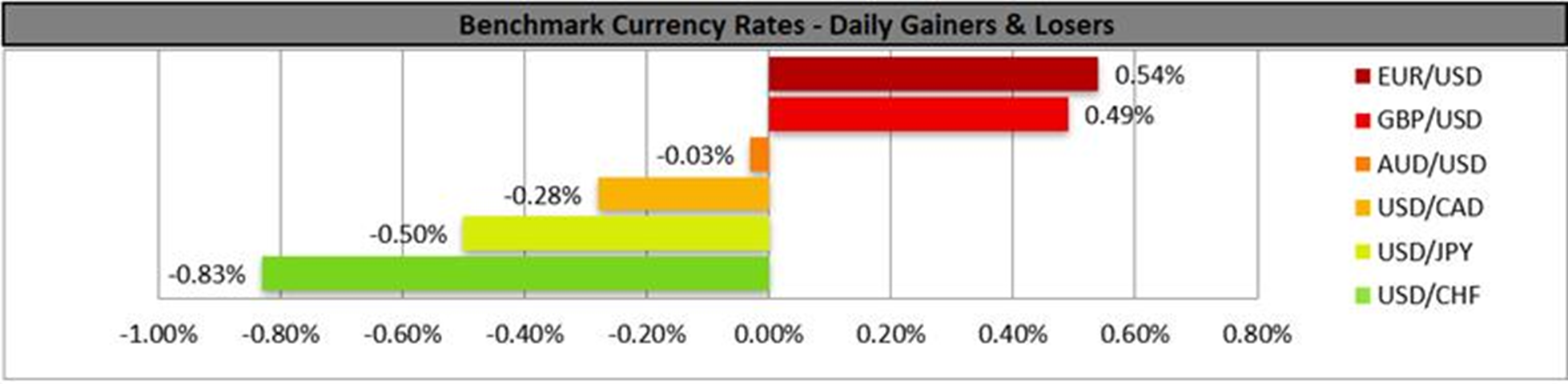

The Fed yesterday cut interest rates by 25 basis points as was widely expected by market participants. The picture that emerged was that not everyone was on board for the reduction, with Chicago Fed President Goolsbee going on record as being against the interest rate reduction, as well as Kansas Fed President Schmid, who also voted against the rate cut. Moreover, a large group of regional Fed bank President’s who where not voting members this year but participated in the debate signalled that they opposed the cut, showcasing how divided and polarized the Fed has become. Our take is that considering the expertise and experience held by Fed Chair Powell, the fact that the vote was opposed to this extent sets the stage for next year with the new Fed Chair, who may find it increasingly difficult to rein in voting members or essentially “lead” the Fed. Hence, with this new data, the White House may re-evaluate its candidates for Fed Chair, potentially passing over Hassett in favour of a “unifier” within the bank. Regarding to the press conference, Fed Chair Powell noted that interest rates were “now within a broad range of estimates of its neutral value and we are well-positioned to wait to see how the economy evolves” which could imply for rate cuts down the line. In conclusion, the waters are murky and the future is unclear, yet on a general level the dollar appears to have weakened yesterday. The Bank of Canada kept interest rates steady yesterday as was widely expected by market participants. In their accompanying statement it was noted that “If inflation and economic activity evolve broadly in line with the October projection, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment” which may tend to imply that the bank could remain on hold and thus reduce rate cut expectations from the market. In turn this may have aided the Loonie.

EUR/USD appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the upwards moving trendline which was incepted on the 5th of November, in addition to the RSI, MACD and ADX with DI indicators, as well as the break above our resistance turned to support at the 1.1685 (S1) level. For our bullish outlook to be maintained, we would require a break above our 1.1815 (R1) resistance level with the next possible target for the bulls being our 1.1917 (R2) resistance line. On the other hand, for a sideways bias we would require the pair to remain confined between our 1.1685 (S1) support level and our 1.1815 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 1.1685 (S1) support level with the next possible target for the bears being our 1.1560 (S2) support line.

XAU/USD appears to be moving in a sideways fashion, with the precious metal appearing to be aiming for our 4142 (S1) support level. We opt for a sideways bias for gold’s price and supporting our case is the failure to clear our 4240 (R1) resistance line. For our sideways bias to be maintained, we would require the commodity’s price to remain confined between our 4142 (S1) support level and our 4240 (R1) resistance line. On the other hand, for a bearish outlook, we would require a clear break below our 4142 (S1) support level with the next possible target for the bears being our 4080 (S2) support line. Lastly, for a bullish outlook we would require a clear break above our 4240 (R1) resistance line with the next possible target for the bulls being our 4315 (R2) resistance level.

