Since our last report, the bullish momentum driving Bitcoin’s price appears to have faded. Crypto bears seem to have regained control over the coin’s direction. In this report, we aim to shed light on the possible factors aiding to the recent developments in combination with a technical analysis of Bitcoin.

Strategic Crypto Reserve

President Trump last week appears to be considering the creation of a national digital asset stockpile. The executive order appears to be in line with President Trump’s campaign promises of creating a national Bitcoin reserve. Yet, we must stress that the order does not specify Bitcoin and thus the stockpile may be composed of various digital assets.

Nonetheless, the executive order also states that a working group on Digital Asset Markets will be created within the National Economic Council and will be chaired by the Special Advisor for AI and Crypto and will evaluate the potential creation and maintenance of a national digital asset stockpile. Overall, President Trump appears to be pro-crypto and thus the possibility of a strategic crypto reserve, could potentially support the wider crypto markets and in particular, Bitcoin which has been touted by many as the possible heavyweight.

CME XRP Futures

Per CoinTelegraph, CME group’s website featured the introduction of SOL and XRP futures, leading to many speculating an even greater adoption of XRP by traditional financial institutions which in turn may have temporarily aided the coin’s price. However, per the same report, a CME spokesperson clarified that the information leaked from the beta version of their website was mistakenly made public and that no official decision has been made. Nonetheless, should an official announcement be made it could aid the coin’s price.

DeepSeek spark’s a wider selloff in riskier assets?

According to some media outlets, the Chinese Large Language Model which appeared from DeepSeek has caused widespread panic in the wider markets, as it appears to be threatening the supremacy of the US tech sector. The apparent concerns in the markets, may have impacted Bitcoin’s price as the aforementioned concerns may have sparked a wider sell-off of riskier assets, which may include Bitcoin. Thus should fears about the US tech sector continue and in turn lead to a sell-off of riskier assets, it could also weigh on Bitcoin’s price.

Crypto Technical Analysis

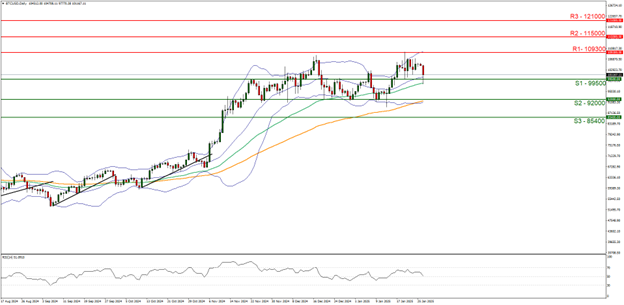

BTC/USD Daily Chart

- Support: 99500 (S1), 92000 (S2), 85400 (S3)

- Resistance: 109300 (R1), 115000 (R2), 121000 (R3)

BTC/USD appears to be moving in a sideways fashion, with the coin currently taking aim for our 99500 (S1) resistance level. We opt for a neutral outlook for the coins price and supporting our case is the coin’s failure to break above our 109300 (R1) resistance line and the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment.

Yet, we should note that our S1 support line was pierced, and the RSI indicator dropping sharply to 50, may imply that the bears may be on the cusp of regaining control over the coin’s direction. Nonetheless, for our sideways bias to continue we would require the coin’s price to remain confined between the 99500 (S1) support level and the 109300 (R1) resistance line.

On the flip side for our bearish outlook to continue we would require a clear break below the 99500 (S1) support line, with the next possible target for the bears being the 92000 (S2) support level. Lastly, for a bullish outlook we would require a clear break above the 109300 (R1) resistance line, with the next possible target for the bulls being the 115000 (R2) resistance level.

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。

リスク警告:

Crypto CFDs are an extremely high-risk, speculative investment and you may lose all your invested capital. Before trading, you need to ensure you fully understand the risks involved taking into consideration your level of experience and investment objectives. Seek independent advice, if necessary.