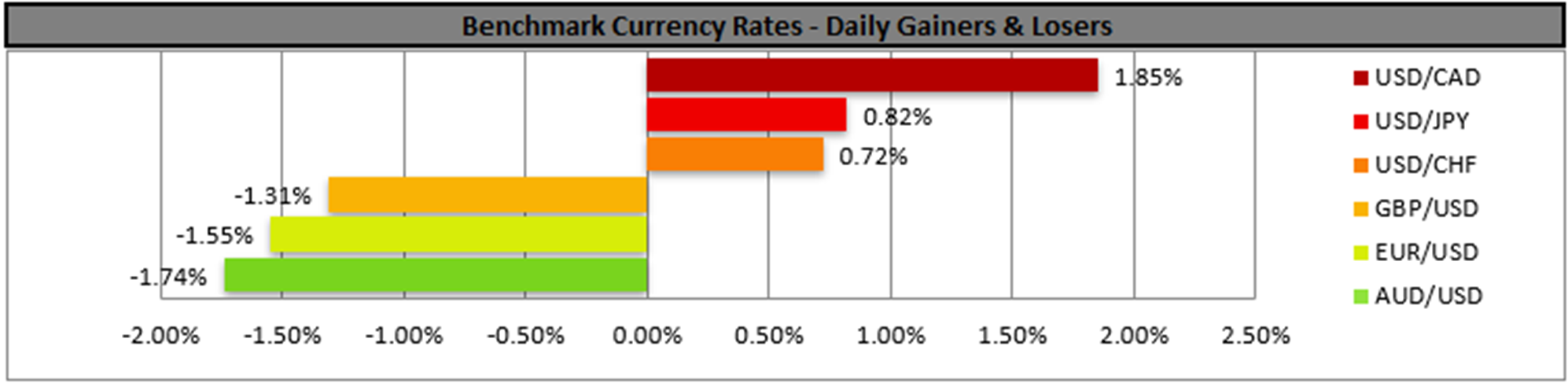

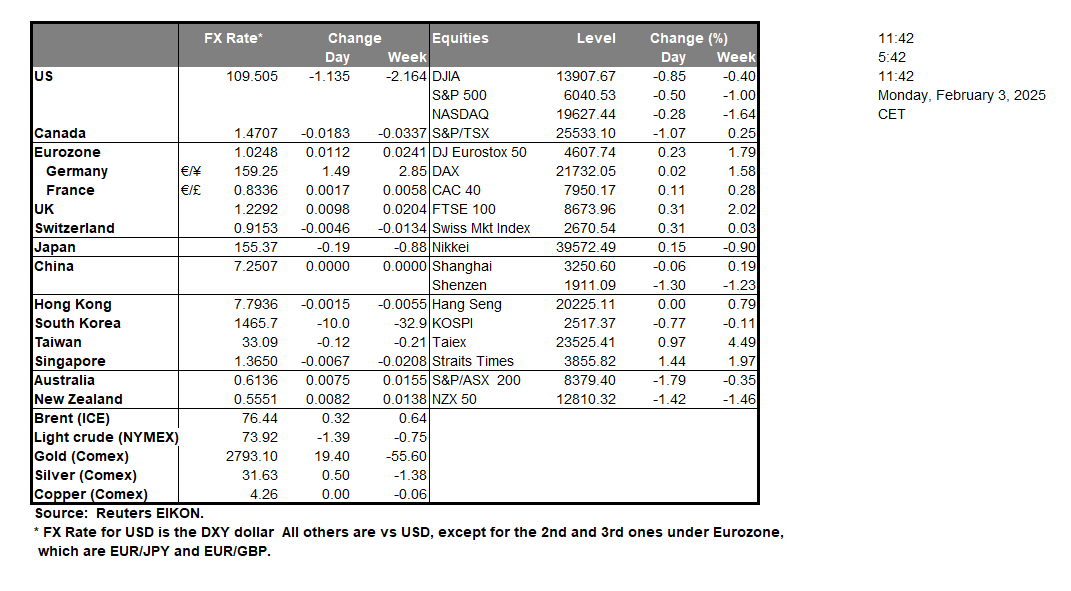

The US activated its threat and imposed tariffs on US imports from Canada, Mexico and China. The tariffs applied are for 25% for Canadian and Mexican products and an additional 10% for Chinese products. US President Trump also noted the US trade deficit with the EU, in a wink of an eye for what’s to come for European products. Overall, the USD got support from the move, while commodity currencies such as the CAD and the AUD, but also MXN and EUR weakened. We see the case for the US tariffs to have an inflationary effect in the US economy, yet at the same time, we also note that the bearish effect for the affected currencies may be enhanced as the monetary policy of their respective banks may have to be eased further.

