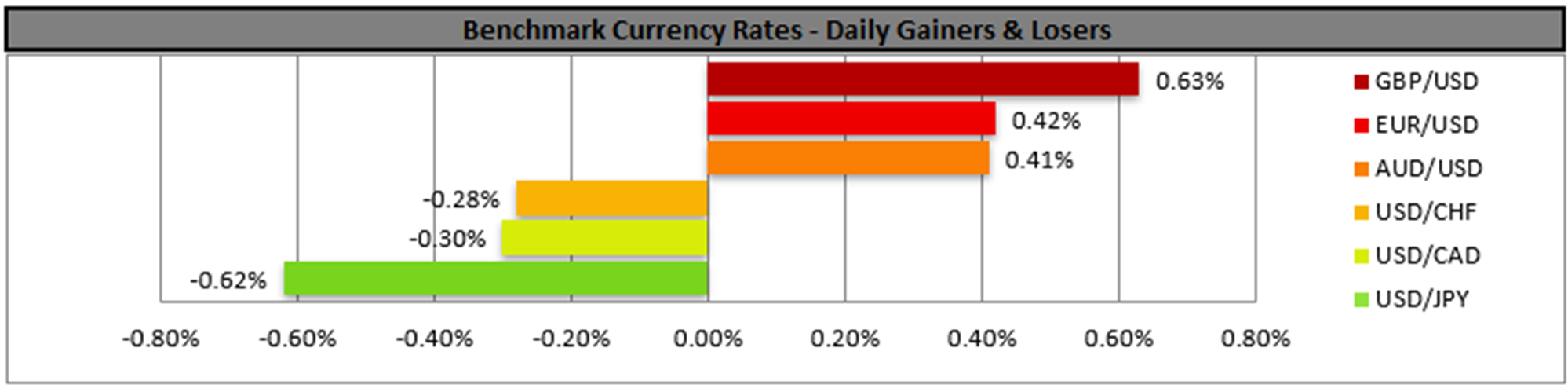

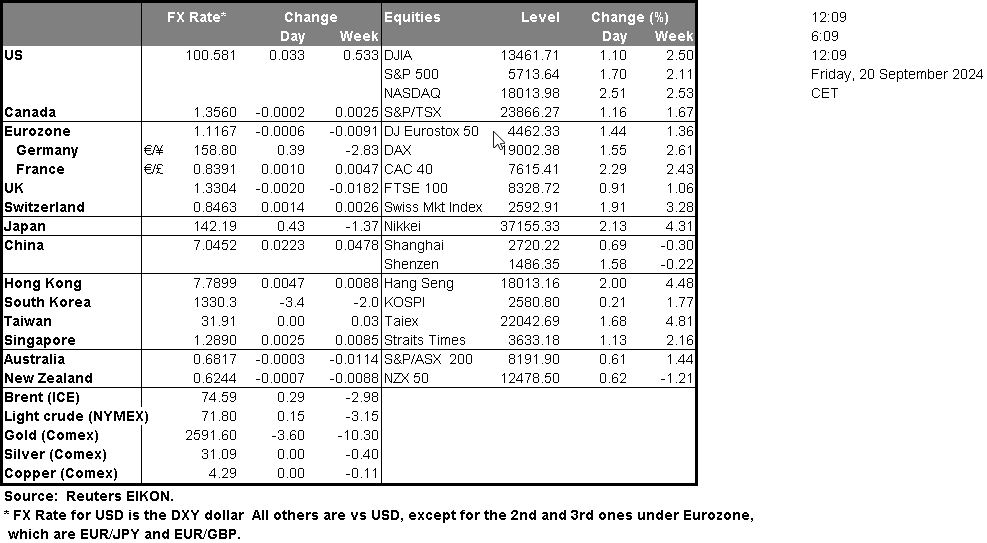

The USD resumed its descent against its counterparts yesterday as the interest rate differentials outlook tended to weigh on the greenback. It should be noted that the prospect of an easing of the financial conditions in the US economy seemed to also ease the market worries for its outlook thus supporting riskier assets such as US stock markets which are about to end the week in the greens. Given the lack of high-impact US financial releases today, we expect fundamentals to lead the USD.

