barrier. On the flip side should the pair find extensive buying orders along its path, we may see EUR/USD breaking the 1.0890 (R1) resistance line and aim for the 1.1010 (R2) resistance hurdle.

その他の注目材料

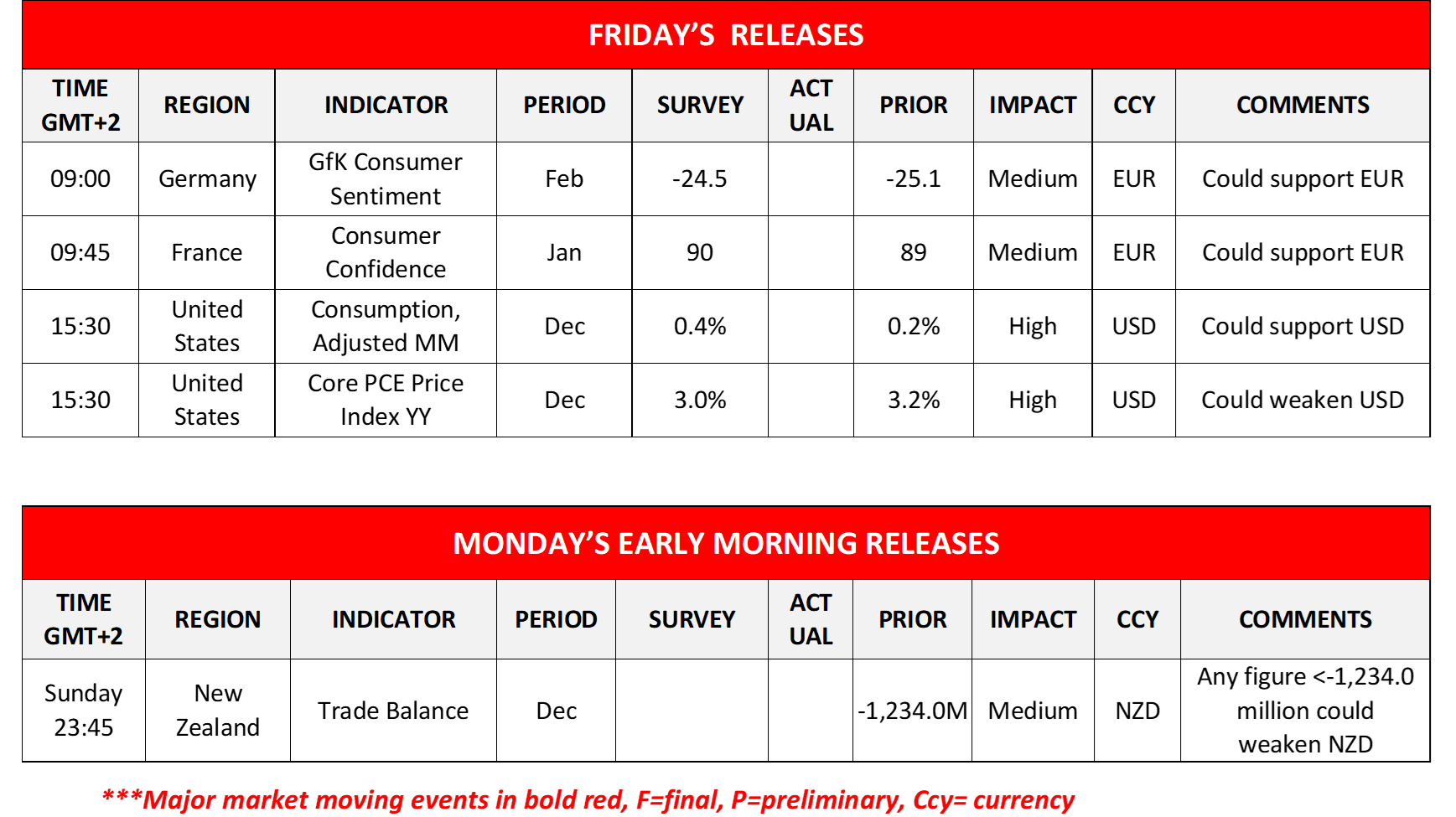

Today in the European session, we note the release of Germany’s GfK Consumer Sentiment for February and France’s consumer sentiment for January. In the American session, we note the release from the US of the Consumption rate and the Core PCE price index, both being for December. Just before Monday’s Asian session, begins we note the release of New Zealand’s December trade data.

EUR/USD 4時間チャート

Support: 1.0740 (S1), 1.0615 (S2), 1.0455 (S3)

Resistance: 1.0890 (R1), 1.1010 (R2), 1.1135 (R3)

USD/JPY 4時間チャート

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。