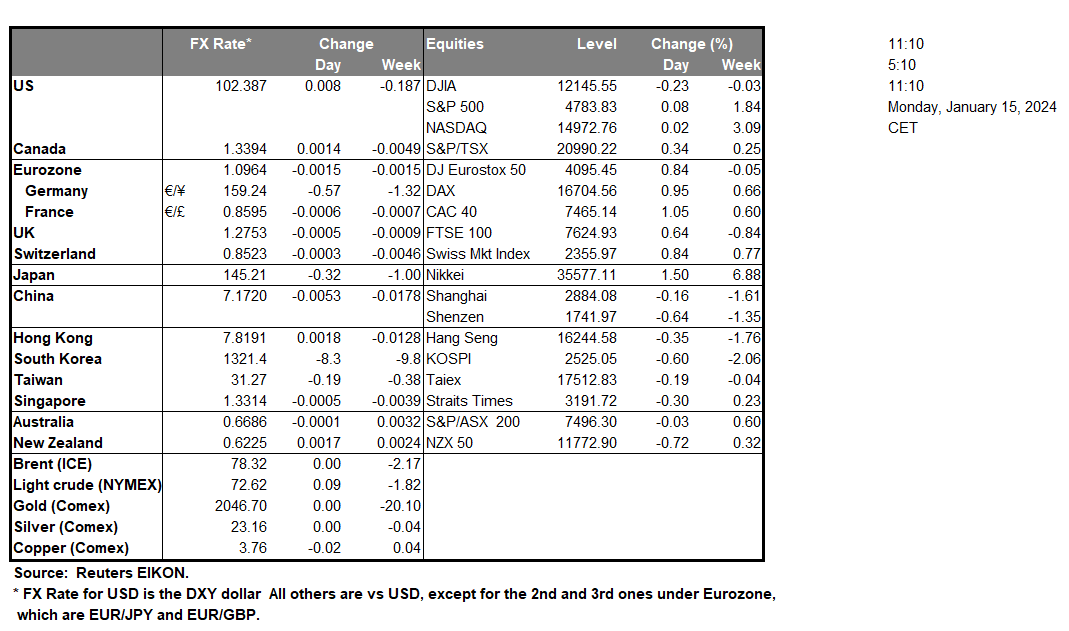

The USD tended to maintain a rather tight range bound motion against its counterparts on Friday and during today’s Asian session as a rather easy-going Monday begins. No high-impact financial releases are expected from the US today, hence we expect fundamentals to lead the way. It should be noted that the Fed’s intentions may still be the main concern of the market, while also we note that the Davos meeting kicks off and tensions in the Middle East remain still high, yet some efforts for a possible mediation seem on the horizon. US stock markets continued to send mixed signals on Friday as large US banks failed to excite traders with their earnings reports. Nevertheless, a more optimistic attitude seems to have been adopted by the markets during today’s Asian session. We expect that the attention of the markets during the week may continue shifting toward US stock markets as headlines about earnings releases may multiply. Overall, should a more risk-oriented market sentiment be maintained it may provide more support for the US equities markets and vice versa.

