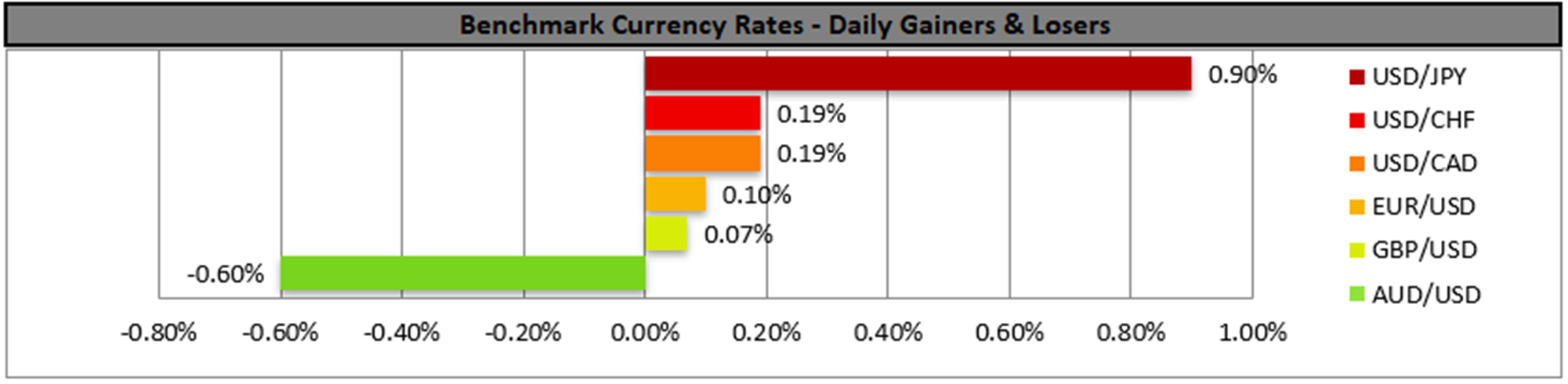

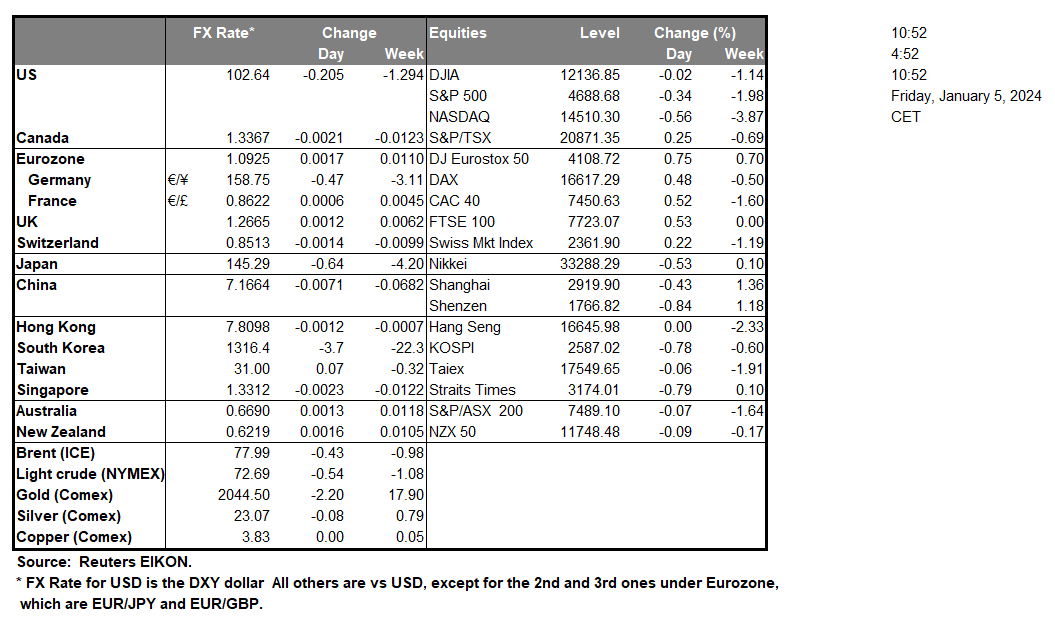

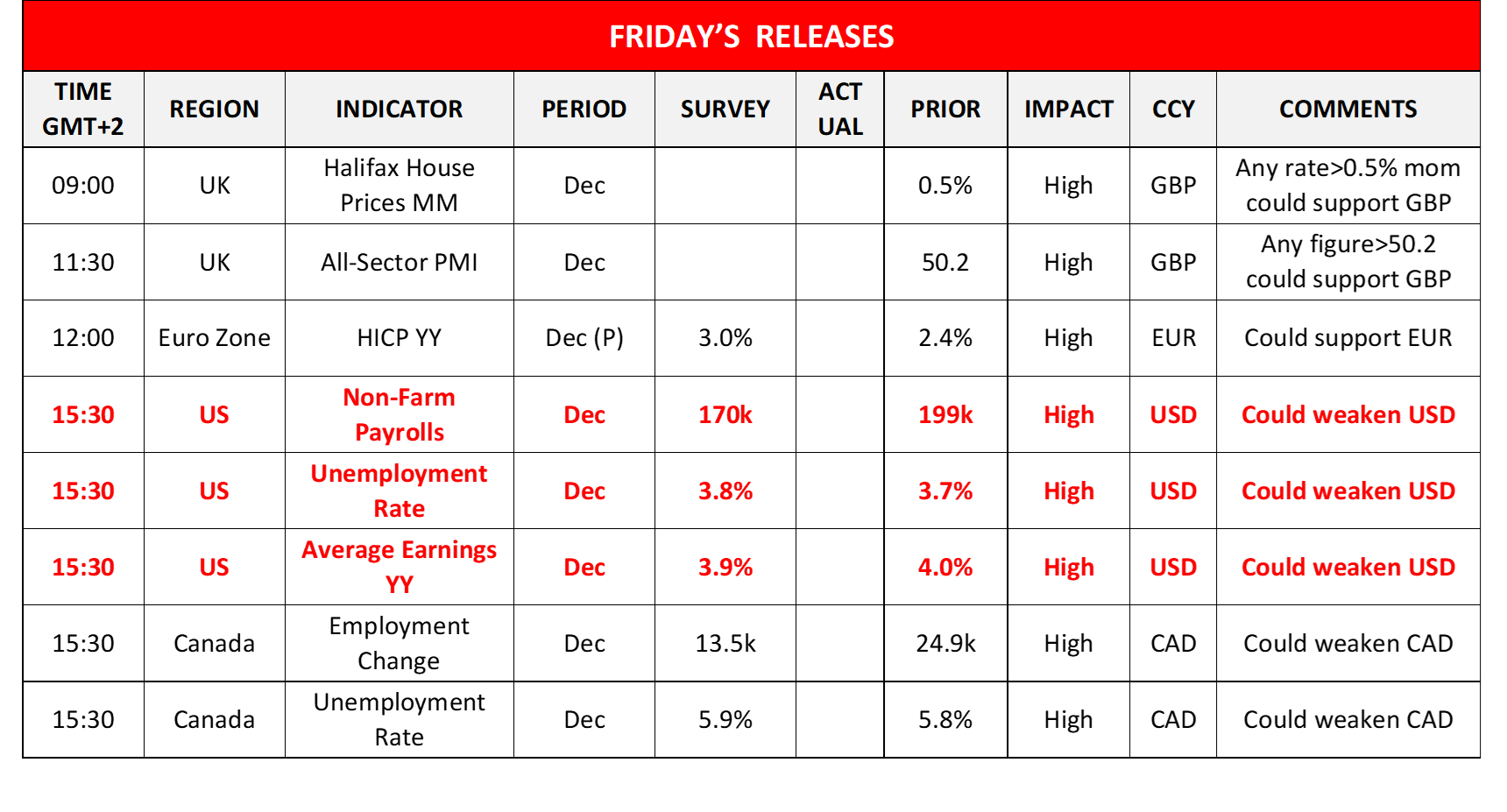

Today, we expect market attention to turn towards the release of the US employment report for December. The non-farm payroll figure is expected to drop to 170k from November’s 199k, the unemployment rate to tick up to 3.8% and the average earnings growth rate to slow down to 3.9% yoy from November’s 4.0% yoy. Should the actual rates and figures meet their respective forecasts, we may see the USD weakening, as all three indicators align in pointing towards an easing of the US employment market’s tightening. Such an easing may enhance the market’s expectations for the Fed to start aggressively cutting rates as early as March and even solidify market expectations for a total of six rate cuts in 2024. Overall, the release is expected to have a wider effect beyond