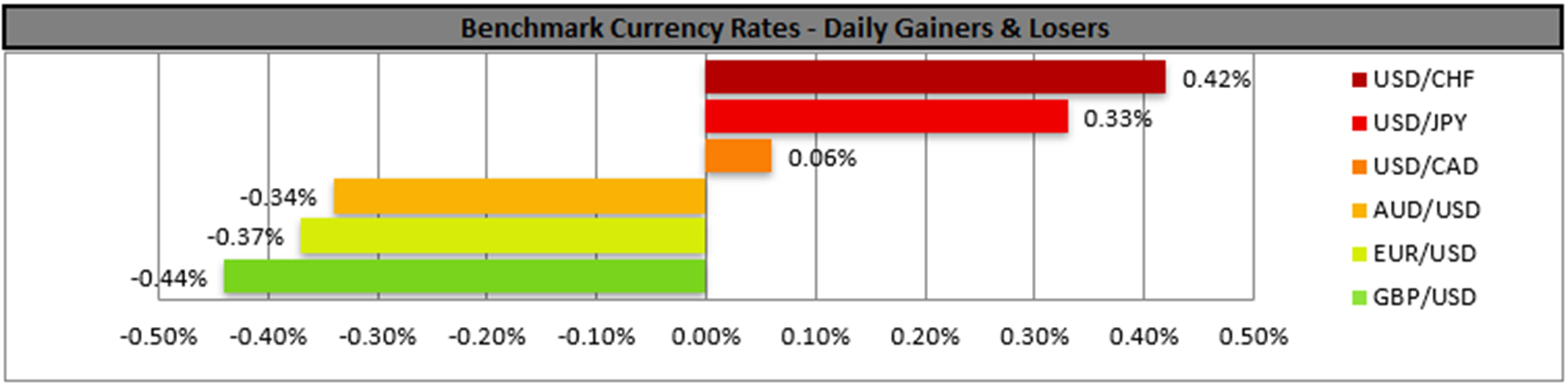

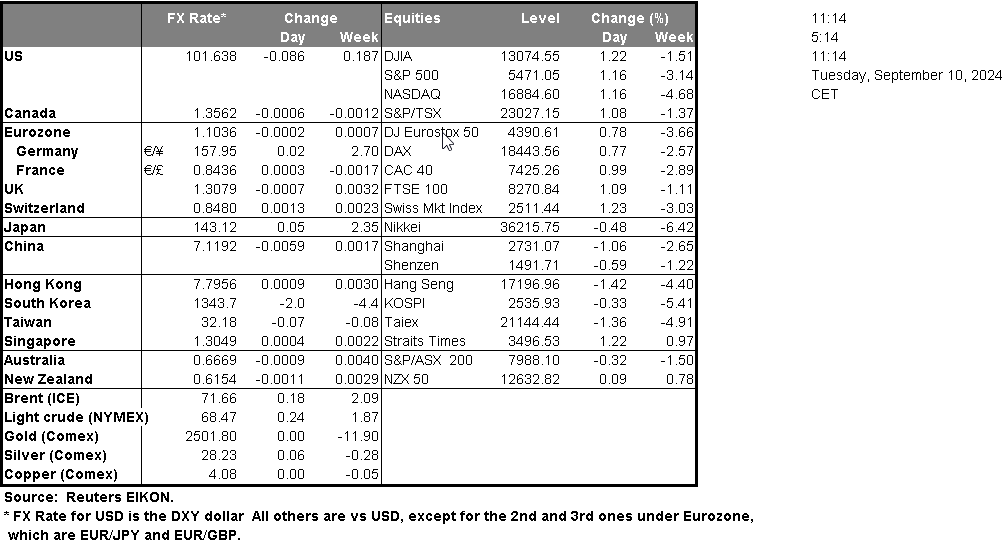

The USD maintained the initiative over its counterparts in the FX market yesterday and strengthened. The tightening of the US employment market albeit not as much as expected, seems to be easing the market’s dovish expectations. Fed policymakers seem to maintain their dovish intentions to cut rates by 25 basis points in the September meeting and seem to be open for an even wider cut if necessary. Similarly, the market is expecting a double rate cut in the November meeting and another 25-basis points rate cut in the December meeting. Given that the US employment report for August has been released, the next big test for the USD is expected to be the release of the US CPI rates for August, on Thursday and a possible failure of the rates on a headline and core level may imply the resilience of inflationary pressures in the US economy and thus contradict market expectations causing possibly asymmetric support for the greenback.

