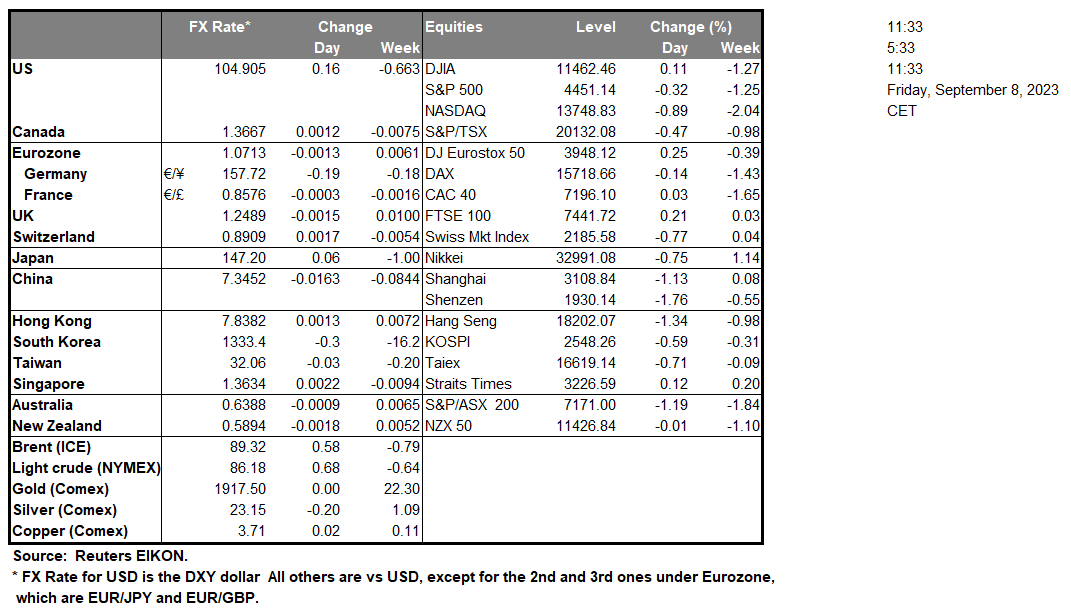

Apple’s share price tumbled yesterday as the Chinese government widened the curbs on iPhone use by Government officials. The market’s worries tended to intensify about Apple’s revenue prospects pushing Apple’s share price lower and further indications for lower sales by Apple may add further downward pressure on the share’s price. Our worries are more intense, as the Chinese government may proceed with a wider hit on US high-tech companies, while a possible escalation of the tensions in the US-Sino relationships looms. The economic outlook for the Eurozone darkened even further as Germany’s industrial output contracted further and Eurozone’s GDP rate for Q2 was revised lower. All of that in conjunction with the ECB expected to keep rates high for a prolonged period may through the Eurozone in a recession and weaken the common currency.

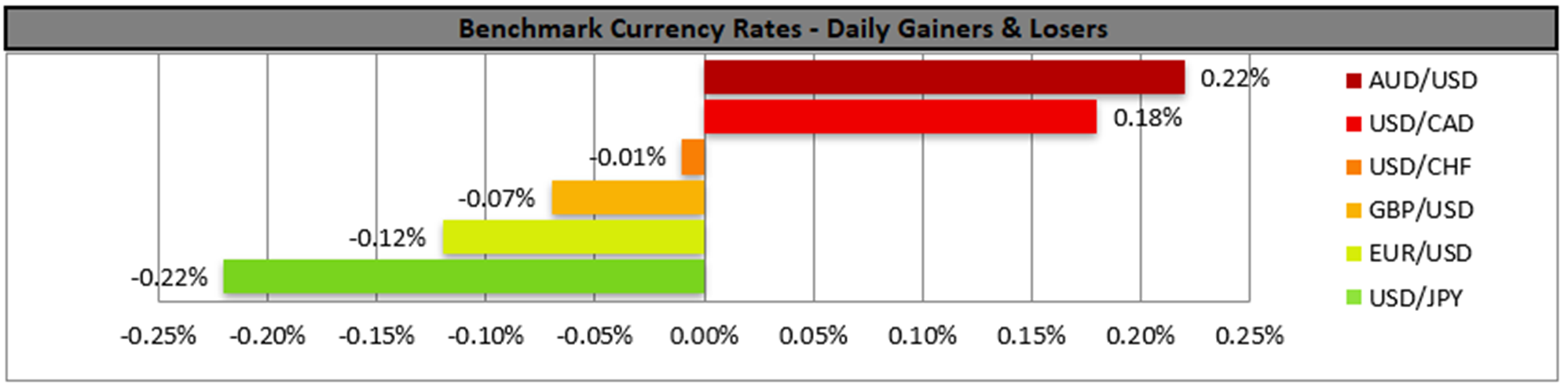

The USD is about to end the 8th week in the greens against its counterparts, while Japan’s GPD rate for Q2 was revised lower. The Japanese currency seems to be caught between calls of BoJ policymakers for a continuance of the bank’s ultra-loose monetary policy which weakens JPY and market expectations for a possible intervention of the bank to rescue the Yen, which tends to provide some support. The CAD was not allowed to strengthen yesterday against the USD and attention turns towards the release of Canada’s August employment data later today. Should the data show that the Canadian employment market is tight we may see the Loonie getting some support and vice versa, while CAD traders may also keep an eye out for the path of oil prices.

