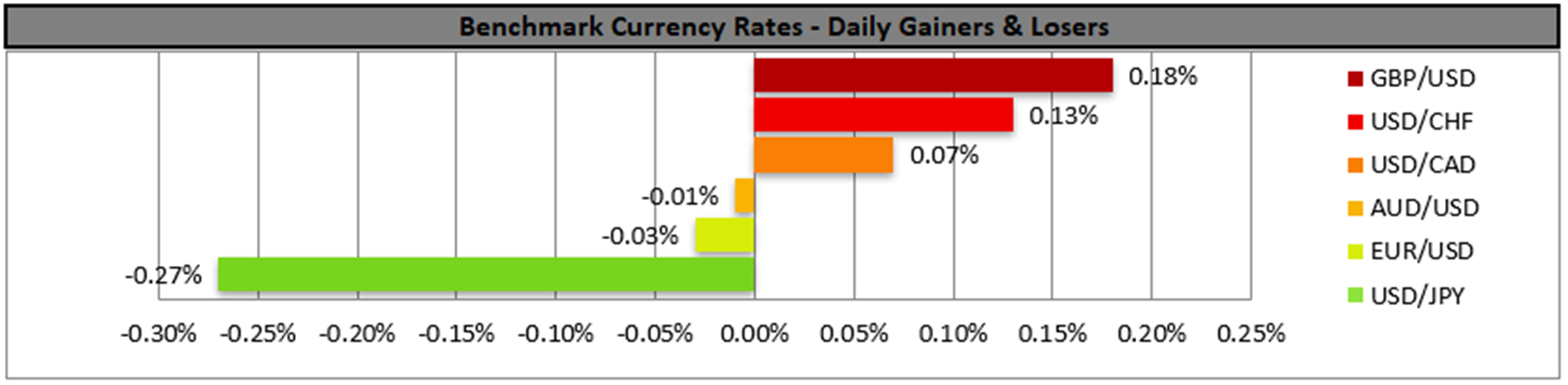

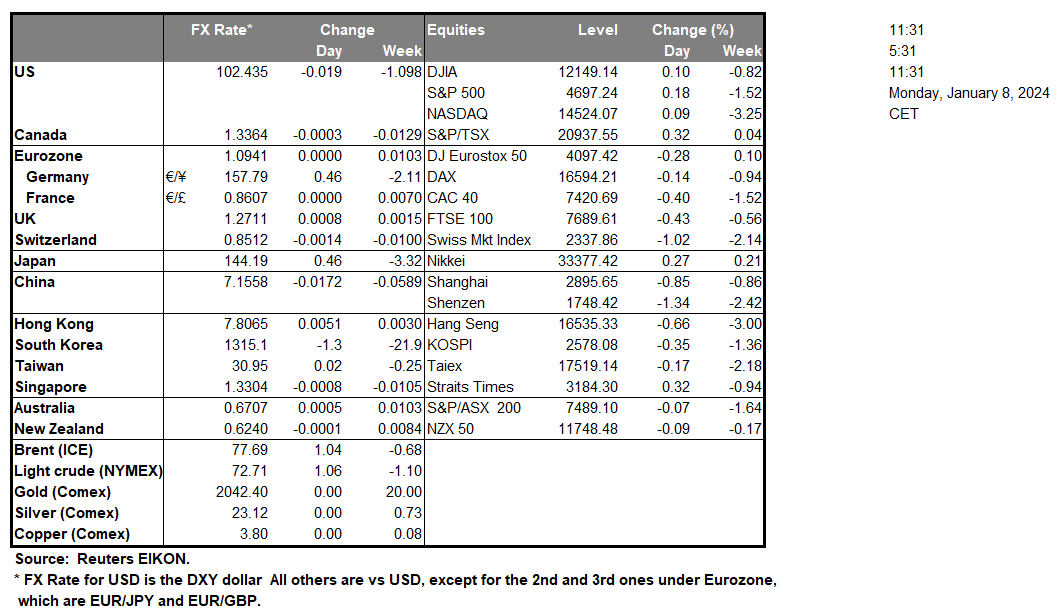

The USD got some support from the far better-than-expected US employment report for December, yet any gains made were quickly relented and the greenback stabilised somewhat. It should be noted that the employment data showed that the unemployment rate remained unchanged at the low level of 3.7% and the NFP figure rose unexpectedly to 216k. It should be noted that the release shook the markets and for a short period forced it to revise its expectations for six rate cuts in 2024 to five, yet that was reversed later on. Overall, the release underscored the resilience of the US employment market and supported the Fed’s narrative of fewer and delayed rate cuts. Yet overall the market’s behaviour tends to underscore its disbelief to the possibility of fewer rate cuts by the Fed. Gold’s price slid lower during today’s Asian session from the rise of US yields, while US stock markets ended their day mixed and prepare for the kickoff of the earnings season. We expect the market’s attention in this week to be placed on the release of the US CPI rates for December, due out on Thursday, and should rates fail to slow down we may see the USD gaining.