Across the Atlantic, we note that BoE kept its interest rates unchanged as was widely expected yet its approach remains dovish in direction as in the the bank mentioned that “a gradual approach to removing policy restraint remains appropriate”, maybe not as dovish as the market expected, an element that provided support for the pound at the time of the release. Yet the pound got renewed support today as the retail sales growth rate accelerated beyond market expectations implying that the UK consumer is able and willing to spend more in the UK economy, contributing to its recovery.

In the land of the rising sun, 日銀は予想通り据え置 during today’s Asian session. The bank’s intentions continue to lean towards the hawkish side in our opinion, as the bank continues to aim towards a normalization of its monetary policy, by further hiking rates, albeit carefully. We expect the bank’s monetary policy and intentions to continue to feed JPY bulls.

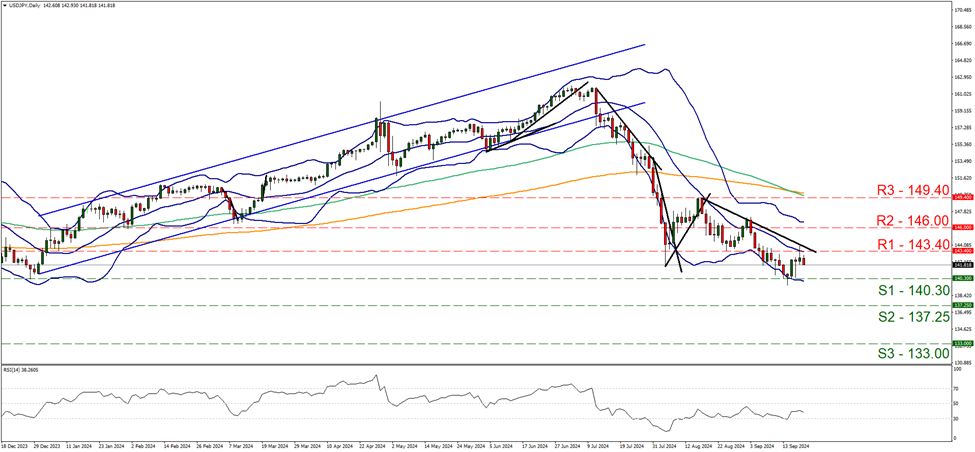

On a technical level, USD/JPY rose yesterday testing the 143.40 (R1) resistance line. We note that the RSI indicator is on the rise aiming for the reading of 50, implying that the bearish sentiment for the pair among market participants is fading away, yet the downward trendline guiding the pair since the 16 of August, remains intact. We note today’s correction lower in the Asian session, yet we may see some stabilisation of the pair. For a bullish outlook we would require USD/JPY’s price action to break the 143.40 (R1) resistance line and continue to break the prementioned downward trendline, in a first signal that the downward motion has been interrupted and take aim of the 146.00 (R2) level. Should the bears regaing the initiative for USD/JPY, we may see the pair breaking the 140.30 (S1) line, forming a new lower low and set the next possible target for the bears the 137.25 (S2) support base, which has not seen any price action since July last year.

Today we turn our attention towards the Loonie. In the American session, we get Canada’s retail sales for July and should the rate accelerate as expected or even more we may see the Loonie getting some support. Also, we note the release of the PPI rates for August and a possible slowdown could weigh on the CAD as it could enhance BoC’s dovish inclinations. BoC Governor Macklem is scheduled to speak and should he adopt a dovish tone we may see that weighing on the CAD. On a fundamental level, we note that oil prices were on the rise yesterday and should such tendencies be maintained we may see CAD getting some support given Canada’s status as a major oil-producing country.

