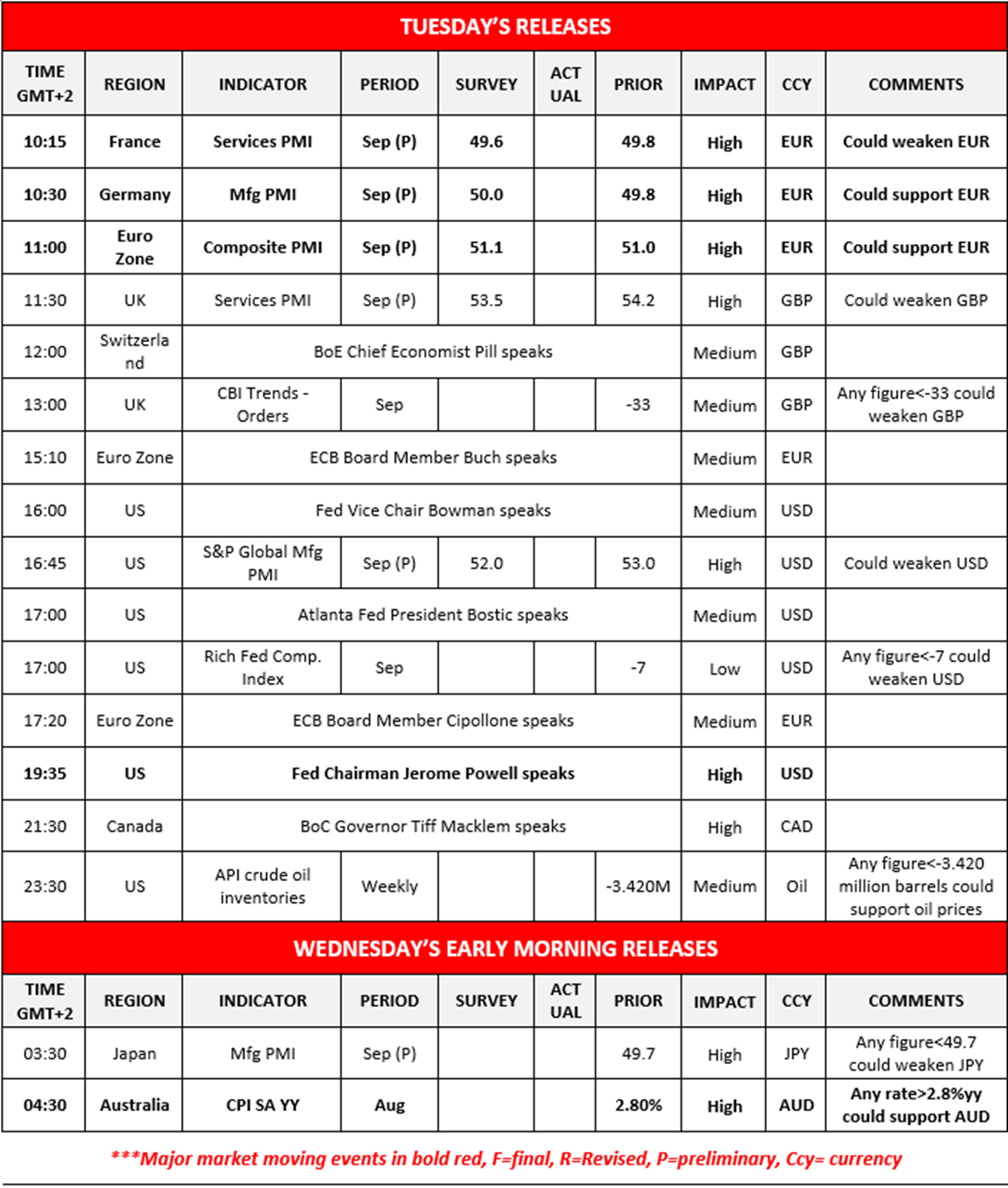

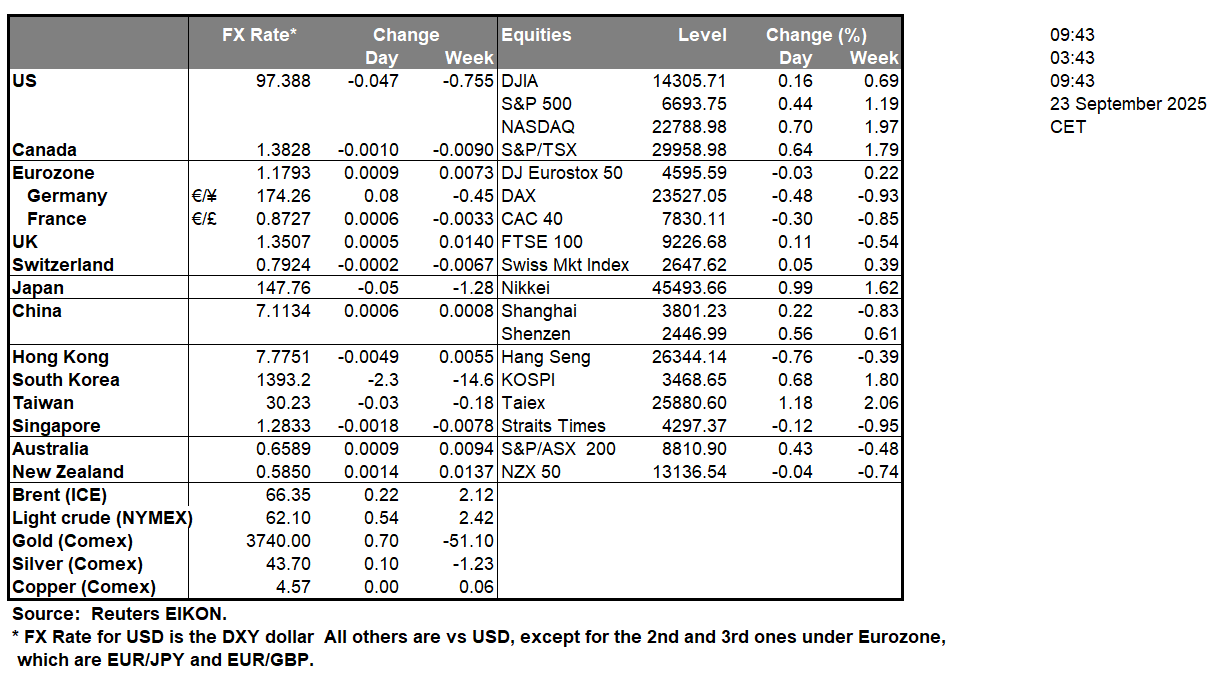

Australia’s CPI rates for August are set to be released during tomorrow’s Asian session. The release of the inflation data for the Australian economy may garner attention from Aussie traders as a hotter-than-expected inflation print could lead to a hawkish rhetoric emerging from RBA policymakers, which may aid the AUD. On the other hand should inflation appear to ease i.e, coming in lower than the prior month’s rate of 2.80% it could amplify the dovish sentiment in the RBA and could thus weigh on the Australian dollar. Nvidia (#NVIDIA) per Reuters will be investing $100 billion in OpenAI and supply it with data center chips, marking a strategic cooperation between two leading technology companies. The move by Nvidia would provide it with a financial stake in OpenAI which in turn could aid the company’s stock price, considering the positive implications of such a move. Sticking to the Equities narrative, Exxon Mobil (#XOM) has greenlighted a $6.8 billion investment in Guyana, marking it’s seventh development project in the country which aims to bring Exxon closer to it’s goal of producing 1.7 mbpd. The continued investment by Exxon into the country may prove lucrative in the future and could thus aid the company’s stock price down the line.On a geopolitical level, NATO members have vowed to down missiles or aircraft that violate NATO airspace deliberately or by mistake. The rising tensions may provide support for gold’s price given its safe haven asset status.

