Since our crypto last report, the price of Bitcoin appears to have moved higher since last week with the coin now appearing to be taking aim for the $50,000 key psychological resistance level. In this report, we aim to shed light on the current developments that may influence the future price action of cryptocurrencies, present the potential catalysts that could drive their prices in the near future and finally conclude with a technical analysis of Bitcoin.

Crypto: Overview Report

Spot BTC ETF’s finally find some relief

According to a recent report by CoinDesk, Spot bitcoin ETFs saw their largest daw of net inflows, racking in approximately $400 million last Thursday, which according to report is their best day since January 17 , 2024. The increase could potentially be attributed to the halving date for Bitcoin nearing, thus potentially leading to increased volatility.

The halving date is expected to be on the 19 of April 2024, where the block reward will be reduced to 3.125 BTC. Nonetheless, despite the halving date still being roughly two months away, it appears that it may be already impacting the price of Bitcoin. As such, with the date slowly coming into view, it could support the price of Bitcoin. Yet, with the date still being far away, we will have to revisit this particular issue once again in the future.

Ethereum Validator demand continues to mount

The demand to become an Ethereum validator appears to be on the rise. According to various media outlets the entry has jumped to 7,045 requests, the highest since October 6 2023 according to data from ValidatorQeue. In order to be approved, validators must stake a minimum of 32 Ether in the network in order to participate in the running of Ethereum’s Proof of Stake (PoS) blockchain.

Therefore, the resurgence in validators, could imply that demand for Ethereum may be increasing and as such, could provide support for the coin’s price. On the other hand, the tally remains well below the figures of 75,000 seen during Ethereum’s upgrade last April. As such, despite the renewed interest, the potential boost to the coin’s price could be temporary.

Philippines, allegedly rules out retail CBDC’s by 2026

According to a report released today by CoinDesk, the Philippines does not plan on issuing a retail CBDC, citing that it is more likely to result in bank runs. Despite, the negative implications, the actual implementation of a CBDC even at an institutional level, could open the door for a retail version to be released in the future. As such, should the pilot program proceed as planned, with the possibility of a wholesale retail CBDC being issued at a later date, it could provide support for the crypto market in general, as blockchain technology becomes more integrated and incorporated into the financial system.

In particular Bitcoin and Ethereum could gain from increased optimism, given their status as the most well-known coins. Although, those positive effects may not be seen immediately but rather further down the road.

Lastly, we would also like to note this week’s upcoming ICOs:

| Monday | Tuesday | Wednesday | Thursday | Friday |

| – | Metahorse Unity (#MUNITY) | Dechat (#CHAT) Hover (#HOV) | Style Protocol (#STYLE) | – |

Crypto Technical Analysis

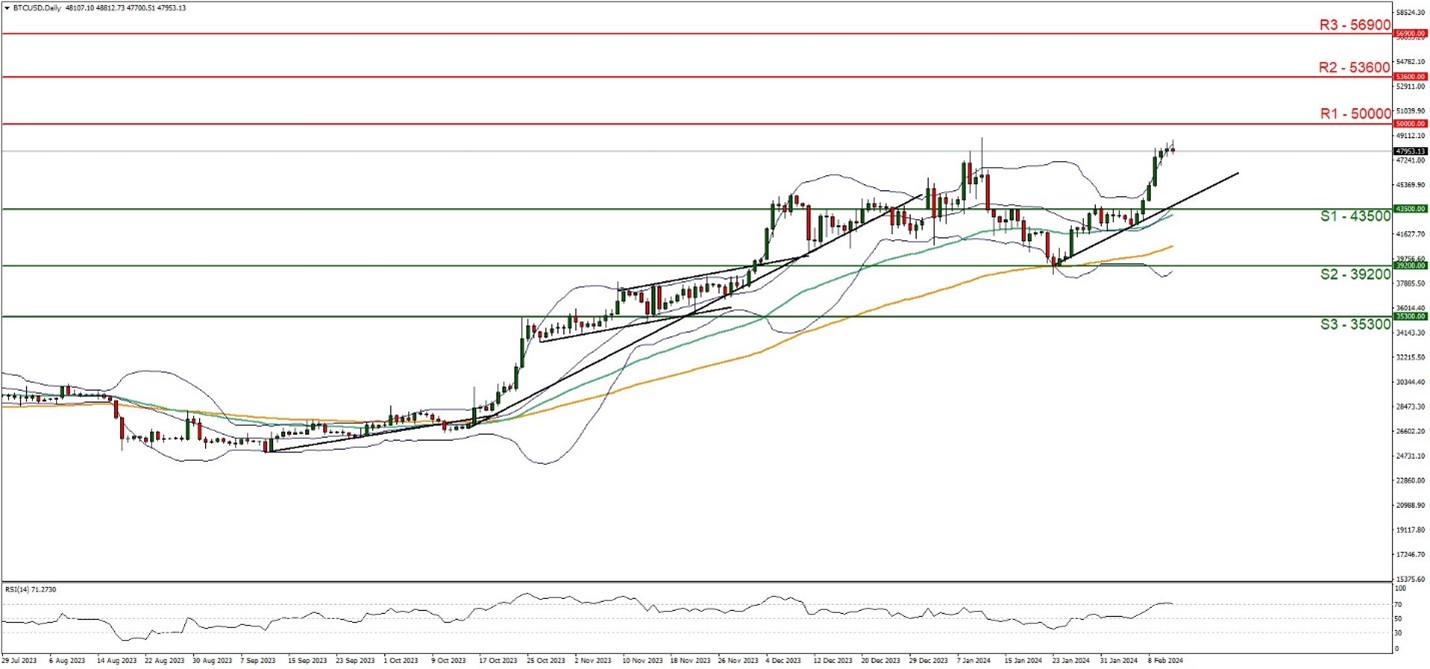

BTC/USD Daily Chart

- Support: 43500 (S1), 39200 (S2), 35300 (S3)

- Resistance: 50000 (R1), 53600 (R2), 56900 (R3)

BTC/USD appears to be moving in an upwards direction, with the coin seemingly taking aim for the 50,000 (R1) key psychological resistance level. We tend to maintain a bullish outlook for the coin and supporting our case is the upwards moving trendline which was incepted on the 23rd of January, in addition to the RSI indicator currently registering a figure of 70, implying a bullish market sentiment.

For our bullish crypto outlook to continue, we would like to see a clear break above the 50,000 (R1) key resistance level, with the next possible target for the bulls being the 53600 (R2) resistance line. On the other hand, for a sideways bias, we would like to see the coin remain confined between the 43500 (S1) support level and the 50,000 (R1) resistance line. Lastly for a bearish outlook, we would like to see a clear break below the 43500 (S1) support level, with the next possible target for the bears being the 39200 (S2) support base.

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。