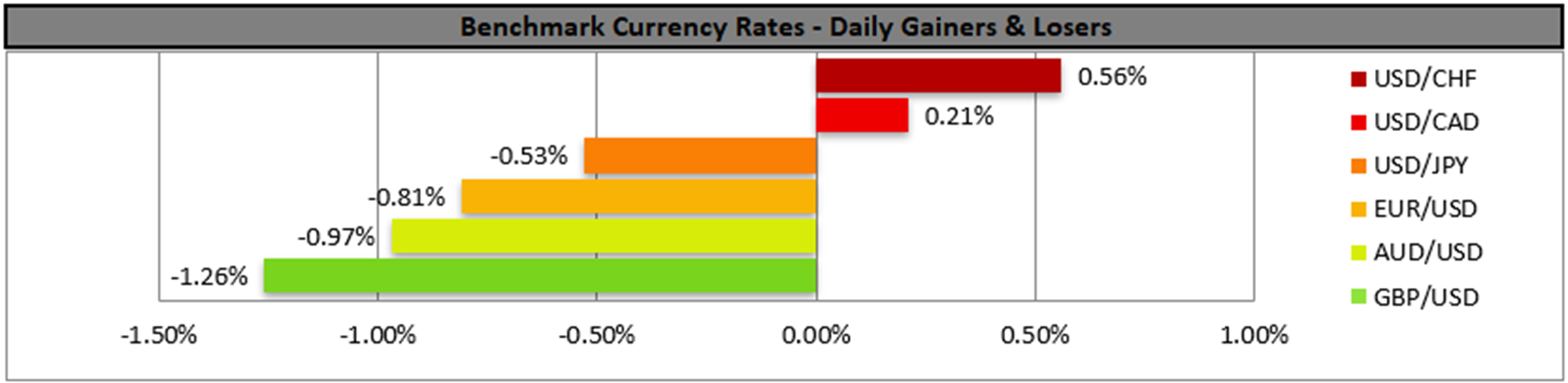

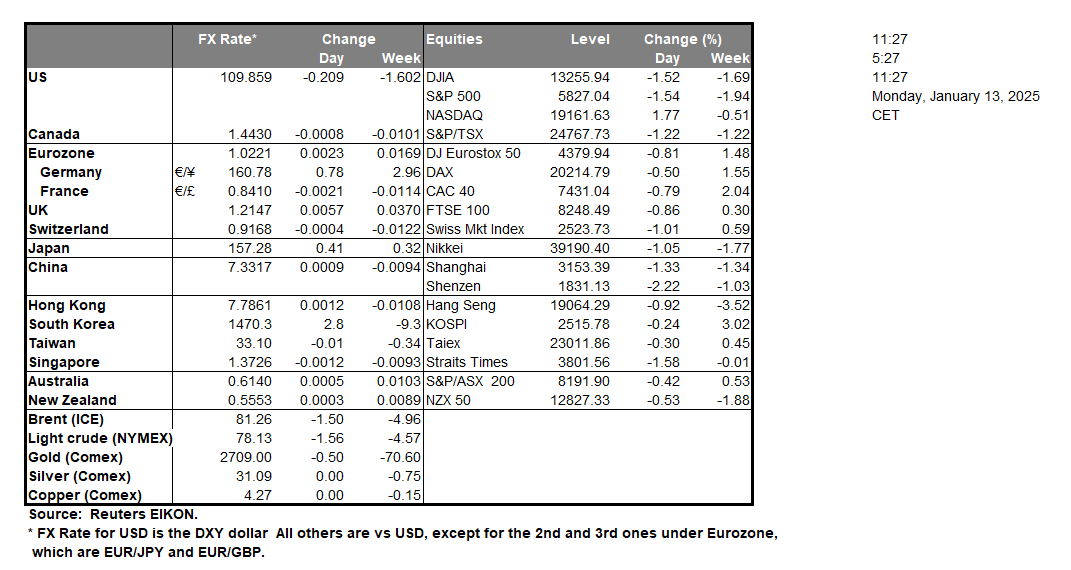

The USD gained against its counterparts on Friday and during today’s Asian session, as the US employment report for December came in hotter than expected with the NFP figure unexpectedly rising instead of dropping and the unemployment rate ticking down. The release solidified the market’s expectations for the Fed to remain on hold in its January meeting and has postponed any rate cut for the year to the end of Q2 2025. On a similar note, Canada’s employment data also showed an unexpected tightening of the Canadian employment market for December which may have failed to support the Loonie against the greenback. The unemployment rate ticked down and the employment change figure rose unexpectedly. The release may ease BoC’s dovishness and provide some support for the CAD, yet possibly not against the USD. Also, China’s December trade data improved with both the import and export growth rates accelerating and the trade surplus widening, implying improved economic activity for China, which could improve the market sentiment and support riskier assets.

