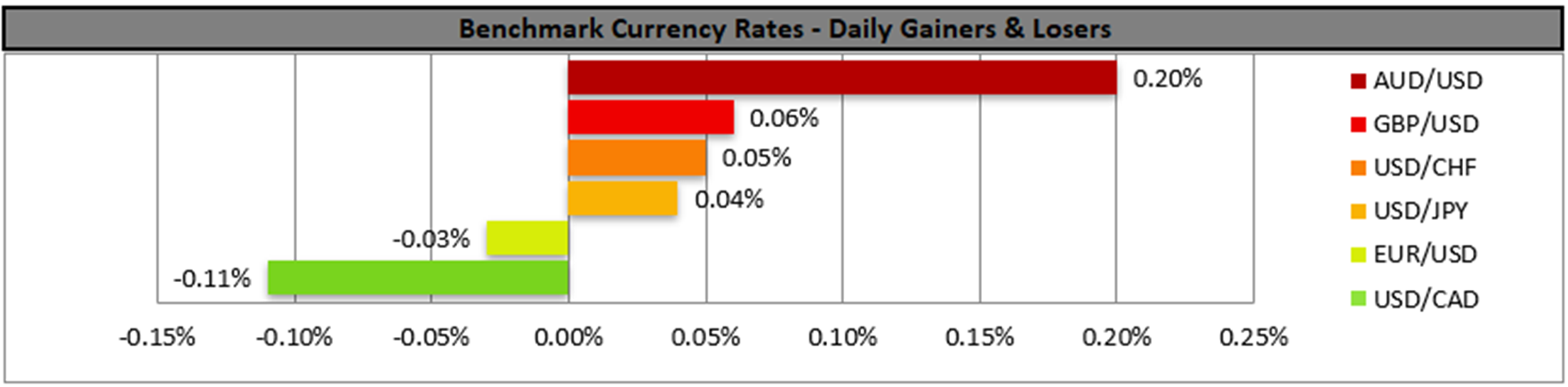

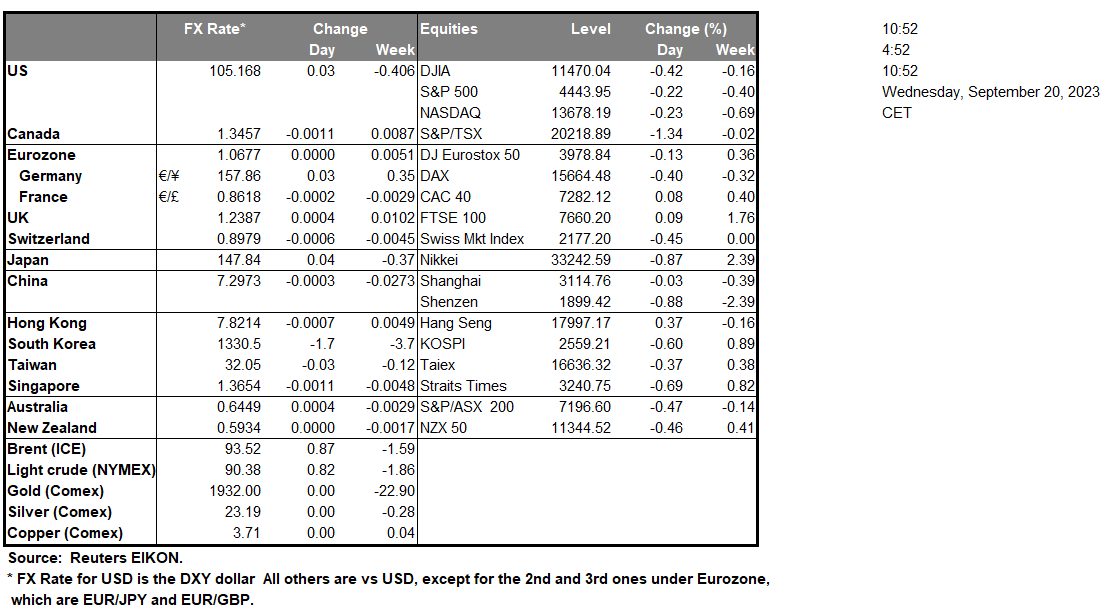

The Fed’s interest rate decision is due out today, with the majority of market participants anticipating that the Fed will remain on pause, amidst the backdrop of the US housing starts figure dropping to the lowest point since 2020, painting a worrying sign for the US economy. In addition, the US House of Representatives passed a measure that would temporarily increase the Government’s spending ability whilst avoiding a government shutdown, yet the Senate Majority leader Schumer, stated that the bill would be “dead” on arrival, thus potentially resulting to a second round between Republicans and Democrats in a government shutdown scenario. In Canada the BOC Core CPI rates came in higher than expected, hinting at persistent inflationary pressures in the Canadian economy, which could increase pressure on the bank to resume its rate hiking cycle and as such could provide support for the CAD. Over in the UK, the CPI rates for August edged lower, hinting at easing inflationary pressures in the UK economy as the BOE prepares to meet to discuss its next interest rate decision. The lower-than-expected CPI rates could potentially ease pressure on the bank should they wish to adopt a more dovish tone or should the decide to remain on pause, albeit an unlikely scenario. In the commodities markets, the liquid gold appears to be halting its upwards trajectory, despite the API weekly oil inventories reporting a wider than expected drawdown of the US oil inventories. In Europe, ECB’s Villeroy stated that “The ECB is not at the point today where we could cut rates”, hinting that the current interest rates will remain at current levels for a prolonged period of time, which could provide support for the common currency in the long run if the ECB’s counterparts cut rates earlier. Lastly, we note the increasing tensions between Poland and Ukraine over Poland’s ban on Ukrainian grain, as such should the ban be lifted and an influx of grain is seen in Europe, we may see the price of Wheat moving to lower ground.

