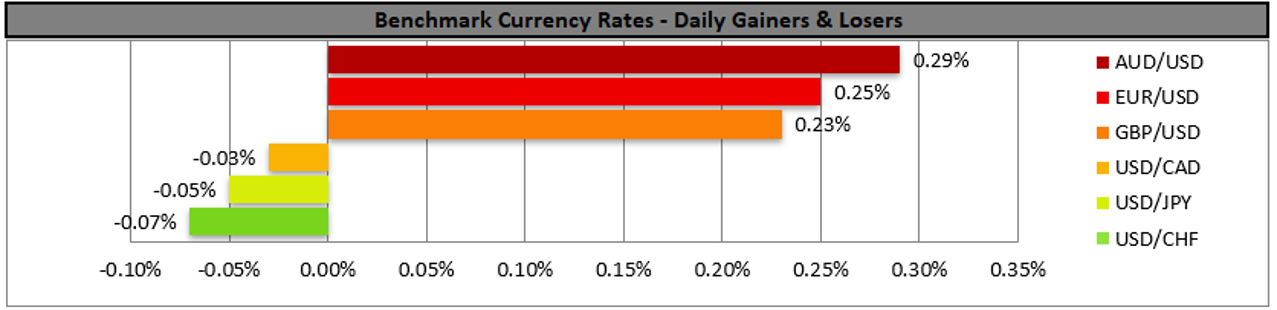

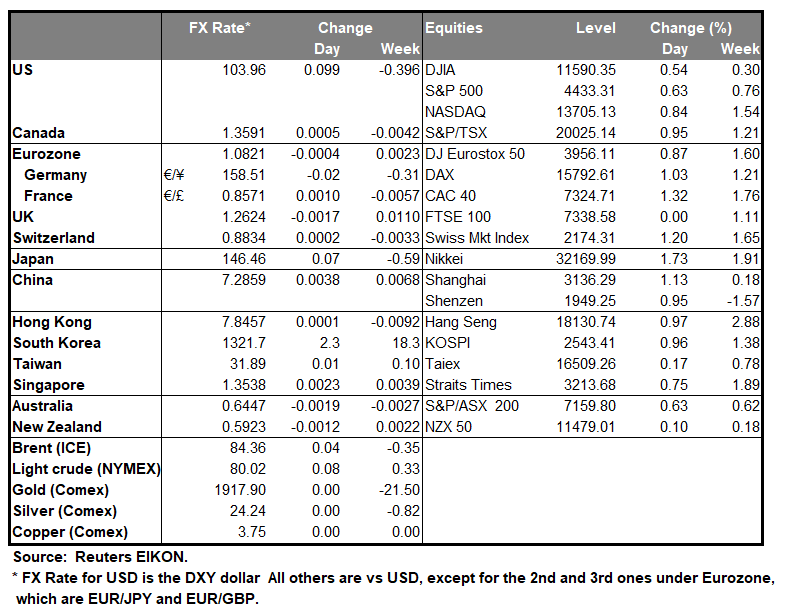

The USD tended to edge a bit lower against its counterparts, yesterday yet nothing convincing that the bears took over, as US Treasury yields tended to drift lower ahead of the release of key US economic data in the week. The market is increasingly focusing on the release of the US employment report for August. The Fed seems to continue to lean on the hawkish side judging from Fed Chairman Powell’s comments at the Jackson Hole summit, in an effort to curb inflationary pressures in the US economy further, which in turn may keep the USD supported. It’s characteristic that gold’s price maintained its negative correlation with the USD and was able to benefit from the slight weakening of the USD and the retreat of US bond yields. We expect this relationship to continue to characterize the movement of gold’s price and should the USD edge further lower we may see gold’s price ascending even higher.

US stock markets on the other hand tended to remain in the greens for a second day in a row taking advantage of the calming market’s worries. The effect of earnings releases has also eased, and most high-profile companies have already released their reports reducing market interest somewhat. Yet China’s problems seem to be stocking some fears about a possible global economic slowdown. We expect China’s PMI figures, for the manufacturing sector to shed more light on the subject on Thursday and Friday. A possible wider contraction of economic activity in the Chinese manufacturing sector could turn the market more cautious. Nevertheless, for the time being the measures of the Chinese government to boost economic activity may allow for some optimism among market participants which could provide some support for riskier assets such as stocks but also commodity currencies AUD, NZD and CAD.

AUD/USD for the time being seems to have hit a floor at the 0.6400 (S1) support line and risen slightly. We tend to maintain a bias for the sideways motion of the pair to continue currently given also that the RSI indicator seems to be running along the reading of 50 implying a rather indecisive market. Should a clearcut selling interest be expressed by the market the pair may break the 0.6400 (S1) support line and aim for the 0.6285 (S2) support barrier. Should the pair find extensive buying orders along its path we may see it breaking the 0.6515 (R1) resistance line and aiming for the 0.6620 (R2) resistance hurdle.

