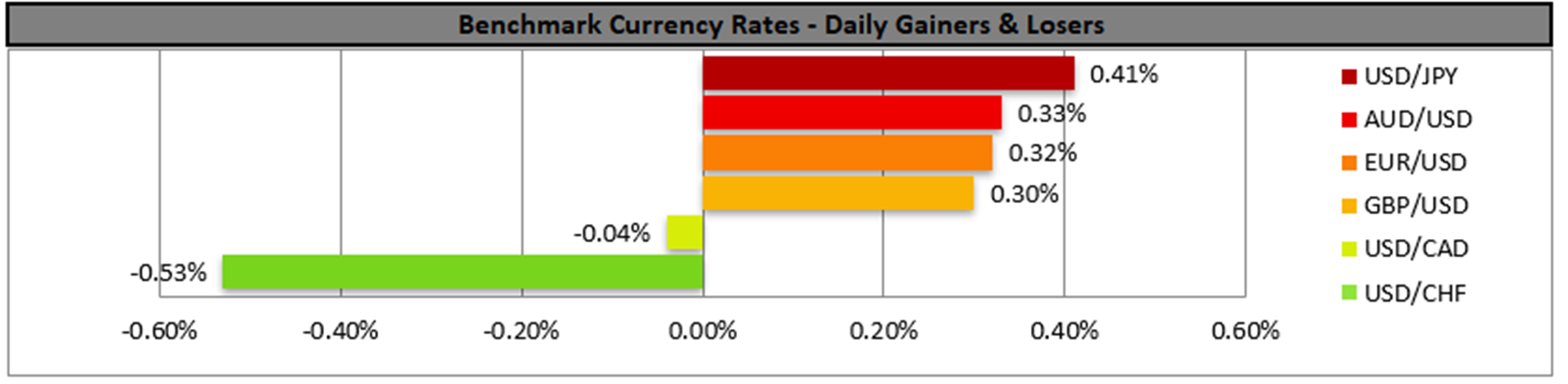

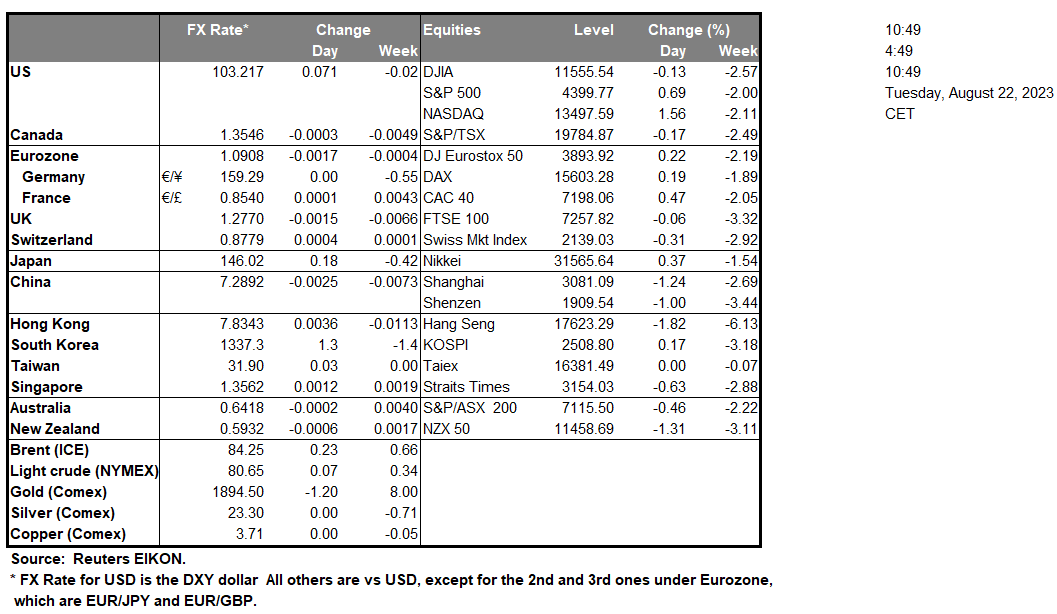

The BRICS summit is due to begin today, in South Africa. Market participants may see increased volatility in the commodities markets, as traders might be eagerly awaiting to see if the alleged discussion of the creation of a common currency that may be backed by precious metals occurs. Arm Holdings LTD, touted as potentially the largest IPO of the year, announced today that it would be seeking an IPO listing on NASDAQ in early September. Furthermore, Microsoft (#MSFT) has announced that it would be submitting a new deal to purchase Activision that will not include its cloud gaming services. With cloud gaming rights for the next 15-years being given to UBISOFT according to a report by Bloomberg, the lack of Activision’s cloud gaming service, could be considered as a major blow given the increased importance cloud services have received over the past few months. The announcement follows what appeared to be a stalling from the UK’s CMA over approving the deal, despite approval being given for the deal to go ahead in both the EU and the US. Following Moody’s decision, S&P announced earlier today that it has cut credit ratings and has revised its outlook for multiple U.S banks according to Reuters. In the commodities markets, oil appears to be stabilizing around the $80 key psychological figure, in addition Gold appears to have halted its descent. Lastly, we note that BestBuy (#BestBuy), Baidu (#BIDU) are expected to post their earnings today.

