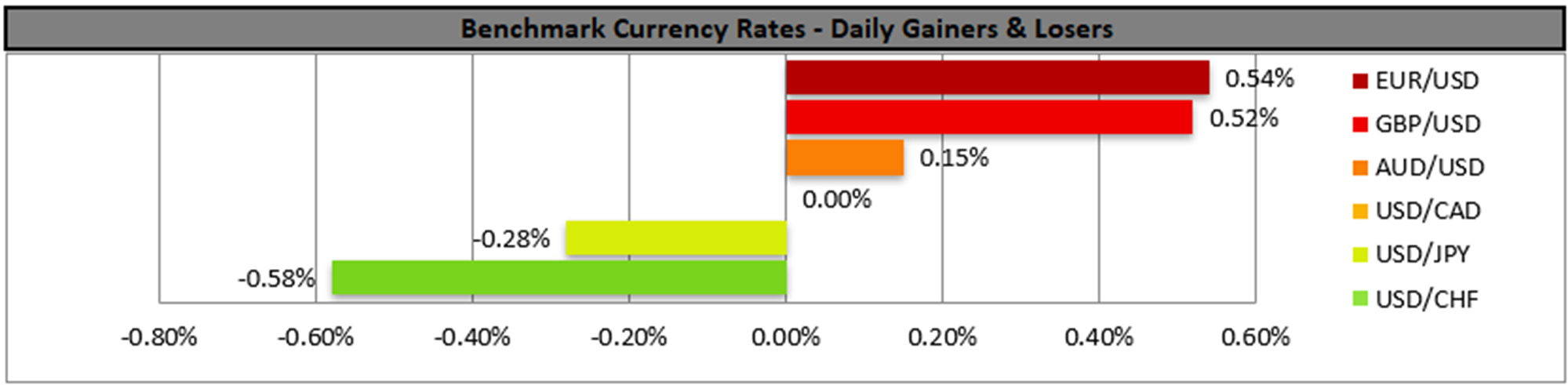

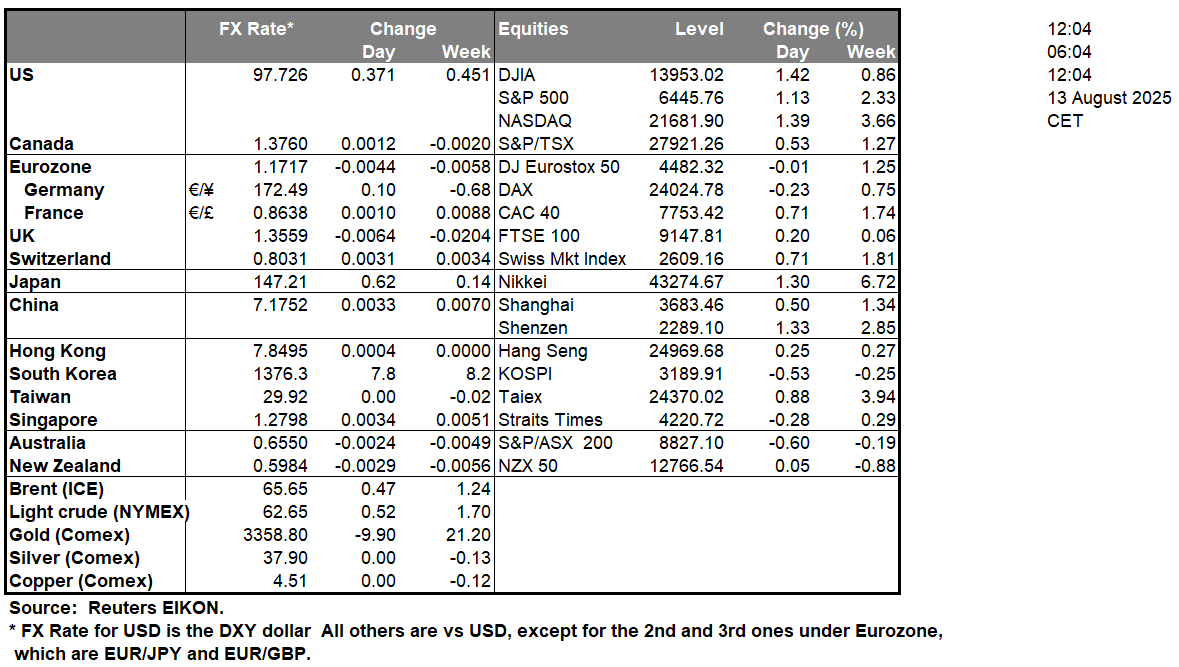

The USD weakened against its counterparts yesterday as the release of the US CPI rates for July sent mixed signals. On the one hand, the headline rate failed to accelerate even marginally as was expected, yet on the other, the headline rate accelerated beyond market expectations, implying a resilience of inflationary pressures. The main issue for the release though, was that it allowed for the markets’ dovish expectations for the Fed’s intentions to be maintained, if not be enhanced after the weak July employment data released on August 1st. Currently, Fed Fund Futures tend to imply a probability of 98% for the bank to proceed with a 25-basis points rate cut in its next meeting, September 17th. Thus, the market’s expectations for the bank to cut rates tend to weigh on the greenback, yet at the same time, tend to provide support for US equities and gold’s price. Today, we expect fundamentals to lead the greenback in the absence of high-impact financial releases stemming from the US. Currently we highlight US President Trump’s efforts to undermine the independence of the Fed, while in a latest development, White House spokeswoman Leavitt mentioned yesterday that the US President was considering a lawsuit against Powell, for the renovation of the Fed’s building, something that may add more pressure on the Fed Chairman.