その他の注目材料

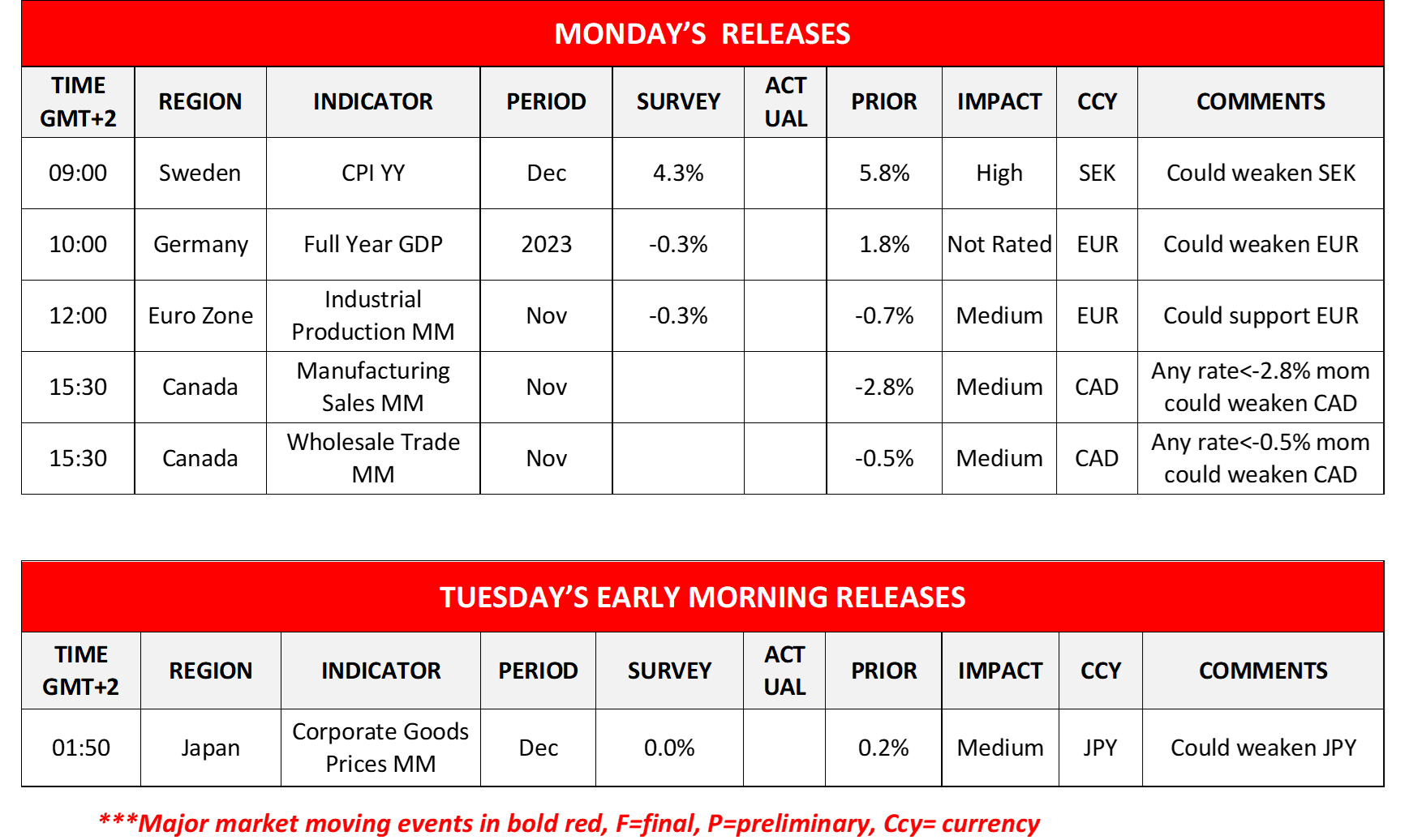

Today in the European session, we note the release of Sweden’s CPI rate for December, Germany’s Full Year GDP rate for 2023 and the Eurozone’s industrial production for November. In the American session, we note the release of Canada’s manufacturing sales and wholesale trade, both being for November. During tomorrow’s Asian session, we get Japan’s corporate goods prices for December.

The relatively low volatility was also expressed on a technical level as EUR/USD remained in a tight rangebound motion between the 1.0890 (S1) support line and the 1.1010 (R1) resistance line. We note that the RSI indicator continues to run along the reading of 50 implying a rather indecisive market and we tend to maintain our bias for the sideways motion to continue as long as the price action does not escape the prementioned boundaries. Should the bulls take over, we may see the pair breaking the 1.1010 (R1) resistance line and aiming for the 1.1135 (R2) resistance nest. Should the bears take over, we may see the pair breaking the 1.0890 (S1) support line and aiming for the 1.0740 (S2) support base.

Similarly USD/CAD maintained a sideways motion remaining close to the 1.3400 (R1) resistance line. We tend to maintain a bias for the sideways motion around the 1.3400 (R1) axis to be maintained given also that the RSI indicator remains just above the reading of 50. Should the pair find extensive buying orders along its path, we may see the pair breaking the 1.3320 (R1) resistance line clearly and aim if not breach the 1.3485 (R2) resistance barrier. Should a selling interest be expressed by the market, we may see the pair breaking the 1.3320 (S1) support line in search of lower grounds.

今週の指数発表:

On Tuesday, we note Japan’s corporate goods price rate for December, Norway’s GDP rate for November, Germany’s ZEW indicators for January and Canada’s BOC Core CPI rates for December. On Wednesday we note China’s industrial output rate for December and their GDP rate for Q4. Later on, we note the UK’s CPI rate the US Retail sales rate, Canada’s producer prices rate and the US industrial production rate all for the month of December. On Thursday, we note Japan’s machinery orders rate for November, Australia’s employment data for December, the US weekly initial jobless claims figure and the US Philly Fed business index figure for January. On Friday, we note Japan’s Core and Headline CPI rates for December, followed by the UK’s retail sales rate for December, Canada’s retail sales rate for November, the US Preliminary University of Michigan consumer sentiment figure for January and ending off the week is the Eurozone’s preliminary consumer confidence figure for January.

EUR/USD 4時間チャート

Support: 1.0890 (S1), 1.0740 (S2), 1.0615 (S3)

Resistance: 1.1010 (R1), 1.1135 (R2), 1.1275 (R3)

USD/CAD 4時間チャート

Support: 1.3320 (S1), 1.3255 (S2), 1.3160 (S3)

Resistance: 1.3400 (R1), 1.3485 (R2), 1.3610 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。