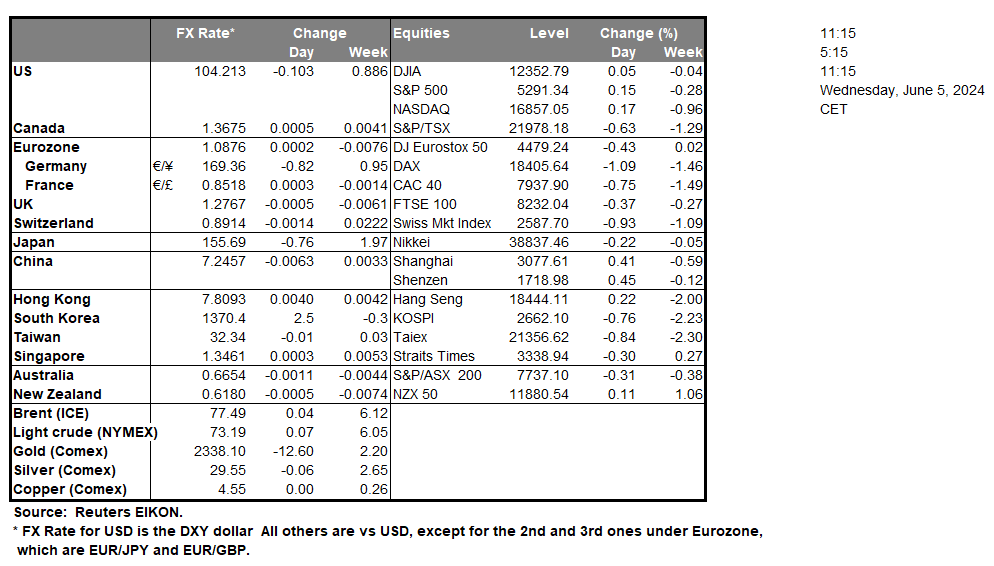

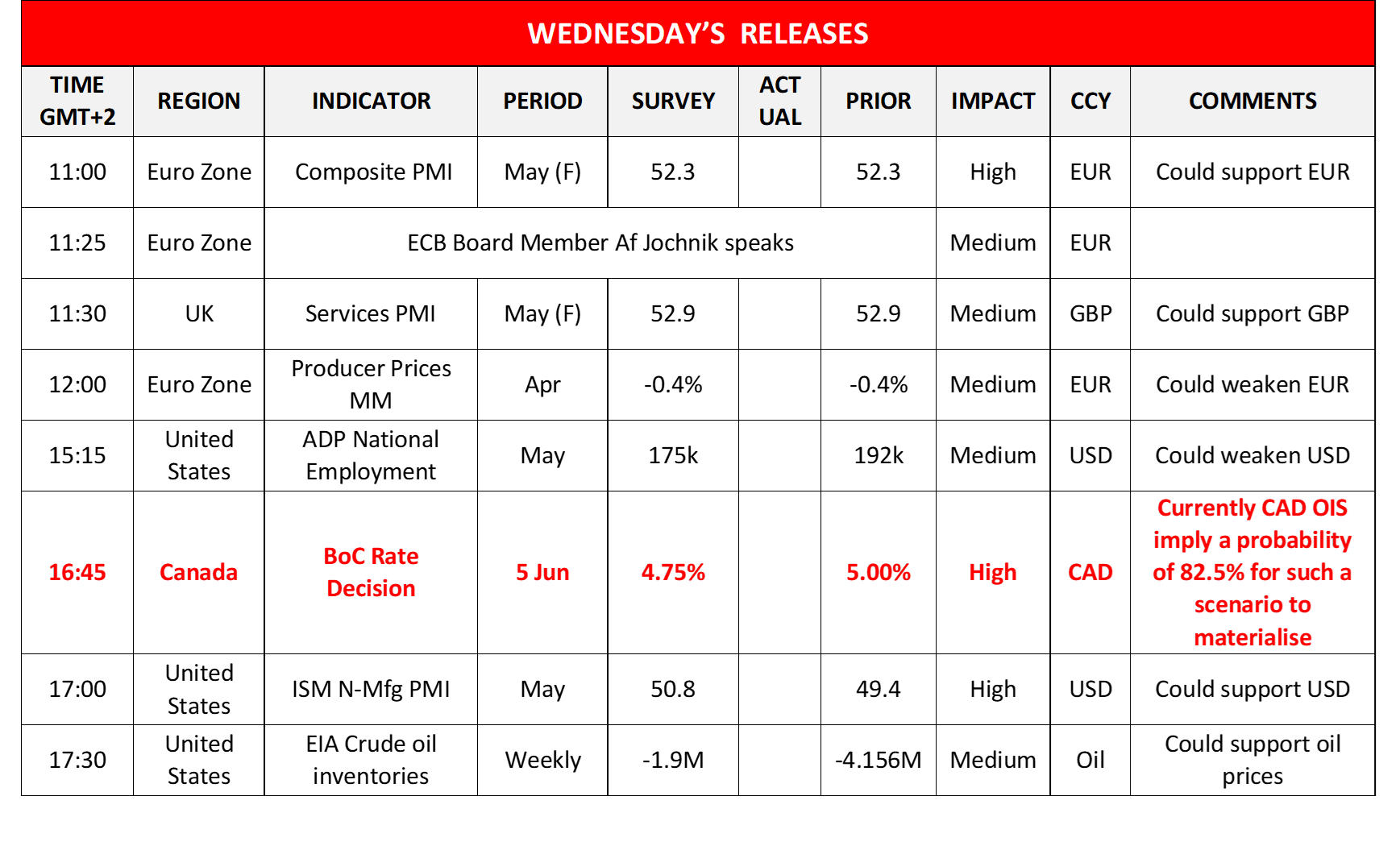

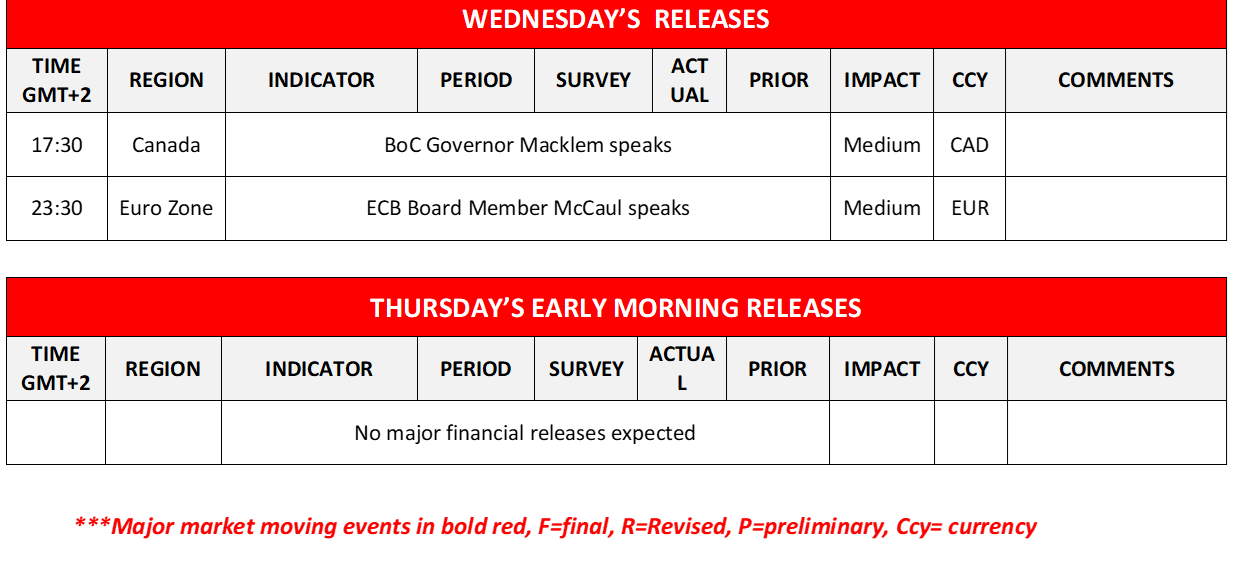

The BoC’s interest rate decision is set to occur later on today. The majority of market participants are anticipating the bank to cut interest rates by 25 basis points, with CAD OIS currently implying an 80.3% probability for such a scenario to materialize. In such a scenario, we may see the Loonie weakening. Yet, we would remain vigilant for the bank’s accompanying statement which is set to be released following the bank’s decision. Should BoC policymakers imply that the bank’s 2% inflation target is in sight, it may imply a loosening of the bank’s monetary policy and thus could weigh on the Loonie. On the flip side, should BoC policymakers imply that the bank may maintain interest rate levels at a higher level than what is currently anticipated by analysts, it could provide support for the Loonie. The US JOLTS Job openings figure for April came in lower than expected at 8.059M versus 8.370M. The lower-than-expected figure, may imply a loosening labour market in the US economy. Moreover, the prior figure was revised downwards to 8.355M from 8.488M, which appears to have weighed on the dollar, following its release. Nonetheless, attention may now turn to the release of the ADP Employment figure for May, which is also expected to showcase a loosening labour market. Thus, should the figure come in as expected or lower, it could further weigh on the dollar, whereas a figure higher than the current market expectations of 173k, could support the greenback.