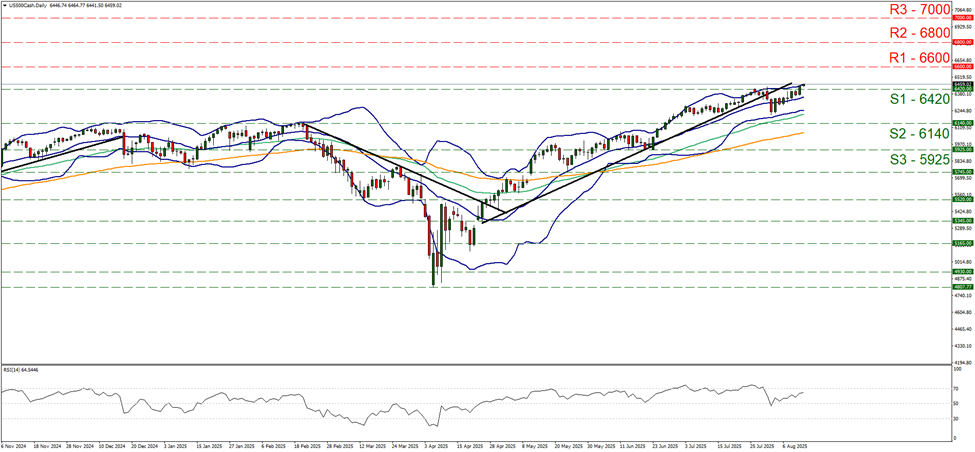

US stock markets were on the rise yesterday and its characteristic that S&P 500, breached the 6420 (S1) resistance line, now turned to support reaching new record high levels. Given that the index’s price action was able to breach the prior record high level and that the RSI indicator is nearing the reading of 70, implying an intensifying bullish market sentiment for the index, we switch our bias for a sideways motion and adopt a bullish outlook for the index. We set as the next possible target for the bulls the 6600 (R1) resistance line. Should the bears take over, we may see the pair breaking the 6420 (S1) support line and aim if not reach the 6140 (S2) support level.