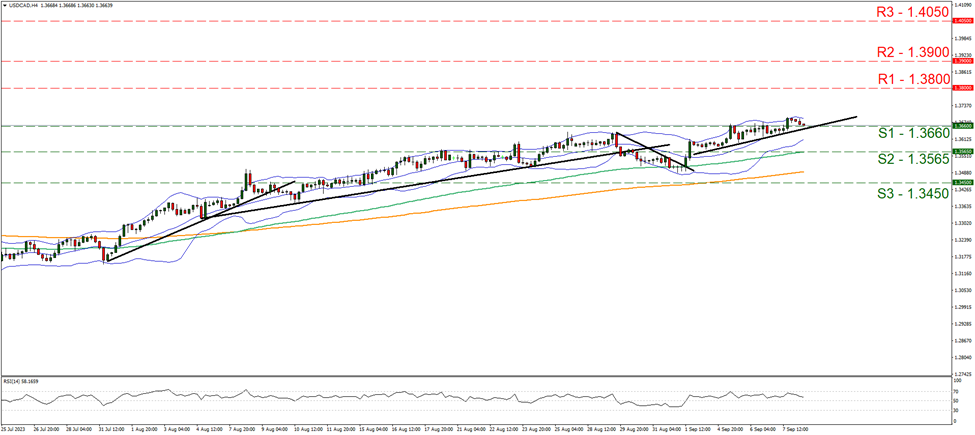

On a technical level, USD/CAD for the time being seems to continue higher as it has broken the 1.3660 (S1) resistance line, now turned to support. We tend to maintain our bullish outlook as long as the upward trendline continues to guide the pair, yet note that USD/CAD is threatening to break it, while the RSI indicator is nearing the reading of 50, implying an easing of the bullish sentiment of the market for the pair which in turn may allow the pair to stabilise somewhat. Should the pair find fresh, extensive buying orders along its path, we may see USD/CAD aiming for the 1.3800 (R1) resistance line. Should a selling interest be expressed by the market for the pair, we may see USD/CAD breaking the prementioned upward trendline, the 1.3660 (S1) support line and aim if not break the 1.3565 (S2) support level.

The influence of the bulls on oil prices seems to have eased as in the commodity’s fundamental demand worries for the economic outlook of China seem to intensify and thus increase expectations for the possibility of lower demand. On the other hand, Russia and Saudi Arabia keep the supply side of the commodity tight by maintaining low production levels, yet there are expectations for increased oil exports from Venezuela and Iran.

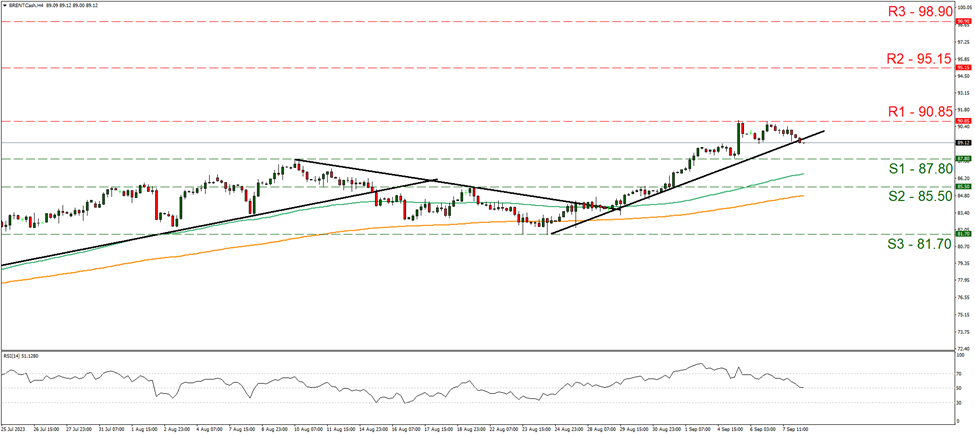

Brent edged lower after hitting a ceiling at the 90.85 (R1) resistance line. We switch our bullish outlook for the commodity as its price action is about to break the upward trendline guiding it, signaling an interruption of the upward movement, while at the same time, the RSI indicator has dropped to 50, implying a rather indecisive market, which may allow for Brent’s price to stabilise. Should the bulls regain control over the commodity’s direction, we may see Brent’s price breaking the 90.85 (R1) resistance line and take aim of the 95.15 (R2) resistance level. Should the bears take over, we may see Brent’s price breaking the 87.80 (S1) support line and aim for the 85.50 (S2) support base.