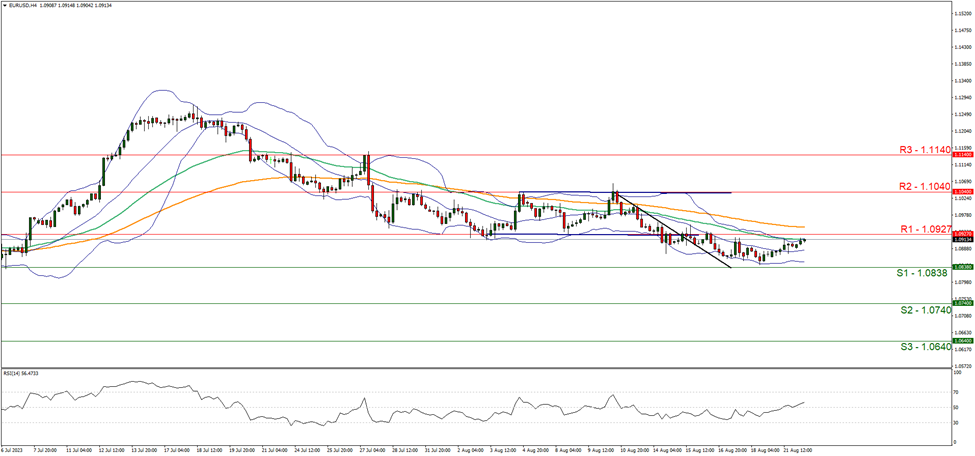

EUR/USD appears to continue moving in a sideways fashion, with the pair appearing to have remained between the 1.0838 (S1) support and 1.0927 (R1) resistance levels. We continue to maintain a neutral outlook for the pair and supporting our case is the RSI indicator below our 4-Hour chart which is currently near the figure of 50, implying a neutral market sentiment, despite having broken above the figure of 50, it appears to be currently respecting the aforementioned support and resistance levels. For our neutral outlook to continue, we would like to see the pair remaining confined between the 1.0838 (S1) support level and the 1.0927 (R1) resistance level. For a bearish outlook, we would like to see a clear break below the 1.0838 (S1) support level with the next possible target for the bears being the 1.0740 (S2) support level. On the other hand, for a bullish outlook, we would like to see a clear break above the 1.0927 (R1) resistance level with the next possible target for the bulls being the 1.1040 (R2) resistance level.

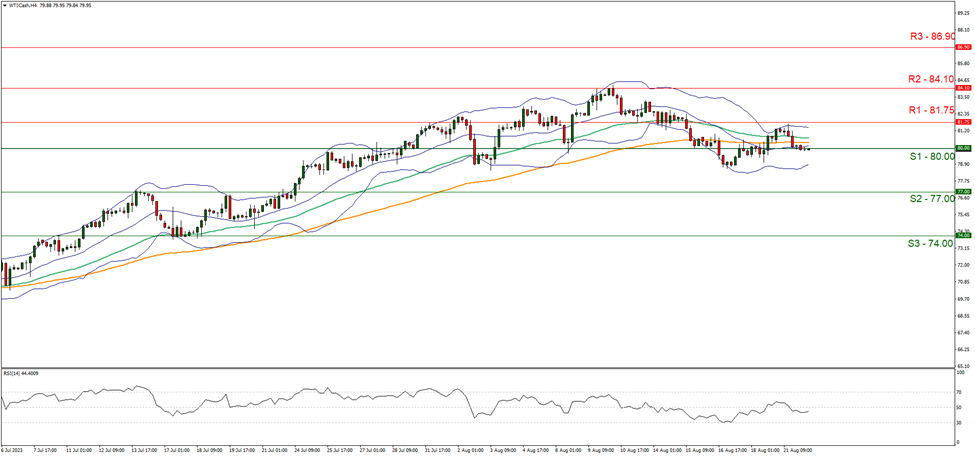

WTI appears to have halted its ascent and now appears to have retraced back to the $80.00 mark, after having tested resistance at the 81.75 (R1) level . We maintain a neutral outlook for the commodity and supporting our case is the RSI indicator below our 4-Hour chart which currently registers a figure near 50, implying a neutral market sentiment. For our neutral outlook to continue, we would like to see the commodity fluctuating around the $80.00 dollar mark and failing to break above the 81.75 (R1) resistance level, or breaking below the 77.00 (S2) support level. For a bullish outlook, we would like to see a clear break above the 81.75 (R1) resistance level, with the next possible target for the bulls being the 84.10 (R2) resistance ceiling. On the other hand, for a bearish outlook , we would like to see a clear break below the 77.00(S2) support level with the next possible target for the bears being the 74.00(S3) support base.

