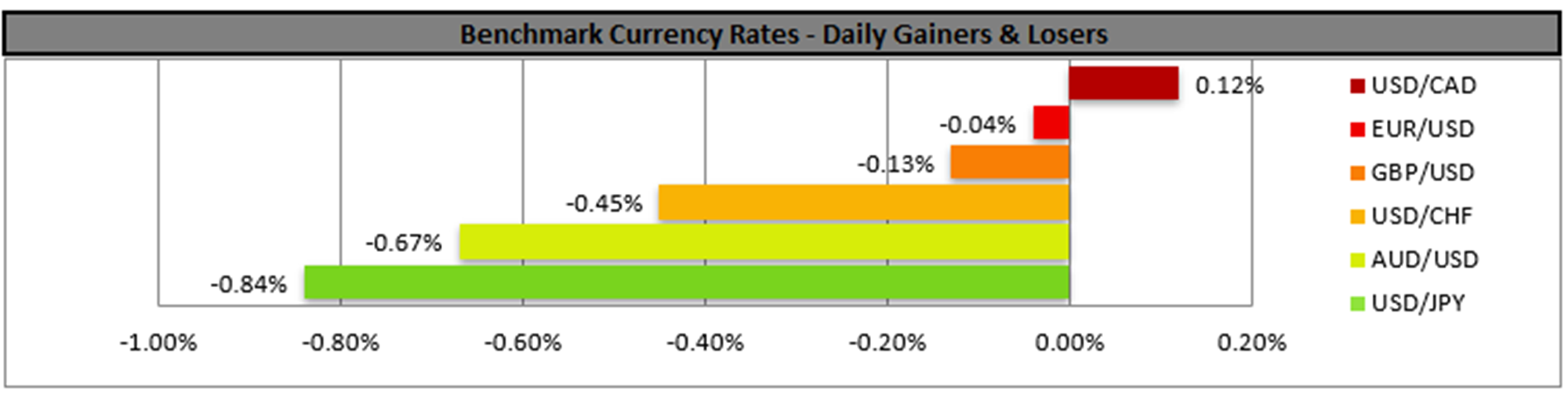

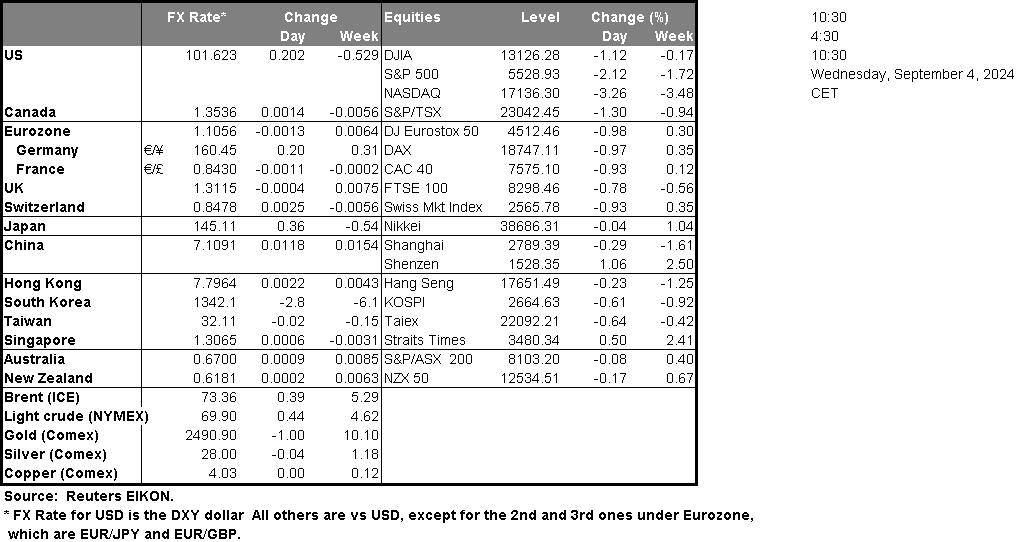

The BoC’s interest rate decision is set to occur during today’s American session, with the majority of market participants are currently anticipating the bank to cut interest rates by 25 basis points, with CAD OIS currently implying a 76.17% probability for such a scenario to materialize, with the rest being attributed to a 50-basis point rate cut. As such with the majority of market participants anticipating the aforementioned rate cut, our attention turns to the bank’s accompanying statement in which should policymakers imply that they may continue on their rate-cutting cycle it could weigh on the CAD. Whereas any form of hesitation to continue may instead provide support for the Canadian dollar. Over in the US, the ISM and S&P manufacturing PMI figures for August came in lower than expected, implying a wider contraction in the manufacturing sector of the US economy. The wider-than-expected contraction may cause some concern over the resilience of the US economy and thus should further financial releases imply that the US economy might be struggling, it could weigh on the