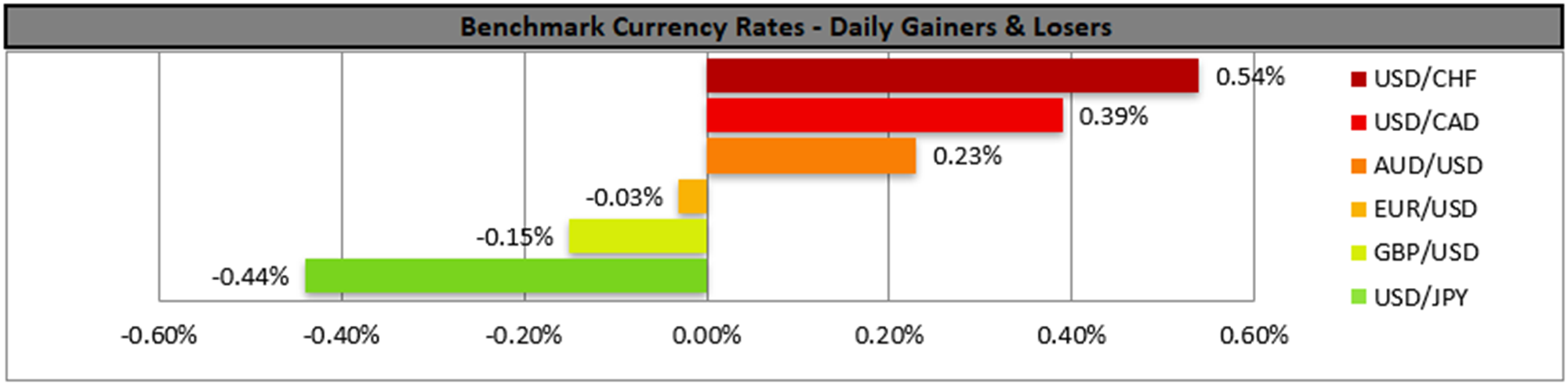

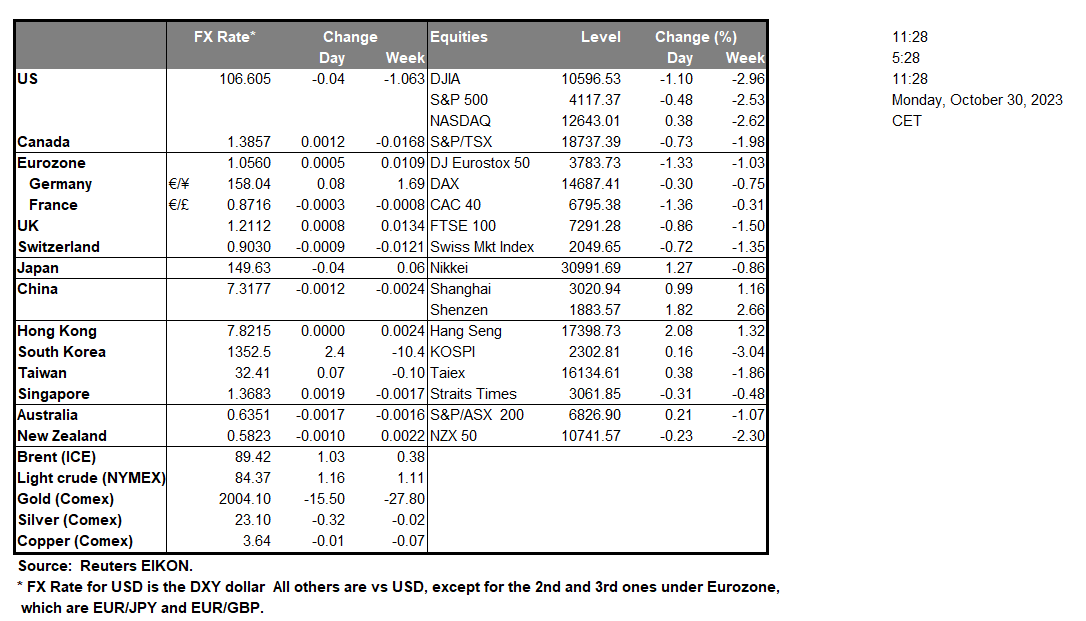

The USD tended to remain in a sideways motion on Friday, yet US stock markets sunk. On a fundamental level, we highlight the increased worries for the level of the US debt and how that may affect the fiscal policy of the US government, especially given that another deadline for the US debt ceiling is nearing. Across the pond, EUR traders are expected to keep a close eye on Germany’s preliminary HICP rate for October and should the rates slow down as expected or even more, we may see the EUR losing ground as the position of the ECB to remain on hold could be justified.

