ECB Villeroy according to Reuters, stated yesterday that a rate cut by the ECB has significant room for rate cuts, with the first possibly occurring in their June meeting. The comments made by the policymaker could be interpreted as dovish in nature and thus, should the ECB ease its monetary policy stance during their meeting next month, it could weigh on the EUR. Moreover, should ECB policymakers re-iterate the aforementioned rhetoric of easing monetary policy in the bank’s next meeting ,it may also weigh on the EUR.

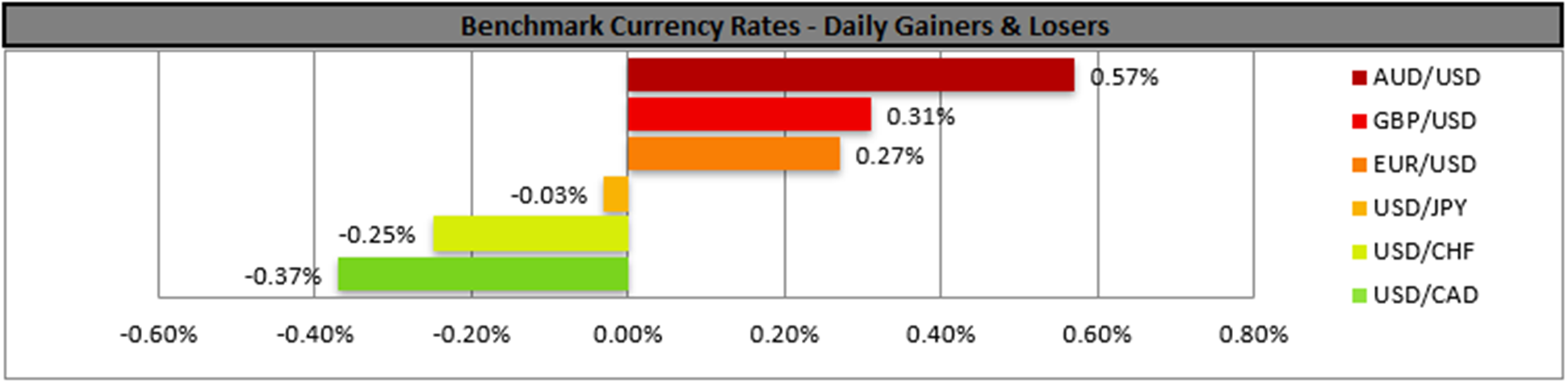

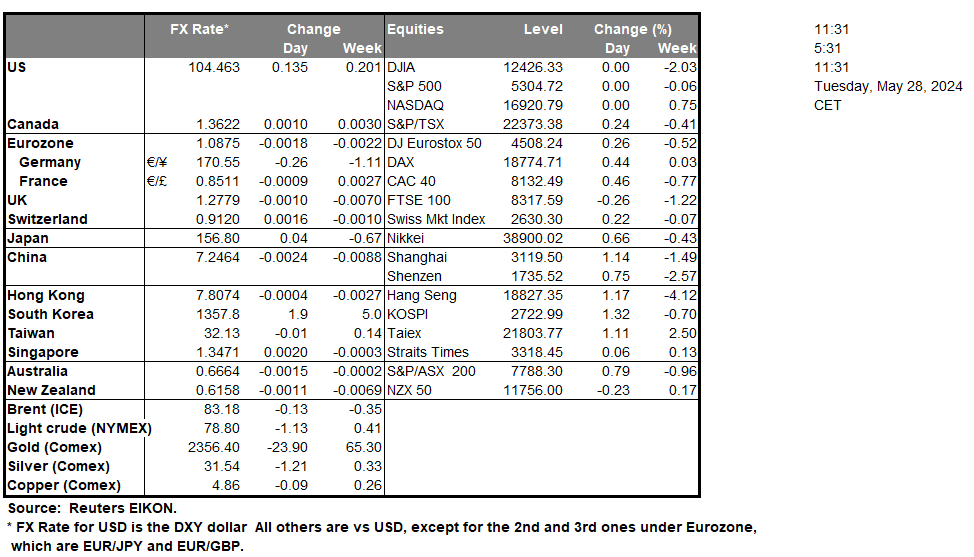

In today’s Asian session, the BOJ’s Core CPI rate for May came in lower than expected at 1.8%, versus the expected rate of 2.2%, thus implying that inflation is increasing at a decreasing rate. The lower-than-expected rate may prove concerning for the BOJ which had abandoned its ultra-loose monetary policy after the assumption that the bank’s sustained 2% inflation target was in sight. In Australia, the nation’s preliminary retail sales rate on a month-on-month level came in lower than expected at 0.1% versus the expected rate of 0.3%. However, despite the lower-than-expected rate, if we take a look at the bigger picture, the 0.1% is greater than the prior rate of -0.4% and thus appears to have slightly aided the Aussie following its release.Over in America, The US’s consumer confidence figure for May is set to be released in today’s American session. Currently, market expectations are for the figure to come in at 96.0 which would be lower than the previous reading of 97. Thus should the figure come in as expected or lower, hence implying a deterioration in the confidence in the US economy from the consumer’s side, it could weigh on the dollar and vice versa.

