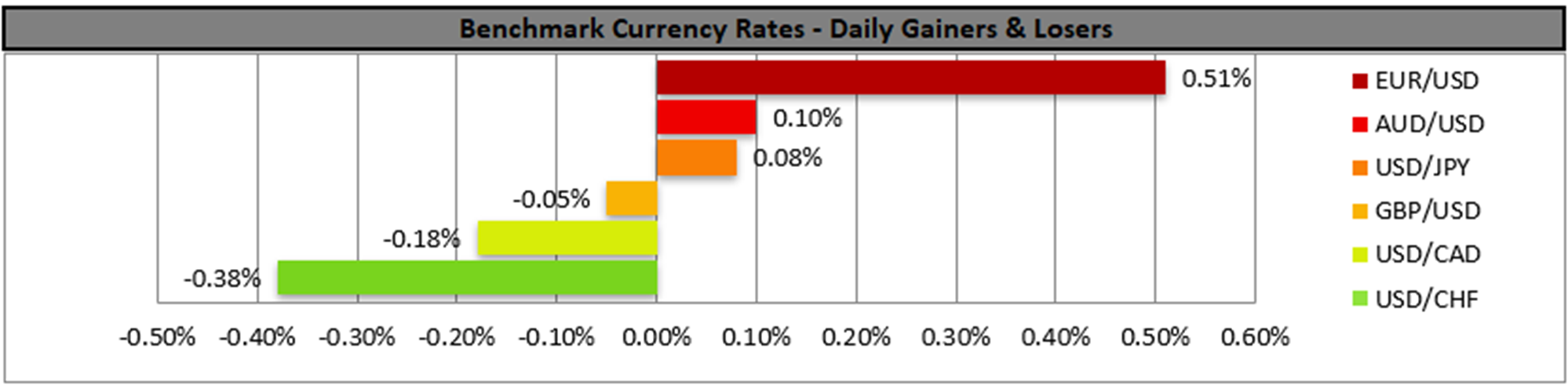

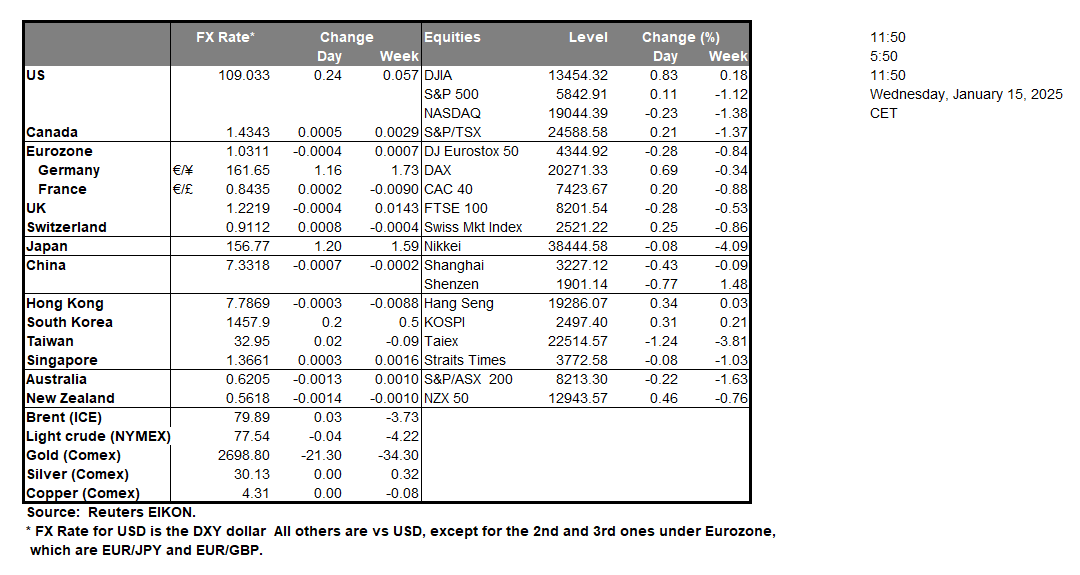

The USD edged higher after the release of the release of December’s PPI rates in the US. The signals sent were kind of mixed as the rates accelerated both on a headline and core level, yet failed to reach the market’s expectations. Nevertheless, the release implied a resilience of inflationary pressures on a producer’s level. Attention today turns to the release of the US CPI rates for December and an acceleration is expected on a headline level while the core rate is expected to remain unchanged. Should the rates show a resilience of inflationary pressures on a consumer’s level, and if combined with the release of the hotter-than-expected employment data for December we may see the release adding additional pressure to ease further its rate-cutting path over 2025, if not remain on hold. An acceleration of the CPI rates could provide support for the USD in the FX market and at the same time may weigh on gold’s price and US equities. Yet equity traders may also be interested in the release of the earnings reports of major US banks such as JPMorgan (#JPM), Wells Fargo & Co (#WFC), Goldman Sachs (#GS) and Citigroup (#C) which signals the start of the earnings season.

