One of the most widely anticipated IPOs of the year is set to take place on Thursday, with Arm LTD (#ARM) expected to go public. The company is a British chip manufacturing company that snubbed the London Stock Exchange in favour of a US-based listing on the NASDAQ Index. Should the IPO be a resounding success, we may see a further erosion of trust in the British pound, as its status as a world financial hub, continues to deteriorate. The Alibaba (#BABA) former group CEO, Daniel Zhang, according to Reuters, has quit the company’s cloud computing unit, in a move that took both the markets and investors by surprise, which could weigh on the stock price.

Over in Australia, LNG workers at Chevron’s plants, went on short strikes on Friday after union negotiations broke down. The ensuing strike places at risk a portion of the world’s global LNG supply and as such could potentially lead to volatile price swings in the natural gas markets.

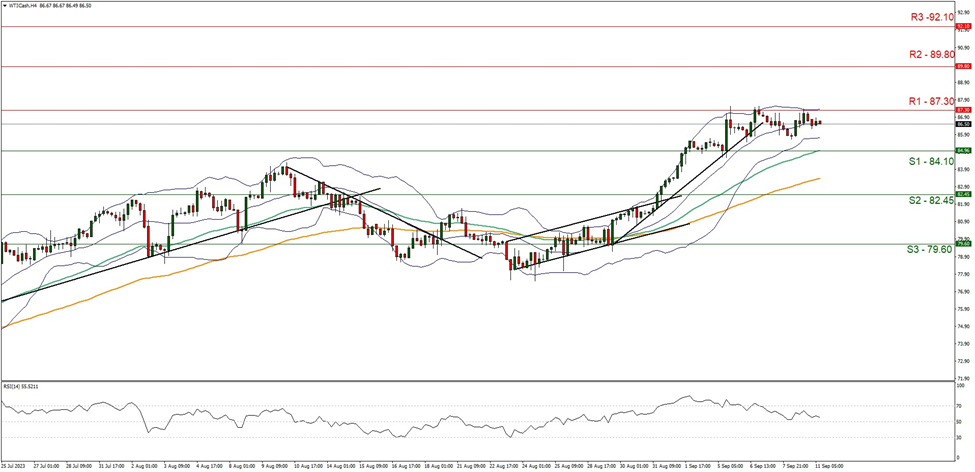

Having a look at the sister commodity oil, WTI prices on a technical level, seem to have hit a ceiling at the 87.30 (R1) line. Given also that the commodity’s price action has broken the upward trendline guiding it and that the RSI indicator remains above but very near to the reading of 50, implying a rather indecisive market, we switch our bullish outlook in favour of a sideways motion bias. Should the bulls regain control over WTI’s price we may see it breaking the 87.30 (R1) line and aim for the 89.30 (R2) barrier. Should the bears take over we may see the commodity’s price breaking the 84.10 (S1) line and aim for the 82.45 (S2) level.

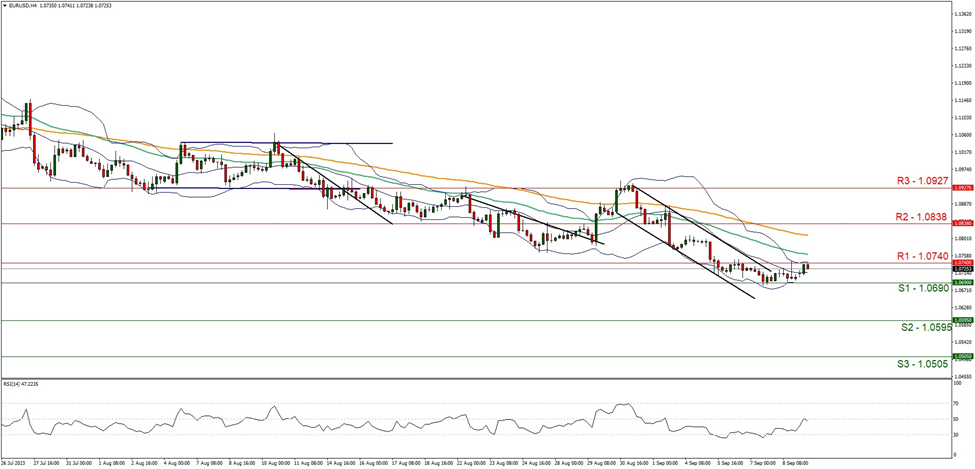

The LNG fundamentals could have an effect on the EUR and on a technical level, we note that EUR edged higher in today’s opening, testing the 1.0740 (R1) line. Given that the downward channel guiding the pair has been broken we abandon our bearish outlook, yet for a bullish outlook, we would require EUR/USD to break the 1.0740 (R1) resistance line and aim for the 1.0838 (R2) resistance level. Should a selling interest be expressed by the market, we may see the pair breaking the 1.0690 (S1) support line and aim for the 1.0595 (S2) level.

