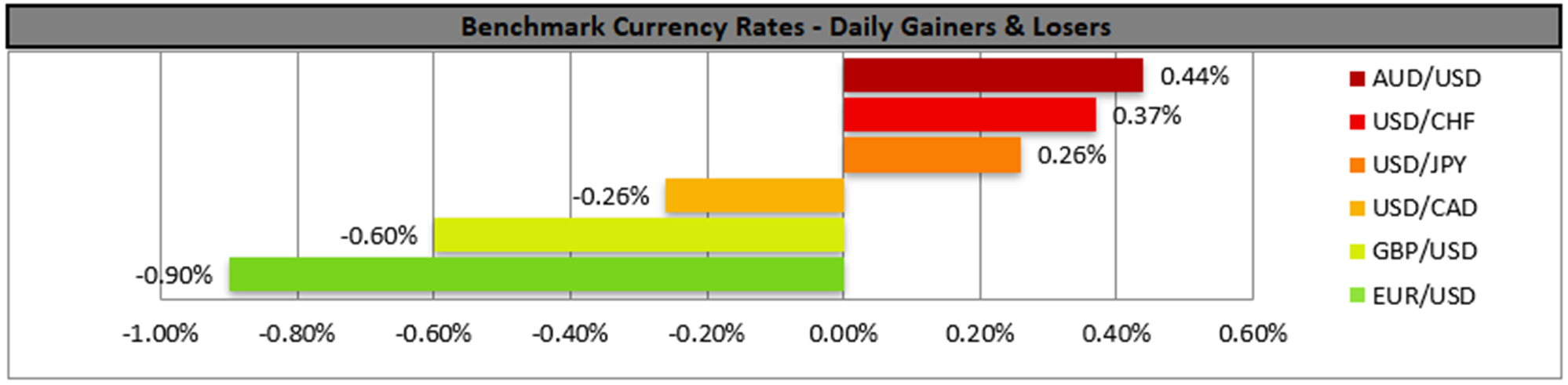

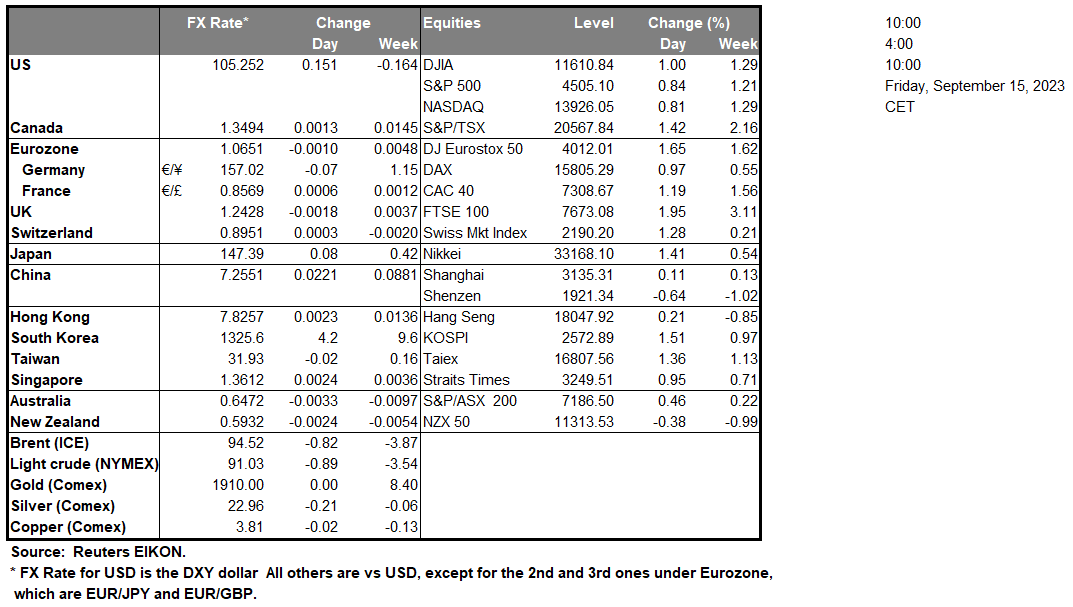

The USD tended to get some support against its counterparts yesterday as the PPI rates for August reaffirmed the persistence of inflationary pressures in the US economy by accelerating more than expected on a year-on-year level, while the retail sales growth rate failed to slow down as much as expected, implying a more resilient demand side of the US economy. Data stemming from the US today are expected to provide us with clues regarding the industrial sector and for the demand side of the US economy and further encouraging data may support the USD.

Across the Atlantic the common currency lost ground across the board yesterday as the ECB hiked rates by 25 basis points as part of the market expected, yet practically implied that it has reached its terminal rate. In the the bank stated that “Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target”. Later on, in her press conference ECB President Lagarde stated that there was a solid majority in favour of the hike yet at the same time answering a question, stated that based on the current assessment the bank, is to maintain the current level of interest rates yet is to maintain a data-dependent approach. We may see the shift of stance of the bank and the lowering of its expectations for the economy to grow, weighing on the common currency.