On a technical level, we note that EUR/USD remained in a sideways motion between the 1.0515 (S1) support line and the 1.0635 (R1) resistance level. Given also that the RSI indicator is running along the reading of 50, implying a rather indecisive market, we tend to maintain a bias for the sideways motion to continue. Should the bulls take over, we may see EUR/USD breaking the 1.0635 (R1) resistance line, aiming for the 1.0735 (R2) resistance level. Should the bears be in charge of the pair’s direction, we may see EUR/USD breaking the 1.0515 (S1) support line and aim for the 1.0430 (S2) support level.

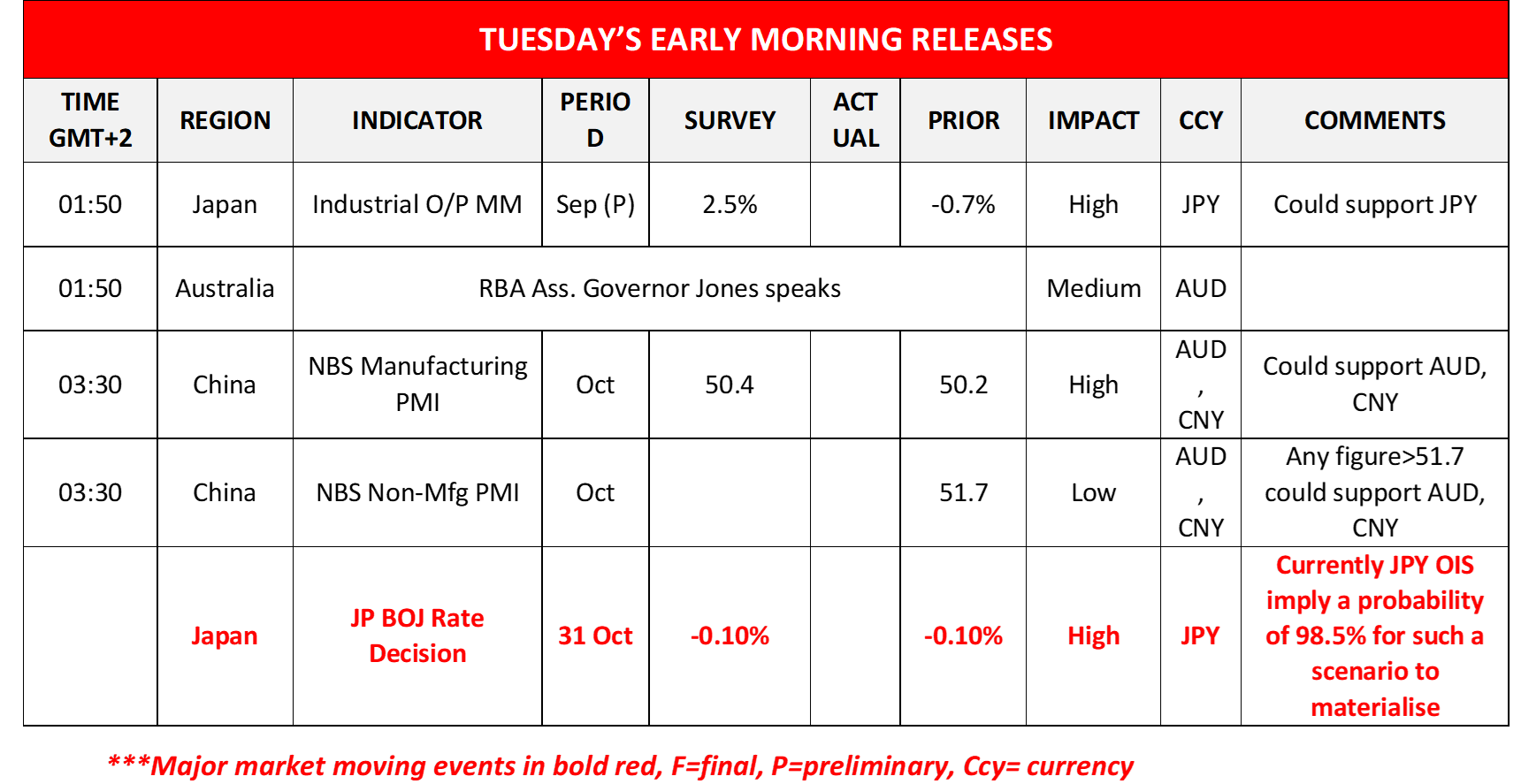

Tomorrow, during the Asian session, we highlight the release of BoJ’s interest rate decision and the bank is expected to remain on hold. Yet the weakening of JPY, given that the interest rate differentials tend to weigh on the JPY, may force the bank to widen its tolerance level in JGB yields in a message to the markets that it will allow