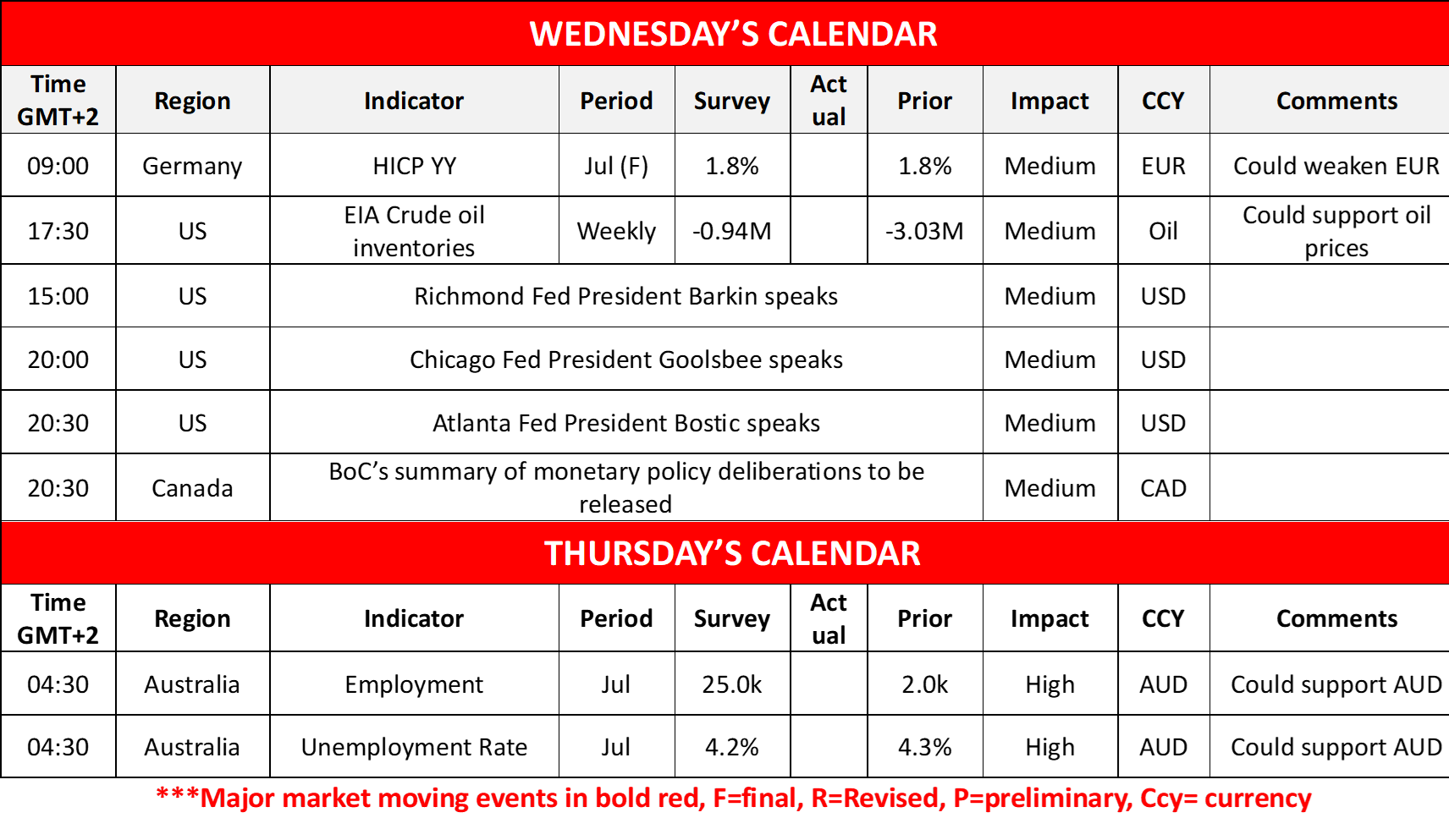

In tomorrow’s Asian session, we highlight the release of Australia’s employment data for July given also the importance RBA places on the Australian employment market as expressed in the accompanying statement for its latest interest decision and mentioned in yesterday’s report. The unemployment rate is expected to tick down, to 4.2% and the employment change figure to rise to 25k if compared to June’s meager 2k. Given also that the wage price index failed to slow down for Q2, the forecasts for July’s employment data tend to imply a possible tightening of the Australian employment market and should actual rates and figures exceed their forecasts, we may see the Aussie getting some support.

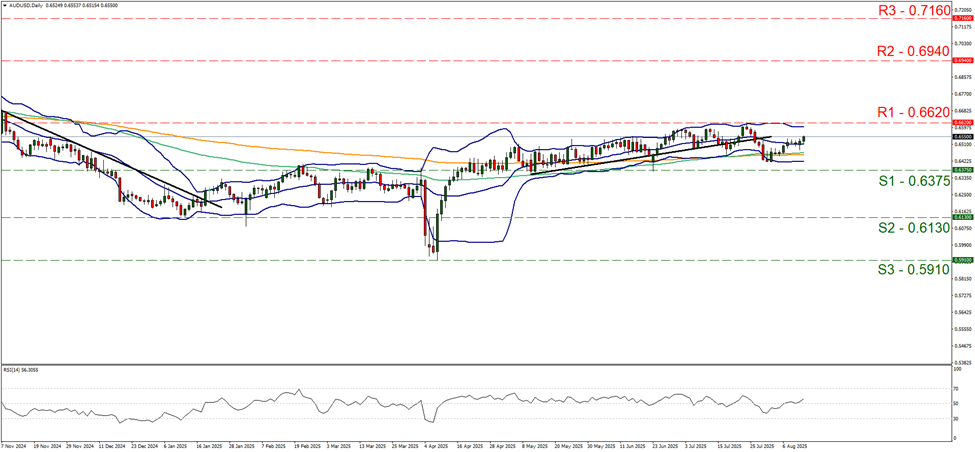

AUD/USD maintained its sideways motion yesterday and edged higher in today’s Asian session, yet remained well between the 6620 (R1) resistance line and the 0.6375 (S1) support level. We tend to maintain our bias for the pair’s sideways motion to continue for the time being yet also note the rise of the RSI indicator, implying some slight bullish tendencies. Should the bulls be in charge, we may see AUD/USD breaking the 0.6620 (R1) resistance line and starting to aim the 0.6940 (R2) level. Should the bears take over, we may see AUD/USD breaking the 0.6375 (S1) support line and start aiming for the 0.6130 (R2) support level.

その他の注目材料

In an easy-going Wednesday, we note the release of Germany’s final HICP rates for July, while oil traders may be more interested in the release of EIA’s weekly crude oil inventories figure. On a monetary level, Richmond Fed President Barkin, Chicago Fed President Goolsbee and Atlanta Fed President Bostic are scheduled to speak while BoC’s summary of monetary policy deliberations is to be released. In tomorrow’s Asian session, we get Australia’s employment data for July.

US 500 Cash Daily Chart

- Support: 6420 (S1), 6140 (S2), 5925 (S3)

- Resistance: 6600 (R1), 6800 (R2), 7000 (R3)

AUD/USD デイリーチャート

- Support: 0.6375 (S1), 0.6130 (S2), 0.5910 (S3)

- Resistance: 0.6620 (R1), 0.6940 (R2), 0.7160 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。