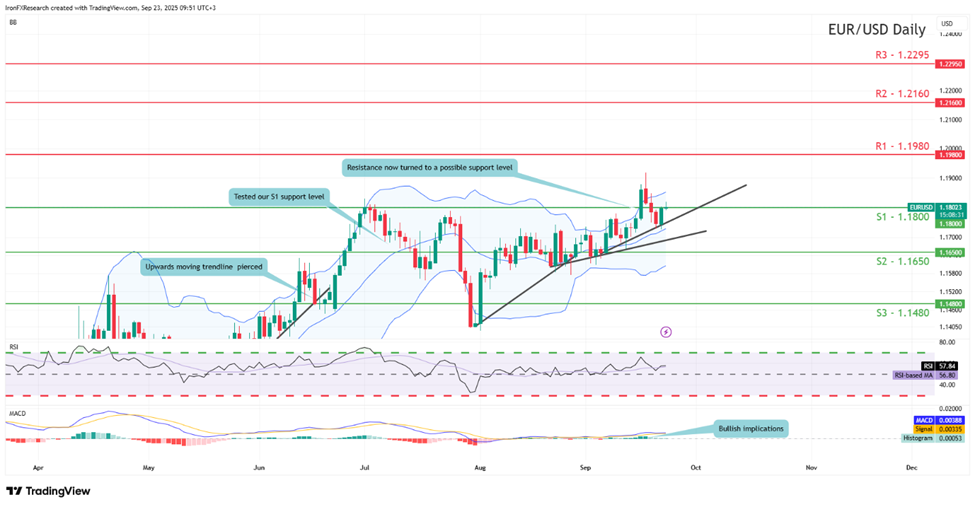

EUR/USD appears to be moving in an upwards fashion with the pair currently resting on our 1.1800 (S1) support level. We cautiously opt for a bullish outlook as long as the pair remains above our 1.1800 (S1) support level and supporting our case is the MACD indicator below our chart. For our bullish outlook to continue we would require a break above our 1.1980 (R1) resistance line with the next possible target for the bulls being the 1.2160 (R2) resistance level. On the other hand for a bearish outlook, we would require a clear break below our 1.1800 (S1) support level if not also our upwards moving trendline which was incepted on the 4th of September. Lastly, for a sideways bias we would require the pair to remain confined between our 1.1800 (S1) support level and our 1.1980 (R1) resistance line.

GBP/USD appears to be moving in a sideways fashion. We opt for a neutral outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained, we would require the pair to remain within our sideways moving channel which was incepted on the 11th of August. On the other hand for a bullish outlook we would require a clear break above our 1.3580 (R1) resistance line with the next possible target for the bulls being the 1.3750 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below our 1.3390 (S1) support level with the next possible target for the bears being the 1.3200 (S2) support line.

その他の注目材料

Today we note the release of Canada’s PPI rates for August and Euro Zone’s preliminary consumer confidence for September. On a monetary level, we note that BoE Chief Economist Pill, NY Fed President Williams, St. Louis Fed President Musalem, Richmond Fed President Barkin, Cleveland Fed President Hammack, BoC Senior Deputy Governor Rogers, BoE Governor Andrew Bailey and BoC Deputy Governor Kozicki are scheduled to speak. In tomorrow’s Asian session, we get Australia’s manufacturing PMI figure for September.

EUR/USD Daily Chart

- Support: 1.1800 (S1), 1.1650 (S2), 1.1480 (S3)

- Resistance: 1.1980 (R1), 1.2160 (R2), 1.2295 (R3)

GBP/USD Daily Chart

- Support: 1.3390 (S1), 1.3200 (S2), 1.3005 (S3)

- Resistance: 1.3580 (R1), 1.3750 (R2), 1.3930 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。