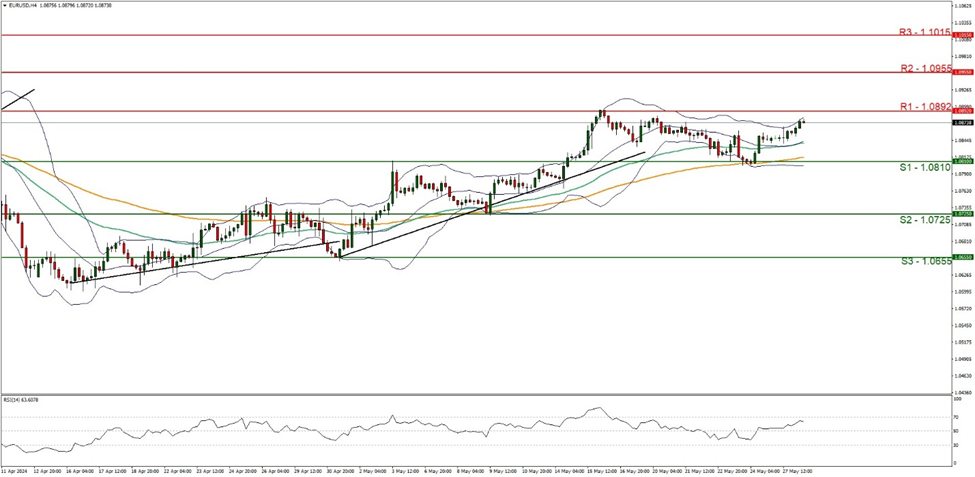

On a technical level EUR/USD appears to be moving in a sideways fashion. We maintain a sideways bias for the pair and supporting our case is the flattening of the 50MA and 100 MA lines, in addition to the Bollinger bands also narrowing which imply low market volatility. However, the RSI Indicator below our chart currently registers a figure near 60, implying some bullish tendencies. Nonetheless for, our sideways bias to continue, we would require the pair to remain confined within the 1.0810 (S1) support line and the 1.0982 (R1) resistance level. On the flip side, for a bullish outlook, we would require a clear break above the 1.0982 (R1) resistance line, with the next possible target for the bulls being the 1.0955 (R2) resistance line.Lastly, bearish outlook, we would require a clear break below the 1.0810 (S1) support line, with the next possible target for the bears being the 1.0725 (S2) support level.

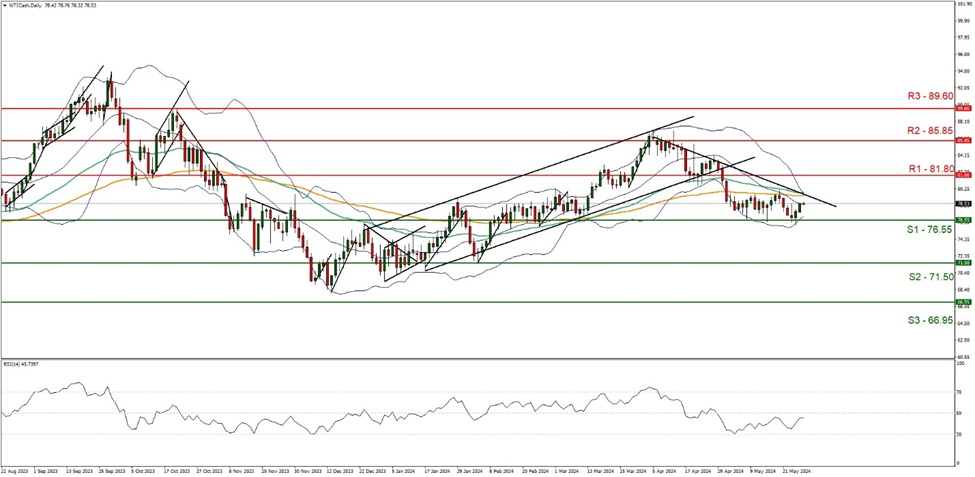

WTICash appears to be moving in a downwards fashion. We maintain a bearish outlook for the commodity and supporting our case is the RSI indicator below our chart which currently registers a figure near 40, implying bearish market tendencies, in addition to the downwards moving trendline which has been guiding the commodity since the 5 of May. For our bearish outlook to continue, we would require a clear break below the 76.55 (S1) support line, with the next possible target for the bears being the 71.50 (S2) support level. On the flip side for a sideways bias, we would like to see the commodity remain confined between the 76.55 (S1) support level and the 81.80 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 81.80 (R1) resistance line, with the next possible target for the bulls being the 85.85 (R2) resistance level

