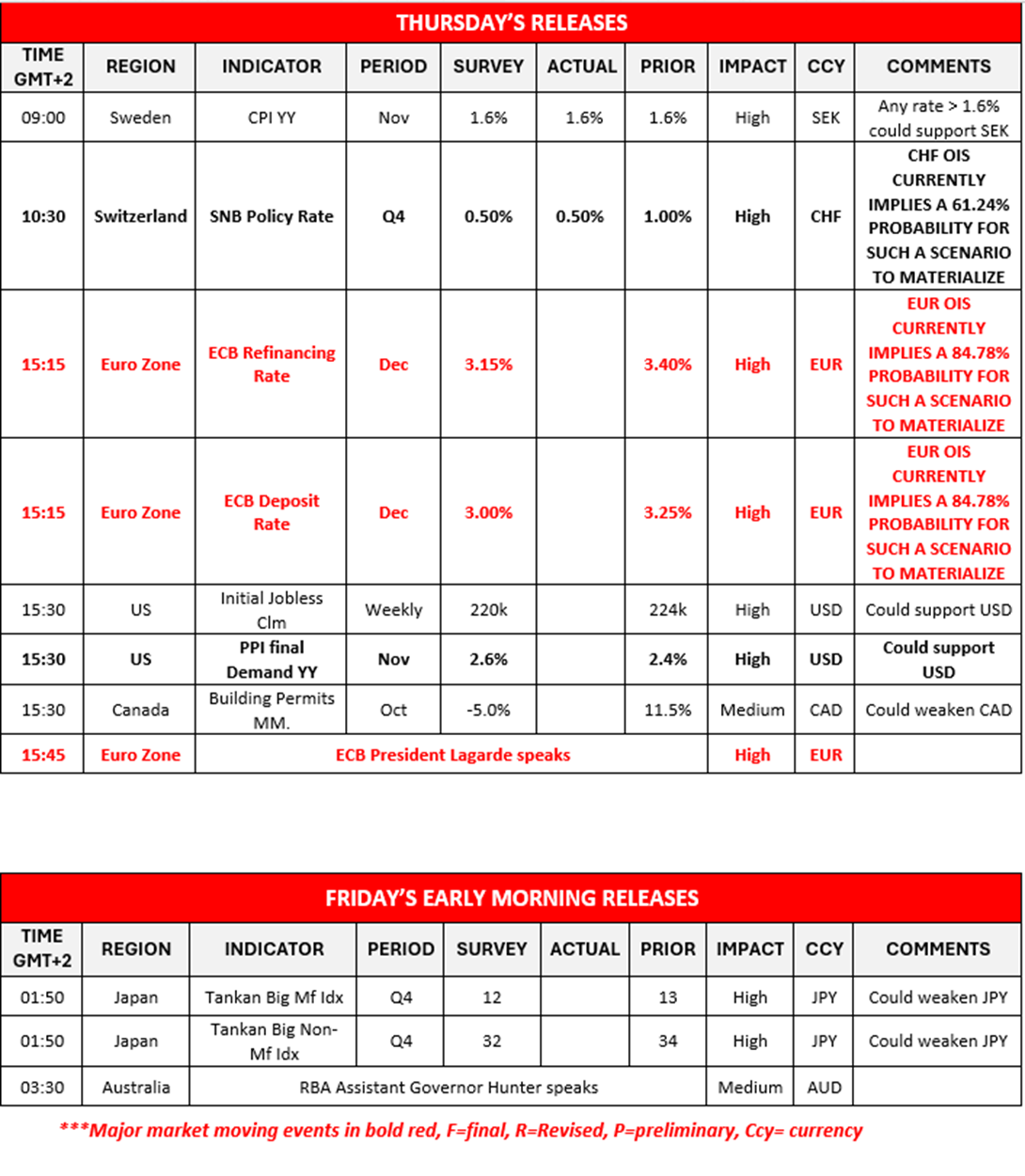

The ECB’s interest rate decision is due out later on today, with the majority of market participants currently expecting the bank to cut interest rates by 25 basis points, with EUR OIS currently implying an 84.78% probability for such a scenario to materialize. The ECB’s decision today will be their last monetary policy meeting for 2024 and thus may garner even greater attention and in particular, ECB President Lagarde’s speech following the bank’s interest rate announcement. The concerns surrounding the economic situation in France and Germany are of high concern, as both services and manufacturing PMI figures for November which were released last week, remain in contraction territory. Moreover, the political instability in both France and Germany is not desirable. In our view, we would not be surprised to see the bank cutting interest rates, in addition to the bank’s accompanying statement and ECB President Lagarde’s speech implying that the bank may continue cutting interest rates with the new year. Such a scenario could potentially weigh on the common currency, yet should the bank showcase a willingness to remain on hold it could have the opposite effect and thus may aid the EUR. Over in Switzerland, the SNB cut interest rates by 50bp as was widely expected by market participants. The release could weigh on the CHF.

