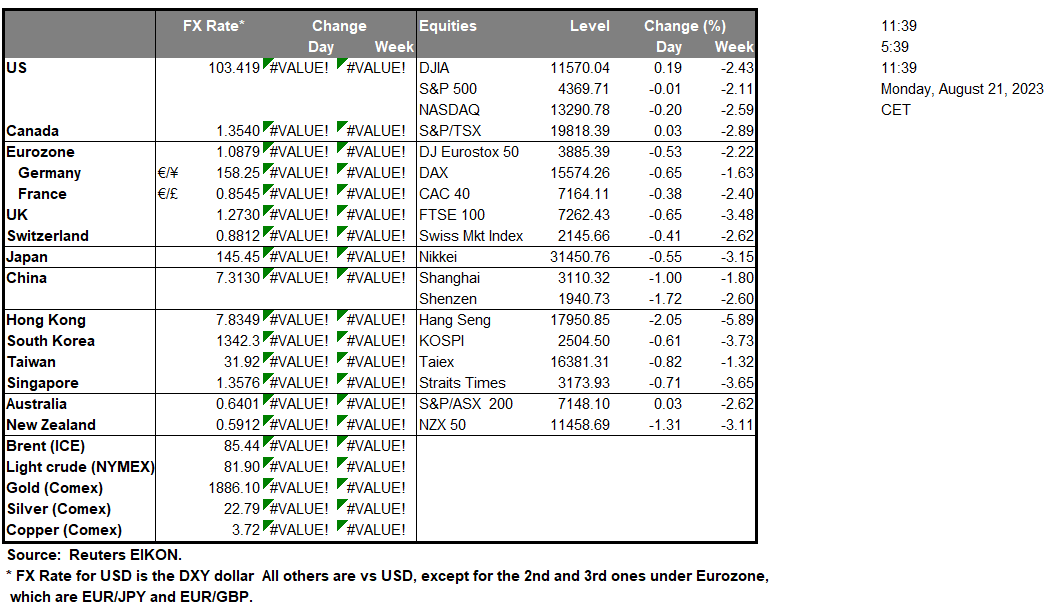

The BRICS summit is due to begin tomorrow, in South Africa. Market participants may be eagerly awaiting to see whether the BRICS nations will be discussing the creation of a common currency that may be backed by precious metals. Furthermore, significant interest appears to be building up around potential new members who have officially requested to join and whether the summit may be used to introduce new members to the group. Over in Australia, LNG workers claim that they will go on strike on Wednesday should no deal be reached. The current situation has heightened market worries about European natural gas supply, as a strike in the LNG sector could potentially impact 10% of global LNG exports according to Bloomberg. China surprisingly holds its five-year loan prime rate at its current levels, which appears to be puzzling economists. The Chinese Government appears to be hinting at a degree of urgency in its current economic situation and as such we may see increased volatility over the coming weeks. In the commodities markets, oil appears to be moving higher, as various media outlets are reporting that OPEC+ is anticipated to report lower exports for the month of August. Yet, we would take any figure with a pinch of salt, as Russia has begun exporting oil via its Artic route, it could potentially undermine attempts by OPEC+ to reduce the oil supply. In the equities markets, we note that BestBuy (#BestBuy), and Baidu (#BIDU) are expected to post their earnings tomorrow.