その他の注目材料

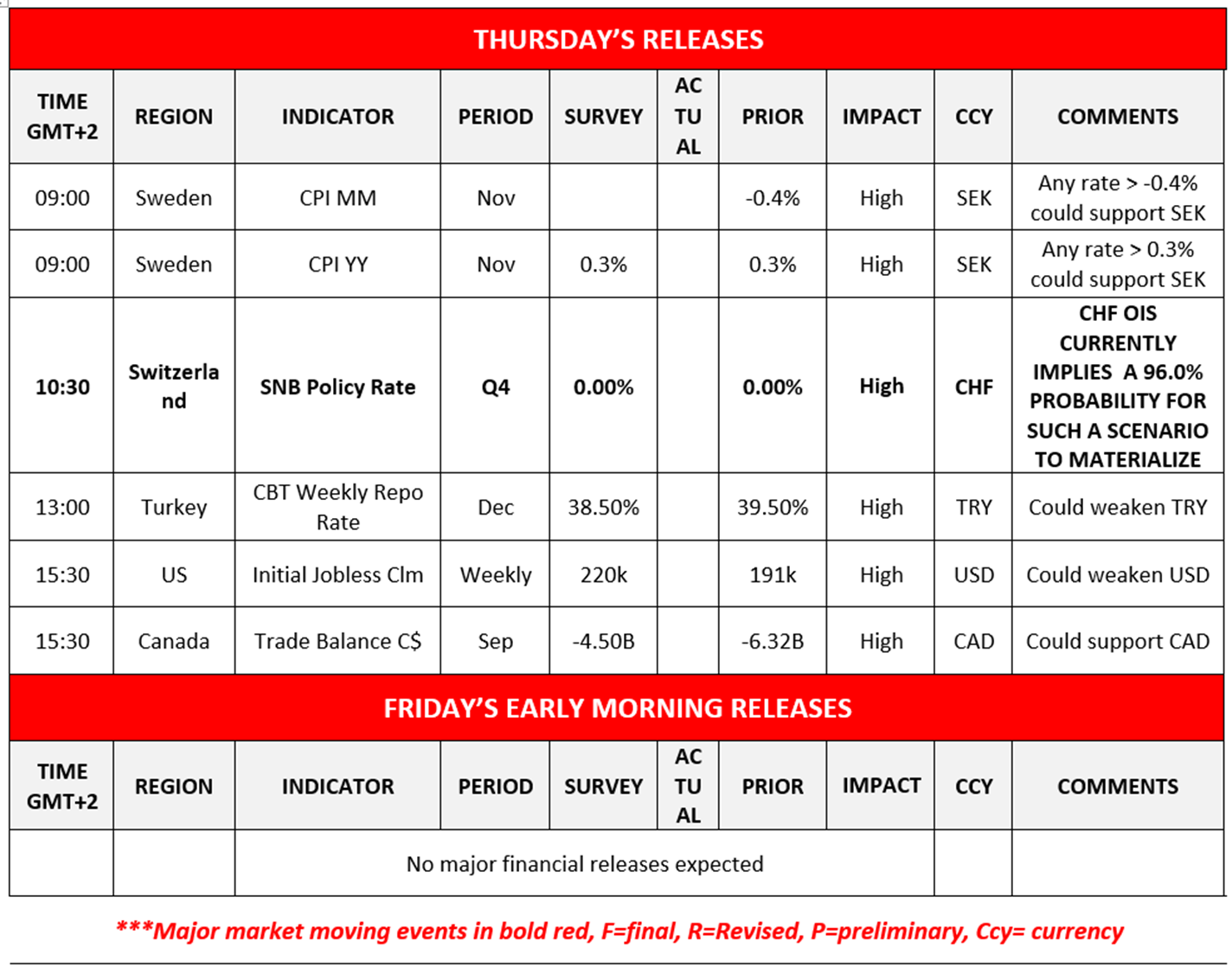

Today, we get Sweden’s CPI rates for November, the SNB’s interest rate decision, the CBT’s interest rate decision, the US weekly initial jobless claims figure and Canada’s trade balance figure for September.

EUR/USD Daily Chart

- Support: 1.1685 (S1), 1.1560 (S2), 1.1460 (S3)

- Resistance: 1.1815 (R1), 1.1917 (R2), 1.2000 (R3)

XAU/USD H4 Chart

- Support: 4142 (S1), 4080 (S2), 4010 (S3)

- Resistance: 4240 (R1), 4315 (R2), 4380 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。