その他の注目材料

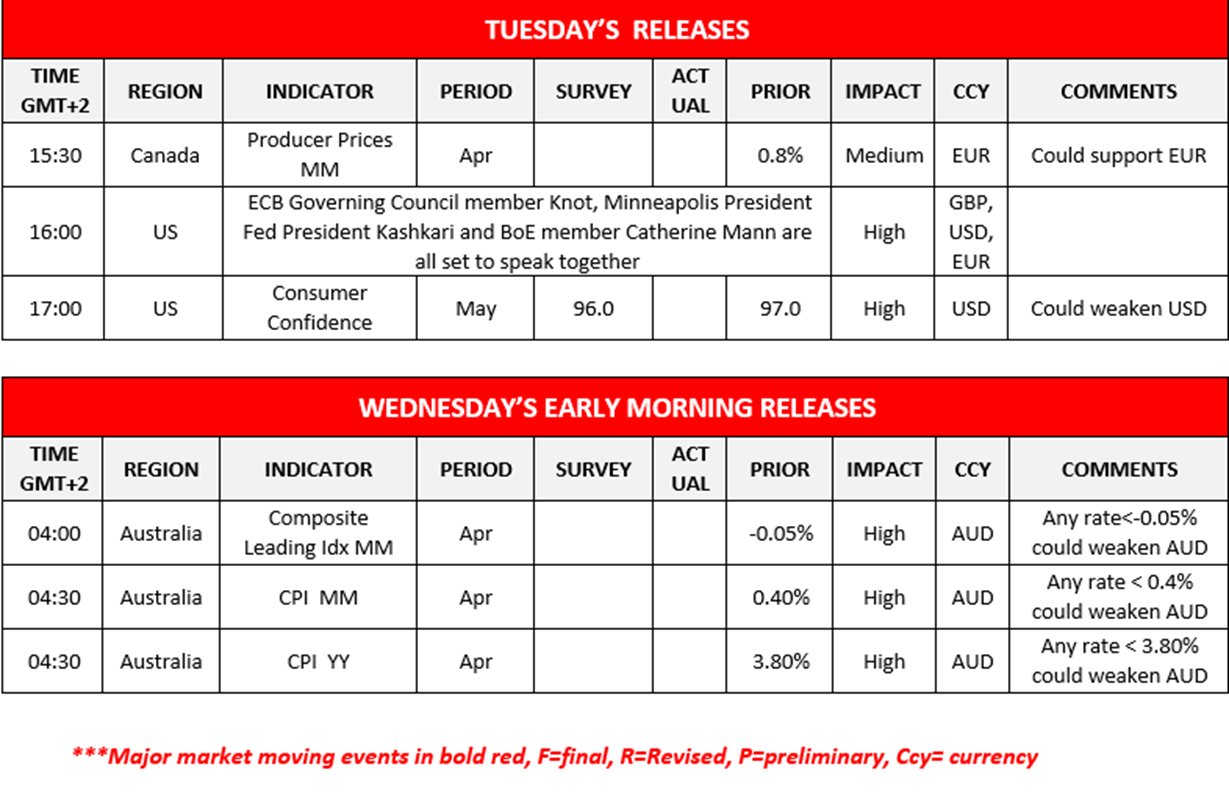

Today we note the release of Canada’s producer prices rate for April, and the US Consumer confidence figure for May. In tomorrow’s Asian session, we would like to note Australia’s composite index rate and CPI rates all for the month of April. On a monetary level, we would like note the joint speech set to occur later on today with ECB Member Knot, Minneapolis Fed President Kashkari and BoE Member Mann.

EUR/USD 4時間チャート

- Support: 1.0810 (S1), 1.0725 (S2), 1.0655 (S3)

- Resistance: 1.0892 (R1), 1.0955 (R2), 1.1015 (R3)

WTICash Daily Chart

- Support: 76.55 (S1), 71.50 (S2), 66.95 (S3)

- Resistance: 81.80 (R1), 85.85 (R2), 89.60 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。