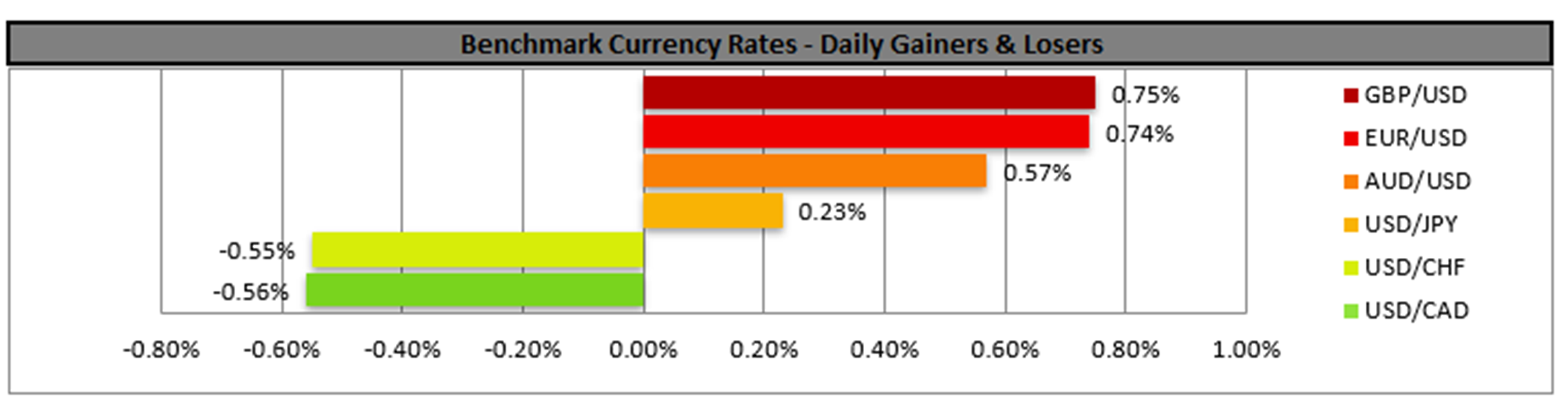

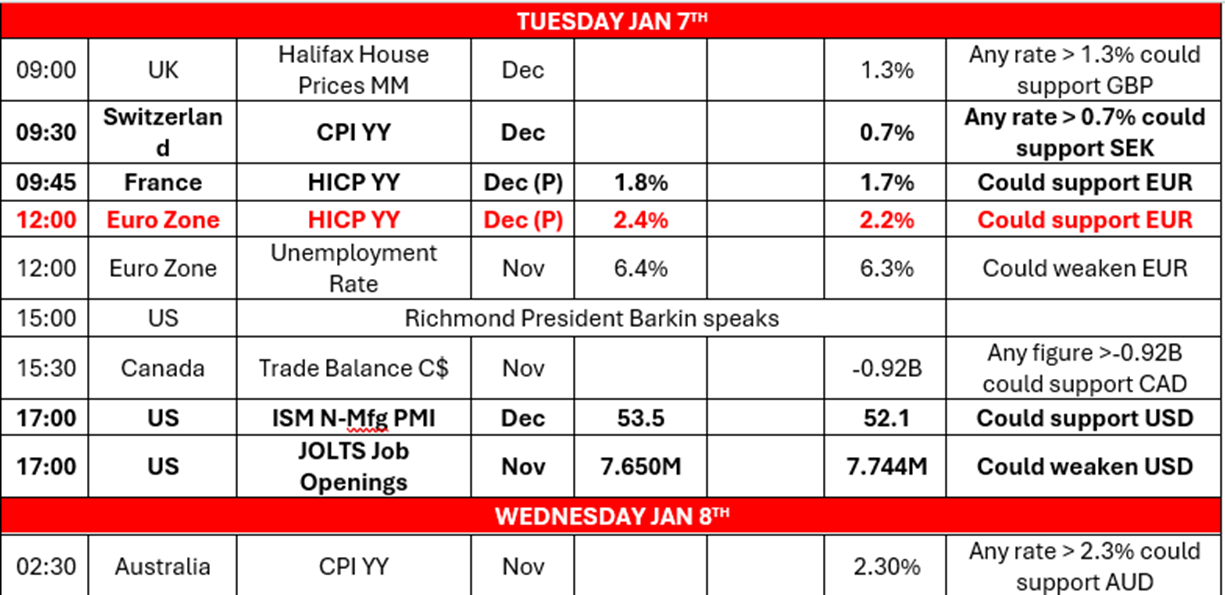

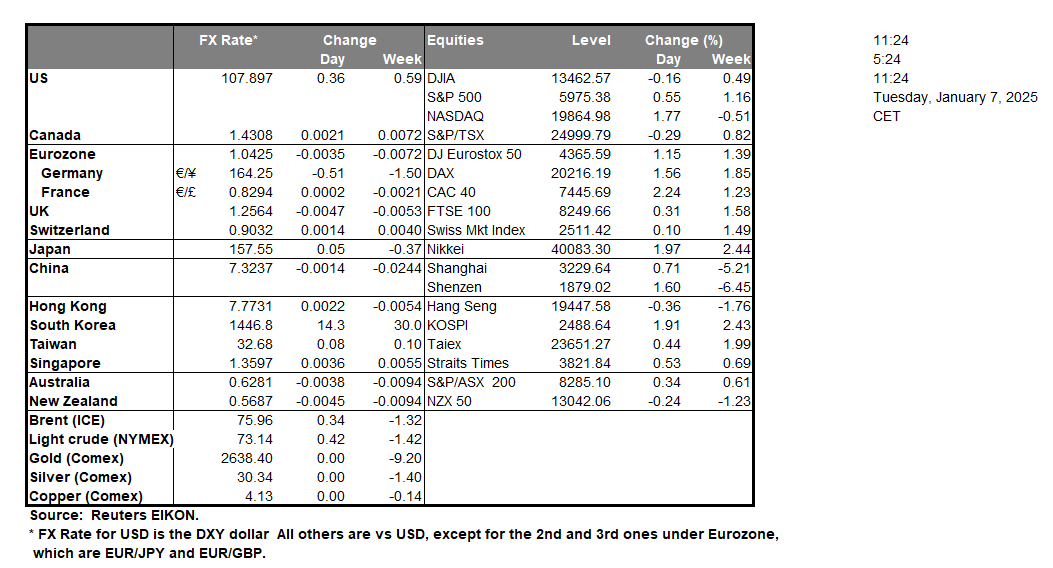

In a not-so-surprising turn of events, Canadian Prime Minister Justin Trudeau announced yesterday that he would be stepping down both as Prime Minister and Liberal party leader. Trudeau has stated per Reuters that he will be staying on in an official capacity for both roles until the party chooses a new chief within the next few months. Canada’s progressive policies appear to have fallen out of favour, with recent polling per CBC News showcasing the opposition party the Conservatives, leading polls at 44.2% versus the Liberal party’s 20.1%. The significant gap between the two main parties appears to have facilitated infighting within the Labour party. The announcement appears to have been well received by the markets, with the CAD rallying against the USD during yesterday’s trading session. In our view, we would not be surprised to see the Conservatives coming into power with the Canadian people possibly heading for early elections. Over in the Eurozone, Germany’s preliminary HICP rate for December came in hotter than expected and higher than the prior reading by coming in at 2.9% versus the expected rate of 2.5% and the prior rate of 2.4%. The hotter-than-expected inflation print may increase pressure on the ECB to err on the side of caution in regards to future rate cuts and thus may aid the EUR. Moreover, of interest may be the Zone’s preliminary HICP rate for December which is due out during today’s European session. Should the HICP rate for the Zone confirm the narrative that inflation has accelerated, it could further aid the EUR as it may imply that the ECB could take a more gradual rate-cutting approach. Shifting towards the US, we would like to note that the US JOLT’s job openings figure for November is due out later on today. The expectations by economists are for the figure to come in at 7.650M which would be lower than the prior figure of 7.744M and thus may imply an easing labour market. In turn this could weigh on the greenback.