greater fluctuation before proceeding with JGB purchases. If so, we may see JPY gaining ground, while should the bank fail to alter its ultra-loose monetary policy settings even slightly we may see the JPY losing ground once again, a scenario that may force Japan to intervene in the markets to support the Yen.

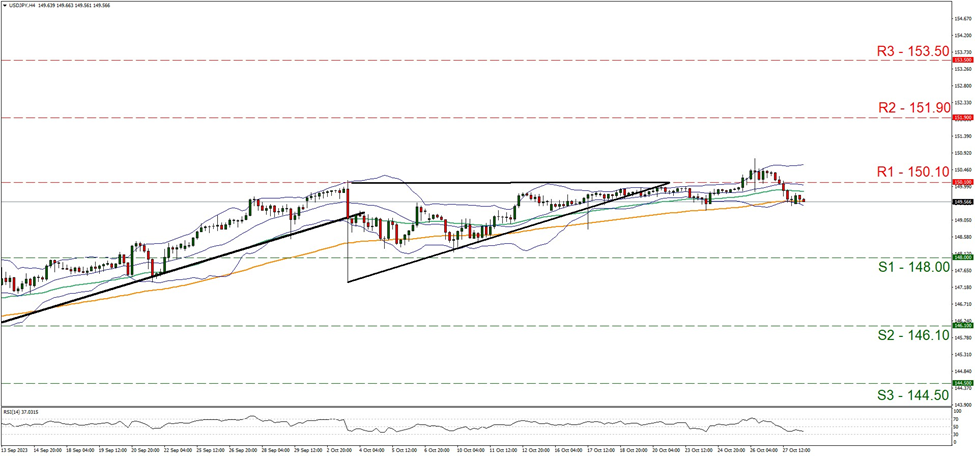

USD/JPY started to drop on Friday, breaking the 150.10 (R1) support line, now turned to resistance. Given that the RSI indicator is nearing the reading of 30, and the continuance of the slight bearish tendencies despite a correction higher during today’s early Asian session, we tend to expect the bears to continue to lead the pair, for now. Should the selling interest be intensified, we may see the pair aiming if not breaching the 148.00 (S1) support line. On the flip side, should buyers be in charge of the pair’s direction, we may see the pair reversing course breaking the 150.10 (R1) resistance line and aim for higher grounds.