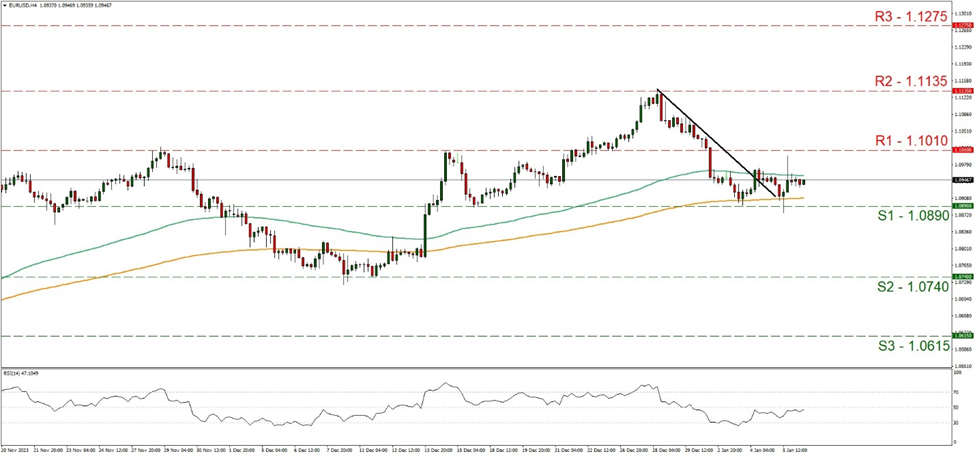

On a technical level, despite some increased volatility the USD remained relatively unchanged against the EUR, with EUR/USD staying between the 1.1010 (R1) and the 1.0890 (S1) levels. Given the movement in the past 48 hours and that the RSI indicator continues to run just below the reading of 50, we tend to maintain our bias for the sideways motion to continue until the market decides on the direction of the pair’s next leg. Should the bulls take over, we may see the pair breaching the 1.1010 (R1) resistance line and aiming for the 1.1135 (R2) resistance level. Should the bears be in charge, we may see EUR/USD breaching the 1.0890 (S1) support line and aiming for the 1.0740 (S2) support level.