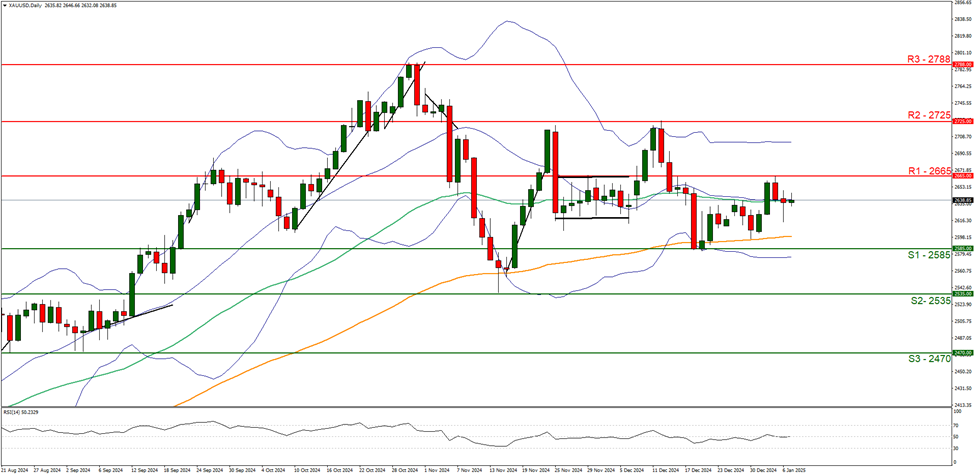

XAU/USD appears to be moving in a sideways fashion. We opt for a neutral outlook for the precious metal’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50 implying a neutral market sentiment. Moreover, we note that the precious metals price has failed to break above our 2665 (R1) resistance line. For our sideways bias to continue we would require the precious metal’s price to remain confined between the 2585 (S1) support level and the 2665 (R1) resistance line. On the flip side, for a bullish outlook we would require a clear break above the 2665 (R1) resistance line with the next possible target for the bulls being the 2725 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below the 2585 (S1) support line with the next possible target for the bears being the 2535 (S2) support base.

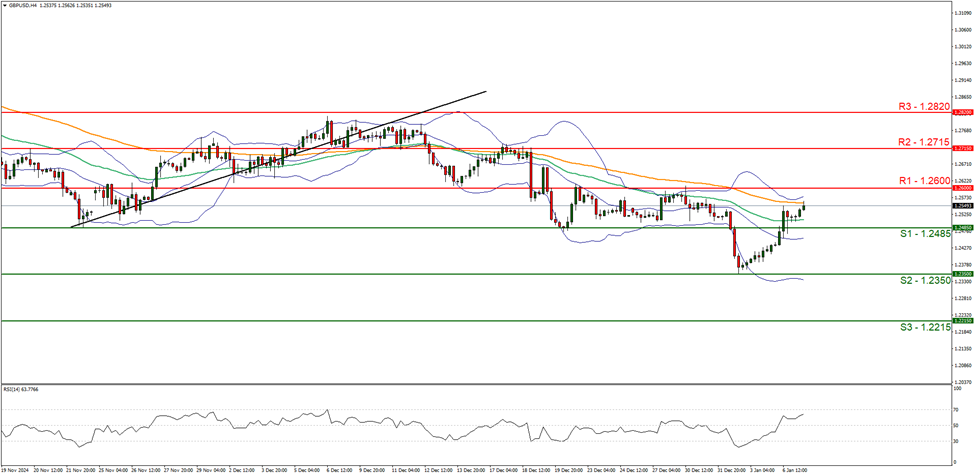

GBP/USD appears to be moving in an upwards fashion, having failed to break below our 1.2350 (S2) support level and re-emerging above our 1.2485 (S1) support line. We opt for a bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure above 60, implying a bullish market sentiment. For our bullish outlook to continue we would require a clear break above the 1.2600 (R1) resistance line with the next possible target for the bulls being the 1.2715 (R2) resistance level.On the flips die for a bearish outlook we would require a clear break below the 1.2485 (S1) support level, with the next possible target for the bears being the 1.2350 (S2) support base.

その他の注目材料

In today’s trading session, we get the UK’s Halifax house prices , Switzerland’s CPI rate, France’s and the Eurozone’s preliminary HICP rates all for December, the Eurozone’s unemployment rate for November , Canada’s trade balance figure for November, the US ISM Non-Manufacturing PMI figure for December and the US JOLTs Job Openings for November. In tomorrow’s Asian session we would like to note Australia’s CPI rate for November.

XAU/USD Daily Chart

- Support: 2585 (S1), 2535 (S2), 2470 (S3)

- Resistance: 2665 (R1), 2725 (R2), 2788 (R3)

GBP/USD Daily Chart

- Support: 1.2485 (S1), 1.2350 (S2), 1.2215 (S3)

- Resistance: 1.2600 (R1), 1.2715 (R2), 1.2820 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。