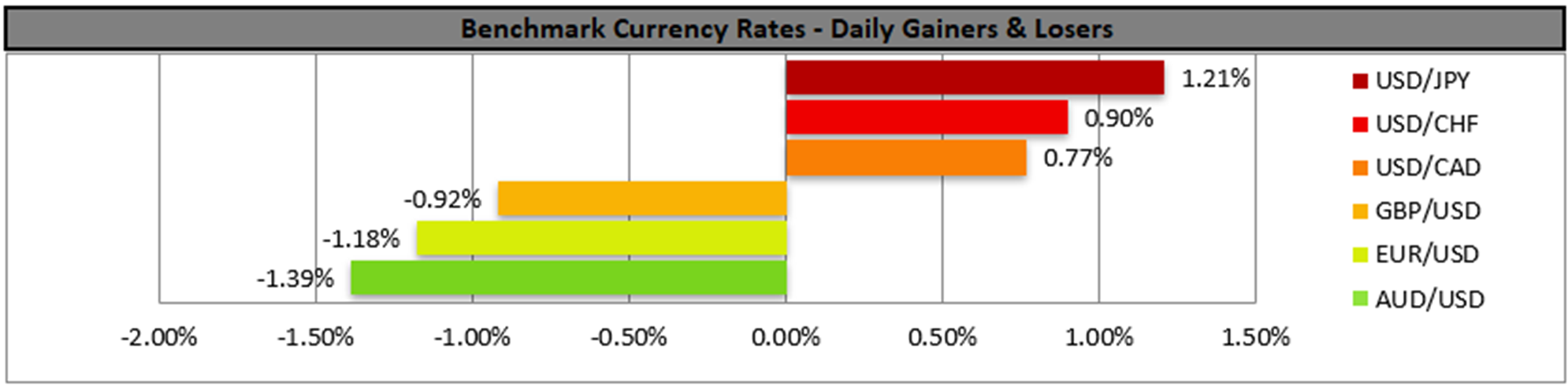

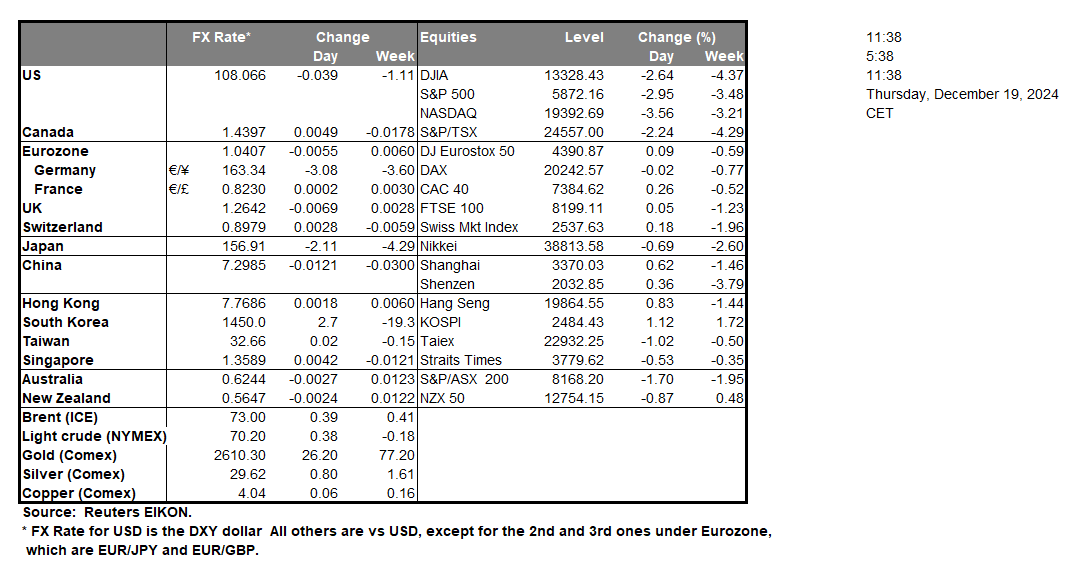

The USD rallied yesterday and during today’s Asian session, as the Fed hawkishly cut rates. As was widely expected the bank cut rates by 25 basis points and the maintained the view that the bank is to continue to assess economic data coming in in deciding the appropriate monetary policy. Yet the bank’s projections and new dot plot tended to enhance the market’s view for an easing of the bank’s rate-cutting path. Especially Fed Chairman Powell’s press conference was deemed as more hawkish as he stated that the bank should be cautious with more rate cuts. Overall, we see the case for the USD to remain supported on a monetary level, especially against the EUR, as the monetary outlook diverges significantly, given ECB’s intentions to continue cutting rates. On the flip side, the Fed’s interest rate decision weighed considerably on US equities and Gold’s price.

