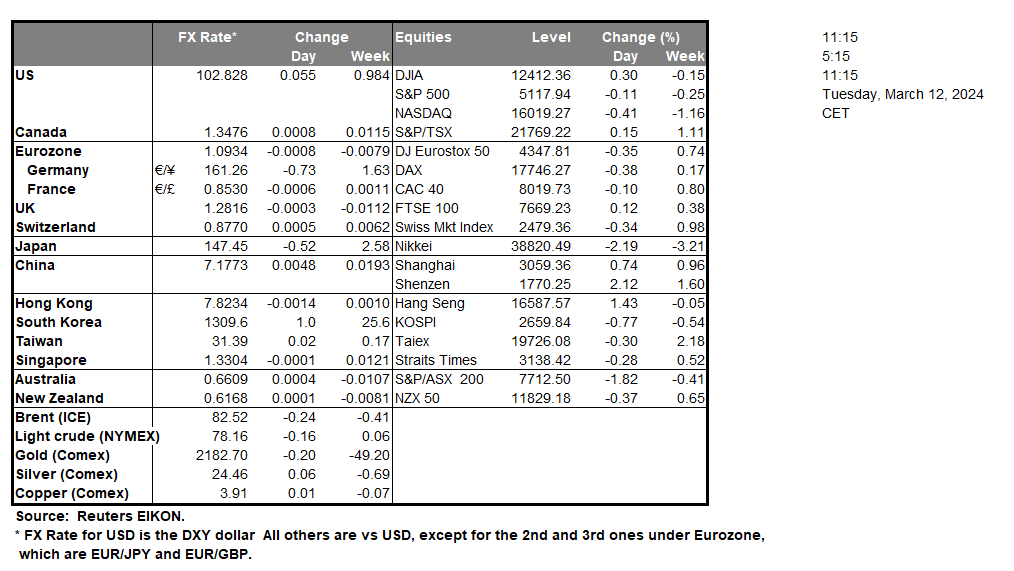

BOJ Ueda according to some media outlets stated earlier on today that when the objective of 2% inflation is stably and sustainably in sight, the bank will “consider adjusting the negative rate policy”, which may imply an exit from Negative rates, YCC and other large-scale monetary easing steps. The potential hike would be the first for the bank since 2007. Currently, JPY OIS implies a 48.9% probability that the BOJ may hike in April, yet market expectations appear to be also fairly close to each other about a potential hike by the BOJ in their March meeting. However, it should noted that the predominant market expectation is for the bank to remain on hold during their March meeting. Nonetheless, we tend to agree with current market expectations about a potential rate hike in April should the data imply that 2% inflation is sustainably in sight. The US Headline CPI rates for February are due to be released later on today. Market participants are currently anticipating the Headline CPI rate to hold steady at 3.1% on a yoy level, whilst accelerating to 0.4% from 0.3% on a mom level. The potential implications of persistent inflationary pressures in the US economy could increase the rhetoric of maintaining interest rates higher for longer, which in turn could support the dollar. However, with the FOMC’s blackout period now in effect, the reaction by Fed officials may be seen through the bank’s accompanying statement on the 20 of March. In the US stock markets, the bad news coverage for Boeing (#BA) simply doesn’t appear to be going away. In particular, a Boeing 787 operated by LATAM, abruptly dropped mid-flight from Sydney to Aukland on Monday, with news organizations attributing the sudden drop to “technical issues”. Nonetheless, the news could weigh on the company’s stock price.