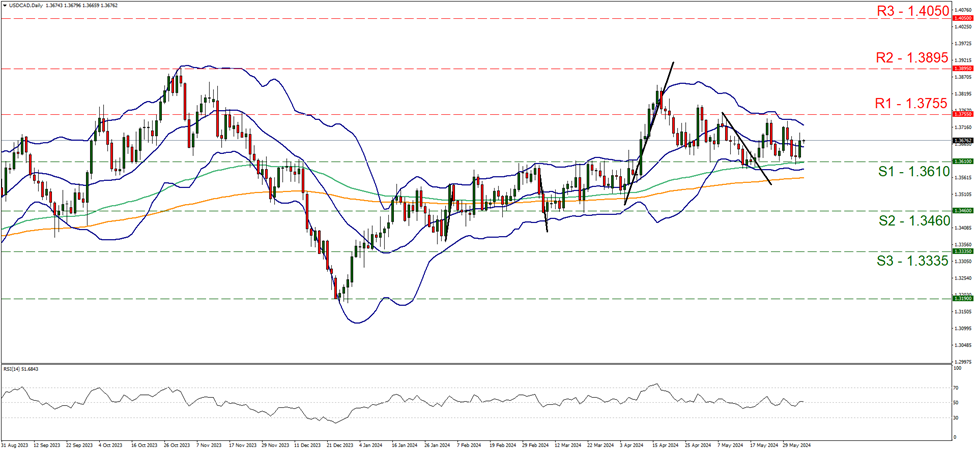

On a technical level ,we note that USD/CAD appears to be moving in a sideways fashion. We maintain a sideway bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. Furthermore, the Bollinger bands appear to have narrowed, implying low market volatility. For our sideways bias to continue we would require the pair to remain confined within the 1.3610 (S1) support level and the 1.3755 (R1) resistance line. On the flip side for a bearish outlook, we would require a clear break below the 1.3610 (S1) support level, with the next possible target for the bears being the 1.3460 (S2) support line. Lastly, for a bullish outlook, we would require a clear break above the 1.3755 (R1) resistance line, with the next possible target for the bulls being the 1.3895 (R2) resistance level.

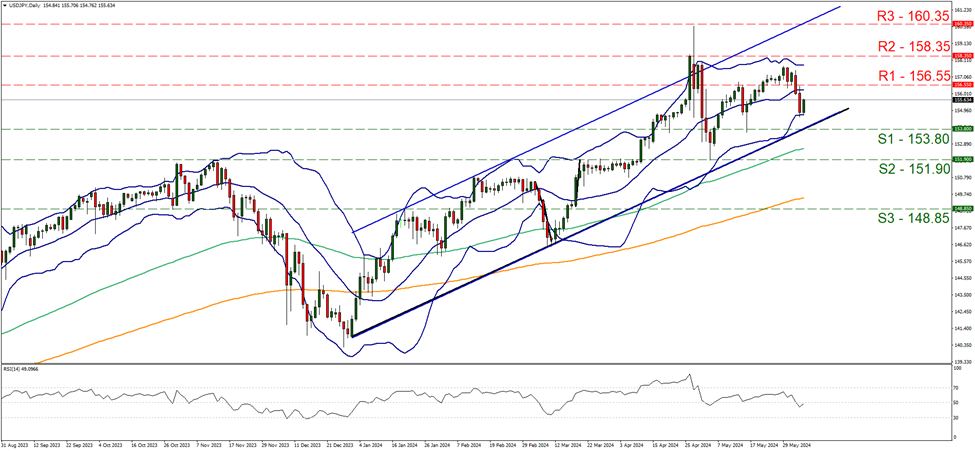

USD/JPY appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the upwards-moving channel which was incepted on the 2 of January in addition to the Bollinger bands being tilted towards the upside, implying a bullish market sentiment. However, we would like to point out that the RSI indicator below our chart has dropped below the 50 figure, implying that the bullish momentum may be fading away. Nonetheless, for our bullish outlook to continue, we would require a clear break above the 156.55 (R1) resistance level, with the next possible target for the bulls being the 158.35 (R2) resistance line. On the flip side, for a bearish outlook, we would require a clear break below the 153.80 (S1) support line, with the next possible target for the bears being the 151.90 (S2) support level. Lastly, for a sideways bias, we would require the pair to remain confined within the sideways moving channel defined by the 153.80 (S1) support level and the 156.55 (R1) resistance line.

その他の注目材料

Today in the European session we note the release of the Eurozone’s and the UK’s final services and composite PMI figures for May as well as Eurozone’s PPI rates for April, while on the monetary front ECB Board Member Af Jochnik is scheduled to speak. In the early American session, we note the release of the US ADP national employment figure for May while later on besides BoC’s interest rate decision we highlight the release of the ISM non manufacturing PMI figure for May and oil traders may find more interesting the release of the weekly EIA crude oil inventories figure. On the monetary front we note that BoC Governor Macklem and ECB Board Member McCaul are scheduled to speak.

USD/CAD Daily Chart

- Support: 1.3610 (S1), 1.3460 (S2), 1.3335 (S3)

- Resistance: 1.3755 (R1), 1.3895 (R2), 1.4050 (R3)

USD/JPY Daily Chart

- Support: 153.80 (S1), 151.90 (S2), 148.85 (S3)

- Resistance: 156.55 (R1), 158.35 (R2), 160.35 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。