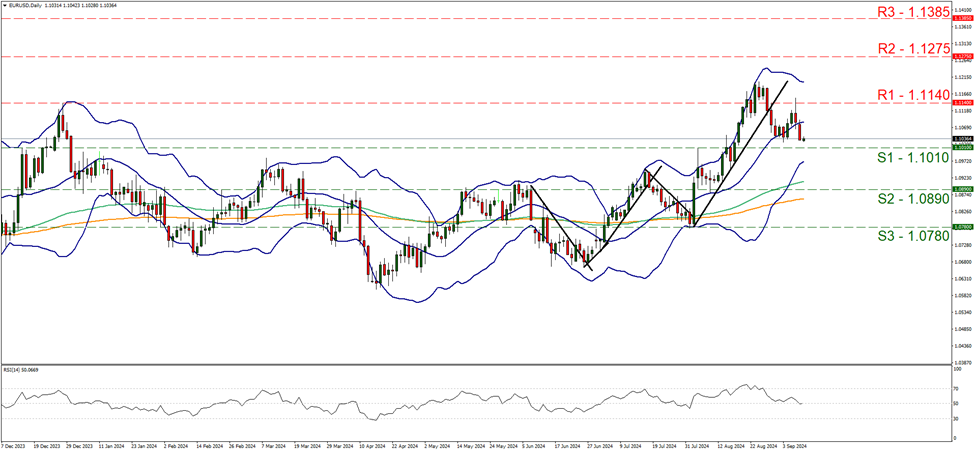

EUR/USD edged lower yesterday and during today’s Asian session, tended to stabilise somewhat, remaining well between the 1.1010 (S1) support line and the 1.1140 (R1) resistance level. We tend to maintain our bias for the sideways motion of the pair given also that the RSI indicator remains near the reading of 50, implying a rather indecisive market. Should the bears dominate the pair’s direction we may see EUR/USD breaking the 1.1010 (S1) support line, with the next possible target for the bears being set at the 1.0890 (S2) support base. Should the bulls take over, we may see the pair reversing direction, breaking the 1.1140 (R1) resistance line and thus open the gates for the 1.1275 (R2) resistance barrier.

Across the world, in China, we note that August’s trade data came in better than expected. The export growth rate accelerated beyond market expectations reaching 8.7%yoy while imports were quite limited settling for only 0.5%yoy. The results allowed for the trade surplus to widen instead of narrowing as expected, implying that the Chinese economy benefited more than expected from its international trading activities in the past month. The news could improve the market sentiment in the market allowing for a more risk-on approach that could benefit riskier assets such as commodity currencies and equities. On the other hand, our worries tend to remain for the low import rate as local demand seems to be shifting if not contracting. On the production side of the Chinese economy, factories seem to continue to struggle to keep economic activity afloat which does not bode well with the markets either.