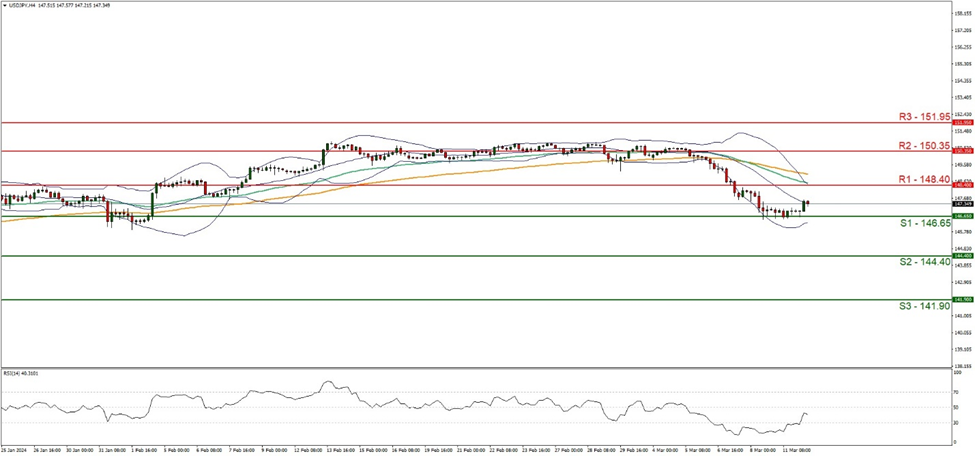

On a technical level, USD against the JPY appears to be moving in a downwards fashion, having bounced off the 146.65 (S1) support level. We maintain a bearish outlook for the pair and supporting our case is the Bollinger bands which appear to be tilted to the downside, implying bearish tendencies for the pair in addition to the RSI indicator below our chart which currently registers a figure near 40, also implying bearish tendencies. For our bearish outlook to continue, we would require a clear break below the 1465.65 (S1) support level, with the next possible target for the bears being the 144.40 (S2) support base. On the other hand, for a sideways bias we would like to see the pair remain confined between the 146.65 (S1) support level and the 148.40 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 148.40 (R1) resistance line, with the next possible target for the bulls being the 150.35 (R2) resistance ceiling.

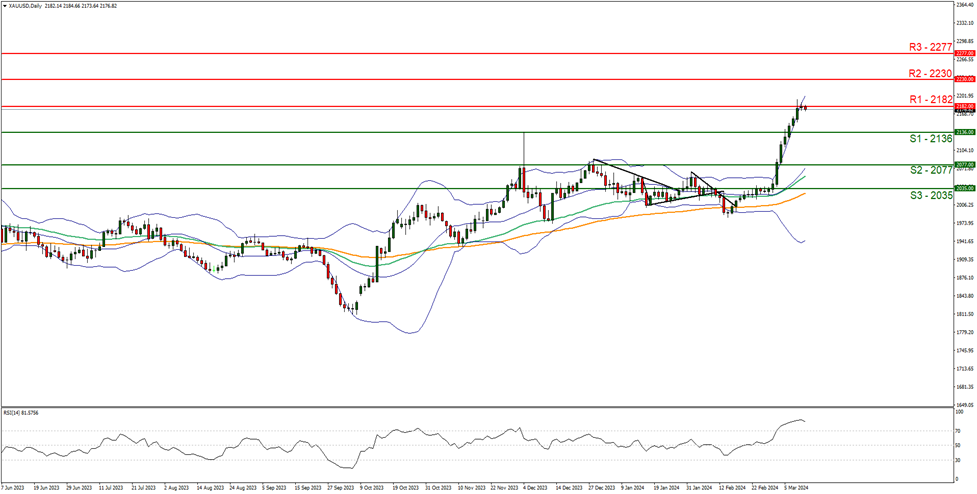

XAU/USD appears to be moving in an upwards fashion. We maintain a bullish outlook for the precious metal and supporting our case is the RSI indicator below our chart which currently registers a figure near 80 implying a strong bullish market sentiment. However, the RSI indicator may also imply that the precious metal appears to be within overbought territory and as such may be due a market correction to lower ground. Nonetheless, for our bullish outlook to continue we would like to see a clear break above the 2182 (R1) resistance line, with the next possible target for the bulls being the 2230 (R2) resistance line. On the other hand, for a sideways bias we would like to see gold’s price remain confined between the 2136 (S1) support level and the 2182 (R1) resistance line. Lastly, for a bearish outlook we would like to see a clear break below the 2136 (S1) support level with the next possible target for the bears being the 2077 (S2) support base.

