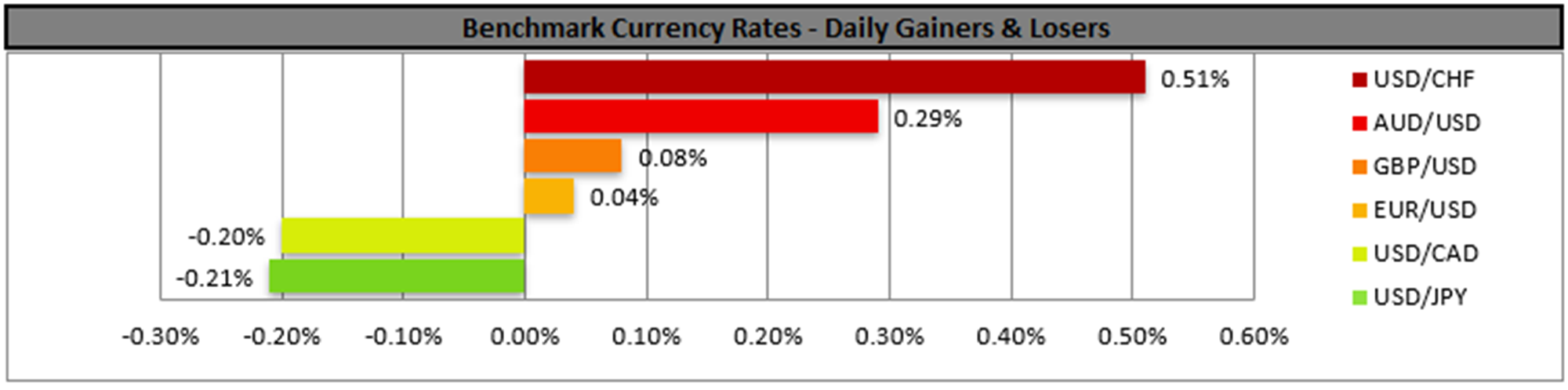

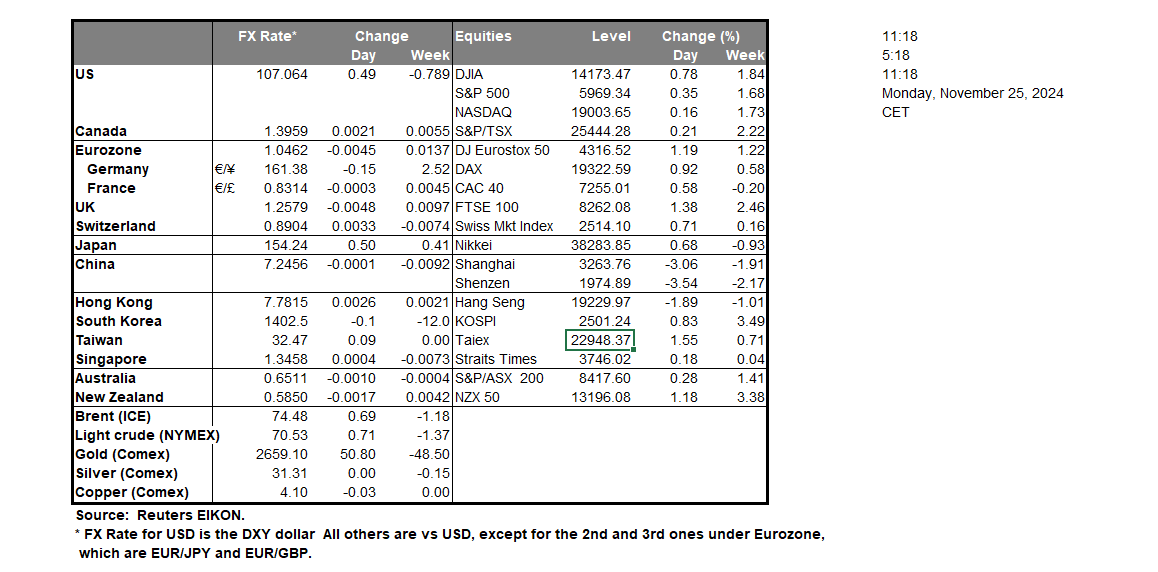

The USD slipped in today’s opening in the Asian session, maybe experiencing some safe haven outflows, given Trump’s pick for the Treasury Secretary. The nominee, Scott Bessent, 62, hedge fund manager, seems to be a more mainstream choice, less controversial and Wall Street likes him. He is considered a good ally in Trump’s ideas for further deregulation of the markets and easing corporate taxation, yet it’s also going to be interesting to see his potential influence in Trump’s intentions to slap tariffs on US imports. The nomination seems to have renewed interest in US bonds, lowering their yield while US market support for US equities seems to have been renewed.