dollar. In the US equities market, Nvidia per Bloomberg has received a DOJ subpoena in regards to its investigation into the dominant provider of AI processors. Thus, the increasing possibility that the DOJ may launch a formal complaint against Nvidia appears to have resulted in the company’s stock price moving lower, with the FT reporting that $250 billion in market cap was wiped during yesterday’s trading session.

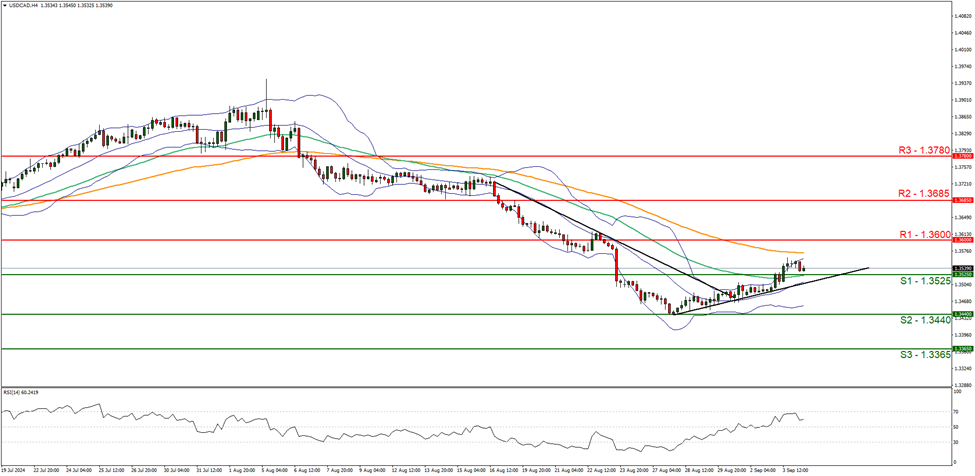

USD/CAD appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure above 60 implying a bullish market sentiment, in addition to the upwards moving trendline which was incepted on the 28 of August. For our bullish outlook to continue , we would require break above the 1.3600 (R1) resistance level, with the next possible target for the bulls being the 1.3685 (R2) resistance level. On the flip side for a bearish outlook we would require a clear break below the 1.3525 (S1) support line, with the next possible target for the bears being the 1.3440 (S2) support line. Lastly, for a sideways bias we would require the pair to remain confined between the 1.3525 (S1) support line and the 1.3600 (R1) resistance level.

