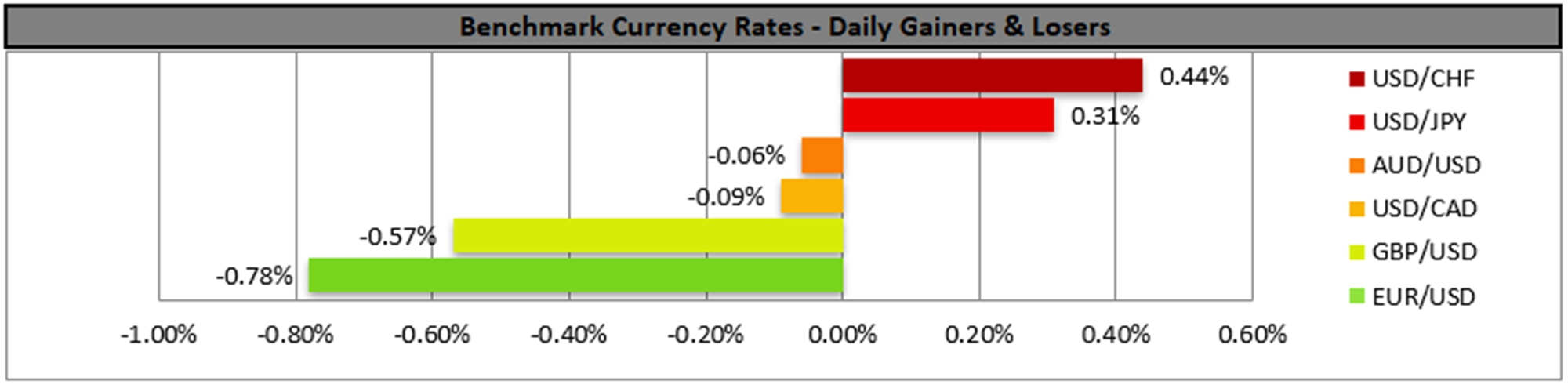

The USD tended to rise against its counterparts on Friday and market attention turns towards BoJ’s interest rate decision due out during tomorrow’s Asian session. The bank is widely expected to remain on hold at -0.10% and JPY OIS imply a probability of 98.81% for such a scenario to materialise, rendering the interest rate part of the decision as an open and shut case. Yet JPY OIS also imply that the market expects the bank to start normalising its ultra-loose monetary policy and proceed with its first rate hike in decades in March. The market’s expectations tended to intensify over the past weeks as BoJ officials allowed for some hawkish hints to escape in their speeches. Should the accompanying statement be characterised by a more hawkish tone that would allow the market’s expectations to solidify, we may see JPY gaining some ground.

USD/JPY maintained a relatively tight rangebound motion on Friday and remained well within the corridor set by the 143.00 (R1) resistance line and the 141.50 (S1) support level. We tend to maintain a bias for the sideways motion to continue on a technical level and also note that some slight bearish tendencies seem to exist in the market sentiment given that the RSI indicator is between the reading of 50 and 30, yet BoJ’s interest rate decision may sway USD/JPY’s direction either way. Should the bulls get control over the pair, we may see it breaking the 143.00 (R1) resistance line and aiming for the 144.45 (R2) resistance level. Should the bears take over, we may see USD/JPY breaking the 141.50 (S1) support line and aim for the 139.75 (S2) support base.