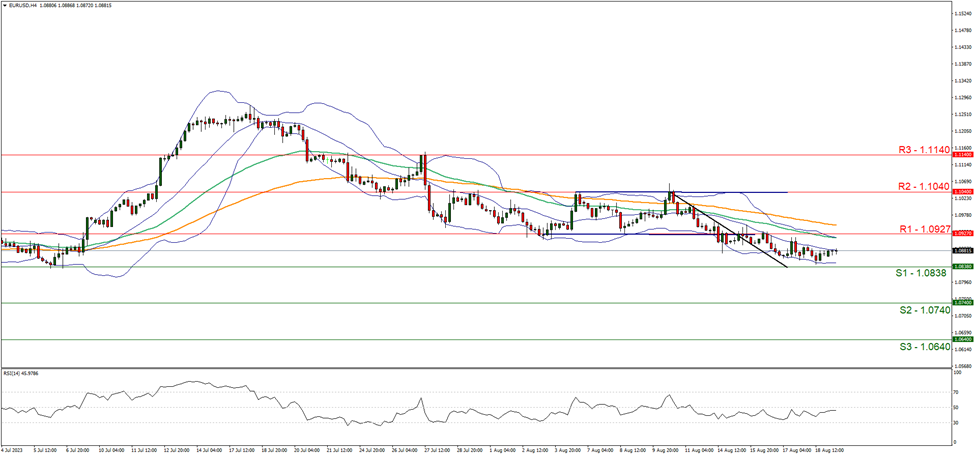

EUR/USD appears to continue moving in a sideways fashion, with the pair appearing to have remained between the 1.0838 (S1) support and 1.0927 (R1) resistance levels. We continue to maintain a neutral outlook for the pair and supporting our case is the RSI indicator below our 4-Hour chart which is currently near the figure of 50, implying a neutral market sentiment, in addition to the narrowing of the Bollinger bands implying low market volatility. For our neutral outlook to continue, we would like to see the pair remaining confined between the 1.0838 (S1) support level and the 1.0927 (R1) resistance level. For a bearish outlook, we would like to see a clear break below the 1.0838 (S1) support level with the next possible target for the bears being the 1.0740 (S2) support level . On the other hand, for a bullish outlook, we would like to see a clear break above the 1.0927 (R1) resistance level with the next possible target for the bulls being the 1.1040 (R2) resistance level.

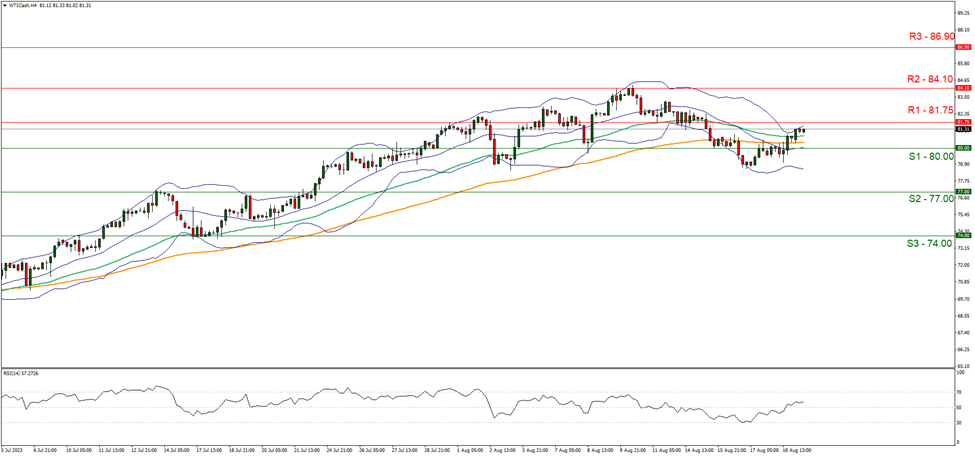

WTI appears to be moving in an upwards fashion, after having broken above the $80 key psychological level. We maintain a bullish outlook for the commodity and supporting our case is the RSI indicator below our 4-Hour chart which currently registers a figure near 70, implying a bullish market sentiment. For our bullish outlook, we would like to see a clear break above the 81.75 (R1) resistance level, with the next possible target for the bulls being the 84.10 (R2) resistance ceiling. On the other hand, for a bearish outlook , we would like to see a clear break below the 80.00 (S1) support level with the next possible target for the bears being the 77.00 (S2) support base.

