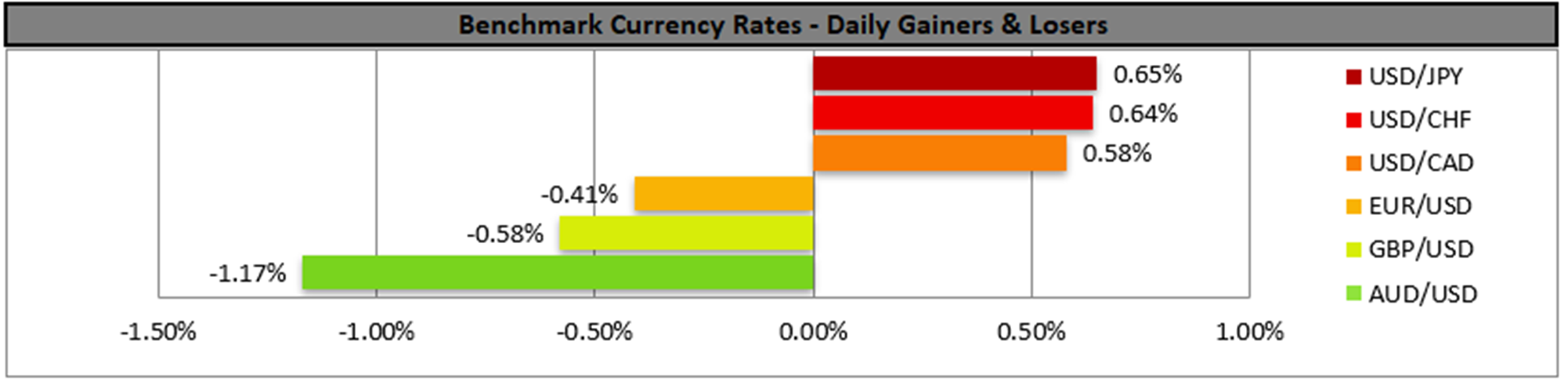

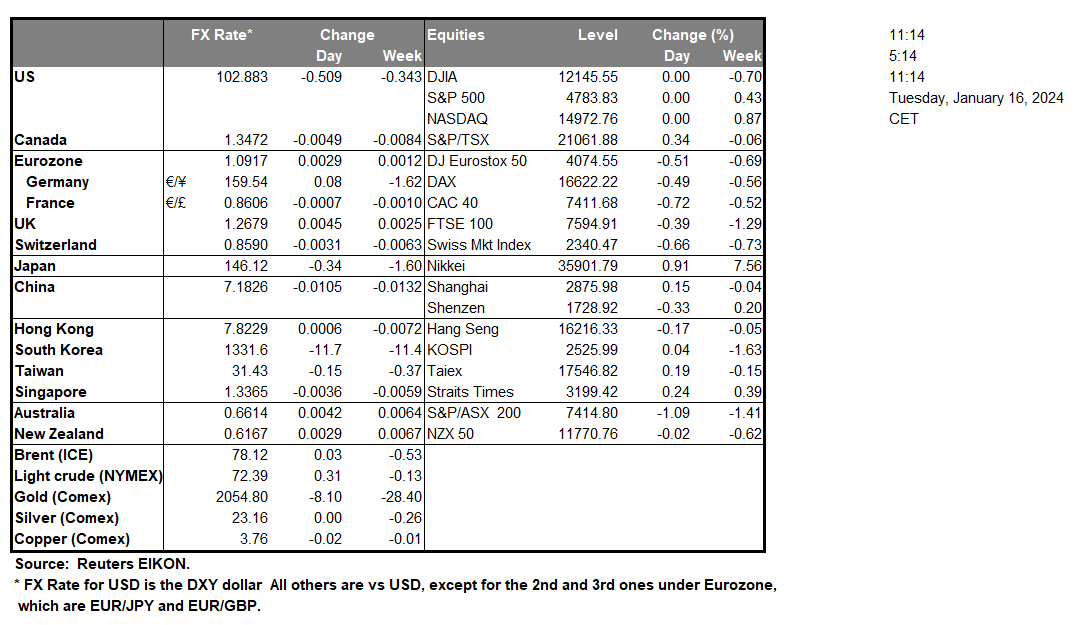

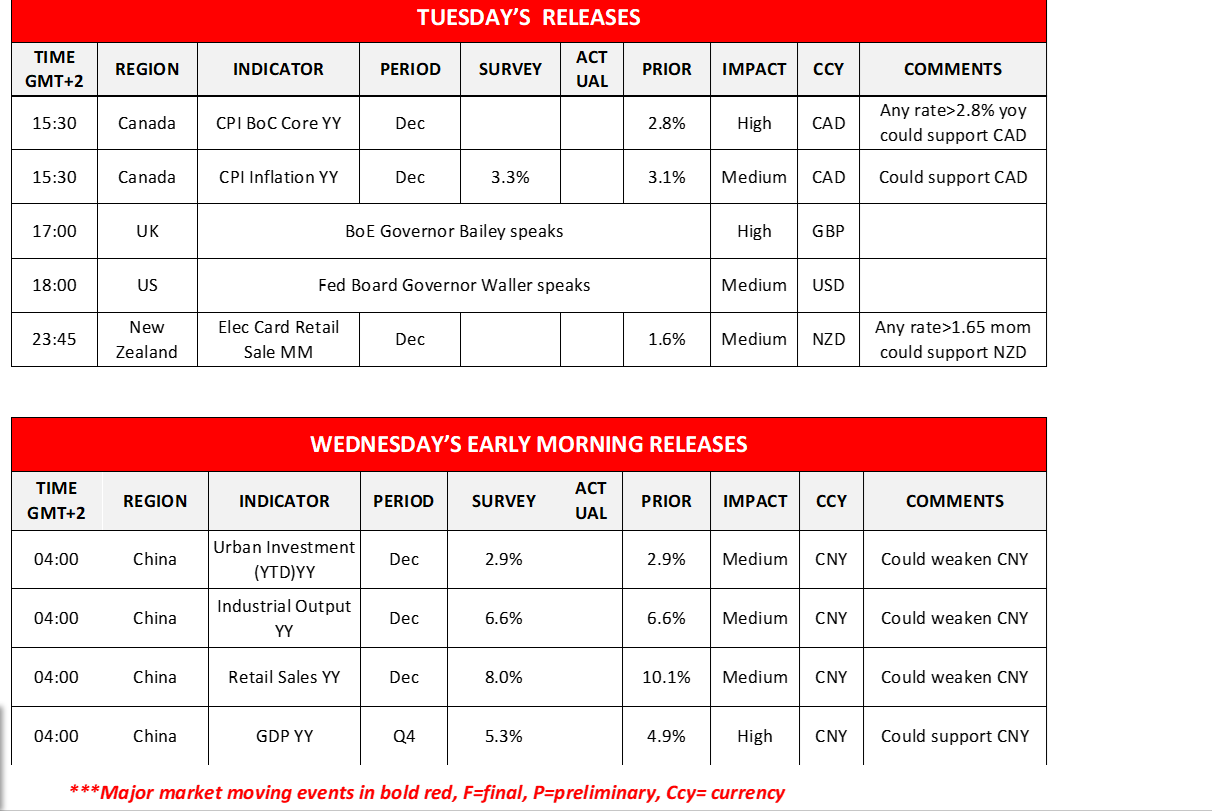

China’s GDP rate for Q4 is due to be released in tomorrow’s Asian session. The GDP rates for Q4 are expected by economists to come in 5.2% versus last quarter’s 4.9%, implying that the Chinese economy is experiencing economic growth and is also expanding. Should the GDP rates come in as expected, it could potentially support the CNY and the Aussie, given their close economic ties. Whereas should the GDP rates disappoint and come in lower than expected, it could potentially weigh on the Aussie and CNY. In today’s European session, the UK’s employment data for November hinted at a resilient labour market, with the unemployment rate remaining steady at 4.2% versus the expectations of 4.3%. The lower-than-expected unemployment rate could have supported the pound, yet at this time it appears that the pound’s downwards trajectory following the release, may be driven by the lower-than-expected average earnings rate for November, which may imply easing inflationary pressures. According to various media sources, Apple (#AAPL) has removed the blood oxygen monitor system from its new Apple watch devices, in an attempt to find a workaround against the ITC ruling. The “re-designed” Apple watch could weigh on the company’s stock price, as it could lead to reduce sales in the future as the technology may have been a key selling point for Apple’s watch. Lastly, we note that Morgan Stanley (#MS) and Goldman Sachs (#GS) are due to report their earnings today.