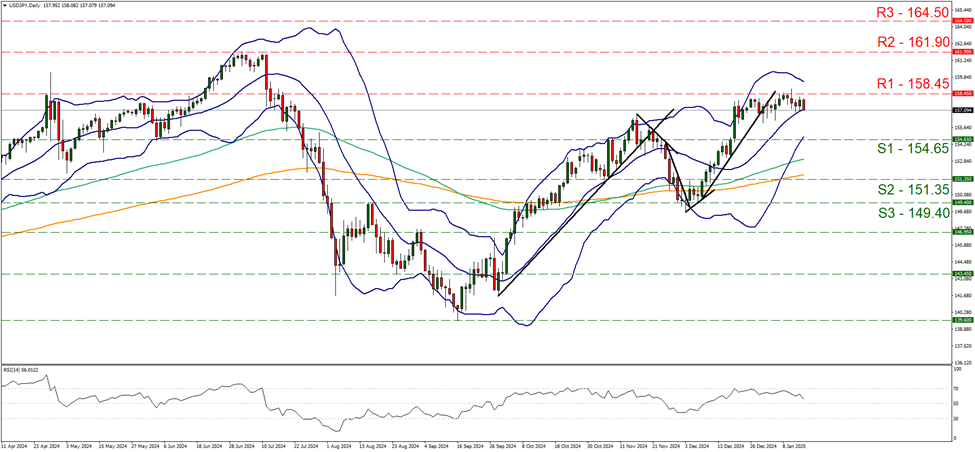

USD/JPY edged lower during today’s Asian session, abandoning the 158.45 (R1) resistance line hence we issue a warning for any possible bearish tendencies of the pair. For the time being we maintain our bias for the sideways motion to be maintained and the RSI indicator is correcting lower, aiming for the reading of 50, implying a considerable easing of the bullish sentiment of the market for the pair. Also the Bollinger bands have started to converge reflecting the lower volatility of the pair’s price action, which if continued could allow the sideways motion to be maintained. Should the bulls take over, we may see USD/JPY breaking the 158.45 (R1) resistance line and start aiming for the 161.90 (R2) resistance base. For a bearish outlook we would require the pair to break the 154.65 (S1) support line and start aiming for the 151.35 (S2) barrier.