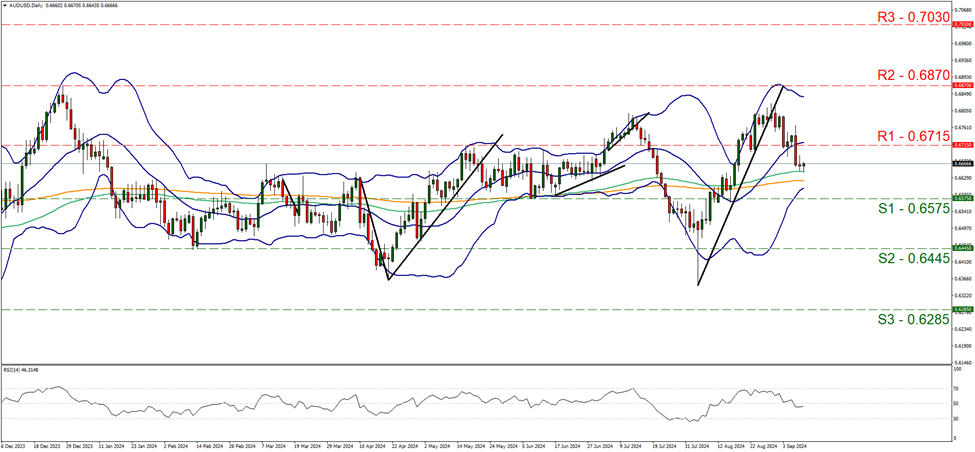

AUD/USD remained relatively stable yesterday and after Friday’s stark fall and currently remains between the 0.6715 (S1) resistance line and aiming for the 0.6575 (S1) support line. we tend to maintain a bias for a range bound motion of the pair, given also that the RSI indicator dropped below the reading of 50 yet remained close by. Bearish tendencies may be building up though and should sellers be able to take over the lead regarding the pair’s direction, we may see AUD/USD breaking the 0.6575 (S1) support line thus paving the way for the 0.6445 (S2) support level. Should the bulls take over, we may see the pair breaking the 0.6715 (R1) resistance line and aiming for the 0.6870 (R2) resistance level.