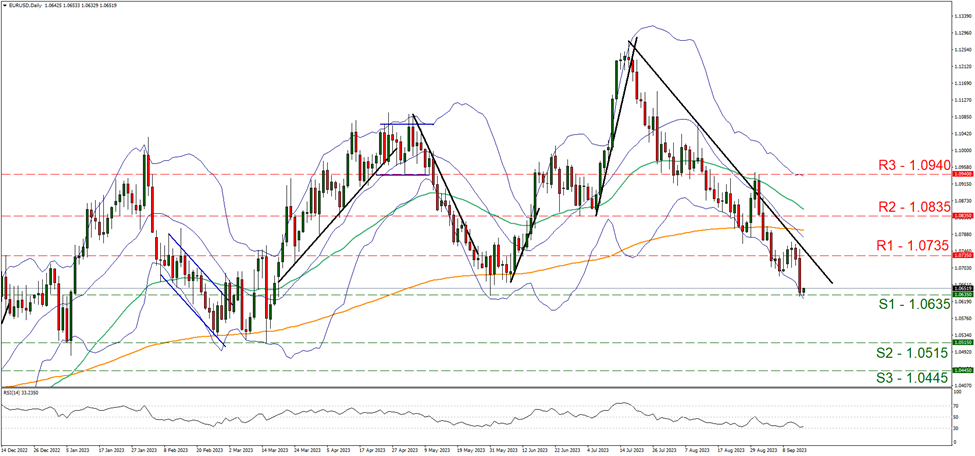

EUR/USD dropped yesterday breaking the 1.0735 (R1) support line, now turned to resistance and proceeded to test the 1.0635 (S1) support base. We tend to maintain a bearish outlook for the pair as long as it remains below the downward trendline incepted since the 18 of July and given that the RSI indicator below our daily chart remains near the reading of 30 implying a bearish sentiment for the pair from market participants. Should the bears maintain control over the pair we may see it breaking the 1.0635 (S1) support line and start aiming for the 1.0515 (S2) support level. Should the bulls take over, we may see the pair reversing course, breaking the downward trendline guiding in a first signal that the downward motion was interrupted and proceeding to break the 1.0735 (R1) resistance line.

On the commodities front, oil prices managed to rise even further yesterday, as the supply side tends to remain tight and the worries for the demand side of the commodity seem to have eased a bit, given that the demand outlook provided by both OPEC and IEA in the past few days, tended to show a healthy rise and a more robust consumption. Furthermore, during today’s Asian session, Chinese manufacturing data for August were better than expected, signaling a possible improvement in oil demand. Additional signals of a tight supply side or improvement of the demand outlook may provide additional support for oil prices.

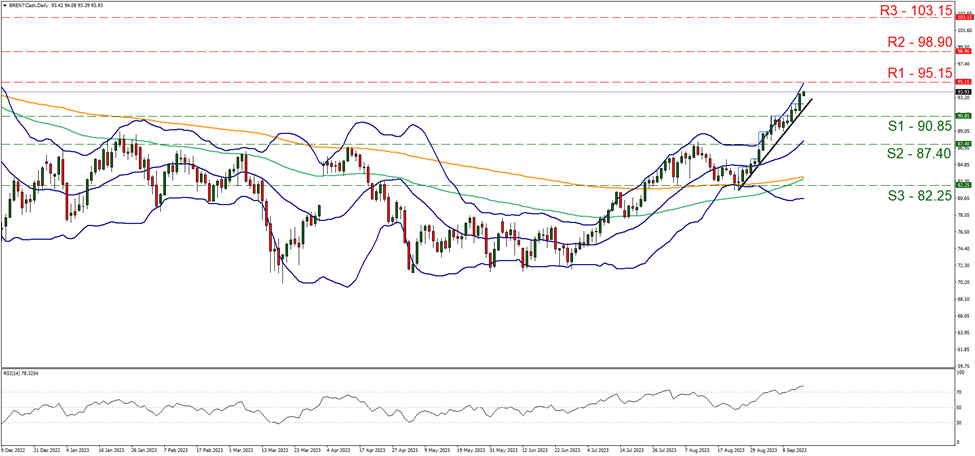

Brent’s price proceeded higher aiming for the 95.15 (R1) resistance line yesterday and during today’s Asian session. We tend to maintain a bullish outlook for the commodity’s price as long as the upward trendline incepted since the 24 of August, continues guiding Brent’s price and given that the RSI indicator is currently at very high levels implying a bullish sentiment for the commodity. Yet the fact that the RSI indicator is above the reading of 70 may also imply that Brent’s price has reached overbought levels and is ripe for a correction lower. Should the bulls maintain control we may see it breaking the 95.15 (R1) resistance line and aim for the 98.90 (S2) support level. Should the bears take over, we may see Brent’s price dropping, breaking the prementioned upward trendline, the 90.85 (S1) support line and aim for the 87.40 (S) support hurdle.

