The Fed as expected remained on hold yesterday and seems to be taking a step back from the possibility of aggressive rate cuts. There was nothing decisive in the forward guidance included in the bank’s accompanying statement, regarding its intentions, yet Fed Chairman Powell in his press conference stated that the bank is in no hurry to cut rates enhancing somewhat the hawkish sentiment. Today we highlight the release of the US GDP advance rate for Q4 and a possible slowdown beyond market expectations could weigh on the USD and vice versa.

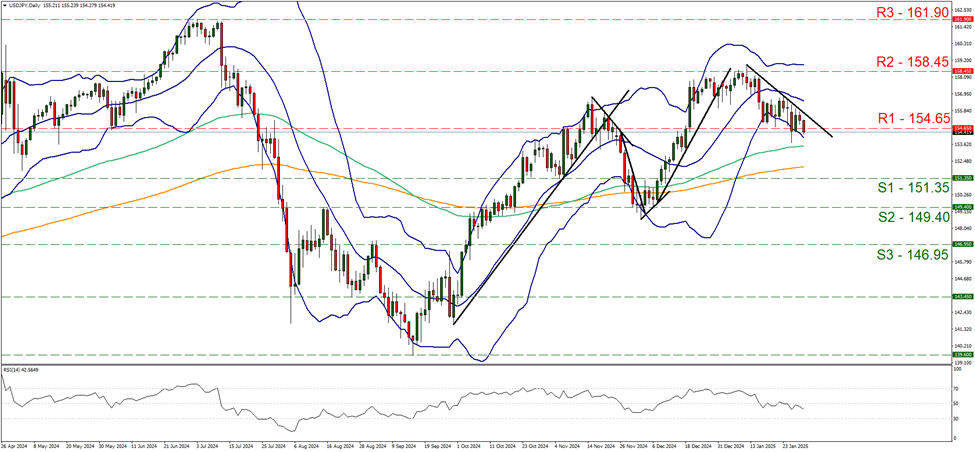

On a technical basis we note that USD/JPY in today’s Asian session, seems to have broken the 154.65 (S1) support line, now turned to resistance. The pair seems to have obeyed the commands of the downward trendline guiding it since the 10 of January. Also we note that the RSI indicator remains below the reading of 50 which may imply a bearish predisposition of the market for the pair. Hence we tend to maintain a bearish outlook for the pair as long as the prementioned downward trendline remains intact. Should the bears maintain control over the pair, we expect it to start actively aiming for the 151.35 (S1) support line. Should the bulls take over, we may see the pair rising breaking the prementioned downward trendline in a first signal that the downward tendencies of the pair have ended and continue to break the 154.65 (R1) resistance line and start aiming for the 158.45 (R2) resistance level.