During today’s Asian session, BoJ announced that it would remain on hold, as was expected. In its the bank mentioned that “underlying CPI inflation is expected to increase gradually” a sentence which keeps practically alive the prospect of a rate hike in its next meeting. On the other hand, BoJ Governor Ueda stated that it’s hard to say if incoming data will be sufficient to support January hike. Overall we see the case for some doubts to emerge for a possible January rate hike and should these tendencies be enhanced we may see JPY losing ground on a monetary level.

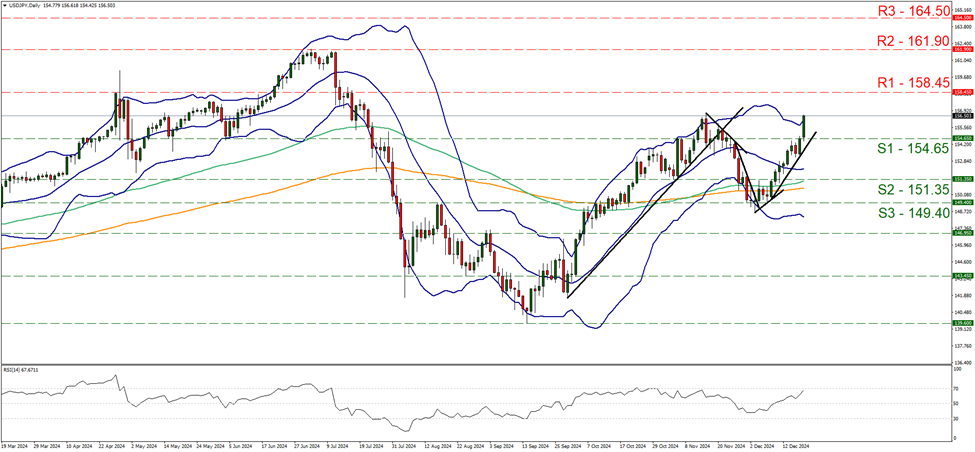

USD/JPY rallied yesterday and during today’s Asian session, breaking the 154.65 (S1) resistance line, now turned to support. The upward movement practically renewed the bullish outlook, by shifting the upward trendline guiding it since the 9 of the December. Hence we renew our bullish outlook and if actually so, we may see the pair reaching if not breaking the 158.45 (R1) resistance line, with the next target for the bulls being set at the 161.90 (R2) resistance level. A bearish outlook seems remote currently and for its adoption the pair would have to break the prementioned upward trendline, signaling an interruption of the upward motion, and continue to break the 154.60 (S1) support line and aim if not breach the 151.35 (S2) level.

On a monetary level today, we highlight BoE’s interest rate decision today. The bank is expected to remain on hold and resume rate cuts in its February meeting. Should the bank’s forward guidance set the market’s expectations in doubt by being more hawkish in its forward guidance, we may see the pound getting some support as it may ease market expectations for a rate cut in the February meeting.

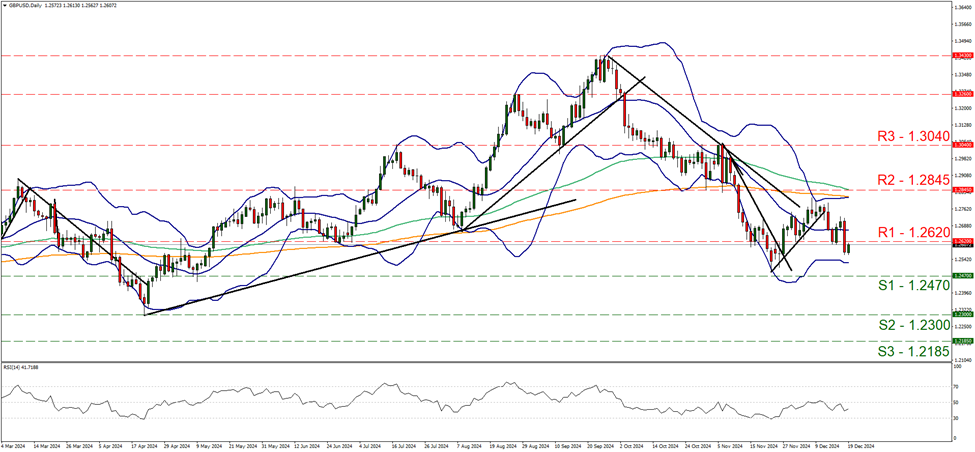

GBP/USD tumbled yesterday, breaking the 1.2620 (R1) support line, now turned to resistance. Nevertheless, the downward motion leaves us unconvinced and we tend to maintain a bias for the sideways motion to continue at the current stage. We also note that the RSI indicator remains below the reading of 50, implying a bearish predisposition for the pair. For a bearish outlook though we would require a lower peak than the on the 22 of November, hence cable has to break the 1.2470 (S1) support line and start aiming for the 1.2300 (S2) support level. Should the bulls take over, we may see the pair breaking the 1.2620 (R1) resistance line and continue to reach if not breach the 1.2845 (R2) resistance base.

