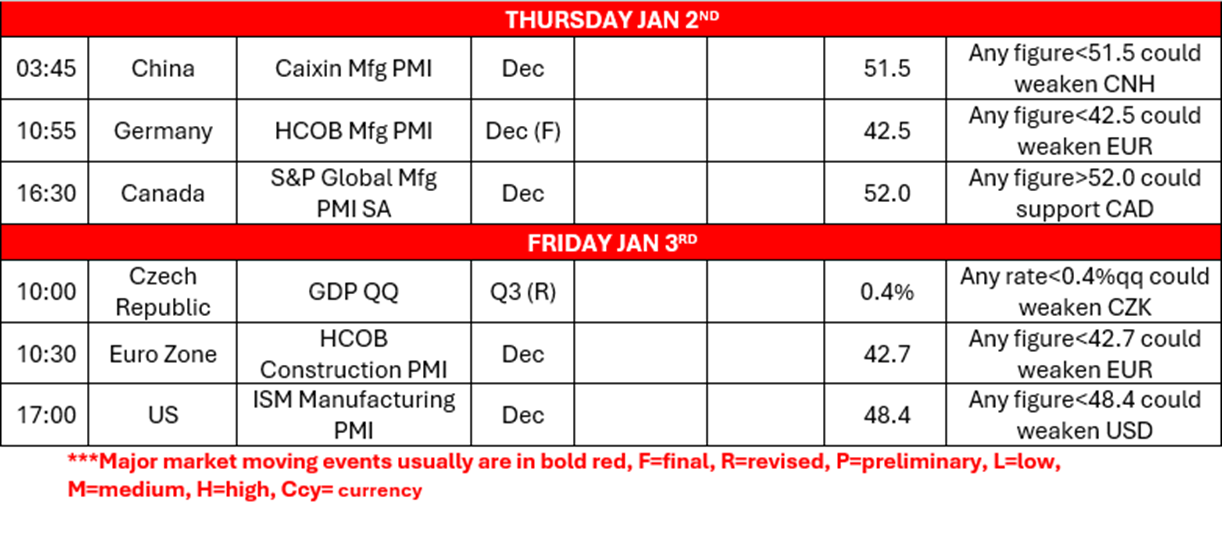

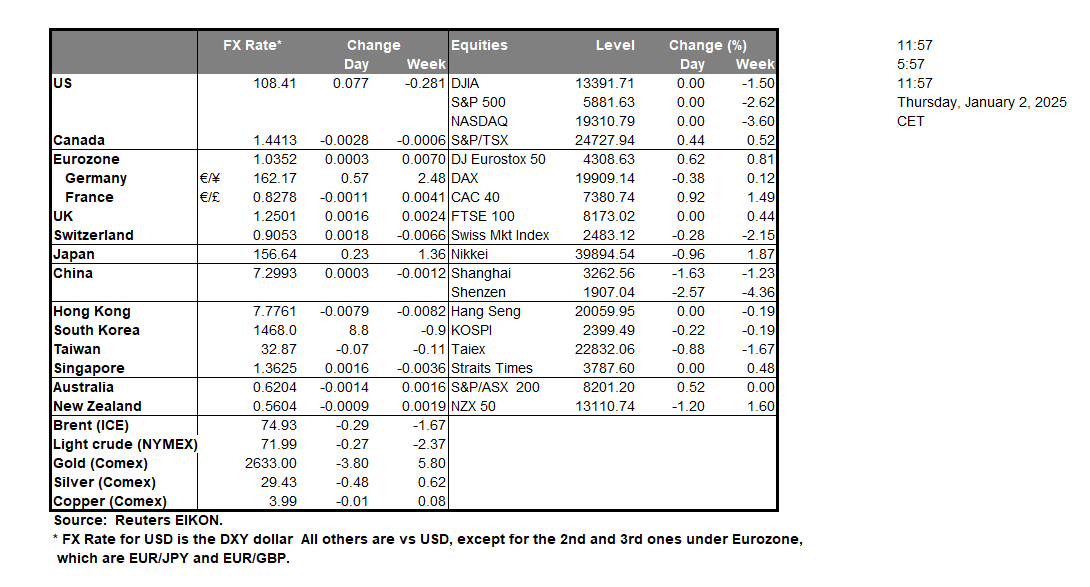

Today we would like to note the release of the US S&P final manufacturing figure for December which is due out later on today during the American session. The financial release is the ‘final figure’ as such should we see the figure coming in as expected at 48.3 it may have little impact on the financial markets. However, should the financial release come in lower than expected, implying a widening contraction of the US manufacturing sector, it could weigh on the dollar. On the flip side should it come in higher than the aforementioned figure of 48.3, it could instead aid the greenback. Over in China, the country’s NBS manufacturing PMI figure for December came in lower than expected at 50.1 versus the expected figure of 50.3 and lower than the prior figure as well. The lower-than-expected figure, despite remaining in expansion territory, may keep concerns elevated for the Chinese economy as 2025 begins. In turn the lower-than-expected figure could weigh on the CNY as well as the Aussie given their close economic ties. Moreover, the release of the Caixin manufacturing figure for the same month which was released during today’s Asian session, tended to confirm the aforementioned worries in regards to the Chinese manufacturing sector. In particular, the figure came in at 50.5 versus the expected figure of 51.6.In the UK, the nationwide house prices index rate for December was released during today’s early European trading session. On a year-on-year level the rate came in higher than expected at 4.7% versus 3.8% and thus may be somewhat of a positive note for the UK economy and thus could potentially aid the pound. In the US Equities market, Apple (#AAPL) per Reuters, is offering iPhone discounts in China in a 4-day promotion which will be running from the 4 会議中、米ドル指数は月間最高値を更新し、金価格は会見中および会見後に約25ドル下落した。 of January 2025, as competition with Huawei heats up. The possibility of increased sales may be perceived as a positive for the company’s stock price in the short run.

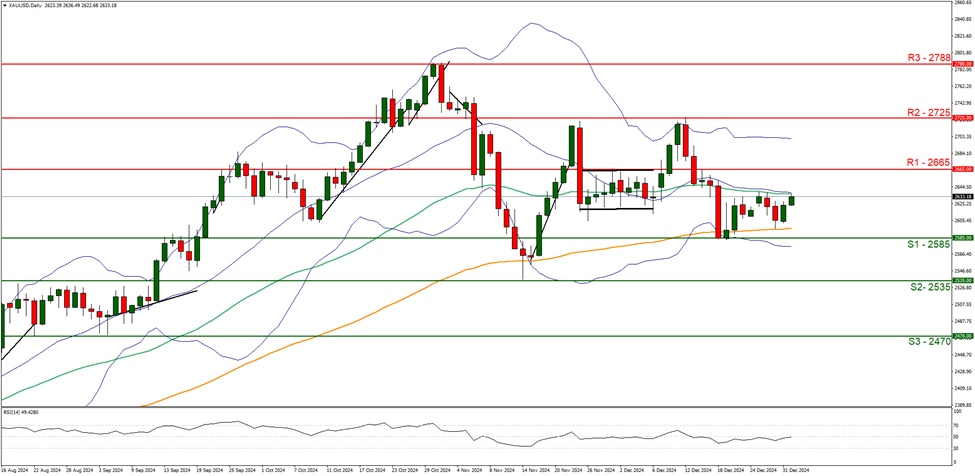

