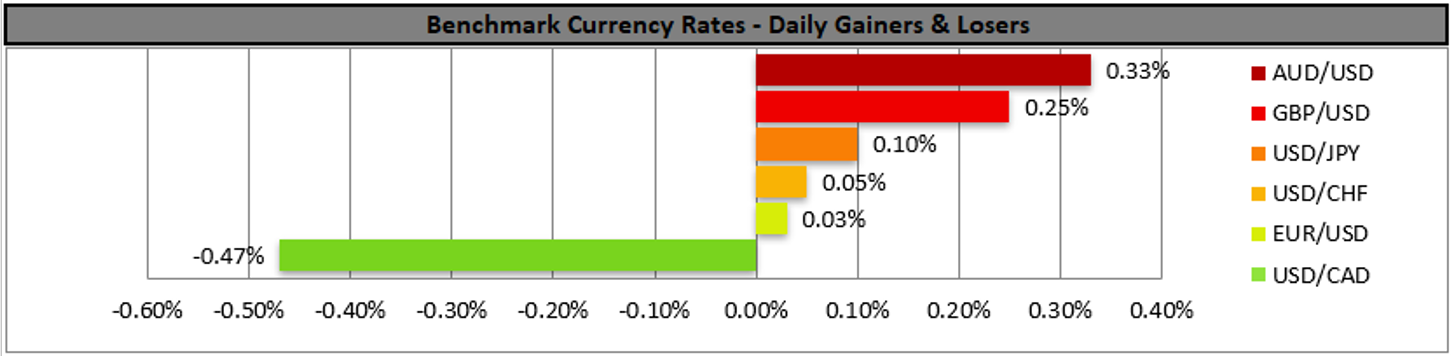

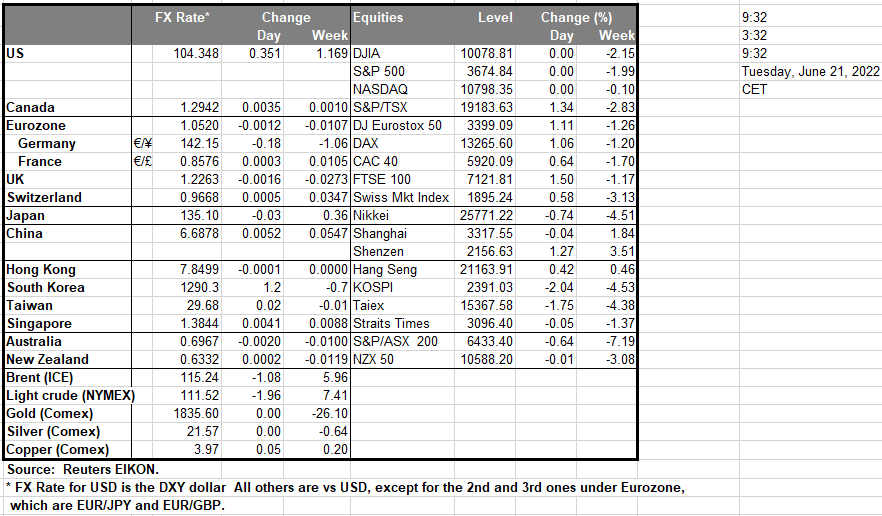

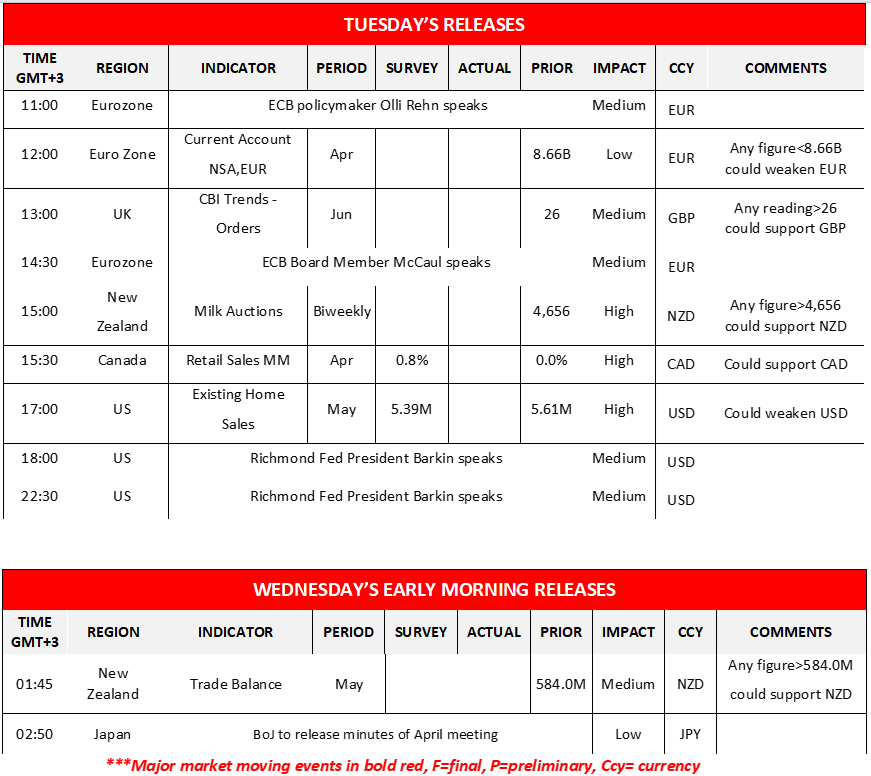

The USD seems to be treading water as the US Bank holiday is about to end and stockmarkets are to restart their activities. It should be noted that the US stockmarkets seemed to regain some of their confidence yet the picture should be clearer with the American opening. The Fed’s intentions are expected to remain in the epicenter of the market’s attention and whether the abrupt tightening of its monetary policy could cause a recession for the US economy, hence Fed Chairman Powell’s testimony to Congress which starts on Wednesday is eyed. For today we note the release of the existing home sales figure for May, which is expected to drop and if actually so, could weaken the USD as it would imply less economic activity for the US real estate sector. On the monetary front we note that Richmond Fed President Barkin is scheduled to speak and should he sound hawkish enough, he may provide some support for the USD, while US stockmarkets may slip.

BoE’s Mann supports faster tightening

The pound has been edging higher against the USD and JPY yesterday yet not against the EUR and overall its rebound seems to be uncertain. It should be noted that on a monetary level BoE MPC member Mann stated yesterday that the bank should hike rates at a faster pace in order to curb inflationary pressures in the UK economy, while a weak pound would add more inflation. BoE may have been one of the first central banks to start raising interest rates yet it does with a steady 25 basis points rate hikes, practically now lagging behind other central banks. A possible faster tightening of the bank’s monetary policy could provide some support for the pound in the coming months. It should be noted that on Wednesday we get from the UK the CPI for May while today we note the release of the UK CBI trends for orders for June and should the reading rise above May’s 26 we may see the pound getting some support.