その他の注目材料

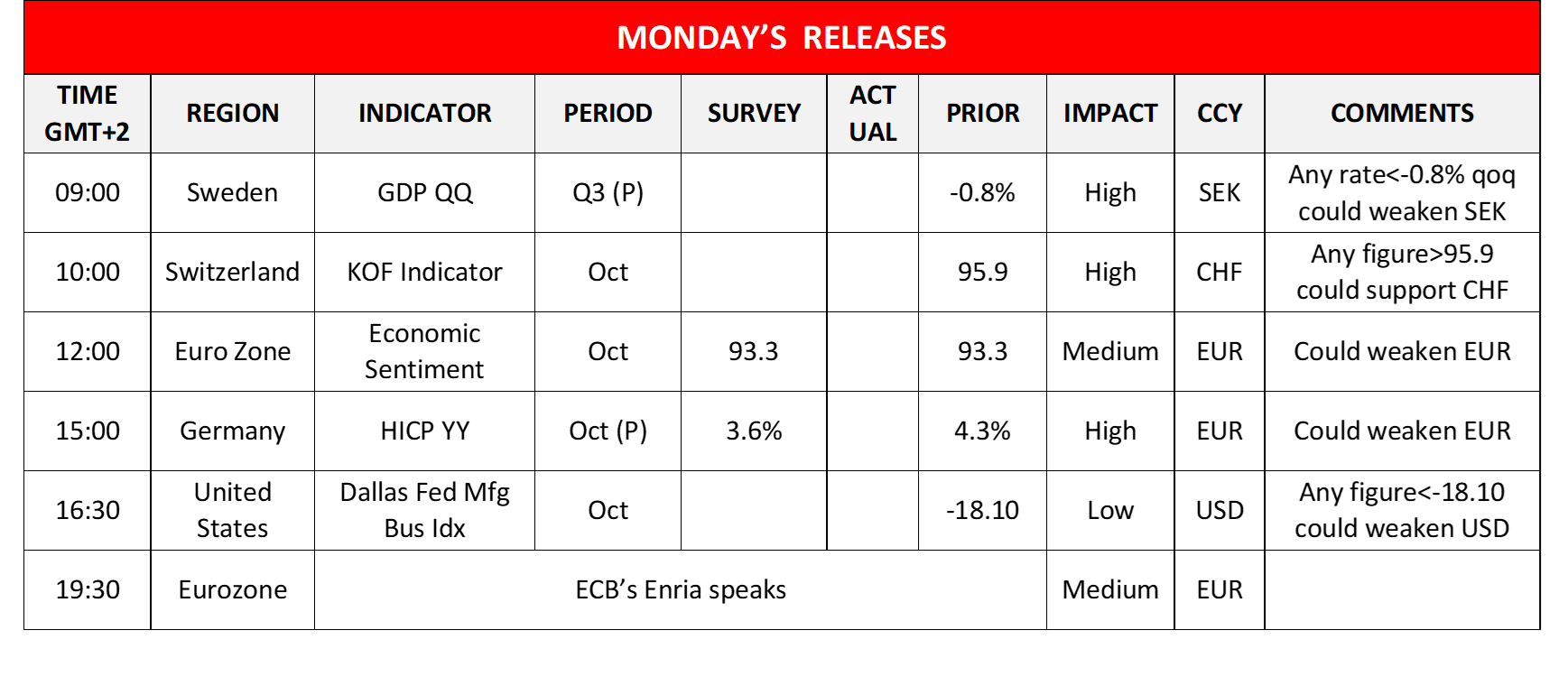

Today we note the release of Sweden’s preliminary GDP rate for Q3, Switzerland’s KOF indicator, the Eurozone’s economic sentiment and the US Dallas Fed manufacturing index all being for October, while on the monetary front, we note that ECB’s Enria speaks. During tomorrow’s Asian session, we note China’s October NBS PMI figure and Japan’s preliminary industrial production rate for September.

今週の指数発表:

On Tuesday we note the release of Germany’s preliminary GDP rates for Q3 and the Eurozone’s and France’s preliminary GDP rates for Q3 and preliminary HICP rates for October, Canada’s GDP rates for August and the US consumer confidence for October. On Wednesday we highlight the Fed’s interest rate decision and note the release of China’s Caixin manufacturing PMI figure for October, the US ISM manufacturing PMI figure for the same month and just before Thursday’s Asian session starts we get New Zealand’s employment data for Q3. On Thursday we start with Australia’s trade data for September, UK’s Nationwide House prices for October, Switzerland’s CPI rates for the same month and from the US, the weekly initial jobless claims figure and Factory orders for September and on the monetary front we note BoE’s, Norgesbank’s and CNB’s interest rate decisions. On Friday, we note the release of the US employment report for October and note the release of Turkey’s CPI rates for October and Canada’s employment data for the same month.

USD/JPY 4 Hour Chart

Support: 148.00 (S1), 146.10 (S2), 144.50 (S3)

Resistance: 150.10 (R1), 151.90 (R2), 153.50 (R3)

EUR/USD 4 Hour Chart

Support: 1.0515 (S1), 1.0430 (S2), 1.0310 (S3)

Resistance: 1.0635 (R1), 1.0735 (R2), 1.0835 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。