その他の注目材料

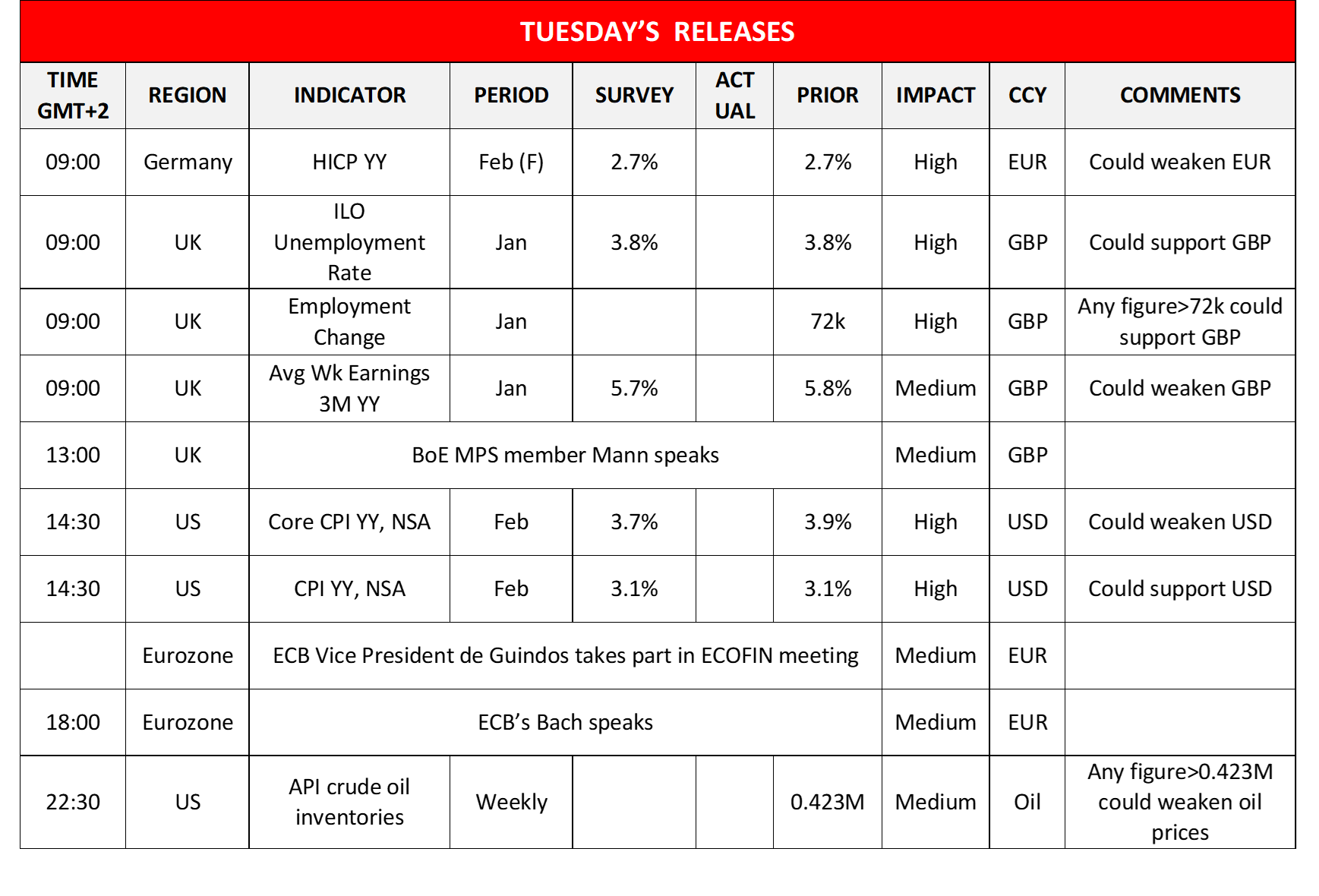

Today in the European session, we note the release of Germany’s final HICP rates for February, UK’s employment data for January and we highlight the release of the US CPI Rates for February in the early American session. On the monetary front, we note that BoE MPC member Mann and ECB’s Bach are scheduled to speak while ECB Vice President de Guindos takes part in the ECOFIN meeting.

USD/JPY 4時間チャート

Support: 146.55 (S1), 144.40 (S2), 141.90 (S3)

Resistance: 148.40 (R1), 150.35 (R2), 151.95 (R3)

XAU/USD Daily Chart

Support: 2136 (S1), 2077 (S2), 2035 (S3)

Resistance: 2182 (R1), 2230 (R2), 2277 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。