major pairs in the FX market and US stockmarkets may get some support should the tightness of the US employment market ease, while a possible weakening of the USD could support gold’s price.

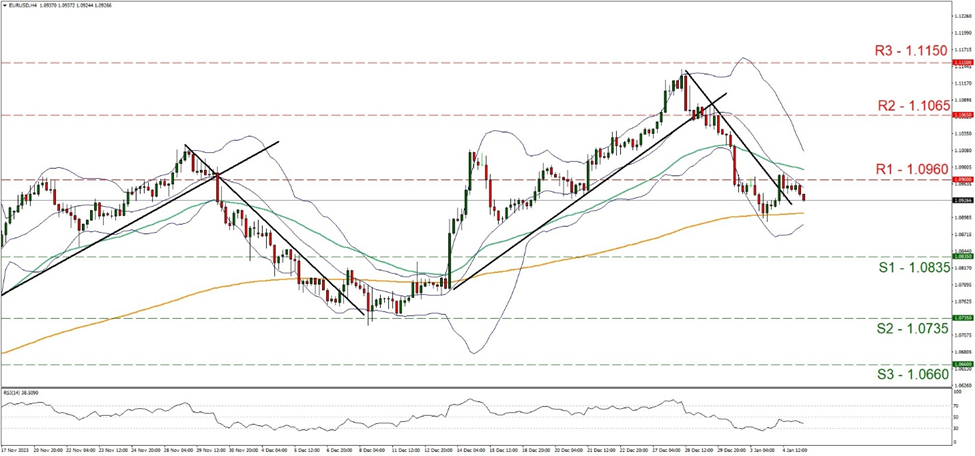

On a technical level, we note that the USD tended to gain against the EUR, as EUR/USD hit a ceiling at the 1.0960 (R1) resistance line. We have to note that the RSI indicator also tended to drop aiming for the reading of 30 and implying a built up of a bearish market sentiment as the price action moved lower. Yet for a bearish outlook we would require EUR/USD, to aim if not breach the 1.0835 (S1) support line and definitely reach a lower low. On the flip side should the bulls take over, we may see the pair breaking the 1.0960 (R1) resistance line and aiming for the 1.1065 (R2) resistance nest.

North of the US border and at the same time of the release of the US employment data, we also get Canada’s employment data for December and CAD traders are expected to keep a close eye on the release. The unemployment rate is expected to tick up and reach 5.9%, while the employment change figure is expected to drop to 13.5k if compared to November’s 24.9k. Should the actual rates and figures meet their respective forecasts, we may see the CAD weakening as they would imply that the slack in the Canadian employment market continues to widen. Such rates and figures may enhance the market’s expectations for BoC to cut rates five times in the current year or even enhance market expectations for the bank to proceed with its first rate cut earlier than April which is currently expected. On the flip side should data diverge from current expectations showing a tightening Canadian employment market, we may see the Loonie getting some asymmetric support.