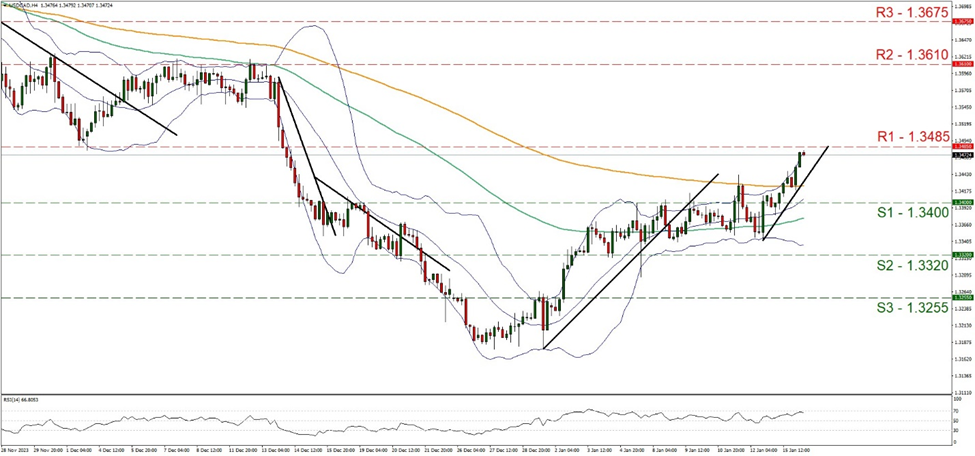

USD/CAD appears to be moving in an upwards direction, with the pair seemingly aiming for the 1.3485 (R1) resistance level. We maintain a bullish outlook for the pair and supporting our case is the RSI Indicator below our chart which currently registers a figure near 70, implying a bullish market sentiment, in addition to the upwards moving trendline which was incepted on the 12 of January. For our bullish outlook to continue, we would like to see a clear break above the 1.3485 (R1) resistance level, with the next possible target for the bulls being the 1.3610 (R2) resistance ceiling. On the other hand, for a bearish outlook, we would like to see a clear break below the 1.3400 (S1) support level, with the next possible target for the bears being the 1.3320 (S2) support base. Lastly, for a sideways bias we would like to see the pair remain confined between the 1.3400 (S1) support level and the 1.3485 (R1) resistance line.

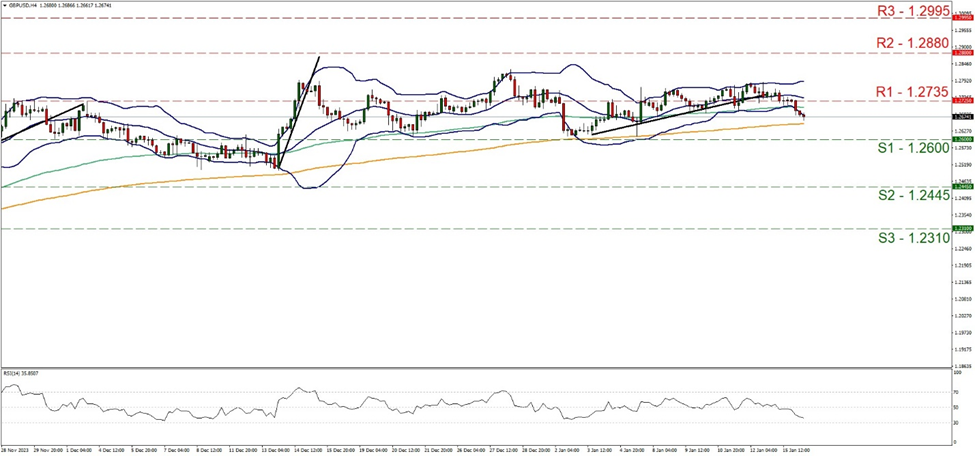

GBP/USD appears to be moving in a downwards motion. We maintain a bearish outlook for the pair and supporting our case is the RSI indicator below our chart, which currently registers a figure near 30, implying a bearish market sentiment. For our bearish outlook to continue, we would like to see a clear break below 1.2600 (S1) support level, with the next possible target for the bears being the 1.2445 (S2) support base. On the other hand, for a sideways bias, we would like to see the pair remain confined, between the 1.2600 (S1) support level and the 1.2735 (R1) resistance line. Lastly, for a bullish outlook, we would like to see a clear break above the 1.2735 (R1) resistance line, with the next possible target for the bulls being the 1.2880 (R2) resistance ceiling.