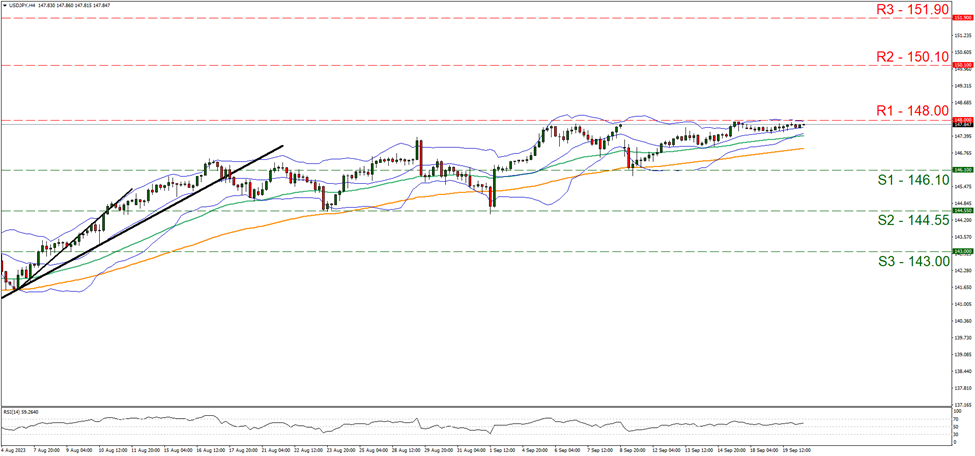

On a technical level, we note that USD/JPY appears to be moving in a upwards fashion, despite an apparent slowdown in its upwards momentum. We maintain a bullish outlook for the pair and supporting our case is the RSI indicator below our 4-Hour chart, which is currently near the figure of 70, implying a bullish market sentiment. For our bullish outlook to continue, we would like to see a clear break above the 148.00 (R1) resistance level, with the next potential target for the bulls being the 150.10 (R2) resistance ceiling. On the other hand, for a bearish outlook, we would like to see a clear break below the 146.10 (S1) support level, with the next potential target for the bears being the 144.55 (S2) support base. Lastly, for a neutral outlook, we would like to see the pair failing to break above the 148.00 (R1) resistance level and remaining confined between the 146.10 (S1) support and the 148.00 (R1) resistance levels.

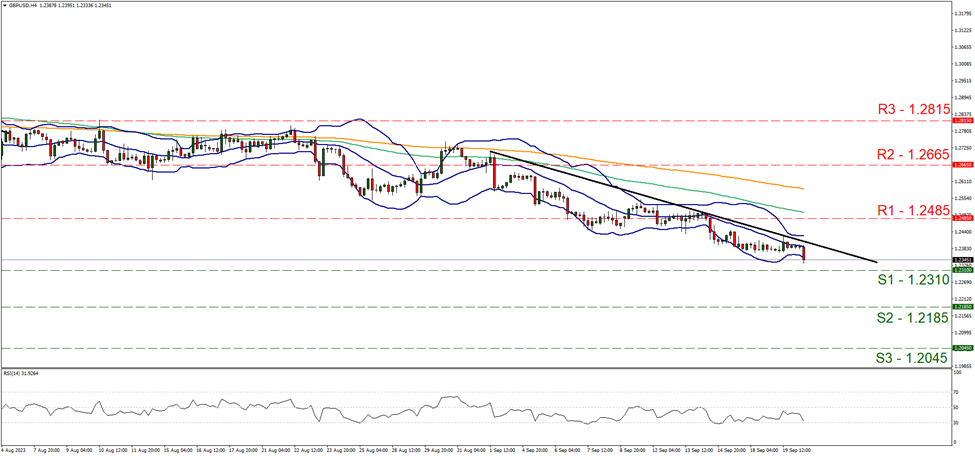

GBP/USD appears to be moving in a downwards fashion and supporting our case is the RSI indicator below our 4-Hour chart which currently registers a figure near 30, implying a bearish market sentiment in addition to the downwards moving trendline which was incepted on the 1 of September. For our bearish outlook to continue, we would like to see a clear break below the 1.2310 (S1) support level, with the next potential target for the bears being the 1.2185 (S2) support base. Whereas for a bullish outlook, we would like to see a clear break above our downwards moving trendline, in addition to a clear break above the 1.2485 (R1) resistance level, with the next potential target for the bulls being the 1.2665 (R2) resistance ceiling.