USD/CAD seemed to stabilise between the 1.3400 (R1) resistance line and the 1.3320 (S1) support level. Yet the upward trendline guiding the pair seems to remain intact and the RSI indicator is just lower than the reading of 70, implying a rather bullish sentiment in the market for the pair currently, thus we tend to maintain our bullish outlook for now. Should the bulls actually maintain control over the pair, we may see it breaking the 1.3400 (R1) resistance line and aim for the 1.3485 (R2) resistance nest. Should the bears say enough is enough and take over, we may see USD/CAD breaching the prementioned upward trendline in a first signal that the upward motion has been interrupted, break also the 1.3320 (S1) support line and aim for the 1.3255 (S2) support base.

その他の注目材料

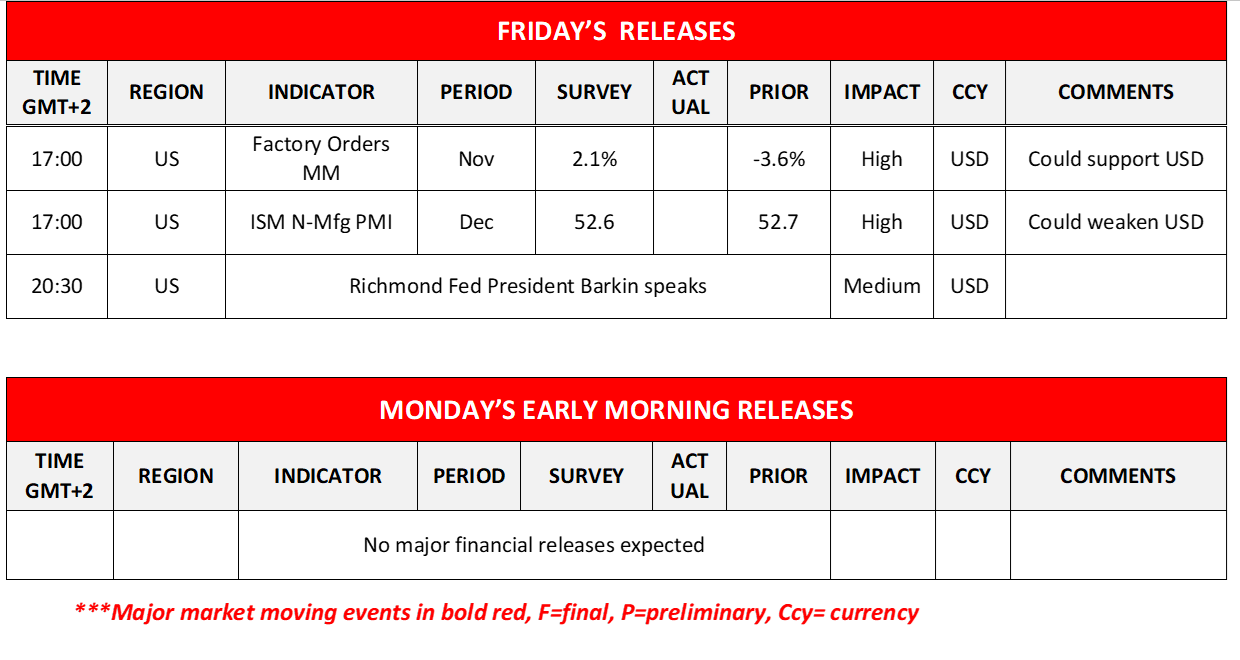

Today in the European session, we note the release of UK’s Halifax House prices and All sector PMI figure, both being for December and highlight the release of Eurozone’s preliminary HICP rate for the same month. In the American session we also note the release from the US of the Factory orders growth rate for November and the ISM non-manufacturing PMI figure for December, while on the monetary front, Richmond Fed President Barkin speaks.

EUR/USD 4時間チャート

Support: 1.0835 (S1), 1.0735 (S2), 1.0660 (S3)

Resistance: 1.0960 (R1), 1.1065 (R2), 1.1150 (R3)

USD/CAD 4時間チャート

Support: 1.3320 (S1), 1.3255 (S2), 1.3160 (S3)

Resistance: 1.3400 (R1), 1.3485 (R2), 1.3610 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。