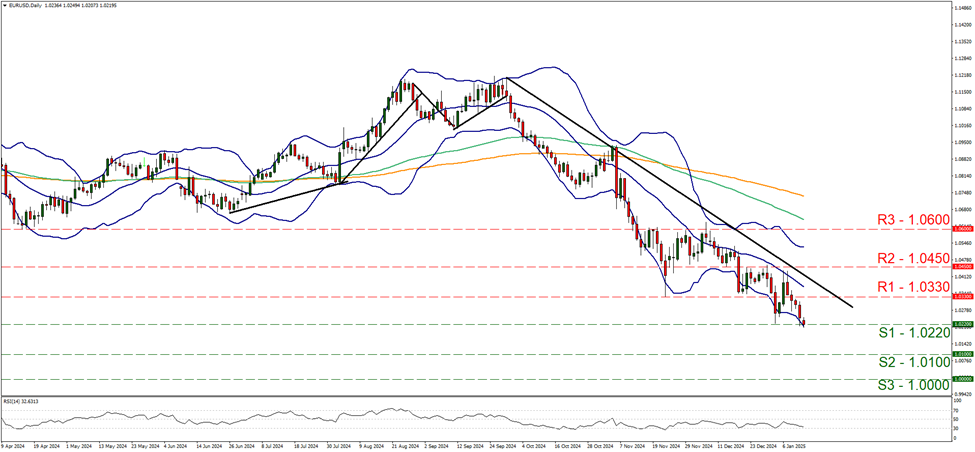

EUR/USD continued to fall on Friday and during today’s Asian session testing the 1.0220 (S1) support line. We maintain our bearish outlook as long as the downward trendline guiding the pair since the last days of September remains intact. Also the RSI indicator remains near the reading of 30 implying a strong bearish sentiment among market participants for the pair. At the same time, the position of the RSI indicator may imply that the pair is nearing oversold positions and may be prone for a correction higher. Similar signals are being sent by the price action flirting with the lower Bollinger band. Should the bears maintain control over the pair as expected, we may see the pair breaking the 1.0220 (S1) support line and aiming for the 1.0100 (S2) support level. For a bullish outlook we would require the pair tο initially break the 1.0330 (R1) resistance line, break the prementioned downward trendline in a first signal that the downward motion has been interrupted and continue to aim if not break the 1.0450 (R2) resistance level.

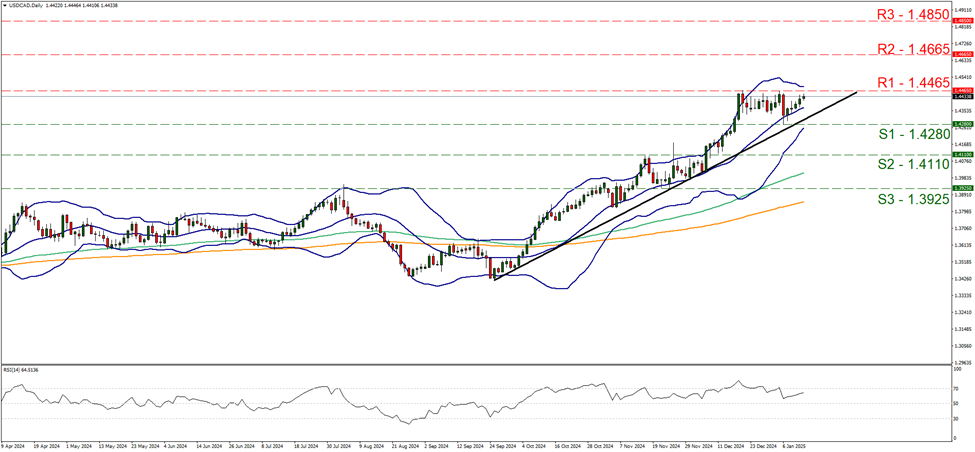

USD/CAD edged higher on Friday and during today’s Asian session, nearing the 1.4465 (R1) resistance line. We note the upward trendline guiding the pair since the 25 of September implying a bullish outlook for the pair, yet at the same time we also note the difficulty the price action has to clearly break the (R1) ceiling implying a stabilisation of the pair’s price action. For the continuance of the bullish outlook, we would require the pair to break the 1.4465 (R1) resistance line, which is a 4-year high and start aiming for the 1.4665 (R2) resistance barrier. Should the bears take over, a scenario we currently view as remote, we may see USD/CAD breaking initially the prementioned upward trendline and continue to break the 1.4280 (S1) support line and start aiming for the 1.4110 (S2) support base.

