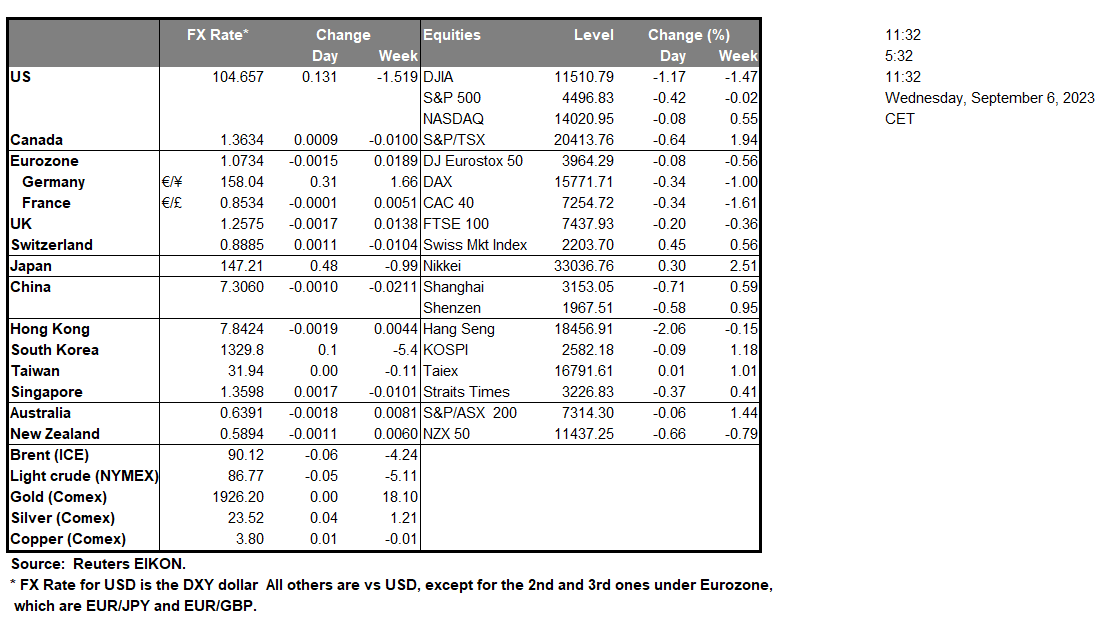

The BOC’s interest rate decision is due out in today’s American session, with the bank widely expected to remain on hold. In the US Equities markets, Apple (#AAPL), according to Reuters has signed a new deal with Arm LTD that “extends beyond 2040” to use its chip technology. The deal comes at a time where Arm LTD is widely anticipated to be releasing their exact IPO date, after having updated one of their SEC filings, in which they state they will be looking for an initial public offering price per ADS between $47.00 and $51.00. The announcement by Apple (#AAPL) could potentially provide support for the stock given the high amount of positive publicity surrounding Arm LTD. Furthermore, Cleveland Fed President Mester, implied during her speech yesterday that the Fed may have to raise rates in their next meeting, potentially implying that inflationary pressures are still at unacceptably high levels which appears to have been re-iterated by Fed Governor Waller who stated, “a couple of months continuing along this trajectory before I say we’re done” raising interest rates”, further supporting the case that the bank may hike in its next meeting.Over in Europe, we note the comments made by ECB Nagel in which he implied that high interest rates may remain in place even if it is perceived that inflation has peaked. On another note, we highlight the plummeting of Germany’s Factory orders rate for July, implying a deterioration in Germany’s factory activity, which may cause recession worries to intensify. WTI trades near $90 per barrel as Saudi Arabia and Russia announced that they will be both extending their voluntary oil production cuts, until the end of 2023, leading the liquid gold to its highest level so far in 2023.