その他の注目材料

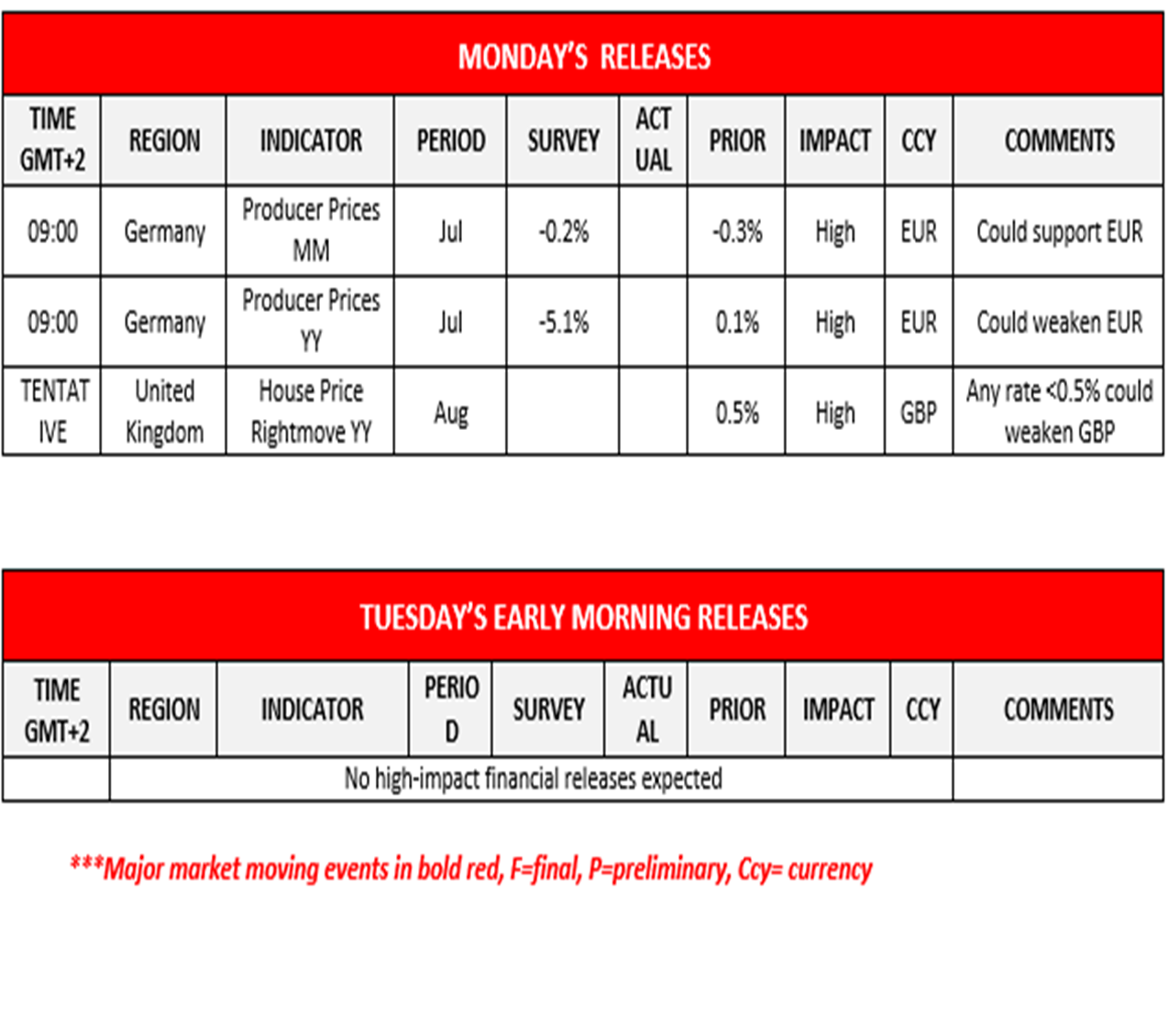

今日のでは、ドイツの7月生産者物価が発表され、英国の8月住宅価格(ライトムーブ)も発表される予定である。また、明日のアジアは、主要な金融関連の発表が予定されていないため、気楽な展開となりそうだ。.

#EUR/USD H4 Chart

Support: 1.0838 (S1), 1.0740 (S2), 1.0640 (S3)

Resistance: 1.0927 (R1), 1.1040 (R2) 1.1140 (R3)

#WTICash H4 Chart

Support: 80.00 (S1), 77.00 (S2), 74.00 (S3)

Resistance: 81.75 (R1), 84.10 (R2), 86.90 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。