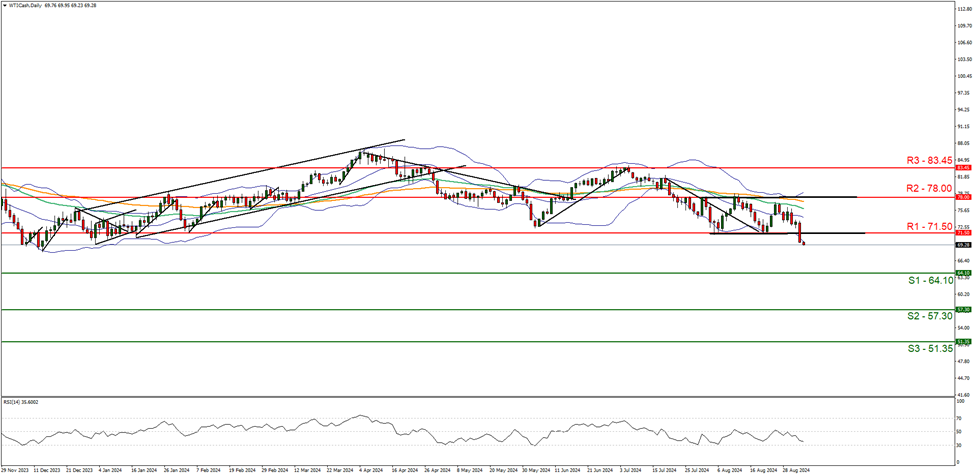

WTICash appears to be moving in a downwards fashion after breaking below our support now turned resistance at the 71.50 (R1) level. We opt for a bearish outlook for the commodity and supporting our case is the RSI indicator below our chart which currently registers a figure near 30 implying a strong bearish market sentiment, in addition to the break below our sideways moving channel which was incepted on the 31 of July. For our bearish outlook to continue, we would require a break below the 64.10 (S1) support line with the next possible target for the bears being the 57.30 (S2) support line. On the flip side for a bullish outlook we would require a clear break above the 71.50 (R1) resistance line with the next possible target for the bulls being the 78.00 (R2) resistance level. Lastly, for a sideways bias we would require the commodity to remain confined between the 64.10 (S1) support line and the 71.50 (R1) resistance line.