本日のその他の注目点

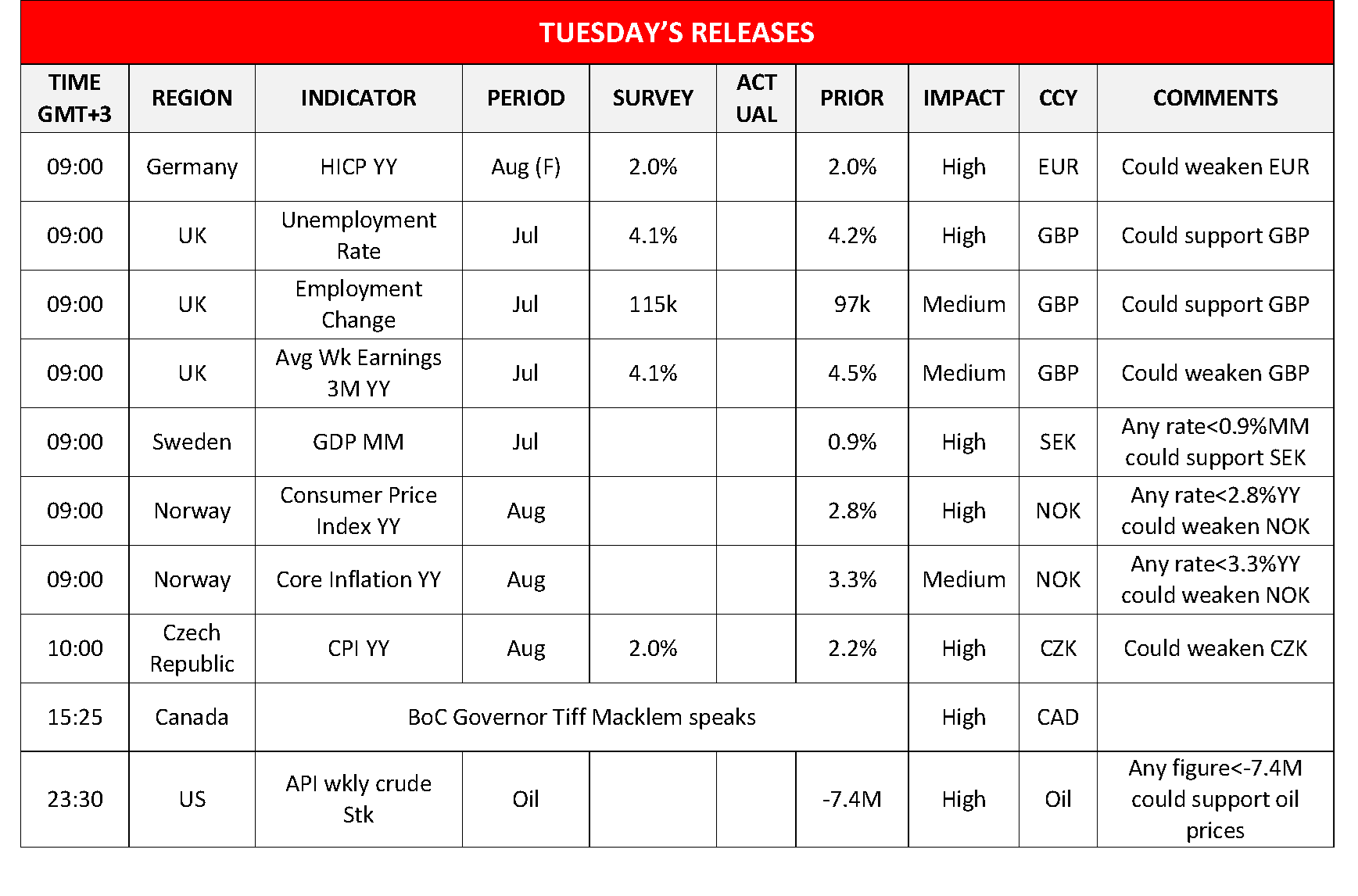

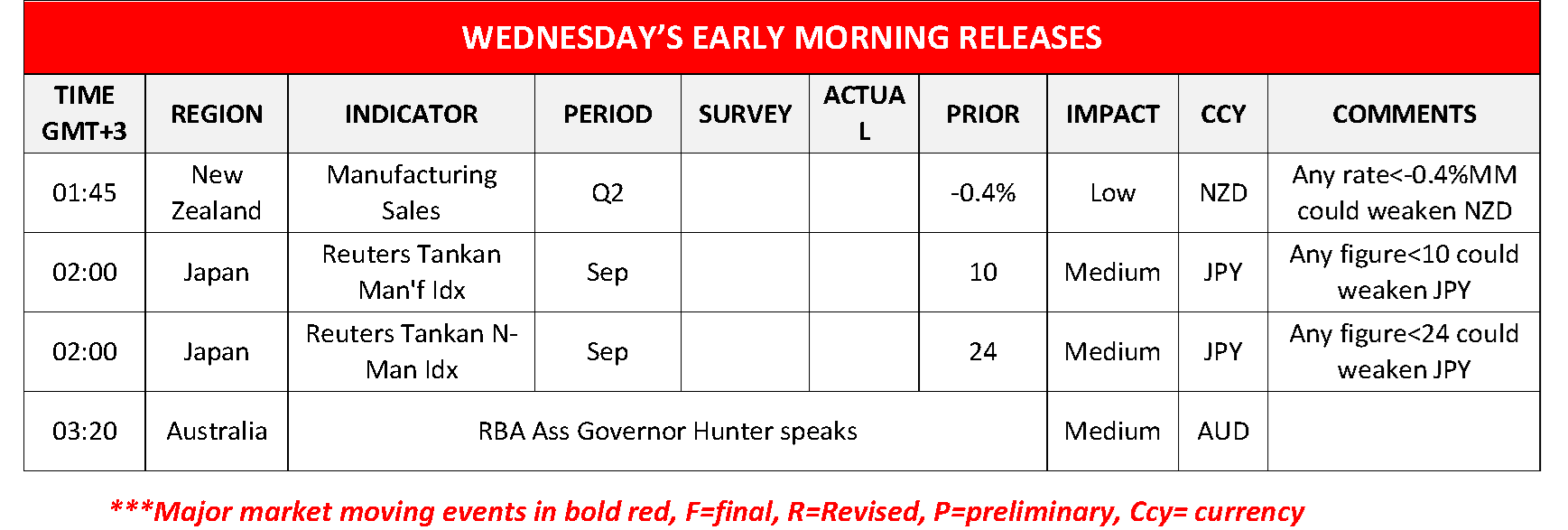

Today in the European session, we get Germany’s final HICP rate for August, UK’s employment data for July, Sweden’s GDP for the same month, Norway’s CPI rate and the Czech Republic’s CPI rates for August. In the American session, we note that BoC Governor Tiff Macklem speaks, while oil traders may be more interested in the release of API’s US weekly crude oil inventories. During tomorrow’s Asian session, we get New Zealand’s manufacturing sales for Q2 and Japan’s Tankan indexes for September while on the monetary front, we note RBA Assistant Governor Hunter’s speech.

EUR/USD デイリーチャート

- Support: 1.1010 (S1), 1.0890 (S2), 1.0780 (S3)

- Resistance: 1.1140 (R1), 1.1275 (R2), 1.1385 (R3)

AUD/USD デイリーチャート

- Support: 0.6575 (S1), 0.6445 (S2), 0.6285 (S3)

- Resistance: 0.6715 (R1), 0.6870 (R2), 0.7030 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。