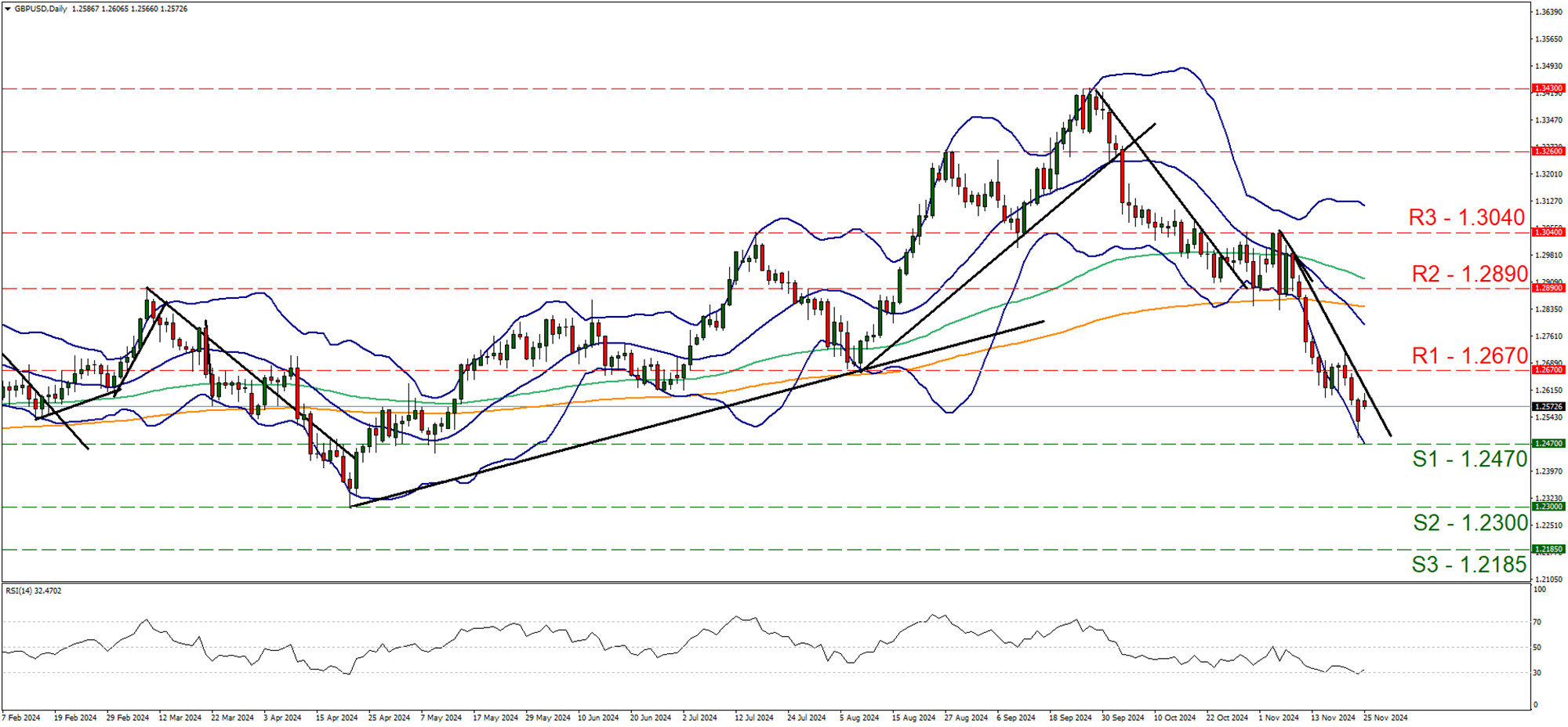

GBP/USD dropped on Friday aiming for the 1.2470 (S1) support line, yet in today’s Asian session, opened with a positive gap. We tend to maintain a bearish outlook for the pair as long as the downward trendline guiding the pair since the 6 of November, remains intact. Furthermore , the RSI indicator despite correcting a bit higher remains close to the reading of 30, implying a rather strong bearish sentiment for the pair. Should the bears maintain control over cable, we expect he pair to break the 1.2470 (S1) support line, with the next possible target for the bears being at the 1.2300 (S2) support level. For a bullish outlook we would require GBP/USD to rise, break the prementioned downward trendline in a first signal that the downward motion has been interrupted and continue to break the 1.2670 (R1) resistance line.

The EUR’s outlook darkened even further today as Germany’s Ifo indicators for November were worrying. The expectations for Germany’s economy turned more pessimistic, maybe not to the extent the market may have been expecting and the conditions on the ground, for the German economy have deteriorated more than expected.