本日のその他の注目点

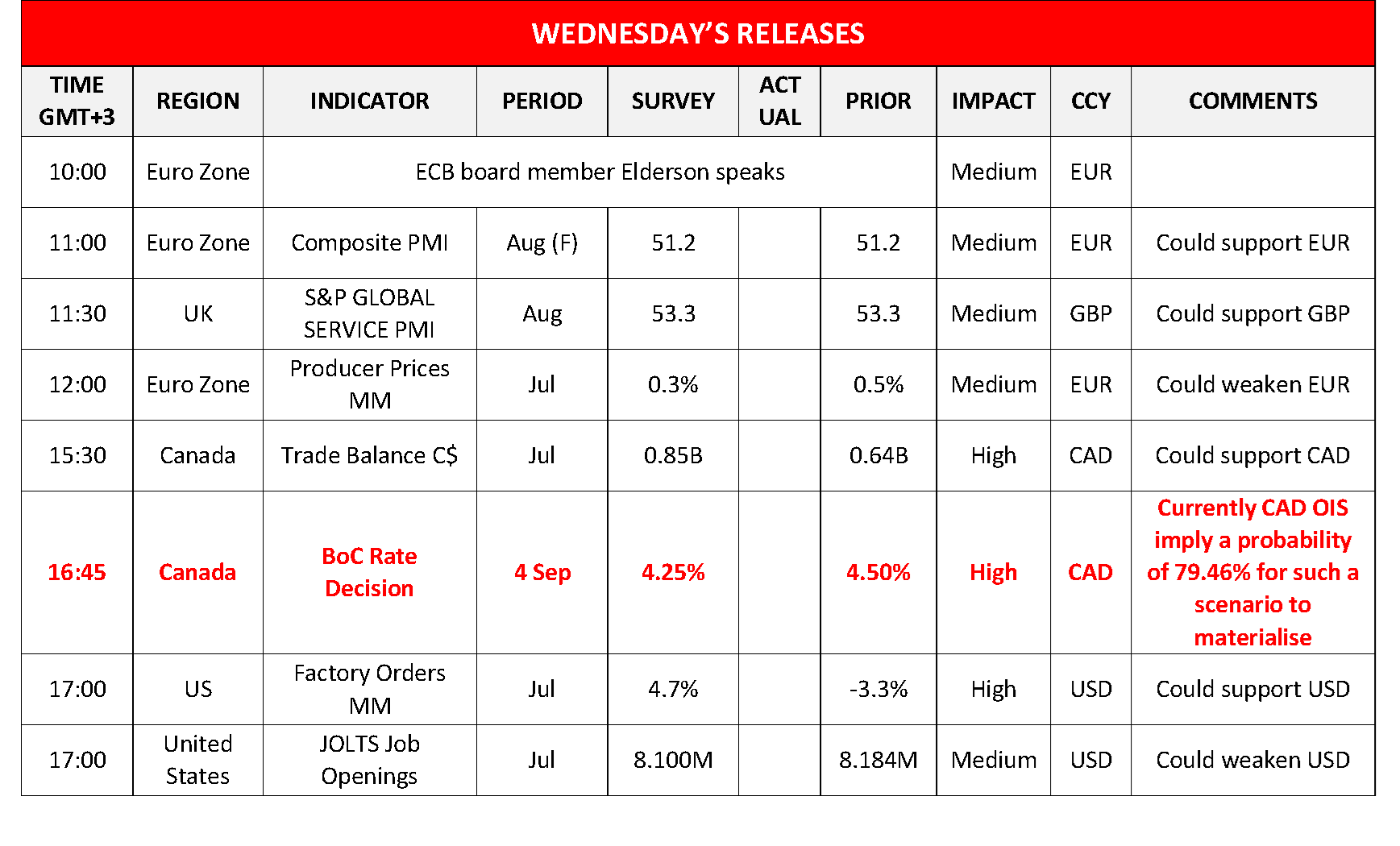

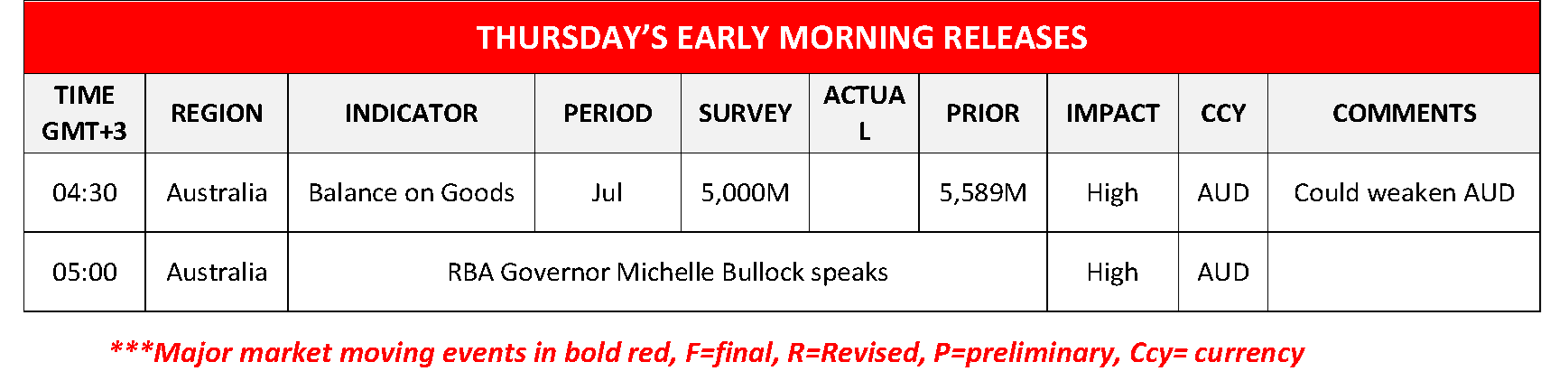

Today in the European session, we get the final services and composite PMI figures for August from Germany, France, the Eurozone as a whole and the UK while from the Eurozone we also get the producer prices for July, while on the monetary front we note that ECB board member Elderson is scheduled to speak. In the American session, we get from Canada, besides BoC’s interest rate decision, the country’s trade balance for July and from the US the factory orders and the JOLTS Job Openings figure, both for July. In tomorrow’s Asian session, we get from Australia the balance on goods for July and note that RBA’s Governor Michelle Bullock is scheduled to speak.

USDCAD H4 Chart

- Support: 1.3525 (S1), 1.3440 (S2), 1.13365 (S3)

- Resistance: 1.3600 (R1), 1.3685 (R2), 1.3780 (R3)

WTICash Daily Chart

- Support: 64.10 (S1), 57.30 (S2), 51.35 (S3)

- Resistance: 71.50 (R1), 78.00 (R2), 83.454 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。