その他の注目材料

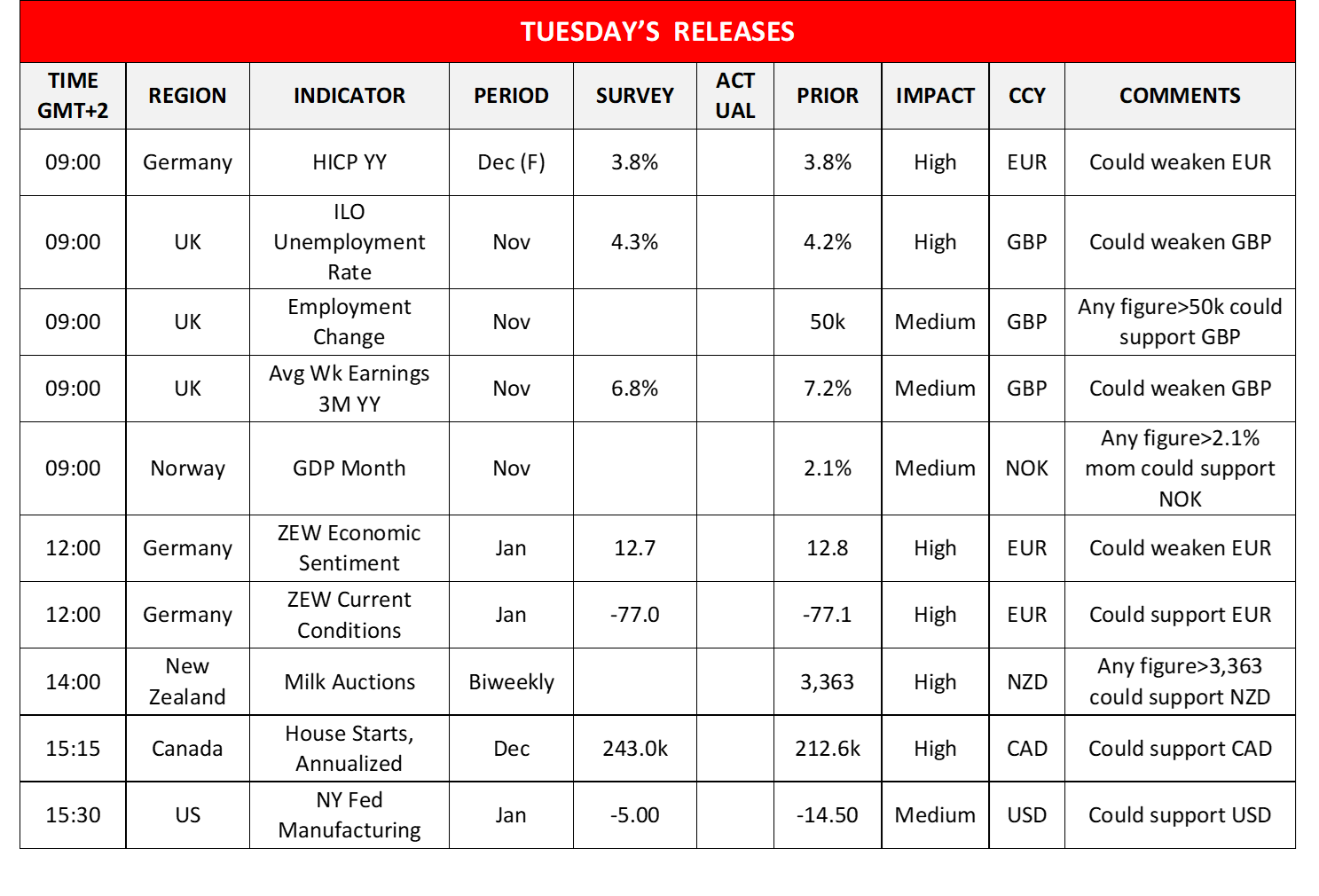

Today in the European session, we make a start with Germany’s final HICP rate for December and continue with Norway’s GDP rate for November, Germany’s January ZEW indicators and New Zealand’s milk auction figure. In the American session, we get Canada’s CPI rates and number of House starts, both being for December, the US NY Fed manufacturing index for January and later on New Zealand’s December electronic card retail sales growth rate. On the monetary front, we note that BoE Governor Bailey and Fed board governor Waller are scheduled to speak. During tomorrow’s Asian session, we note from China the release of December’s urban investment, industrial output, and retail sales growth rates and we highlight the GDP rate for Q4.

USD/CAD 4時間チャート

Support: 1.3400 (S1), 1.3320 (S2), 1.3255 (S3)

Resistance: 1.3485 (R1), 1.3610 (R2), 1.675 (R3)

GBP/USD 4時間チャート

Support: 1.2600 (S1), 1.2445 (S2), 1.2310 (S3)

Resistance: 1.2735 (R1), 1.2880 (R2), 1.2995 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。