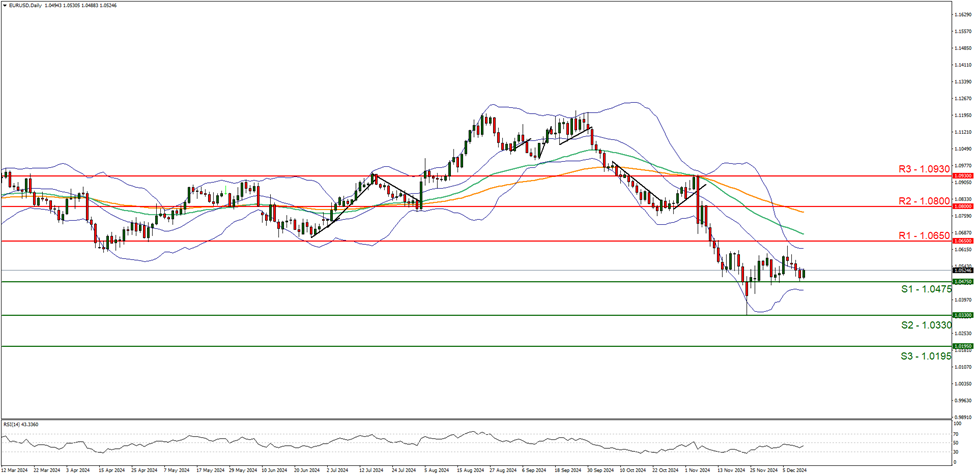

EUR/USD appears to be moving in a relatively sideways fashion. We opt for a sideways bias for the pair, yet the RSI indicator below our chart which currently registers a figure of 40, implying a bearish market sentiment. Nonetheless, for our sideways bias to continue, we would require the pair to remain confined between the 1.0475 (S1) support level and the 1.0650 (R1) resistance line. Yet, we would switch our sideways bias in favour of a bearish outlook in the event of a clear break below the 1.0475 (S1) support level, with the next possible target for the bears being the 1.0330 (S2) support line. Lastly, for a bullish outlook we would require a clear break above the 1.0650 (R1) resistance level, with the next possible target for the bulls being the 1.0800 (R2) resistance line.

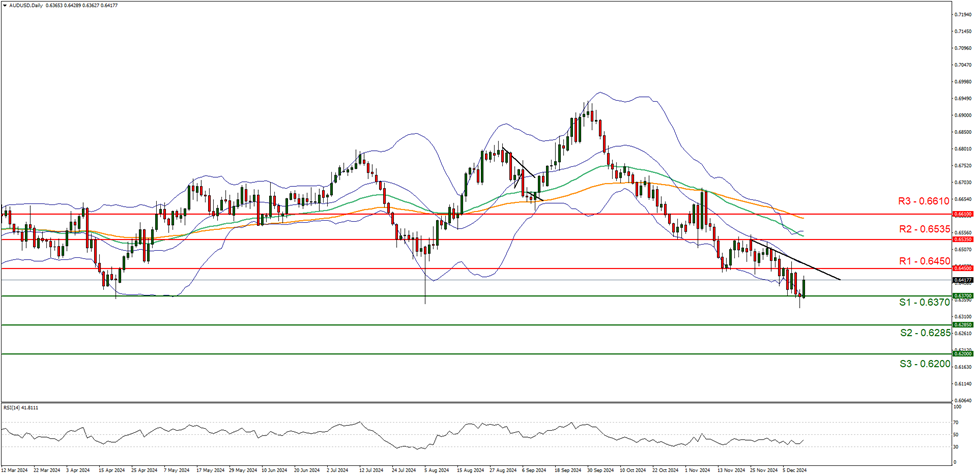

AUD/USD appears to be moving in a relatively downwards fashion. We opt for a bearish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 40 implying a bearish market sentiment, in addition to the downwards moving trendline which was incepted on the 25 of November. For our bearish outlook to continue we would require a clear break below the 0.6370 (S1) support line with the next possible target for the bears being the 0.6285 (S2) support base. On the flip side for a sideways bias we would require the pair to remain confined between the 0.6370 (S1) support level and the 0.6450 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 0.6450 (R1) resistance level, with the next possible target for the bulls being the 0.6535 (R2) resistance line.