Gold’s price was allowed to rise yesterday despite the rise of the USD and during today’s Asian session took advantage of the greenback’s weakening to rise further. Fed policymakers tended to intensify market expectations for the Fed to remain on hold in the September meeting yesterday and should there be further such comments today, we may see the USD weakening and gold’s price advancing.

その他の注目材料

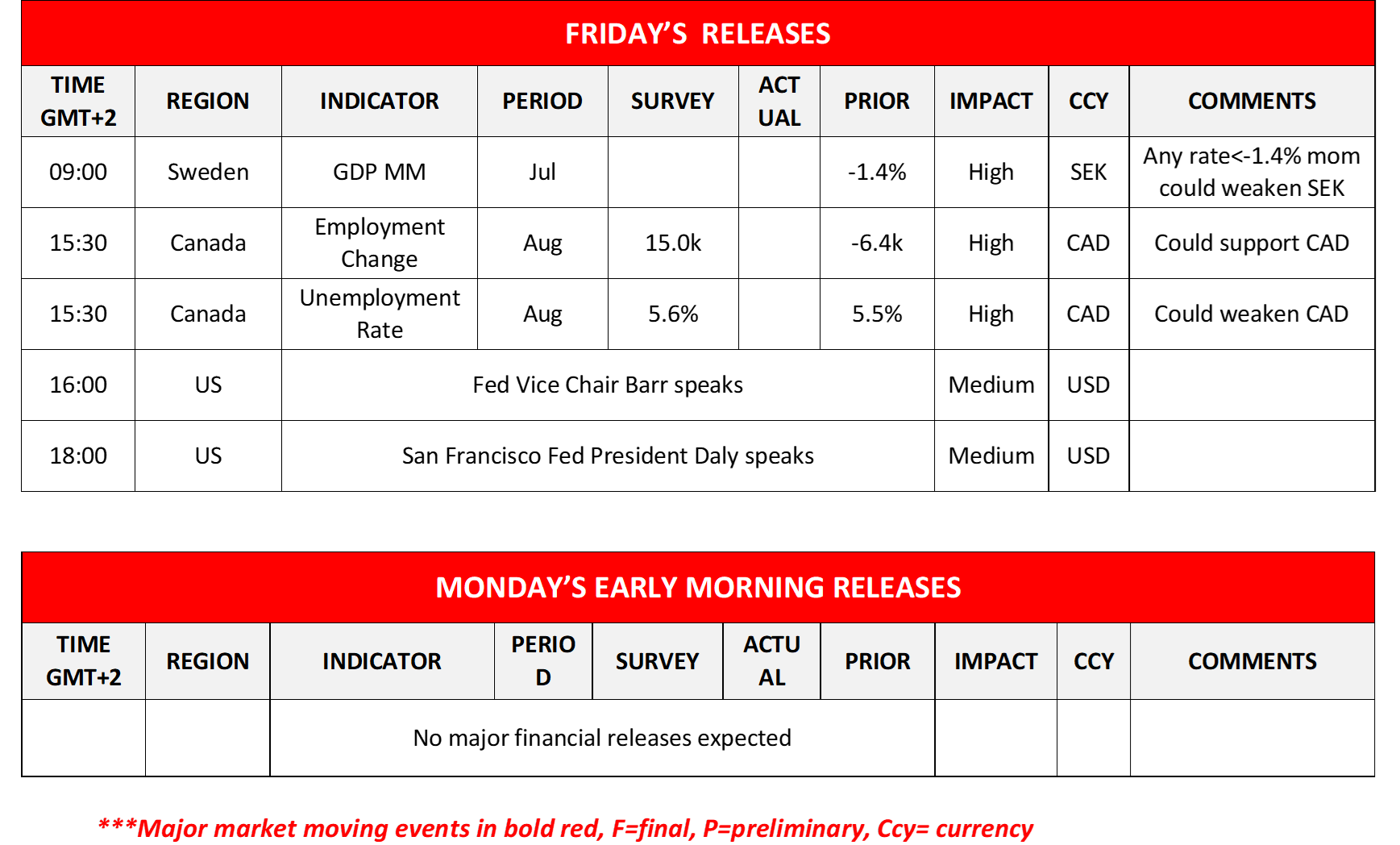

We note in the European session, the release of Sweden’s GDP rates for July, and in the American session, Canada’s employment data are due out, while Fed Vice Chair Barr and San Francisco Fed President Daly are scheduled to speak.

USD/CAD 4時間チャート

Support: 1.3660 (S1), 1.3565 (S2), 1.3450 (S3)

Resistance: 1.3800 (R1), 1.3900 (R2), 1.4050 (R3)

Brent H4 Chart

Support: 87.80 (S1), 85.50 (S2), 81.70 (S3)

Resistance: 90.85 (R1), 95.15 (R2), 98.90 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。