その他の注目材料

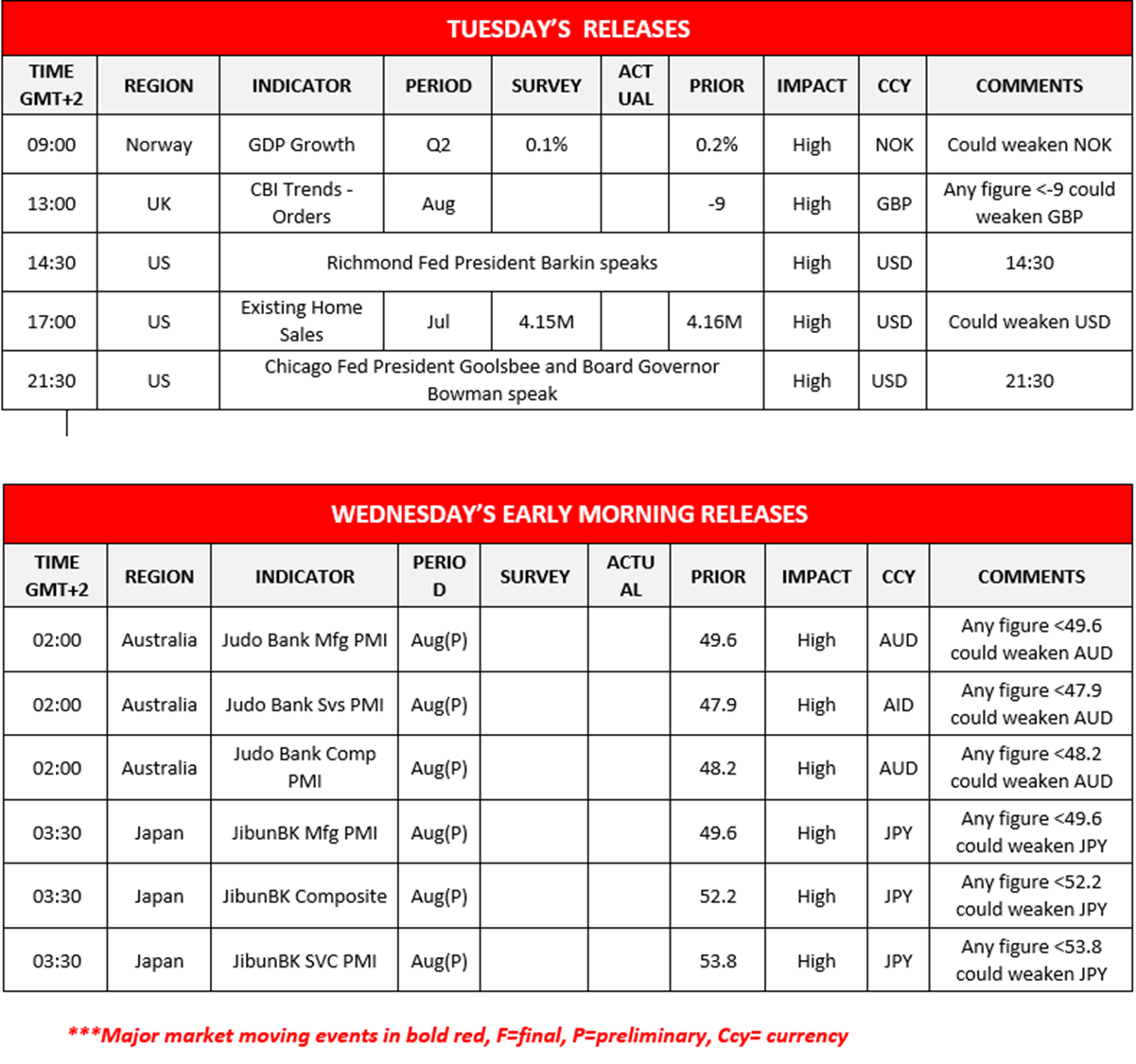

In today’s session, we note Norway’s GDP growth rate for Q2, the UK’s CBI trends figure for August, followed by the US existing home sales figure for July. In tomorrow’s busy Asian session, we make a start with Australia’s Preliminary PMI figures for August, followed by Japan’s Preliminary PMI figures for August, as well. On a monetary level, we highlight in today’s session, the speeches by Richmond Fed President Barkin and later on in the day, the join speeches by Chicago Fed President Gooolsbee and Board Governor Bowman

#EUR/USD H4 Chart

Support: 1.0838 (S1), 1.0740 (S2), 1.0640 (S3)

Resistance: 1.0927 (R1), 1.1040 (R2) 1.1140 (R3)

#WTICash H4 Chart

Support: 80.00 (S1), 77.00 (S2), 74.00 (S3)

Resistance: 81.75 (R1), 84.10 (R2), 86.90 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。