その他の注目材料

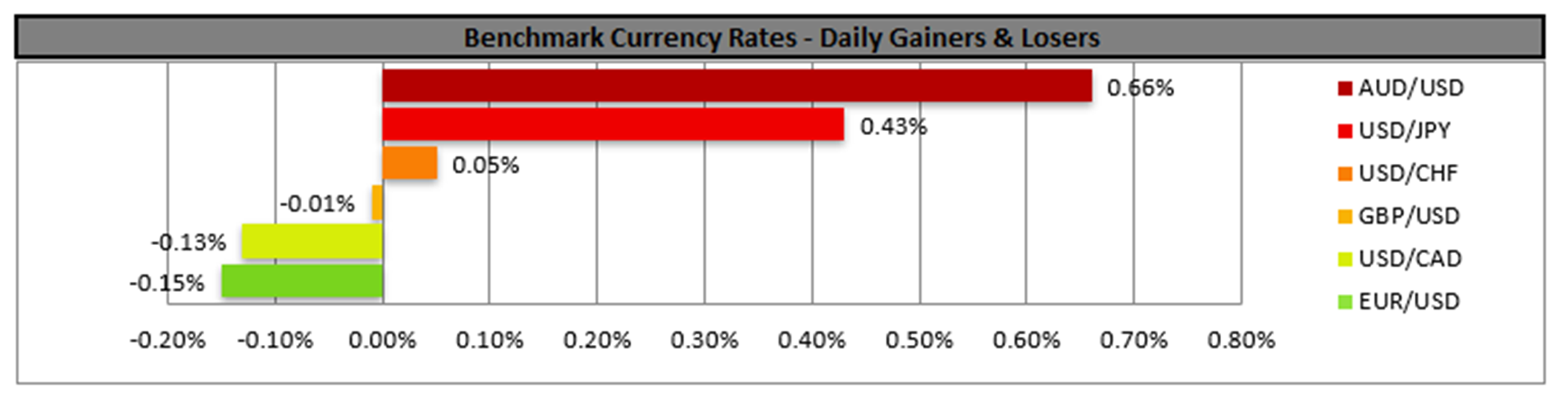

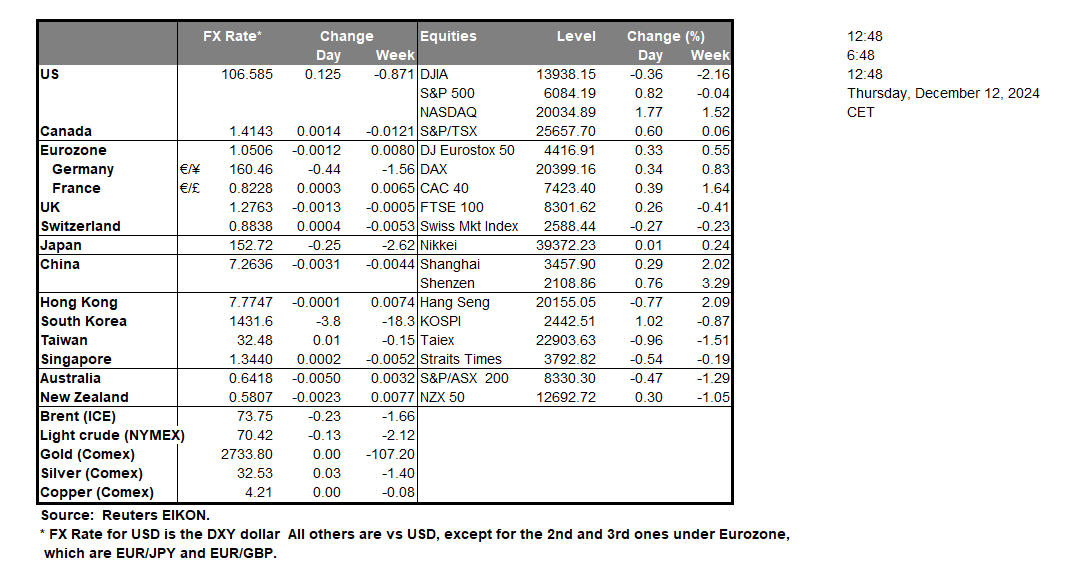

Today, we note the release of Sweden’s CPI rate for November, the US weekly initial jobless claims figure, US PPI machine manufacturing figure for November and Canada’s building permits figure for October. In tomorrow’s Asian session we note Japan’s Tankan index figures for Q4. On a monetary level we highlight the SNB’s and ECB’s interest rate decisions followed by ECB President Lagarde’s press conference later on the day. In tomorrow’s Asian session we note RBA Hunter’s speech.

EUR/USD デイリーチャート

- Support: 1.0475 (S1), 1.0330 (S2), 1.0195 (S3)

- Resistance: 1.0650 (R1), 1.0800 (R2), 1.0930 (R3)

AUD/USD デイリーチャート

- Support: 0.6370 (S1), 0.6285 (S2), 0.6200 (S3)

- Resistance: 0.6450 (R1), 0.6535 (R2), 0.6610 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。