その他の注目材料

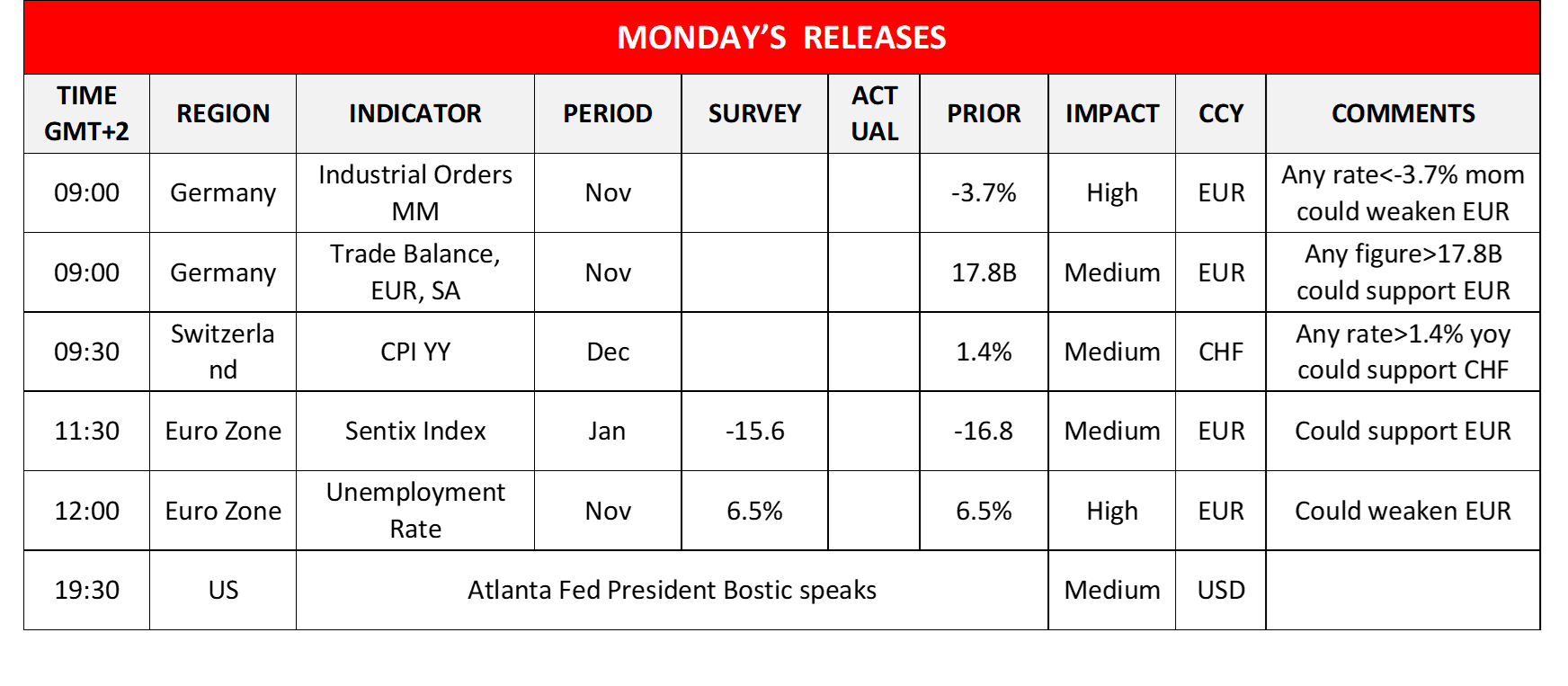

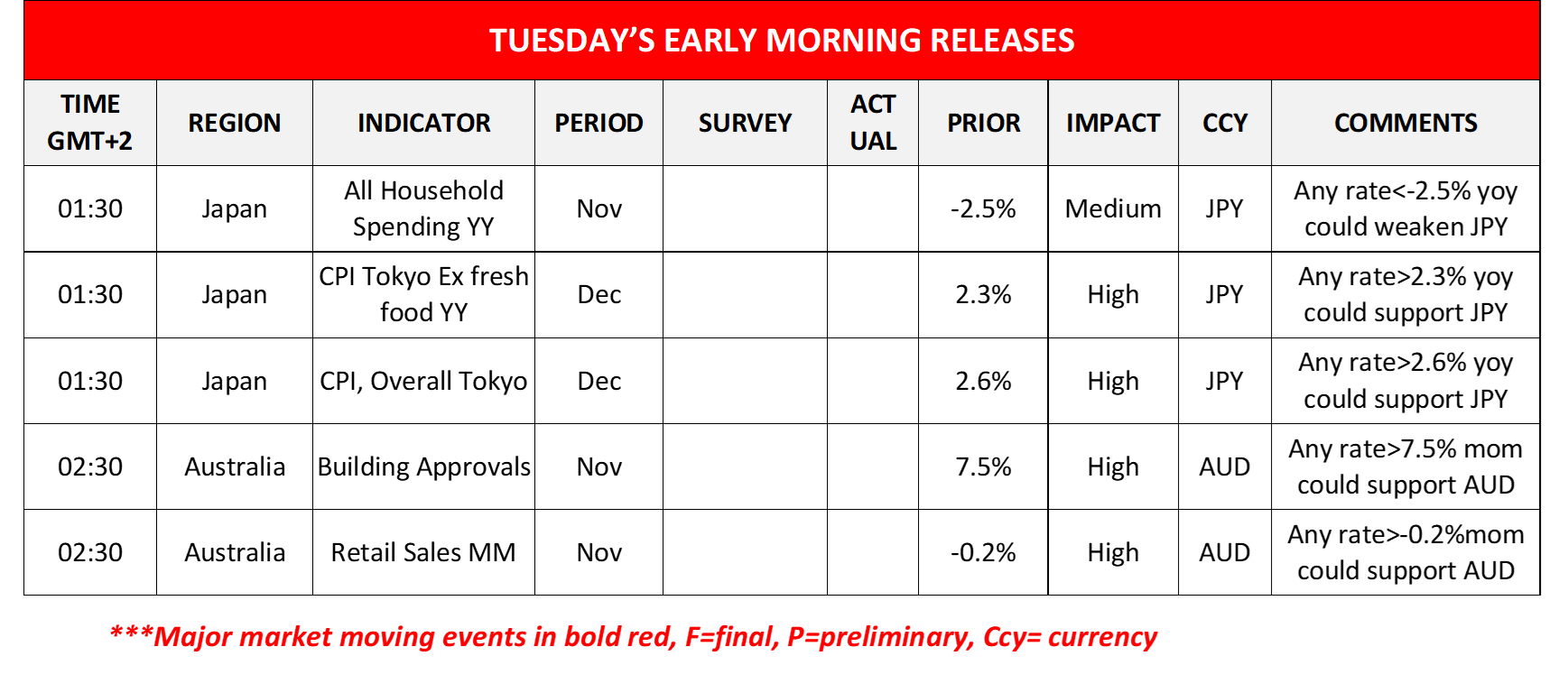

Today in the European session, we note the release of Germany’s industrial orders for November and trade data for the same month, from Switzerland we get December’s CPI rates and from the Eurozone we get January’s Sentix index. In the American session, we note that Atlanta Fed President Bostic is scheduled to speak. During tomorrow’s Asian session, we get from Japan November’s All household spending growth rates and December’s Tokyo CPI rates, while from Australia we note the release of November’s building approvals and retail sales.

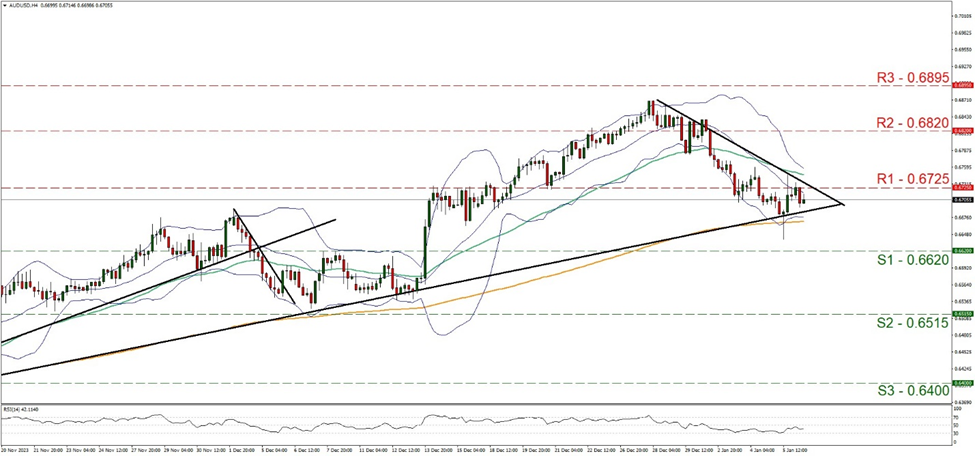

AUD/USD despite testing the 0.6725 (R1) resistance line, proved unable to clearly break it. For the time being we tend to maintain our bias for a sideways motion, yet note the symmetrical triangle that’s being formed and may allow the pair to break out. Should the pair find extensive buying orders along its path we may see AUD/USD breaking the 0.6725 (R1) resistance line and aiming for the 0.6820 (R2) resistance level. Should the selling interest be extended, we may see the pair breaking the 0.6620 (S1) support line and aiming for the 0.6515 (S2) support base.

今週の指数発表:

On Tuesday, we note Germany’s industrial production rate both for November and lastly Canada’s Trade balance figure for November. On a quiet Wednesday, we note Australia’s CPI rate for November and Norway’s CPI rate for December. On Thursday, we note Australia’s trade balance figure for November, followed by the Czech Republic’s and the US CPI rates both for the month of December and closing off the day is the US weekly initial jobless claims figure. Finally, on a busy Friday, we note China’s PPI and CPI rates and trade balance figure all for the month of December, followed by the UK’s Preliminary GDP rate, Industrial output rate and Manufacturing output growth rates all for the month of November, France’s Final HICP rates and the US PPI rates both for December.

EUR/USD 4時間チャート

Support: 1.0890 (S1), 1.0740 (S2), 1.0615 (S3)

Resistance: 1.1010 (R1), 1.1135 (R2), 1.1275 (R3)

AUD/USD 4時間チャート

Support: 0.6620 (S1), 0.6515 (S2), 0.6400 (S3)

Resistance: 0.6725 (R1), 0.6820 (R2), 0.6895 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。