その他の注目材料

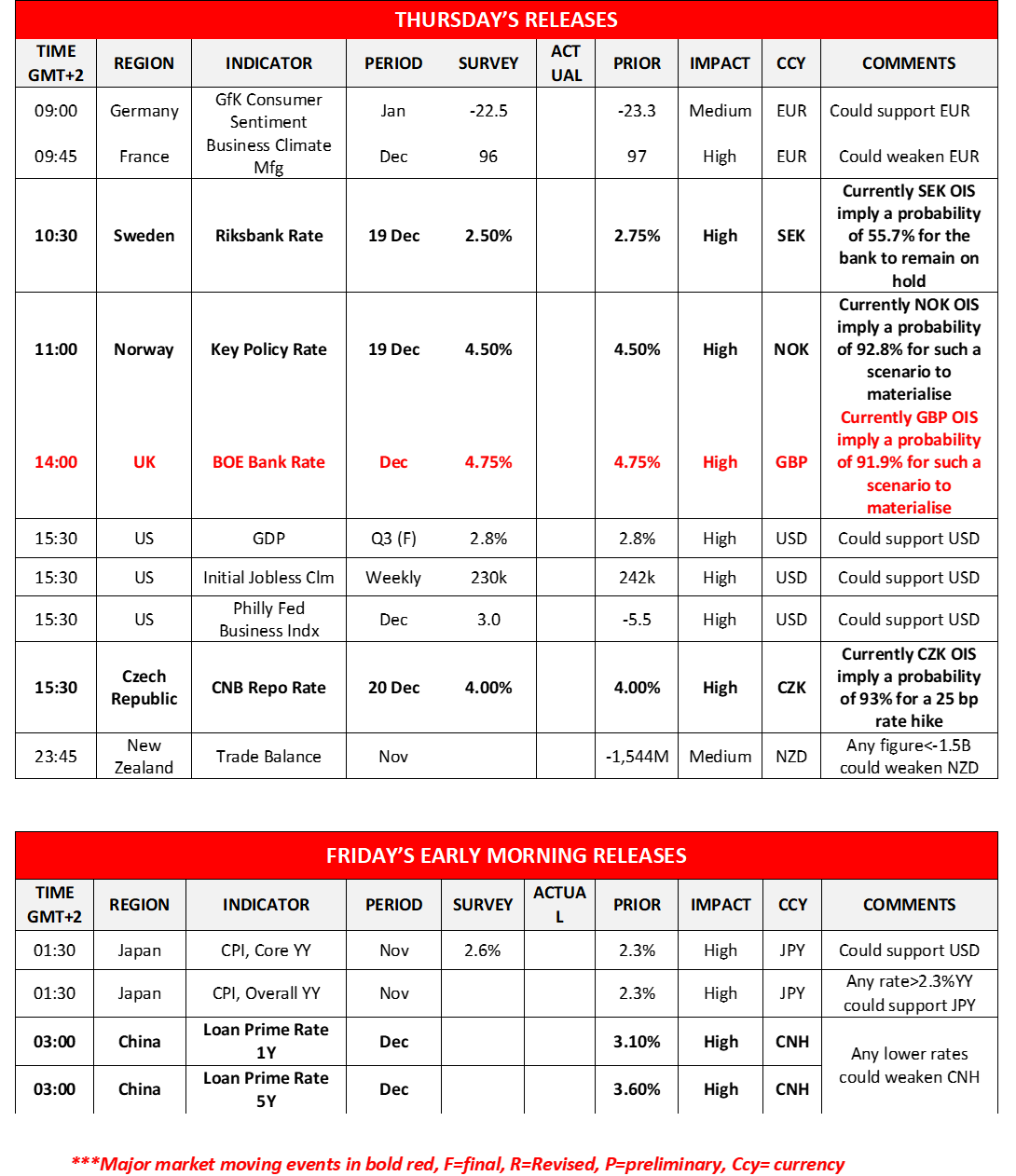

In today’s European session, we get Germany’s GfK consumer sentiment for January and France’s December business climate for manufacturing. On the monetary front, we note the release of the interest rate decisions of Sweden’s Riksbank, Norway’s Norgesbank and the Czech Republic’s CNB. In the American session, we get from the US the final GDP rate for Q3, the weekly initial jobless claims and the Philly Fed Business index for December and later on New Zealand’s November Trade data. On Friday’s Asian session, we get Japan’s November CPI rates and from China PBoC is to release its interest rate decision.

USD/JPY Daily Chart

- Support: 154.65 (S1), 151.35 (S2), 149.40 (S3)

- Resistance: 158.45 (R1), 161.90 (R2), 164.50 (R3)

GBP/USD Daily Chart

- Support: 1.2470 (S1), 1.2300 (S2), 1.2185 (S3)

- Resistance: 1.2620 (R1), 1.2845 (R2), 1.3040 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。