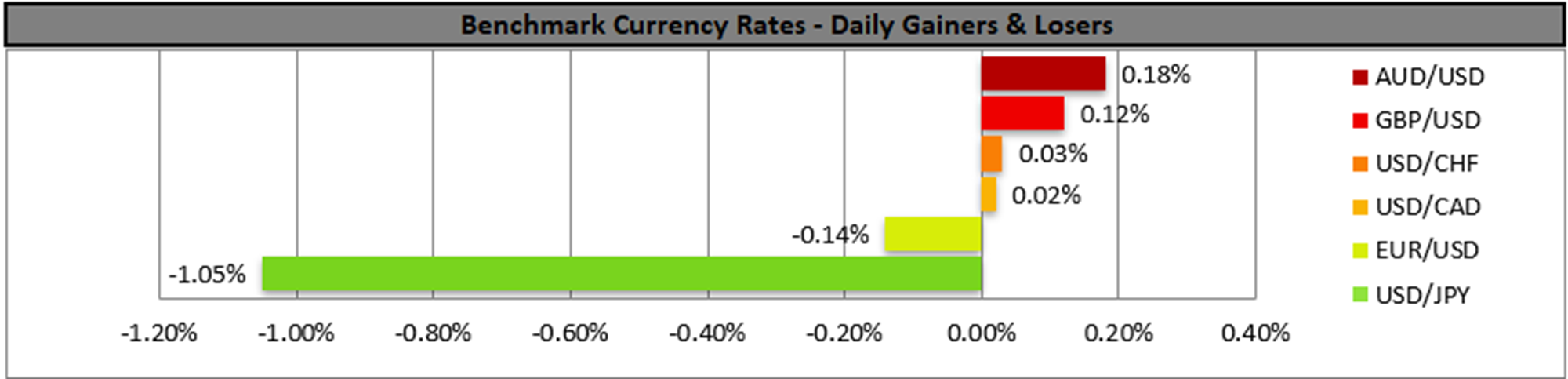

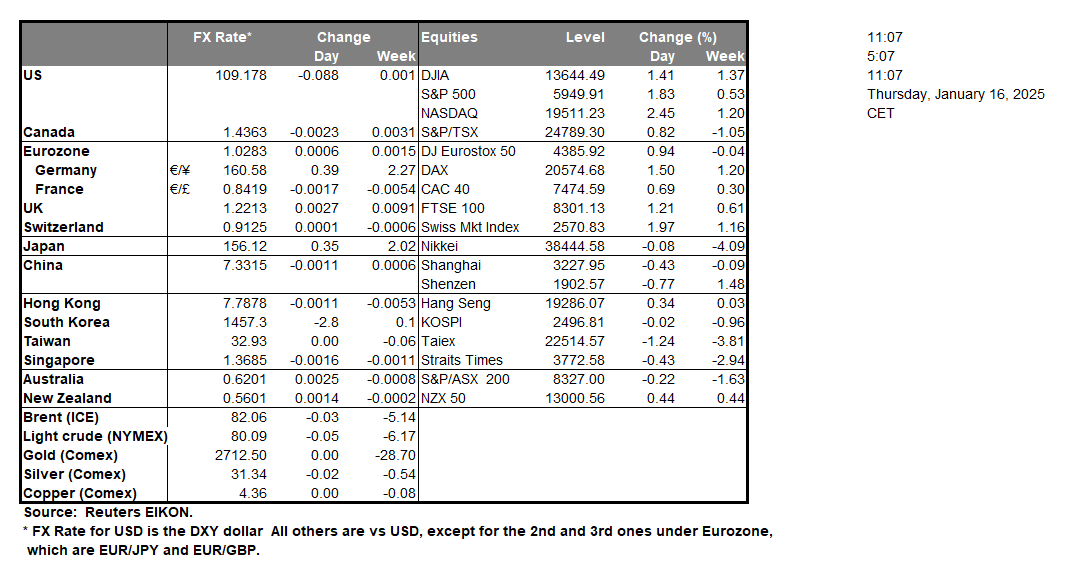

The release of the US CPI rates for December yesterday displayed a resilience of inflationary pressures on a consumer level in the US economy for the past month. It’s characteristic that both the core and headline rates accelerated which if combined with the strong employment data for the same month may add pressure on the Fed to remain on hold for a longer period. For the time being we note that the market’s expectations are for the bank to proceed with its next rate cut in the June meeting, as per Fend Fund Futures. Today we note the release of the US retail sales growth rate for December and the headline rate is expected to slow down a bit, which could be perceived as awkward, given the holiday season and could weigh on the USD as it may perceived as a signal of an easing demand in the US economy should the expectations be realised. Furthermore, we also note the release of the Philly Fed Business index for January which is expected remain in the negatives yet improve and thus provide some support for the greenback.