XAU/USD appears to be moving in a predominantly sideways motion as seen by the commodity’s failure to break below the 2585 (S1) support level and may be currently moving to test our 2665 (R1) resistance line. We opt for a sideways bias for the precious metal’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to continue, we would require the precious metal’s price to remain confined between the 2585 (S1) support level and the 2665 (R1) resistance line. On the flip side, for a bullish outlook we would require a clear break above the 2665 (R1) resistance line with the next possible target for the bulls being the 2725 (R2) resistance level. Lastly, for a bearish outlook, we would require a clear break below the 2585 (S1) support level, with the next possible target for the bears being the 2535 (S2) support line.

EUR/USD appears to be moving in a predominantly downwards fashion. We opt for a bearish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure close to 40 implying a strong bearish market sentiment. Moreover, further aiding our bearish outlook is our downwards moving trendline which was incepted on the 6 of December in 2024. For our bearish outlook to continue, we would require a clear break below the 1.0330 (S1) support level, with the next possible target for the bears being the 1.0195 (S2) support line. On the flip side, for a sideways bias we would require the pair to remain confined between the 1.0330 (S1) support level and the 1.0450 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 1.0450 (R1) resistance line with the next possible target for the bulls being the 1.0595 (R2) resistance level.

その他の注目材料

In today’s trading session, we get Germany’s final manufacturing PMI figure for December, Canada’s manufacturing PMI figure as well as the US S&P final manufacturing PMI figure both for December as well.

XAU/USD Daily Chart

- Support: 2585 (S1), 2535 (S2), 2470 (S3)

- Resistance: 2665 (R1), 2725 (R2), 2788 (R3)

EUR/USD デイリーチャート

- Support: 1.0330 (S1), 1.0195 (S2), 1.0070 (S3)

- Resistance: 1.0450 (R1), 1.0595 (R2), 1.0720 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。