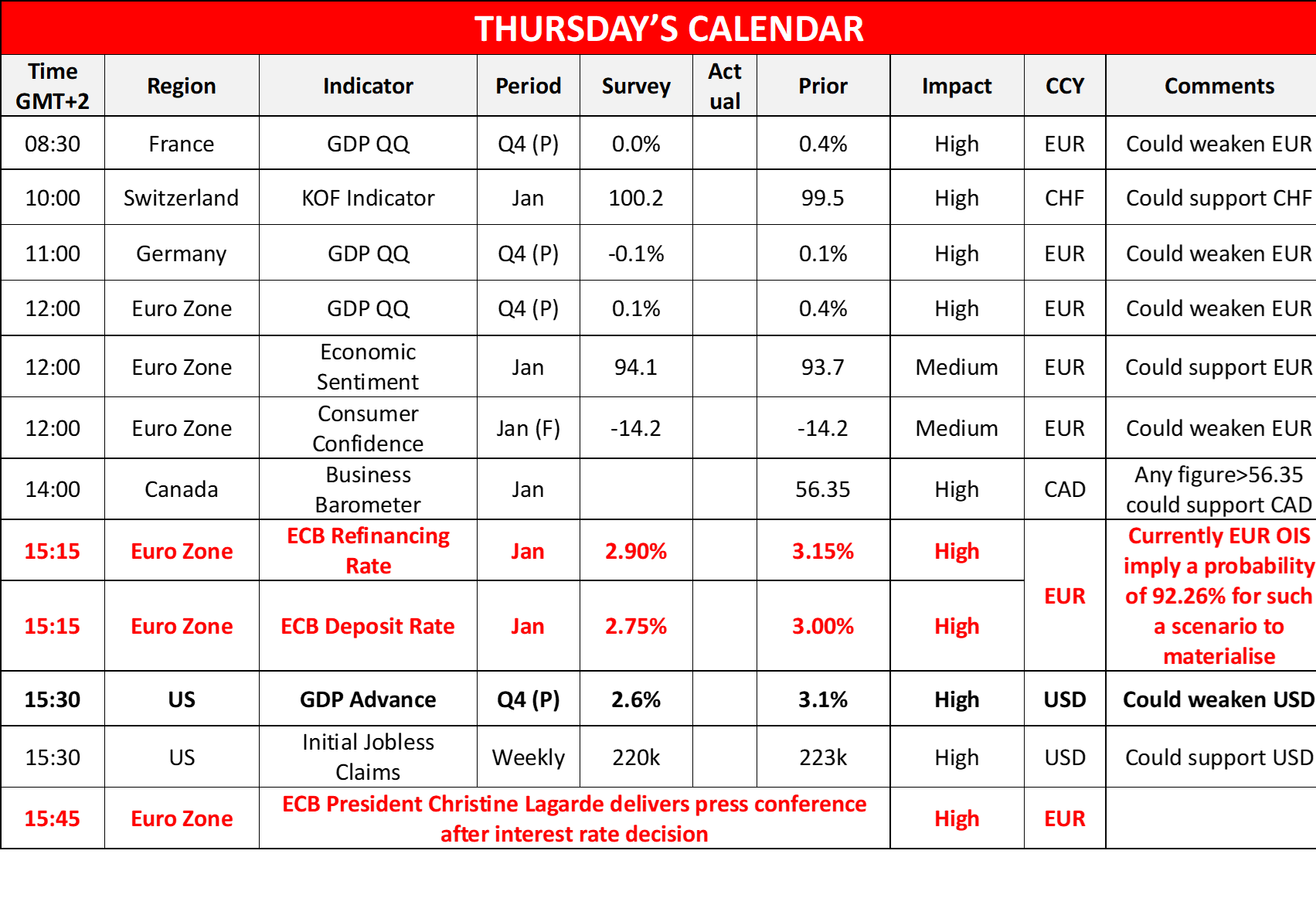

Today, we highlight ECB’s interest rate decision, and the bank is widely expected to cut its rates by 25 basis points and currently EUR OIS imply a probability of 92.6% for such a scenario to materialise. The market also expects the bank to proceed with another three rate cuts within the year. Please note that recently ECB policymakers have stated that Trump’s tariffs, should they be imposed, could expedite the bank’s rate-cutting path. Hence should the bank proceed with a 25-basis points rate cut as expected it could weigh on the EUR, yet we suspect that given that the market is expecting more rate cuts to come, attention is to be placed on the bank’s forward guidance in the bank’s accompanying statement and ECB President Lagarde’s press conference later on. So volatility for EUR pairs is expected to be extended beyond the time of the release as such. Should the accompanying statement and Lagarde’s press conference be characterised by sufficient dovishness to verify or surpass the market’s expectations we may see the bearish tendencies for EUR being enhanced. On the other hand, we note a persistence of inflationary pressures in the EuroZone which may force the bank to ease its dovishness, thus supporting the EUR.

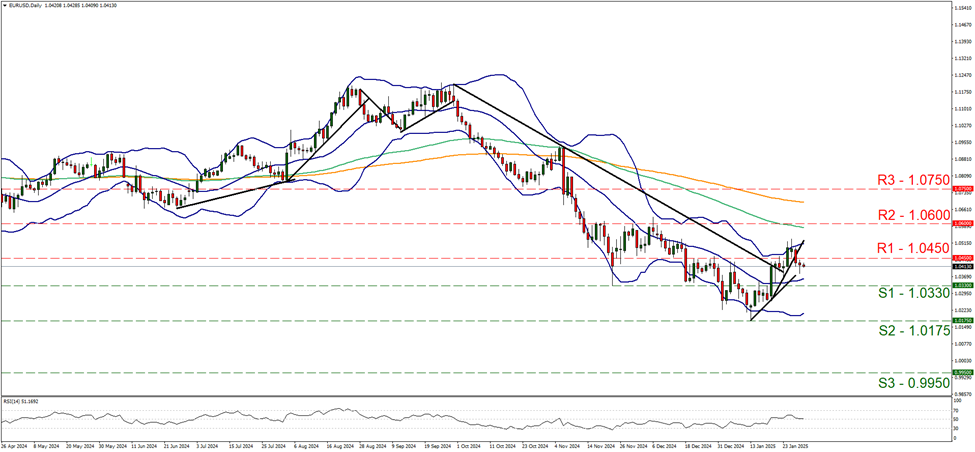

After breaking the 1.0450 (R1) support line and reversing its role to a resistance line, EUR/USD seems to have stabilised somewhat just below it. The RSI indicator seems to be running along the reading of 50, implying a relatively indecisive market. Hence for the time being we tend to maintain a bias for a sideways motion, we expect that the ECB’s interest rate decision may play a key role in the forming of the pair’s new direction. Should the bulls take over, we may see EUR/USD breaking the 1.0450 (R1) resistance line and a form a higher peak by aiming for the 1.0600 (R2) resistance level. Should the bears be in charge, we may see EUR/USD aiming if not breaching the 1.0330 (S1) support line paving the way for the 1.0175 (S2) support level.

