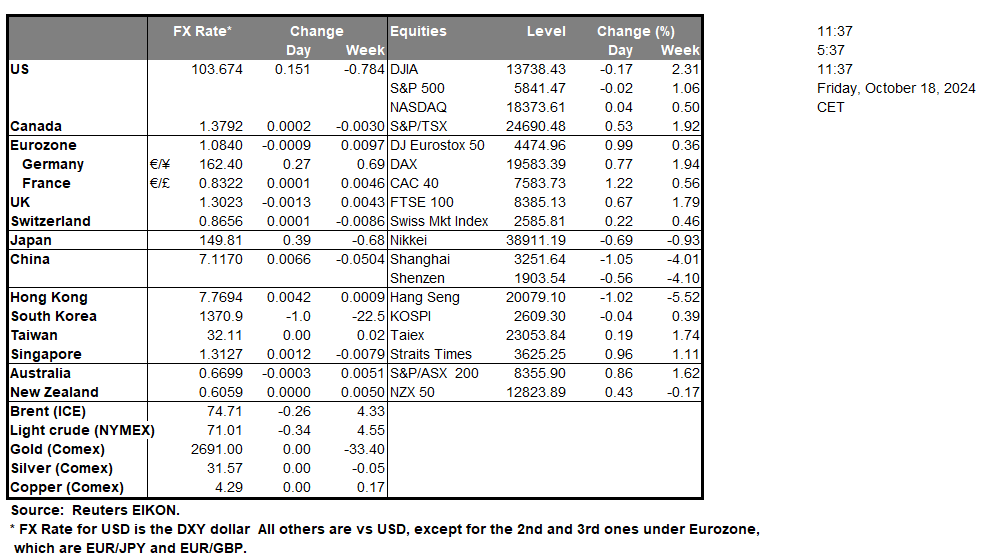

Today’s Asian session had a surprise for FX traders, as China’s GDP rate slowed down. The release highlighted the distance of economic reality with the Chinese government’s target of a 5%yoy GDP rate. Calls for a wider stimulus by the Chinese Government and its central bank tended to gain further traction and uncertainty may have been enhanced. There is still a positive aspect in the release as the market may have been expecting a wider slowdown of the GDP rate. Furthermore, we note that the retail sales growth rate for September accelerated, in a positive signal for the internal demand side of the Chinese economy, as did the industrial output growth rate in a signal of increased economic activity in the sector. Finally, the Urban investment growth rate failed to slow down, in a sign of how the construction sector in China despite its problems, hasn’t given up. We turn our attention to Monday’s Asian session, as we get from China, PBoC’s interest rate decision. The big question mark is whether the bank will give into markets’ pressure and lower interest rates with special highlight being set on the loan 1-year and loan 5-year rates or not. A possible easing of the bank’s monetary policy could weigh on the Yuan somewhat, yet at the same time may improve the market sentiment and support riskier assets such as equities and commodity currencies such as the AUD.

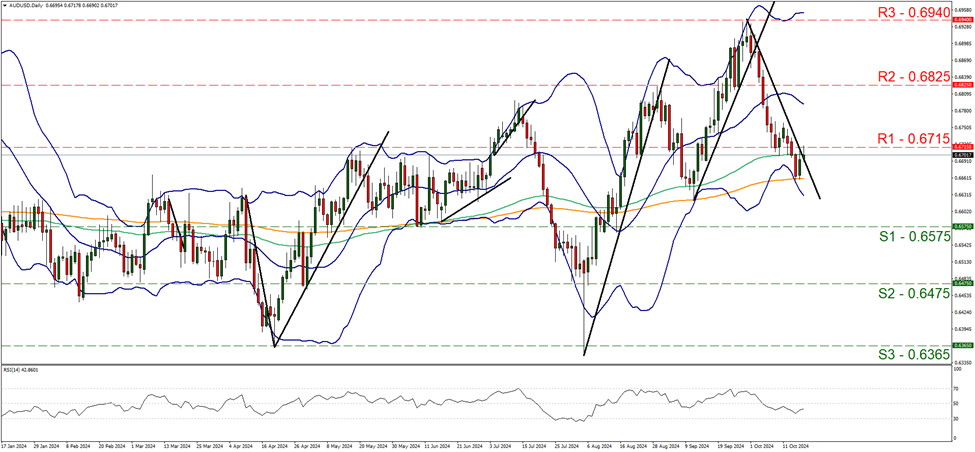

On a technical level AUD corrected higher against the USD and during today’s Asian session, testing the 0.6715 (R1) resistance line. Given that AUD/USD in its upward movement seems to be breaking the downward trendline guiding the pair since the start of the month, hence we stand ready to switch our bearish outlook in favor of a sideways motion bias initially, should the downward trendline be clearly broken, signaling the interruption of the downward movement. Should the bears regain control over the pair, we may see the pair reversing course, shifting the downward trendline to the right, surpass yesterday’s low point and renew its aiming for the 0.6575(S1) support line. Should the bulls take over, we may see the pair breaking the 0.6715 (R1) resistance line and start aiming if not breaking the 0.6825 (R2) resistance base.