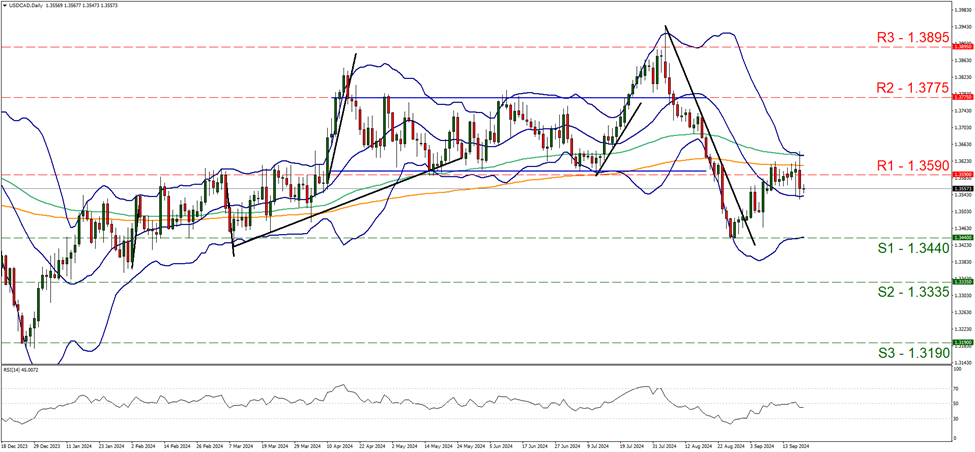

Despite a rise of USD/CAD over the past few days, we note the pair’s substantial drop yesterday breaking below the 1.3590 (R1) support line, now turned to resistance. We note that the RSI indicator dropped below the reading of 50, yet for the time being remains unconvincing for a build up of bearish tendencies. We expect a possible stabilisation of the pair’s price action for now and should the bears take over, we may see the pair aiming if not breaking the 1.3440 (S1) support line. Should the bulls take over we may see the pair breaking the 1.3590 (R1) resistance line and aiming for the 1.3775 (R2) resistance level.