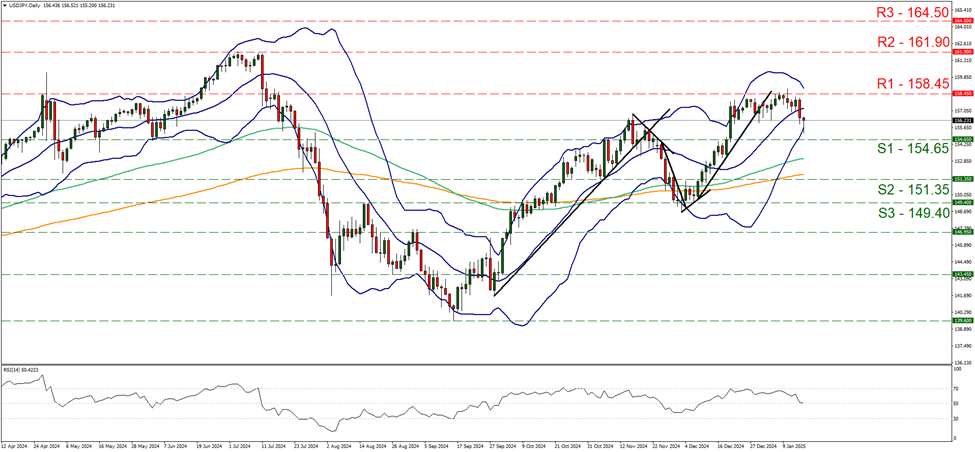

USD/JPY dropped yesterday, aiming at some point during todays’ Asian session for the 154.65 (S1) support line yet corrected higher later on. We see the case for some bearish tendencies of the pair yet for the time being we still remain unconvinced for a bearish outlook maintaining our bias for the sideways motion to be continued. The RSI indicator has reached the reading of 50, implying a relative indecisiveness of market participants for the pair’s direction. Also the Bollinger bands continued to converge reflecting the lower volatility of the pair’s price action, and its characteristic that the pair’s price action corrected higher after hitting the lower Bollinger band. For a bearish outlook we would require the pair to break the 154.65 (S1) support line and start aiming for the 151.35 (S2) support level. Should the bulls take over, we may see USD/JPY breaking the 158.45 (R1) resistance line and start aiming for the 161.90 (R2) resistance base.