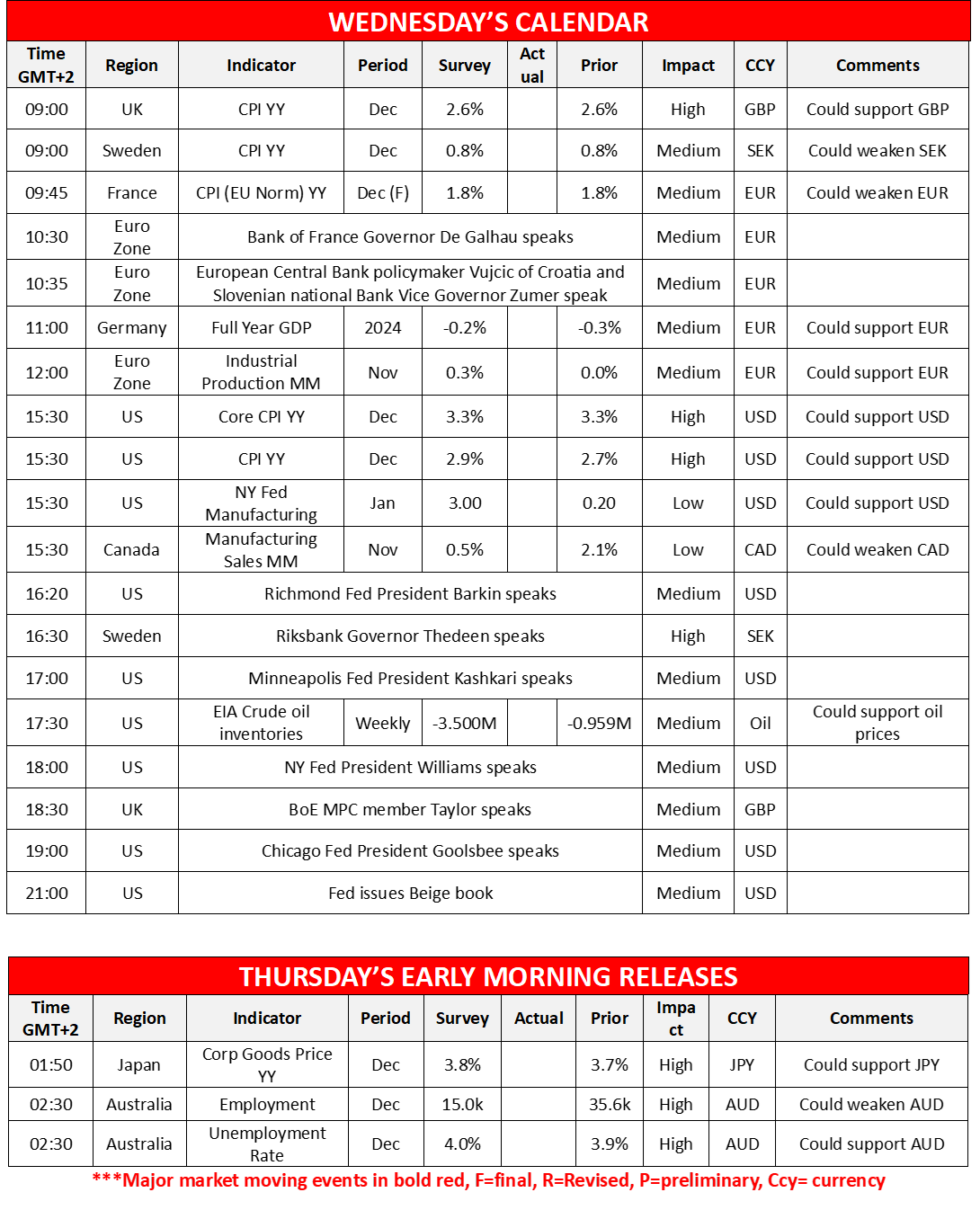

We also highlight the release of Australia’s employment data for December in tomorrow’s Asian session. The employment change figure is expected to drop to 15k if compared to November’s 35.6k and the unemployment rate to tick up to 4.0%. On the one hand the forecasts tend to point towards a loosening of the Australian employment market, which in turn may weigh on the Aussie, yet on the other, the data forecasted despite showing an expected deterioration, tend to imply a rather tight employment market which may allow RBA to remain on hold for longer thus clipping any possible losses for the Aussie.

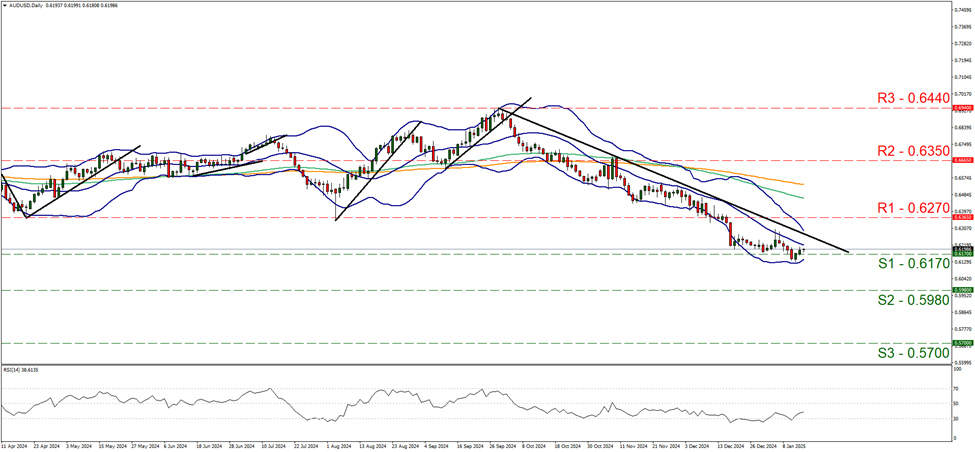

AUD/USD remained close to the 0.6170 (S1) support line despite edging a bit higher yesterday. We maintain a bearish outlook for the pair as long as the downward trendline incepted since the 30 of September, remains intact. Yet, we note that the RSI indicator bounced on the reading of 30 implying an easing of the bearish sentiment, yet remains below the reading of 50 implying the presence of a bearish predisposition of the market for the pair. Should the bears actually maintain control over the pair’s direction, we may see AUD/USD breaking the 0.6170 (S1) support line, opening the gates for the 0.5980 (S2) support level. For a bullish outlook we would require the pair to reverse direction by breaking initially the prementioned downward trendline, in a first signal that the downward motion has been interrupted and continue to break the 0.6270 (R1) resistance line, thus paving the way for the 0.6350 (R2) resistance hurdle.

その他の注目材料

Today we note the release of UK’s and Sweden’s CPI rates as well as France’s HICP rate all for December, Germany’s full GDP rate for 2024, Euro Zone’s industrial output for November, from the US the NY Fed manufacturing index for January, Canada’s manufacturing sales for the same month and for oil traders the weekly EIA crude oil inventories. On the monetary front, we note a number of ECB and Fed policymakers which are scheduled to speak, while the Fed is to issue its Beige Book. In tomorrow’s Asian session, we get Japan’s corporate goods prices growth rate for December.

USD/JPY Daily Chart

- Support: 154.65 (S1), 151.35 (S2), 149.40 (S3)

- Resistance: 158.45 (R1), 161.90 (R2), 164.50 (R3)

AUD/USD デイリーチャート

- Support: 0.6170 (S1), 0.5980 (S2), 0.5700 (S3)

- Resistance: 0.6270 (R1), 0.6350 (R2), 0.6440 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。