EUR/USD tumbled in today’s Asian session, as it broke the 1.0330 (R1) support line, now turned to resistance. Given the intense downward motion and despite that a correction higher may be possible and given the fact that the RSI indicator has moved decisively lower aiming of the reading of 30 and implying a build-up of a bearish sentiment for the pair among market participants. Should the bears maintain control over the pair we may see EUR/USD breaking the 1.0175 (S1) support line and aiming for the 0.9950 (S2) support level. Should the bulls take over, we may see EUR/USD reversing course and breaking the 1.0330 (R1) resistance line and start aiming for the 1.0450 (R2) resistance base.

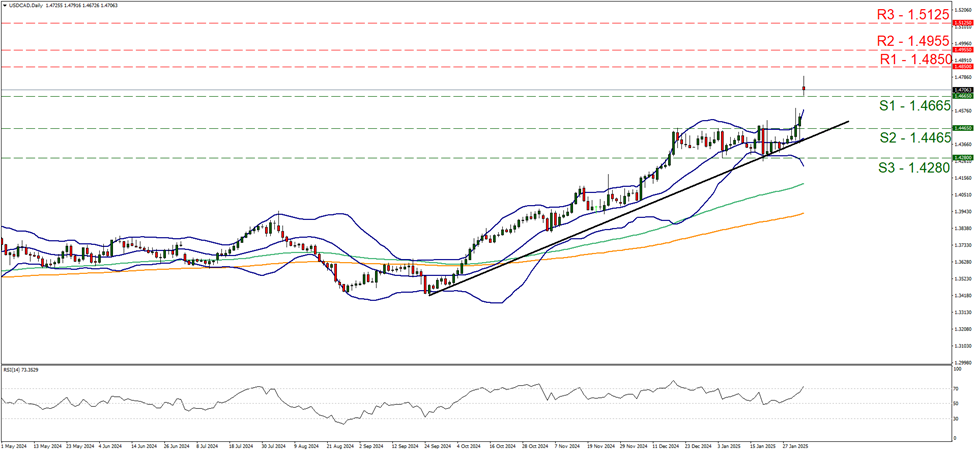

USD/CAD rallied during today’s Asian session, breaking the 1.4665 (S1) resistance line, now turned to support. We tend to maintain a bullish outlook for the pair as the upward movement allowed us to shift the upward trendline to the right. We also note that the RSI indicator has risen above the reading of 70, implying a strong bullish sentiment among market participants, yet at the same time may be implying that the pair’s price action has reached overbought levels and is ripe for a correction lower. Similar signals are also being send by the fact that USD/CAD’s price action has broken substantially above the upper Bollinger band. Should the bulls continue to lead the pair higher, we would expect it to break the 1.4850 (R1) resistance level, with the next possible target for the pair’s bulls being the 1.4955 (R2) resistance hurdle. For the adoption of a bearish outlook, we would require the pair to break the 1.4665 (S1) support level, break the 1.4465 (S2) support level and continue to break the prementioned upward trendline in a first signal that the upward movement has been interrupted and continue to aim for the 1.4280 (S3) support barrier.