その他の注目材料

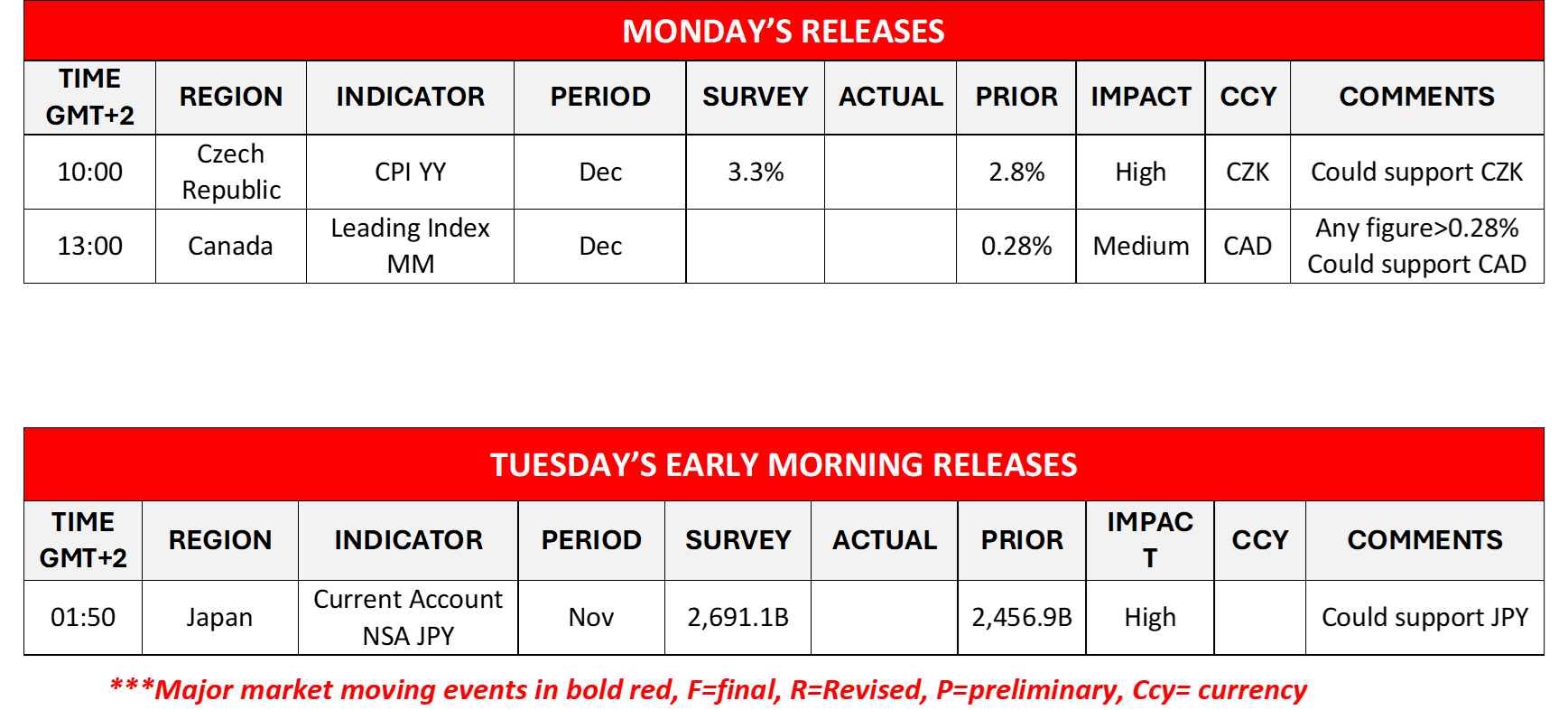

In an easy going Monday we get the Czech Republic’s CPI rates for December and Canada’s leading index for the same month. In tomorrow’s Asian session, we get Japan’s Current Account balance for November.

今週の指数発表:

On Tuesday, we get the US PPI rates for December. On Wednesday we get Japan’s Tankan indexes for January, UK’s and Sweden’s CPI rate for December and in the American session we highlight the release of the US CPI Rates for the same month, while we also get the NY Fed manufacturing index for January and Canada’s manufacturing sales for November. On Thursday we get Japan’s corporate goods prices for December, Australia’s employment data for December, UK’s GDP rate for November, Canada’s number of house starts for December and from the US the weekly initial jobless claims figure, January’s Philly Fed Business index and December’s retail sales. On Friday we get from China December’s industrial output and Q4’s GDP rate, UK’s retail sales, Eurozone’s final HICP rate and the US industrial production all for December.

EUR/USD デイリーチャート

- Support: 1.0220 (S1), 1.0100 (S2), 1.000 (S3)

- Resistance: 1.0330 (R1), 1.0450 (R2), 1.0600 (R3)

USD/CAD Daily Chart

- Support: 1.4280 (S1), 1.4110 (S2), 1.3925 (S3)

- Resistance: 1.4465 (R1), 1.4665 (R2), 1.4850 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。