その他の注目材料

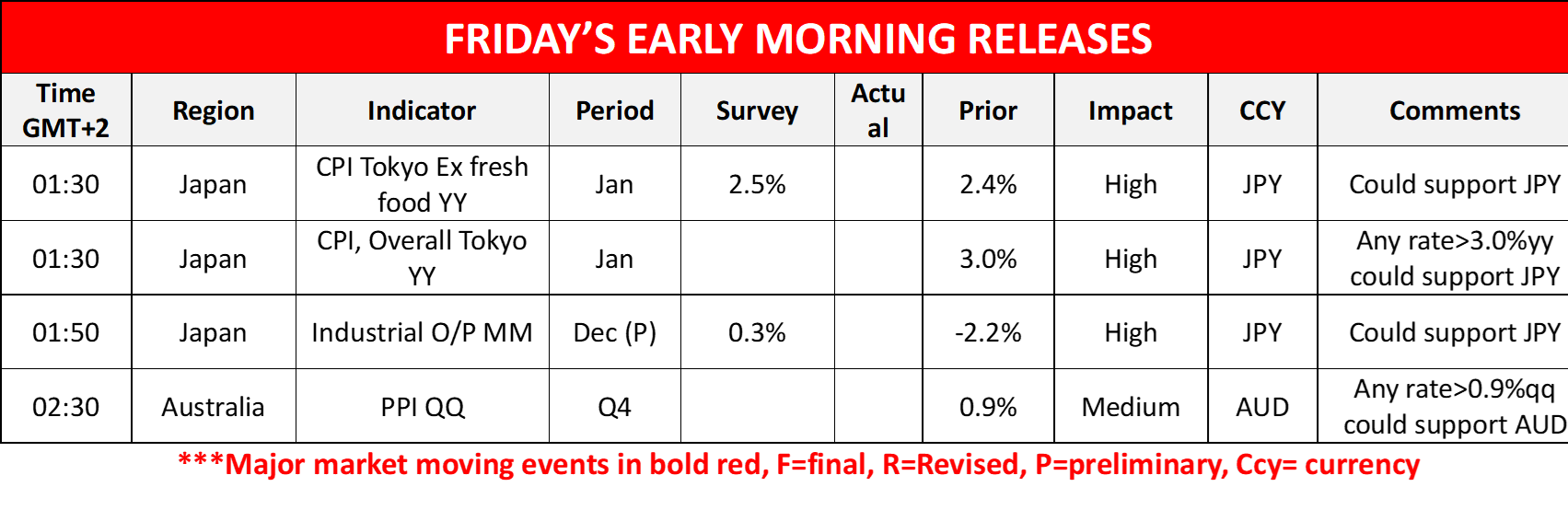

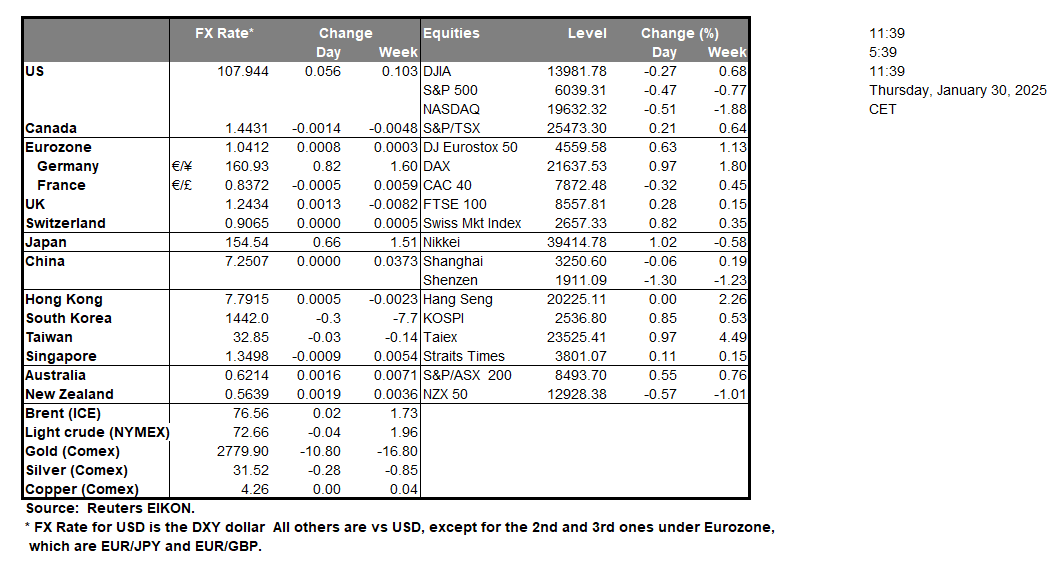

Today in the European session, we note the release of the preliminary GDP rates for France, Germany and the Eurozone as a whole for Q4 and Switzerland’s KOF indicator for January. Later on, we note the release of Canada’s Business Barometer for January and from the US the weekly initial jobless claims figure and highlight the release of GDP advance rate for Q4. In tomorrow’s Asian session, we note the release from Japan of Tokyo’s CPI rates for January and the preliminary industrial output growth rate for December as well as Australia’s PPI rates for Q4.

USD/JPY Daily Chart

- Support: 151.35 (S1), 149.40 (S2), 146.95 (S3)

- Resistance: 154.65 (R1), 158.45 (R2), 161.90 (R3)

EUR/USD デイリーチャート

- Support: 1.0330 (S1), 1.0175 (S2), 0.9950 (S3)

- Resistance: 1.0450 (R1), 1.0600 (R2), 1.0750 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。