その他の注目材料

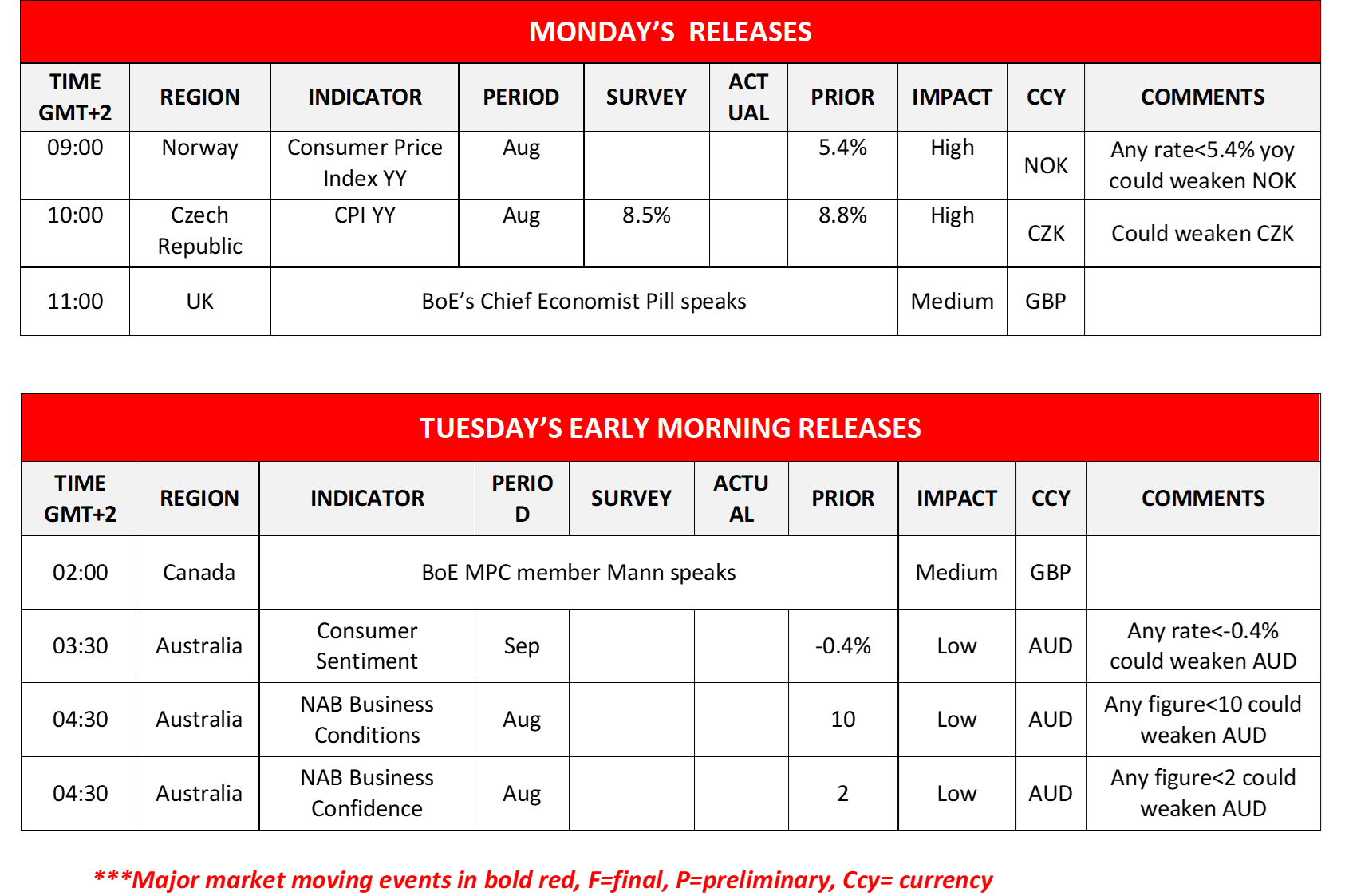

We note in the European session today the release of Norway’s and the Czech Republic’s CPI rates for August. During tomorrow’s Asian session, we note the release of Australia’s consumer sentiment of September and business indicators for August. On the monetary front we note for GBP traders that BoE’s Chief Economist Pill and BoE MPC member Mann speak.

今週の指数発表:

On Tuesday, we begin with the UK’s Employment data, followed by Norway’s GDP rate for July and finish the day with Germany’s ZEW indicators for September. On Wednesday we make a start with Japan’s corporate goods price rate for August, followed by the UK’s Preliminary GDP and Manufacturing Output rates both for the month of July. Later on, we note the Eurozone’s industrial production rate for July and we highlight the release of the US CPI data for August. On a Thursday, we begin with Japan’s Machinery orders rate for July, followed by Australia’s Employment data and Sweden’s CPI rate for August, the US weekly initial jobless claims figure, PPI rates and Retail sales rates both for the month of August, while on the monetary front, we highlight ECB’s interest rate decision. Finally on Friday, we note China’s industrial output rate for August, followed by Canada’s Manufacturing sales rate for July, the US Industrial production rate for August and the Preliminary University of Michigan Sentiment figures for September.

EUR/USD 4時間チャート

Support: 1.0690 (S1) 1.0595 (S2), 1.0505 (S3)

Resistance: 1.0740 (R1), 1.0838 (R2), 1.0927 (R3)

WTICash 4時間チャート

Support: 84.10 (S1), 82.45 (S2), 79.60 (S3)

Resistance: 87.30 (R1), 89.80 (R2) 92.10 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。