Across the world ECB delivered the much-awaited rate cut yesterday and signaled that the doors are open for another one. The bank in its highlighted that “the disinflationary process is well on track” despite a inflation being expected to rise in the coming months, before declining to target, something that is expected given the upcoming Christmas season, which is heavily celebrated in Europe. ECB President Lagarde in her press conference tended to paint a rather gloomy picture for economic growth in the Zone, hence worries remain about the outlook of the area, which could weigh on the EUR. Overall, we see the case for ECB’s stance to weigh on the EUR on a monetary policy level.

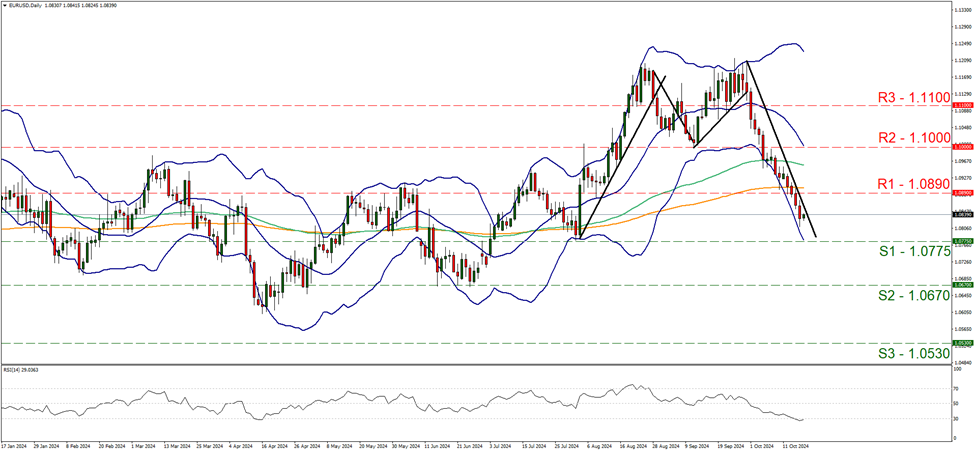

EUR/USD bears seem to hesitate in today’s Asian session remaining between the 1.0775 (S1) support line and the 1.0890 (R1) resistance level. We tend to maintain a bearish outlook for the pair as long as the downward trendline remains intact. Furthermore, we note that the RSI indicator has dropped below the reading of 30, underscoring the strong bearish sentiment of market participants for the pair, yet at the same time may imply that the pair may be in oversold territory and ripe for a correction higher. Yet the lower Bollinger band is still below and has some distance with the price action, implying that there is still some room to play for the bears. Should the selling interest be renewed we may see the pair breaking the 1.0775 (S1) support line and aim for the 1.0670 (S2) support level. For a bullish outlook we would require the pair to enhance today’s upward direction, break the prementioned downward trendline signaling the end of the downward movement, breaking the 1.0890 (R1) resistance line and aim for the 1.1000 (R2) resistance level.

その他の注目材料

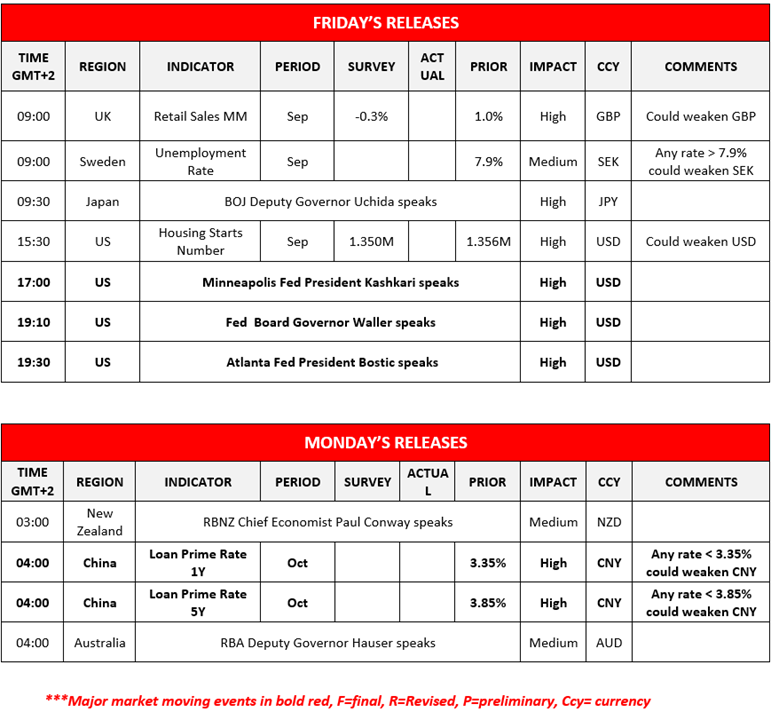

Today we get the US housing starts figure for September, while BOJ Deputy Governor Uchida, Minneapolis Fed President Kashkari, Fed Governor Waller and Atlanta Fed President Bostic speak.

EUR/USD デイリーチャート

- Support: 1.0775 (S1), 1.0670 (S2), 1.0530 (S3)

- Resistance: 1.0890 (R1), 1.1000 (R2), 1.1100 (R3)

AUD/USD デイリーチャート

- Support: 0.6575 (S1), 0.6475 (S2), 0.6365 (S3)

- Resistance: 0.6715 (R1), 0.6825 (R2), 0.6940 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。