その他の注目材料

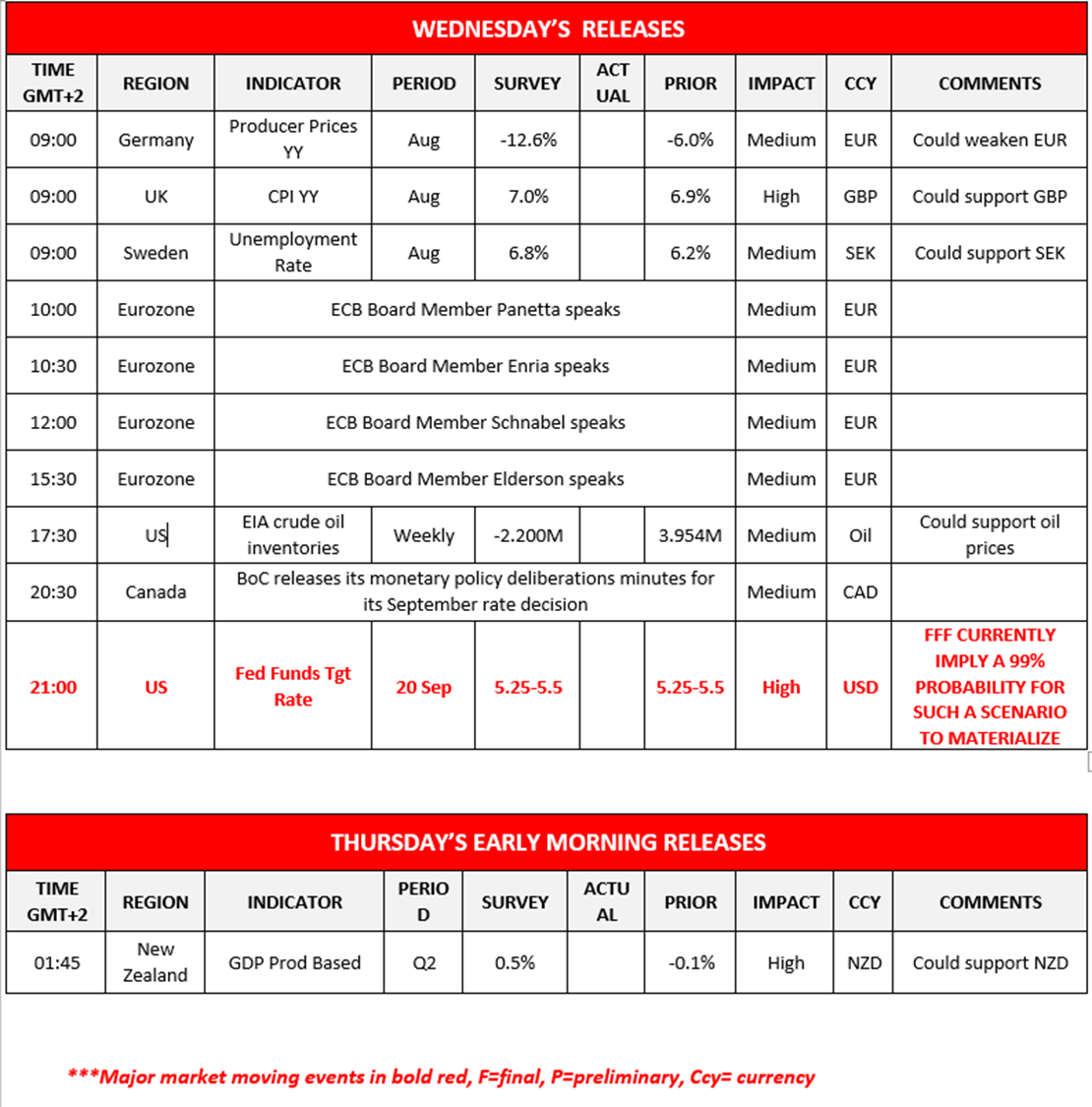

Today we make a start with Germany’s producers prices rate for August and Sweden’s Unemployment rate for August. During the American session, we note the US EIA weekly crude oil inventories figure. In tomorrow’s Asian session we note New Zealand’s producer-based GDP rate for Q2. On a monetary level, we highlight the speeches by ECB’s members Paneta, Enria, Schnabel and Elderson, followed by the BoC’s deliberations minutes for their September rate decision and finishing of the day is the FED’s interest rate decision.

USD/JPY 4 Hour Chart

Support: 146.10 (S1), 144.55 (S2), 143.00 (S3)

Resistance: 148.00 (R1), 150.10 (R2), 151.90 (R3)

GBP/USD 4H Chart

Support: 1.2310 (S1), 1.2185 (S2), 1.2045 (S3)

Resistance: 1.2485 (R1), 1.2665 (R2), 1.2815 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。