その他の注目材料

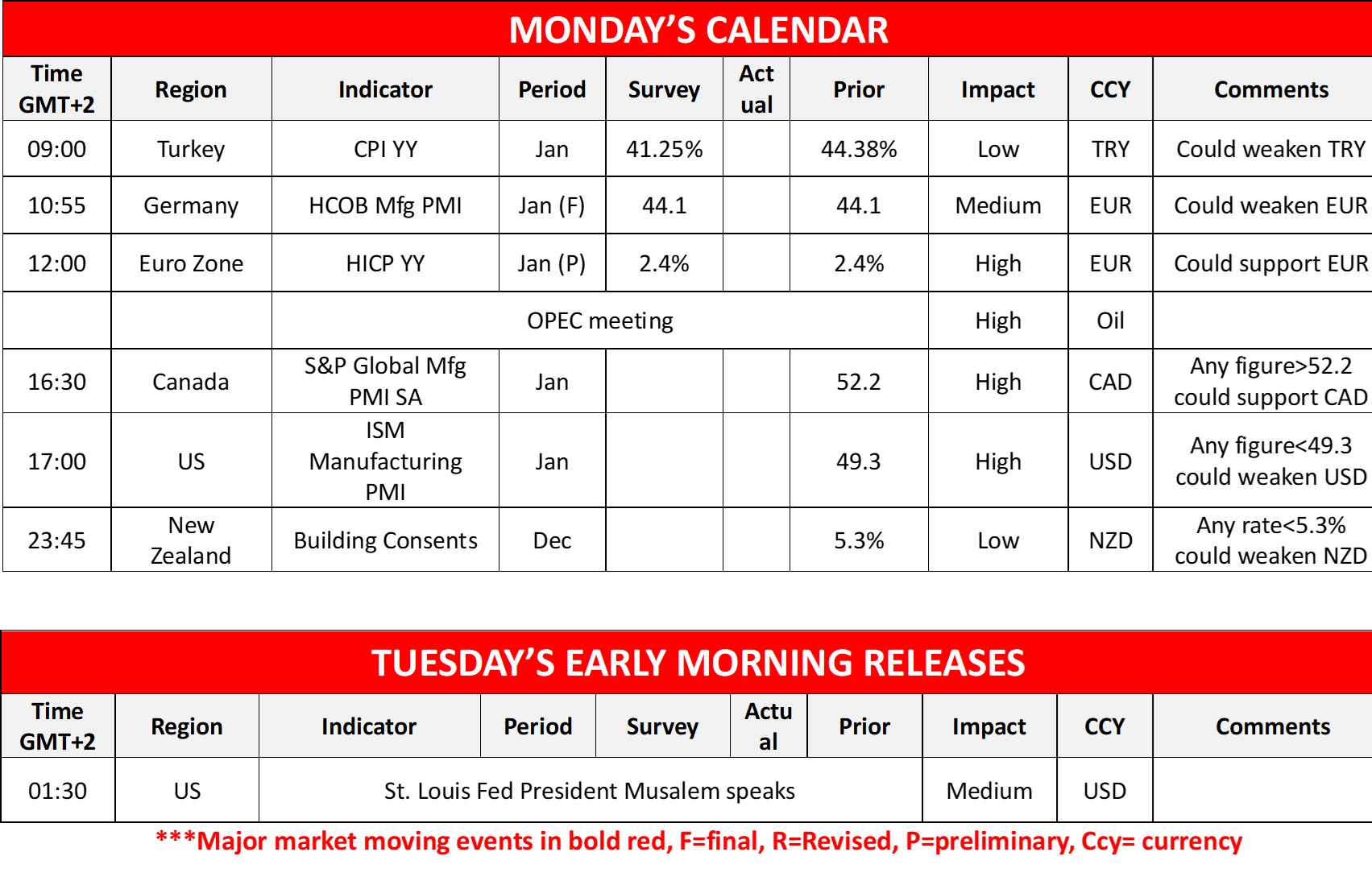

Today we note the release of easing of Turkey’s inflation, and also the release of Germany’s final manufacturing PMI figure, as well as Euro Zone’s preliminary HICP rate. In the American session, we get Canada’s manufacturing PMI figure as well as the US ISM manufacturing PMI, all being for January. Oil traders on the other hand may be more interested in today’s OPEC meeting.

今週の指数発表:

On Tuesday we get the US factory orders rate and US JOLTs job openings figure both for December and New Zealand’s unemployment rate for Q4 2024. On Wednesday, we make a start with China’s Caixin services PMI figure, France’s Services PMI figure, the Eurozone’s final composite PMI figure, the US ADP employment figure all for January, followed by Canada’s trade balance figure for December, the US S&P services PMI figure and ISM Non-Manufacturing PMI figures both for January. On Thursday we get Australia’s trade balance figure for December, Switzerland’s unemployment rate for January, Germany’s industrial orders rate for December, Sweden’s and the Czech Republic’s preliminary CPI rates for January and Canada’s Ivey PMI figure for January and from the UK, BoE is to release its interest rate decision. Lastly, on Friday we get the UK’s Halifax house prices rate, the US and Canada’s employment data all for January and ending off the week is the US University of Michigan preliminary consumer sentiment figure for February.

EUR/USD デイリーチャート

- Support: 1.0175 (S1), 0.9950 (S2), 0.9740 (S3)

- Resistance: 1.0330 (R1), 1.0450 (R2), 1.0600 (R3)

USD/CAD Daily Chart

- Support: 1.4665 (S1), 1.4465 (S2), 1.4280 (S3)

- Resistance: 1.4850 (R1), 1.4955 (R2), 1.5125 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。