その他の注目材料

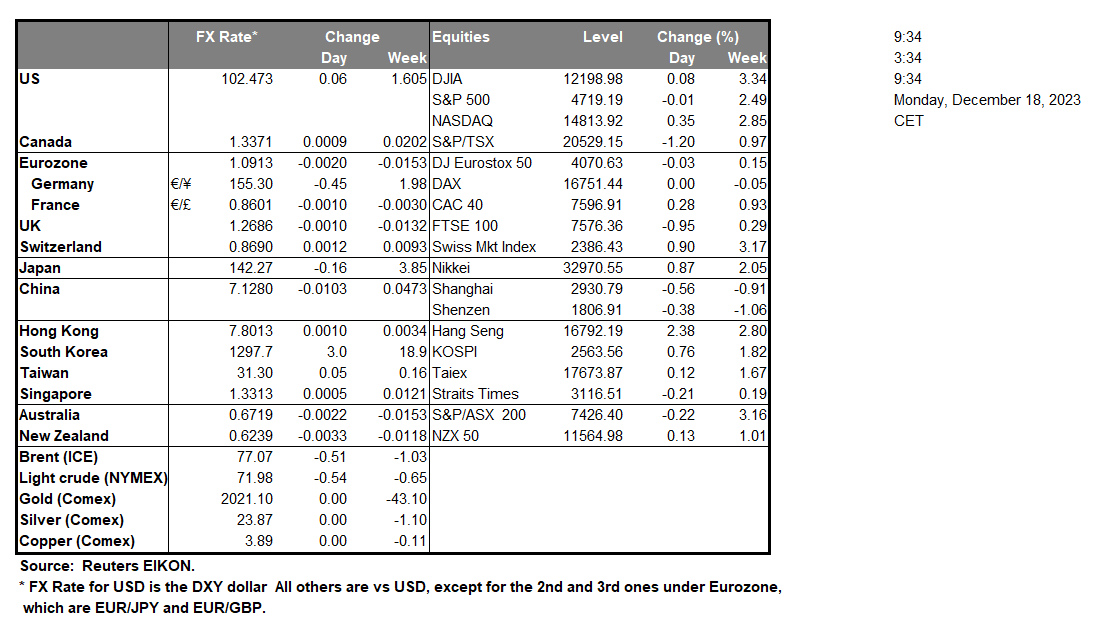

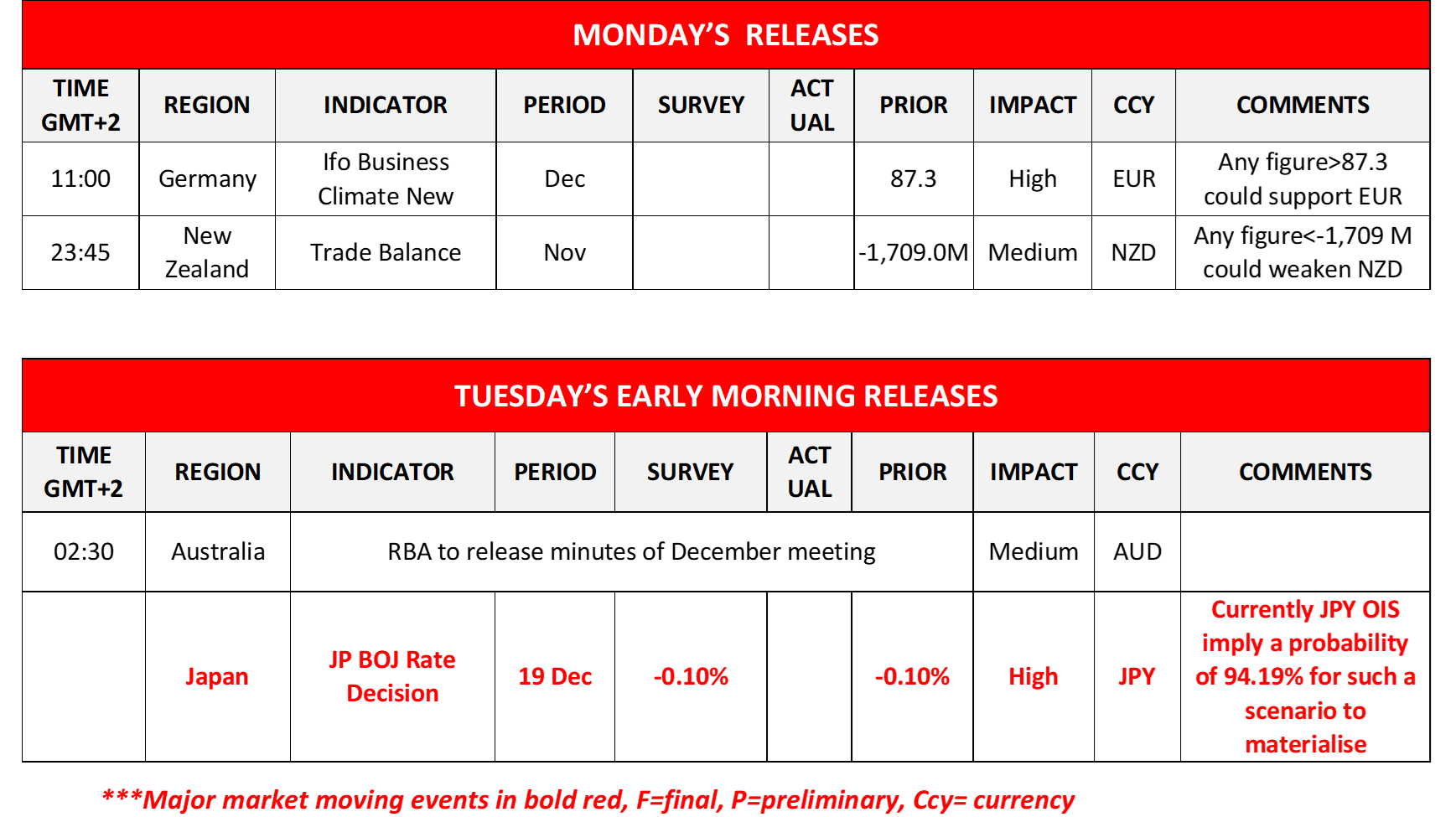

Today we note the release of Germany’s December Ifo indicators and later on New Zealand’s trade data for November. On the monetary front, we note the release from Australia the release of RBA’s December meeting minutes.

EUR/USD dropped on Friday breaking the 1.0960 (R1) support line, now turned to resistance. The pair seems to have stabilised for the time being between the 1.0960 (R1) resistance line and the 1.0830 (S1) support line. Also, the RSI indicator seems to be running just above the reading of 50, implying some slight bullishness in the market sentiment, yet nothing conclusive, allowing us to maintain temporarily a bias for the sideways motion to continue, yet the direction may alter. Should EUR/USD find extensive buying orders along its path, we may see the pair breaking the 1.0960 (R1) resistance line and aim for the 1.1065 (R2) resistance level. Should a selling interest be expressed by the market, we may see the pair breaking the 1.0835 (S1) support line and aim for the 1.0735 (S2) support level.

今週の指数発表:

On Tuesday we note the release of UK’s CBI trends for industrial orders for December and Canada’s CPI rates for November. On Wednesday, we get Japan’s trade data for November, Germany’s GfK consumer sentiment for January, UK’s CPI rates for November, Eurozone’s preliminary consumer confidence and the US consumer confidence, both being for December and on the monetary front, we note the release of BoC’s deliberations for the December meeting. On Thursday, we get the UK’s CBI distributive trades for December and we highlight the final US GDP rate for Q3, the weekly initial jobless claims, the Philly Fed business index for December, and Canada’s retail sales for October and on the monetary front we note the release of Turkey’s CBT and the Czech Republic’s CNB interest rate decisions. Finally on Friday, we note the release of Japan’s November CPI rates, UK’s GDP rate for Q3 and retail sales for November as well as the US consumption rate, the Core PCE price index and the durable goods orders all for November, Canada’s GDP rates for December and the final US University of Michigan consumer sentiment.

USD/JPY 4時間チャート

Support: 141.50 (S1), 139.75 (S2), 138.00 (S3)

Resistance: 143.00 (R1), 144.45 (R2), 146.30 (R3)

EUR/USD 4時間チャート

Support: 1.0835 (S1), 1.0735 (S2), 1.0660 (S3)

Resistance: 1.0960 (R1), 1.1065 (R2), 1.1150 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。