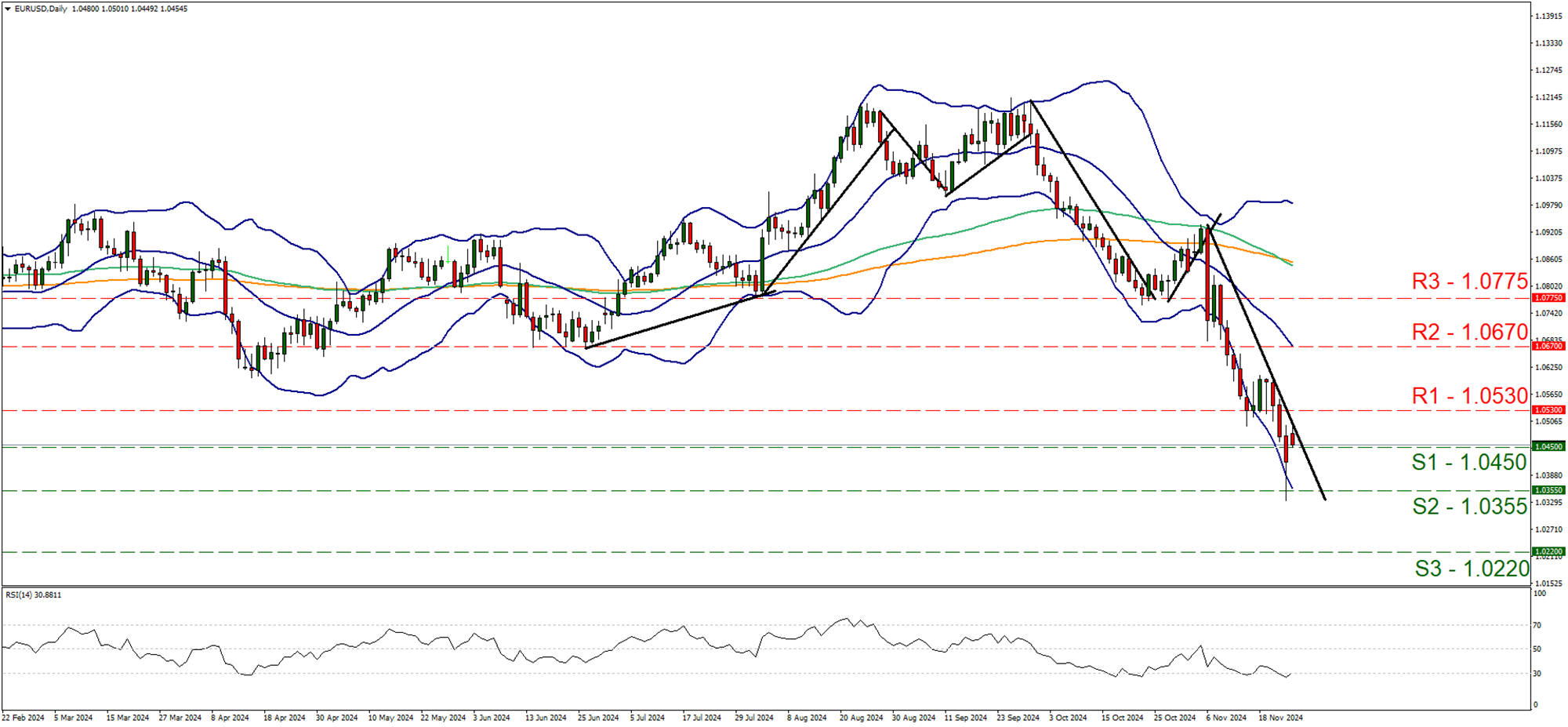

EUR/USD tumbled on Friday at some point breaking the 1.0355 (S2) support line before correcting higher and opening today with a positive gap just above the 1.0450 (S1) support line. We maintain our bearish outlook for EUR/USD as the downward trendline guiding remains intact and the RSI indicator remain near the reading of 30, implying a strong bearish sentiment for the pair. Should the selling interest be renewed, we may see the pair breaking the 1.0450 (S1) support line aiming for the 1.355 (S2) support level. Should buyers take over, we may see the pair rising, breaking the 1.0530 (R1) resistance line with the next possible target for the bulls being the 1.0670 (R2) resistance level.