本日のその他の注目点

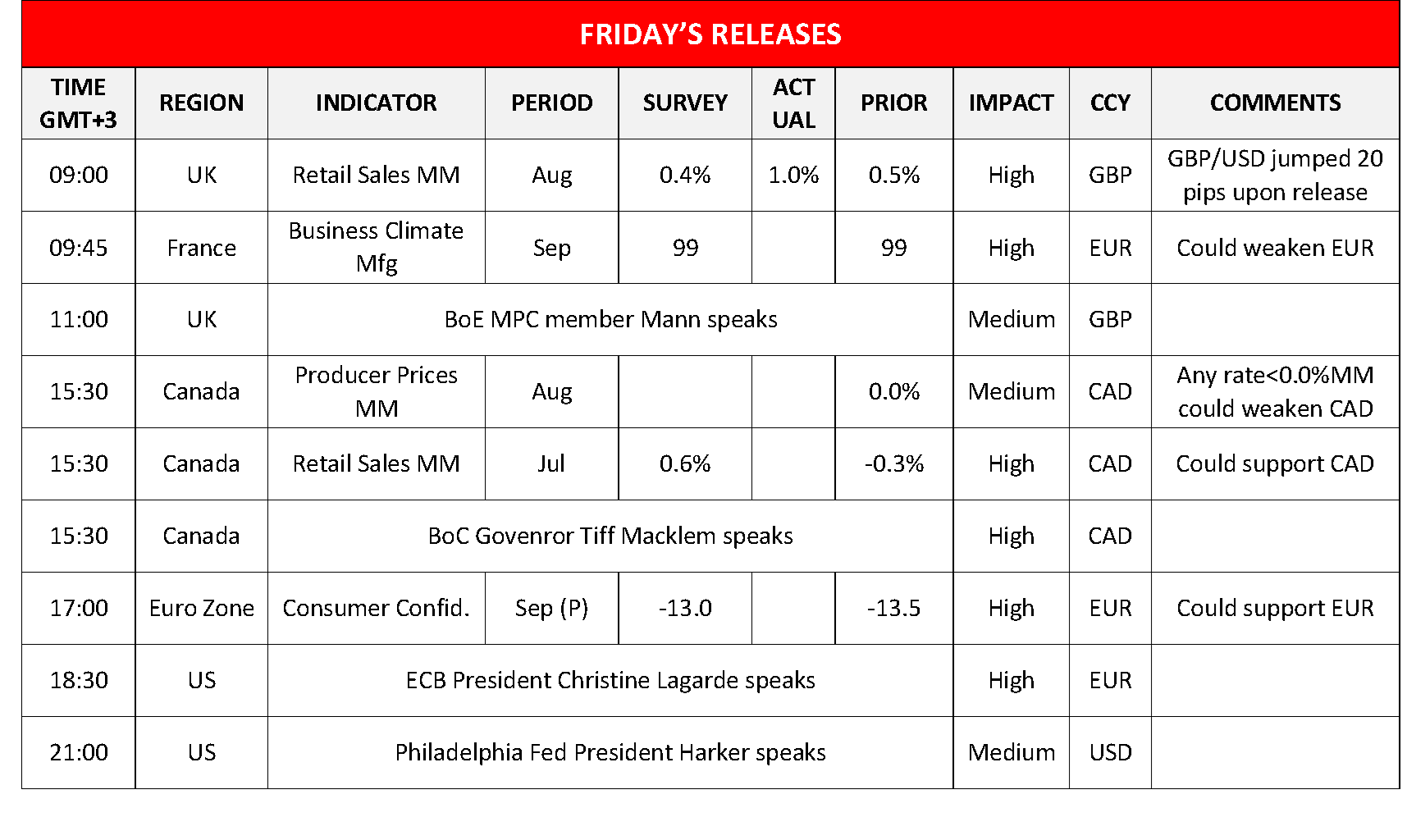

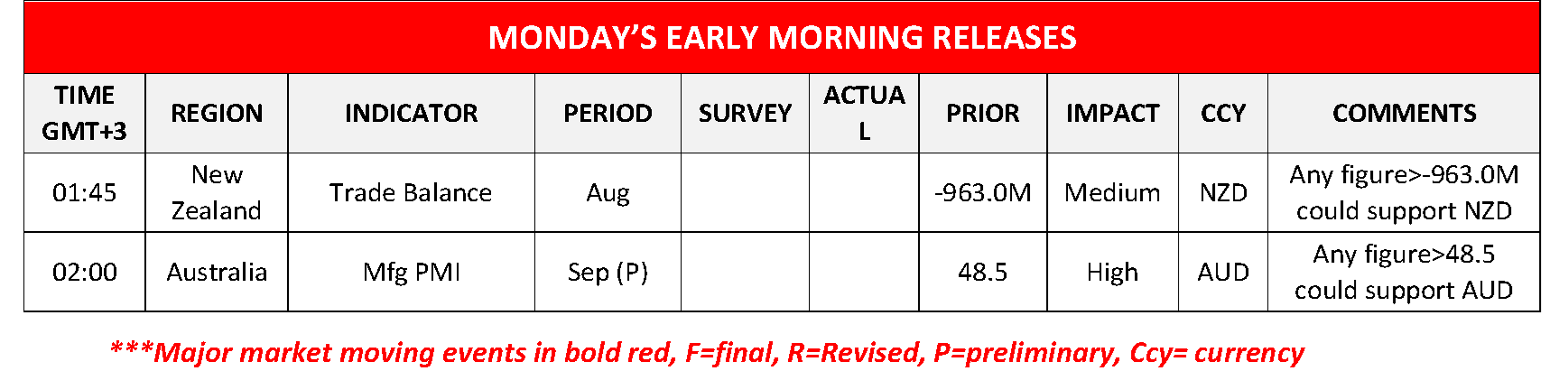

Today on the monetary front, BoE’s MPC member Mann, ECB President Christine Lagarde and Philadelphia Fed President Harker are scheduled to make statements.

USD/JPY Daily Chart

- Support: 140.30 (S1), 137.25 (S2), 133.00 (S3)

- Resistance: 143.40 (R1), 146.00 (R2), 149.40 (R3)

USD/CAD Daily Chart

- Support: 1.3440 (S1), 1.3335 (S2), 1.3190 (S3)

- Resistance: 1.3590 (R1), 1.3775 (R2), 1.3895 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。