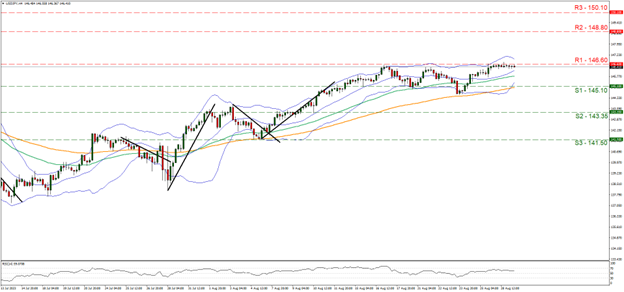

On a technical level, we note that JPY failed to gain against the weakening USD and characteristically USD/JPY remained unchanged with little volatility, unable to break the 146.60 (R1) resistance level. For the time being, we tend to maintain a bias for the sideways motion of the pair and for a bullish outlook, we would require the pair the clearly break the 146.60 (R1) resistance line and start aiming for the 148.80 (R2) resistance base. It should be noted that the RSI indicator remains above the reading of 50 implying a bullish predisposition of the market, yet for the time being no bullish price action seems to accompany it. For a bearish outlook, we would require USD/JPY to drop, break the 145.10 (S1) line and aim for the 143.35 (S2) level.

その他の注目材料

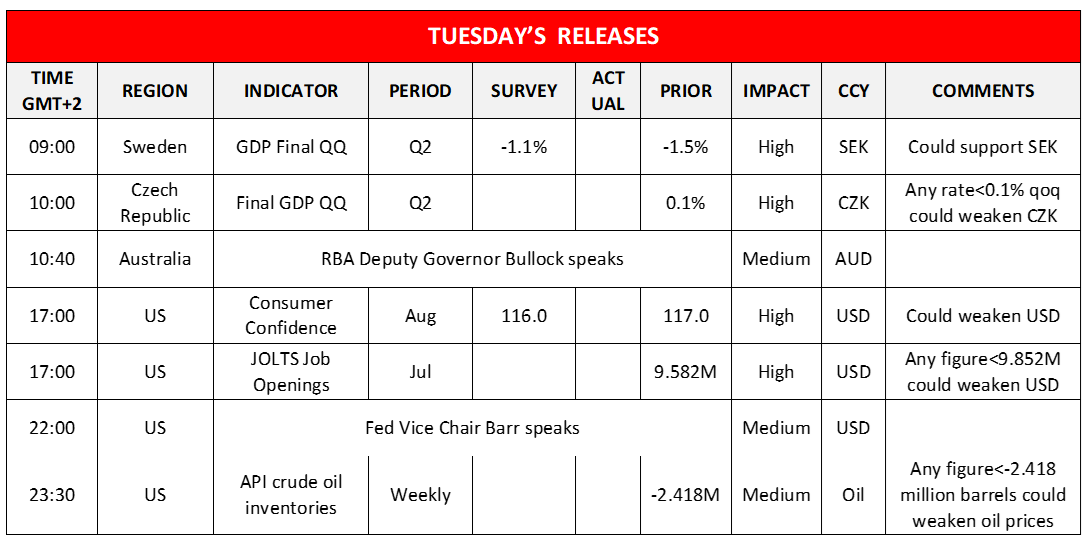

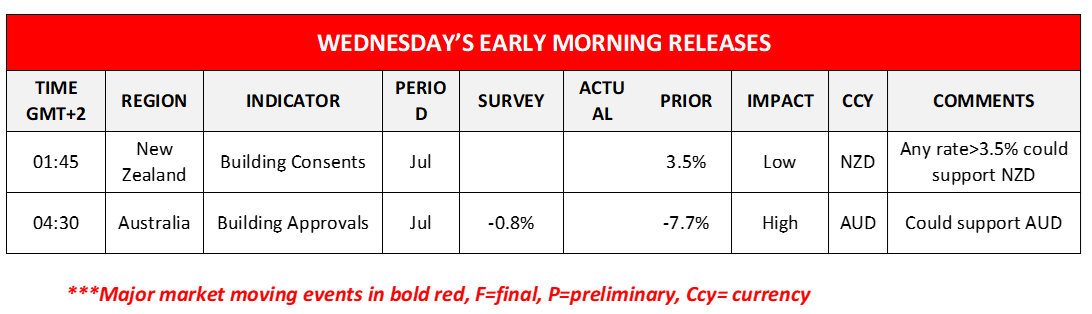

During today’s European session, we note the release of the GDP rates for Q2 of Norway and Sweden, while RBA Deputy Governor Bullock is scheduled to speak. In the American session, we note the release from the US of the Consumer confidence for August and the JOLTS job openings figure for July, while Fed Vice Chair Barr speaks. Oil traders, on the other hand, may be more interested in the release of the US API weekly crude oil inventories figure. During tomorrow’s Asian session, we note the release of New Zealand’s and Australia’s building approvals growth rates, both being for July.

USD/JPY 4時間チャート

Support: 145.10 (S1), 143.35 (S2), 141.50 (S3)

Resistance: 146.60 (R1), 148.80 (R2), 150.10 (R3)

AUD/USD 4時間チャート

Support: 0.6400 (S1), 0.6285 (S2), 0.6170 (S3)

Resistance: 0.6515 (R1), 0.6620 (R2), 0.6725 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。