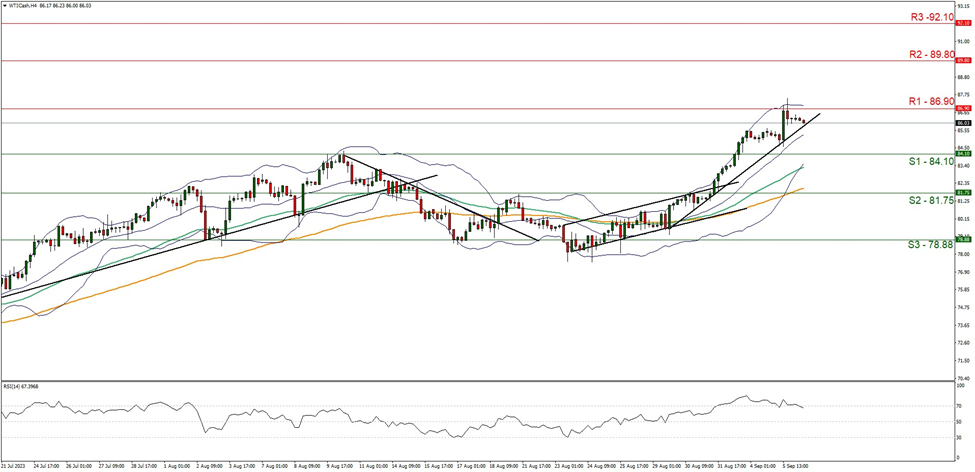

On a technical level, WTICash formed yearly high’s during yesterday’s trading session, with the commodity now seemingly moving in an upwards fashion. We maintain a bullish outlook for the commodity and supporting our case is the RSI indicator below our 4-Hour chart which currently registers a figure near 70, implying a strong bullish market sentiment, in addition to the upwards moving trendline formed on the 29 of August. For our bullish outlook to continue, we would like to see a clear break above the 86.90 (R1) resistance level, with the next possible target for the bulls being the 89.90 (R2) resistance ceiling. On the other hand, for a bearish outlook, we would like to see a clear break below the 84.10 (S1) support level, with the next possible target for the bears being the 81.75 (S2) support base.

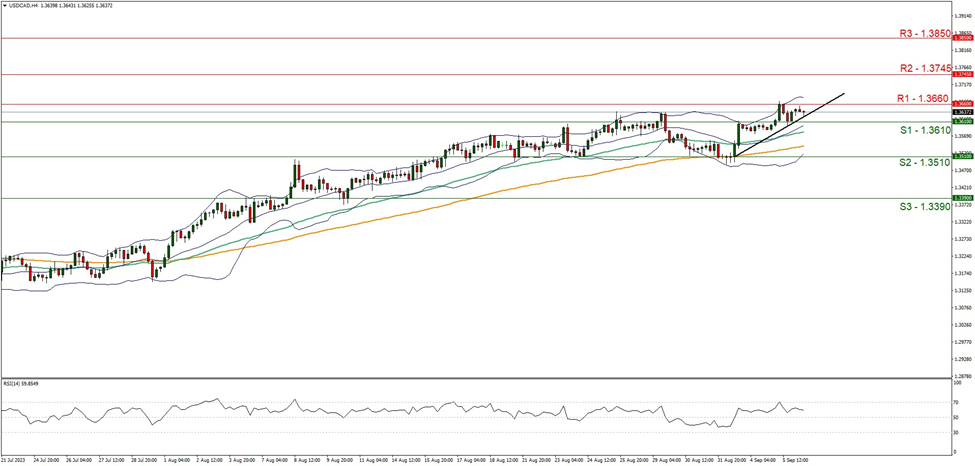

USD/CAD edged higher during yesterday’s trading session, with the pair now appearing to be aiming for the 1.3660 (R1) resistance level. We maintain a bullish outlook for the pair and supporting our case is the RSI indicator below our 4-Hour chart which is currently near the figure of 70, implying a bullish market sentiment, in addition to the upwards moving trendline formed on the 1 of September. For our bullish outlook to continue, we would like to see a clear break above the 1.3660 (R1) and the 1.3745 (R2) resistance levels, with the next possible target for the bulls being the 1.3850 (R3) resistance barrier. On the other hand, for a bearish outlook, we would like to see a clear break below the 1.3610 (S1) and 1.3510 (S2) support levels, with the next possible target for the bears being the 1.3390 (S3) support base.