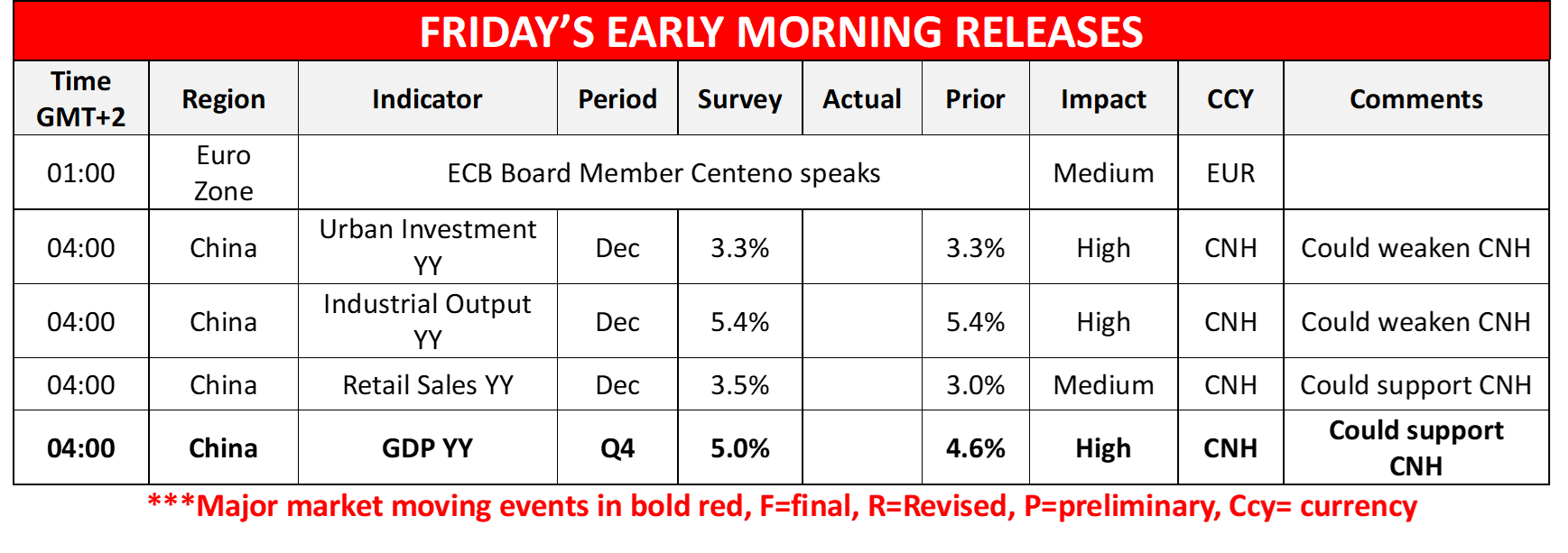

In tomorrow’s Asian session, we highlight the release of China’s GDP rate for Q4, as well as December’s Urban investment, industrial output and retail sales growth rates as key indicators for the health of the Chinese economy. The GDP rate is expected to accelerate and reach 5%yoy, in a signal that the Chinese government despite the struggling of Chinese factories to increase economic activity, has reached its growth goal and provide more confidence in the markets for China’s economic outlook. Also, the retail sales growth rate is expected to accelerate, implying a stronger demand side in the Chinese economy which in turn may support CNY. Yet the release is expected to also catch the attention of Aussie traders given the close Sino-Australian economic ties. A possible acceleration of the industrial output growth rate could provide some support for the AUD as it could imply more exports of Australian raw materials to China.

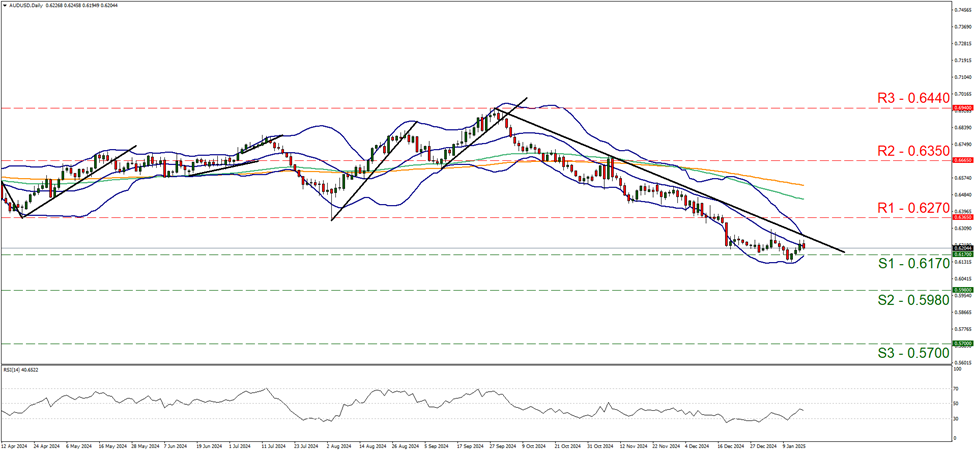

AUD/USD remained close to the 0.6170 (S1) support line in the past 24 hours. We maintain a bearish outlook for the pair as long as the downward trendline incepted since the 30 of September, remains intact. Yet, we note that the RSI indicator remains below the reading of 50 implying the presence of a bearish predisposition of the market for the pair. Should the bears actually maintain control over the pair’s direction, we may see AUD/USD breaking the 0.6170 (S1) support line, opening the gates for the 0.5980 (S2) support level. For a bullish outlook we would require the pair to reverse direction by breaking initially the prementioned downward trendline, in a first signal that the downward motion has been interrupted and continue to break the 0.6270 (R1) resistance line, thus paving the way for the 0.6350 (R2) resistance hurdle.

その他の注目材料

Today we note the release of UK’s GDP rate and manufacturing output rate for November, Germany’s HICP rate for December and later on Canada’s House Starts for December, the US weekly initial jobless claims figure, and we note the release of ECB last meeting minutes and the speech of BoC’s Deputy Governor Gravelle. In tomorrow’s Asian session, we note the planned interview of ECB’s Centeno.

USD/JPY Daily Chart

- Support: 154.65 (S1), 151.35 (S2), 149.40 (S3)

- Resistance: 158.45 (R1), 161.90 (R2), 164.50 (R3)

AUD/USD デイリーチャート

- Support: 0.6170 (S1), 0.5980 (S2), 0.5700 (S3)

- Resistance: 0.6270 (R1), 0.6350 (R2), 0.6440 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。