その他の注目材料

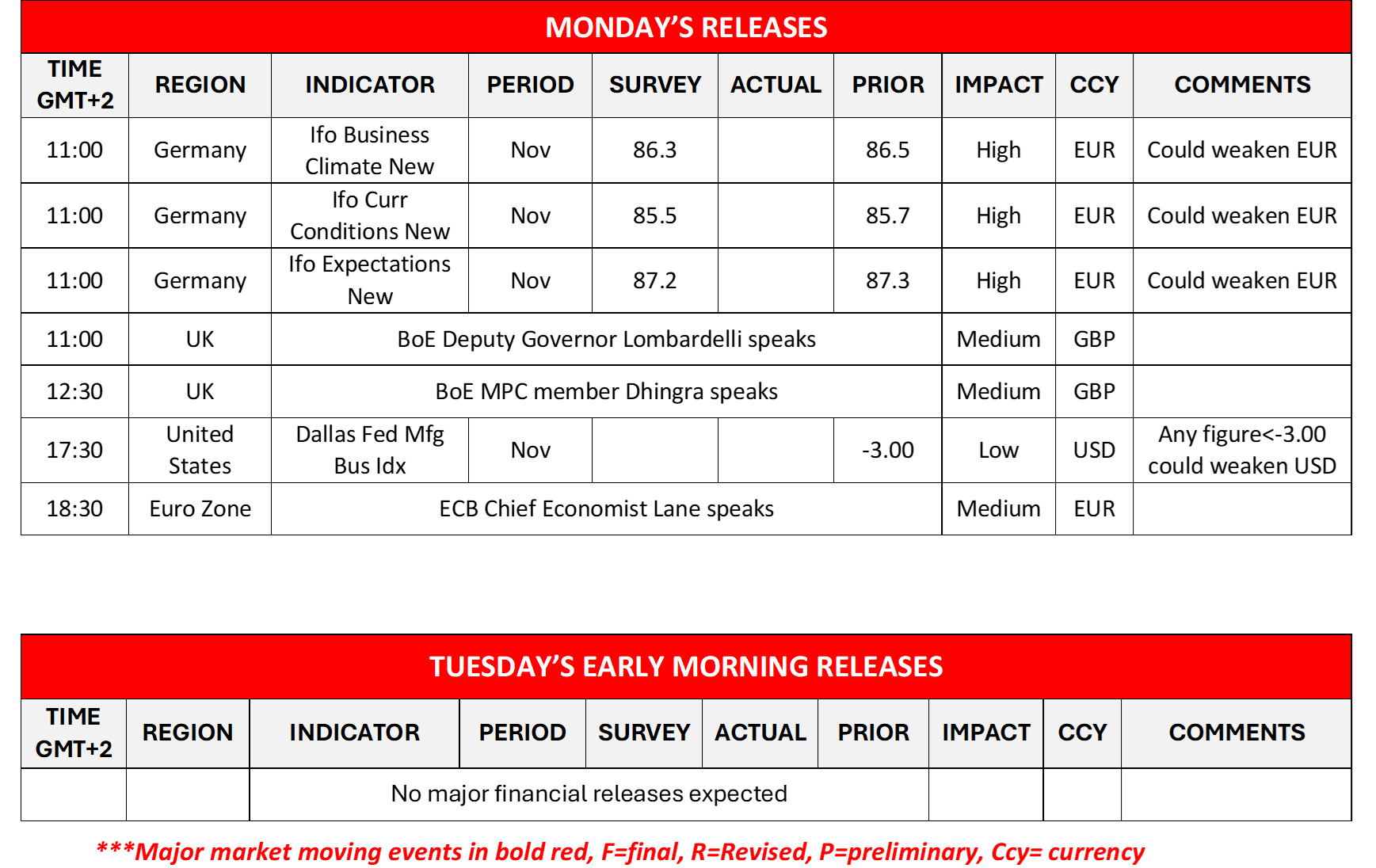

Today we get the US Dallas Fed manufacturing business index for November. On the monetary front, we note the speeches of BoE’s Lombardelli and Dhingra as well as ECB’s Lane.

今週の指数発表:

On Tuesday we get the US Consumer confidence for November and the Fed is to release the minutes of the November meeting. On Wednesday’s Asian session, we get from New Zealand RBNZ’s interest rate decision and Australia’s CPI rates for October and later on UK’s nationwide house prices for November and from the US, October’s Durable goods orders, weekly initial jobless claims figure, the PCE rates for October and we highlight the revised GDP Rate for Q3. On Thursday we get Eurozone’s final consumer confidence for November and Germany’s preliminary HICP rate for the same month. On Friday, we get from Japan, Tokyo’s CPI rates for November, -preliminary industrial output for October and retail sales for the same month. Later on, we get GDP rates of Turkey, Sweden, France, Switzerland, the Czech Republic and Canada for Q3, while from France the Eurozone we also get the preliminary HICP rate for November and from Switzerland November’s KOF indicator.

EUR/USD デイリーチャート

- Support: 1.0450 (S1), 1.0355 (S2), 1.0220 (S3)

- Resistance: 1.0530 (R1), 1.0670 (R2), 1.0775 (R3)

GBP/USD Daily Chart

- Support: 1.2470 (S1), 1.2300 (S2), 1.2185 (S3)

- Resistance: 1.2670 (R1), 1.2890 (R2), 1.3040 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。