その他の注目材料

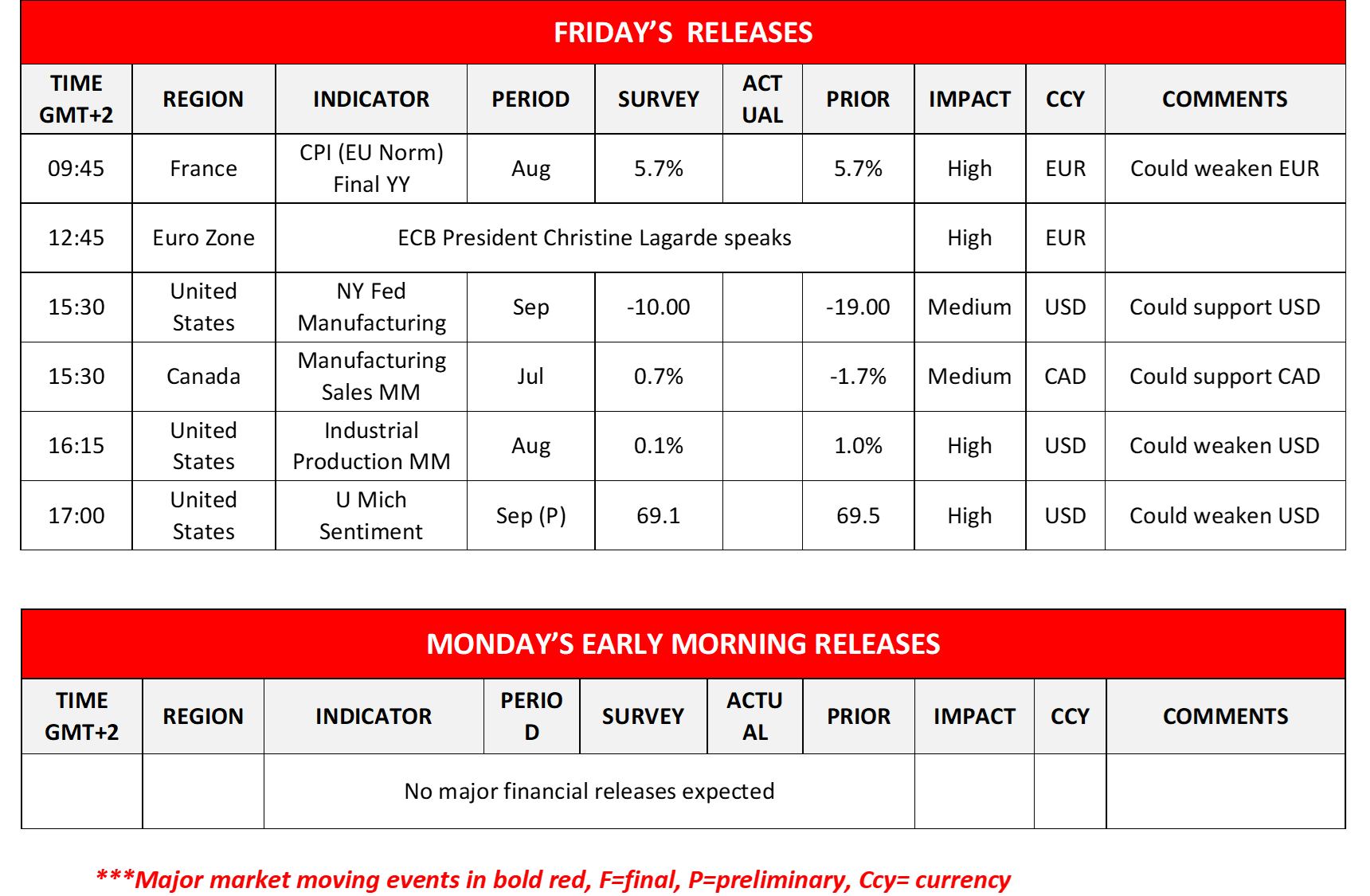

In today’s European session, we note the release of France’s final HICP rates for August, while ECB President Lagarde is expected to speak. In the American session, besides the US data, we also note the release from Canada of the manufacturing sales for July.

EUR/USD デイリーチャート

Support: 1.0635 (S1), 1.0515 (S2), 1.0445 (S3)

Resistance: 1.0735 (R1), 1.0835 (R2), 1.0940 (R3)

Brent Daily Chart

Support: 90.85 (S1), 87.40 (S2), 82.25 (S3)

Resistance: 95.15 (R1), 98.90 (R2), 103.15 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。