その他の注目材料

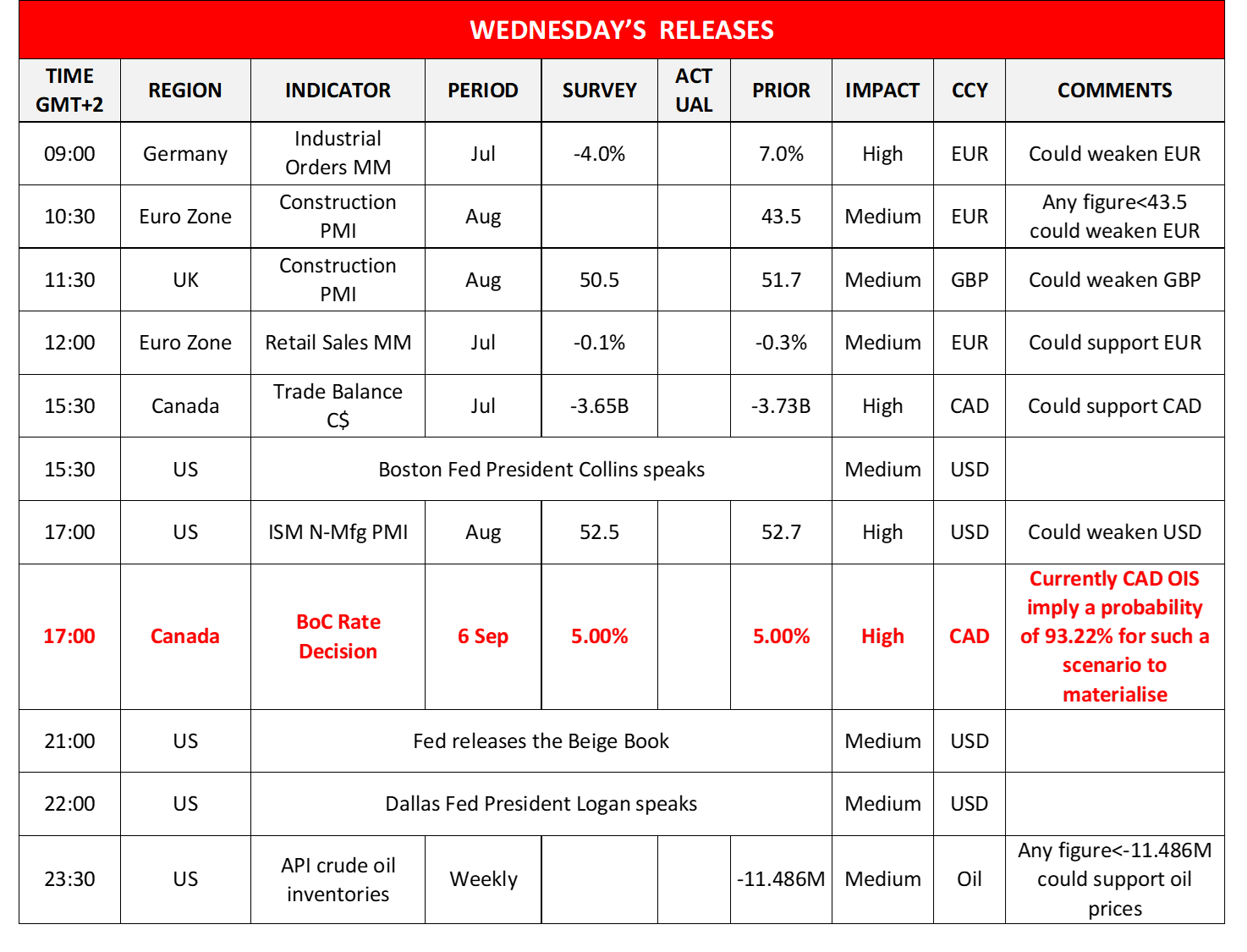

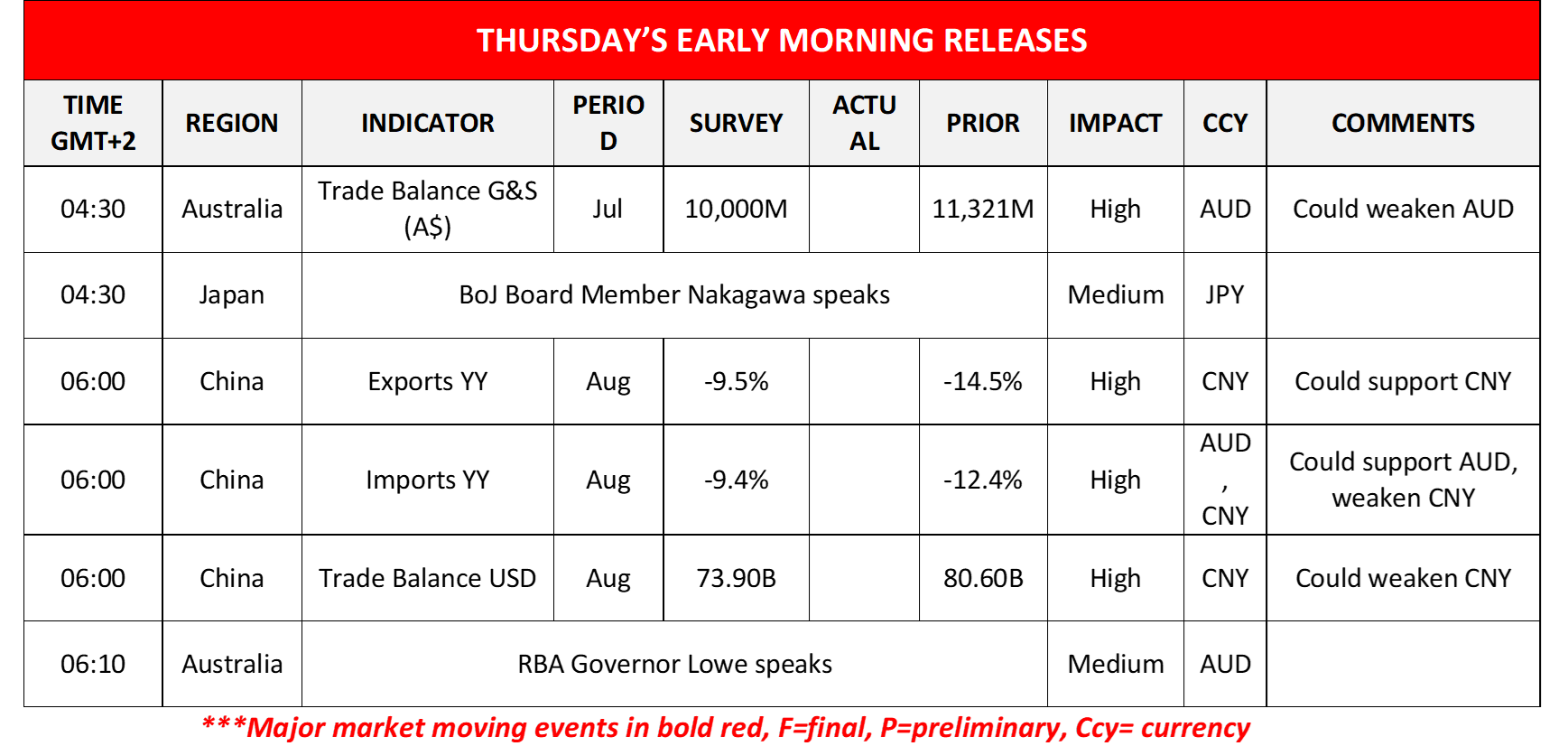

Today in the European session, we note the release of Germany’s industrial orders growth rate for July, the Eurozone’s and the UK’s construction PMI figure for August and the Eurozone’s retail sales growth rate for July. In the American session, besides BoC’s interest rate decision we also note from Canada the release of July’s trade balance figure and from the US we get the ISM non-manufacturing PMI figure for August. On the monetary front, we note that Boston Fed President Collins and Dallas Fed President Logan are scheduled to speak while the Fed is to release the beige book. Oil traders on the other hand, may be more interested in the API weekly crude oil inventories figure. During tomorrow’s Asian session, we get Australia’s and China’s trade data for July and August respectively while BoJ Board Member Nakagawa and RBA Governor Lowe speak.

#WTICash H4 Chart

Support: 84.10 (S1), 81.75 (S2), 78.88 (S3)

Resistance: 86.90 (R1), 83. (R2), 86.90 (R3)

#USD/CAD H4 Chart

Support: 1.3610 (S1), 1.3510 (S2), 1.3390 (S3)

Resistance: 1.3660 (R1), 1.3745 (R2) 1.3850 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。