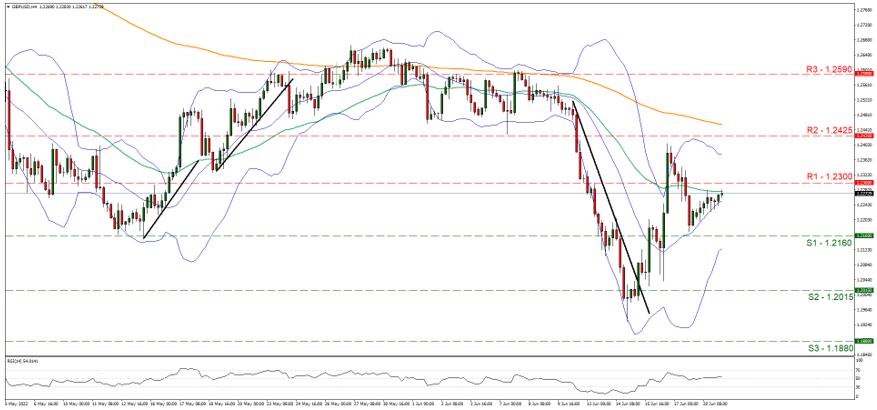

GBP/USD was on the rise yesterday aiming for the 1.2300 (R1) resistance line. For the time being we tend to maintain a bias for a sideways movement of the pair and to switch it to wards a bullish outlook we would require a clear breaking of the R1. Please note that the RSI indicator below our 4-hour chart runs along the reading of 50 also implying a rather indecisive market. Should the bulls actually take charge, we may see cable breaking the 1.2300 (R1) and aim for the 1.2425 (R2) resistance level. Should the bears tale over, we may see the pair breaking the 1.2160 (S1) support line and aim for the 1.2015 (S2) level.

CAD traders eye retail sales

The CAD was able to regain some of its losses against the USD yesterday as the drop of oil prices seems to have been halted, at least for now. Also a rise of Canadian bond yields seemed to support the Loonie as well yesterday as may have a somewhat improved market sentiment. Overall the oil market seems to worry about its supply side remaining tight, which in turn could push oil prices higher once again. It should be noted that Bank of Canada tends to remain hawkish given also the high inflationary pressures in the Canadian economy. Today we turn our attention towards the release of Canada’s April retail sales growth rate and should the rate accelerate, we may see the CAD getting some support as it would imply a more robust demand side for the Canadian economy. On a fundamental level, we expect the direction of oil prices and the market sentiment to affect CAD’s direction as well.

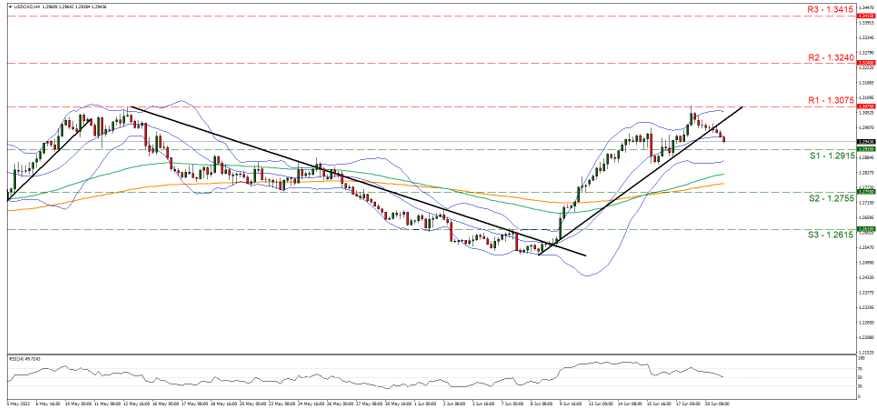

USD/CAD dropped yesterday aiming for the 1.2915 (S1) support line. As the pair in its downward movement broke the upward trendline guiding it since the 8 of June, we switch our bullish outlook in favor of a sideways movement bias initially. Should a selling interest be expressed we may see the pair breaking the 1.2915 (S1) support line and aim for the 1.2755 (S2) support level. Should the pair find fresh buying orders along its path we may see USD/CAD breaking the 1.3075 (R1) resistance and aim for higher grounds.

GBP/USD 4時間チャート

Support: 1.2160 (S1), 1.2015 (S2), 1.1880 (S3)

Resistance: 1.2300 (R1), 1.2425 (R2), 1.2590 (R3)

USD/CAD 4時間チャート

Support: 1.2915 (S1), 1.2755 (S2), 1.2615 (S3)

Resistance: 1.3075 (R1), 1.3240 (R2), 1.3415 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。