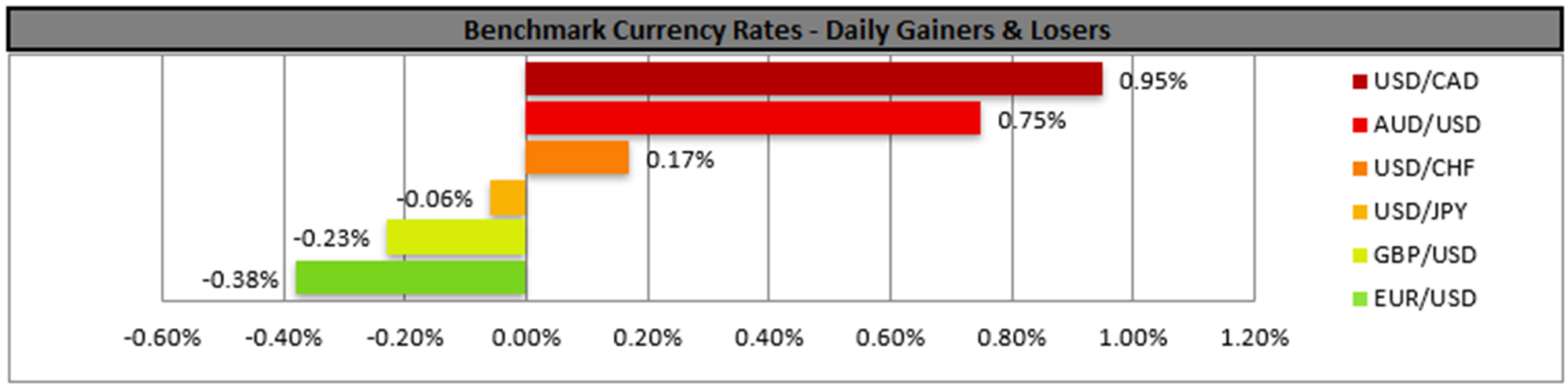

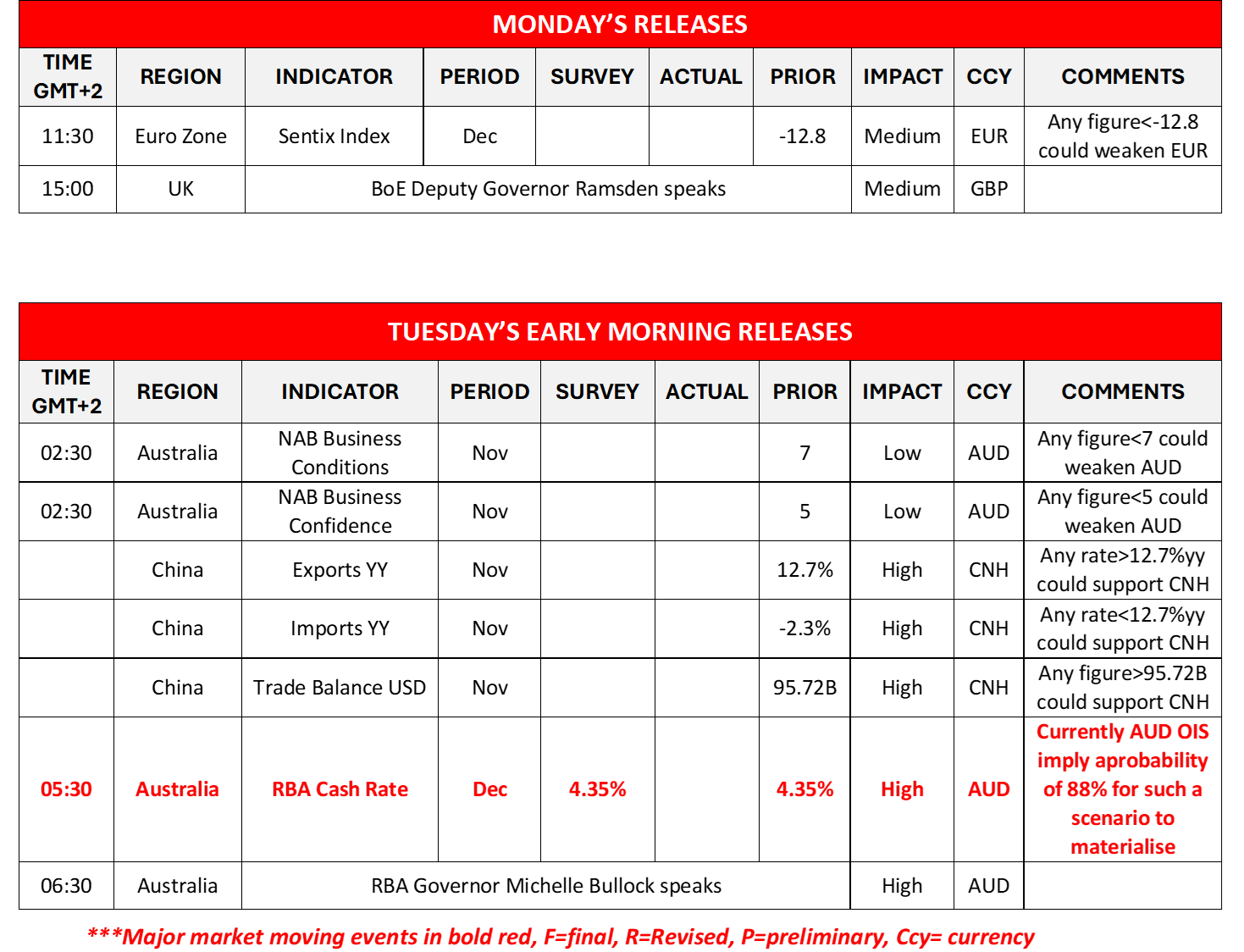

The USD seems to be extending its gains against other currencies in the FX market as November’s employment report came in stronger than expected. Practically, the NFP topped expectations, yet the tick-up of the unemployment rate may have clipped some of USD’s bullish movement. Overall, we are entering a week with a heavy calendar, as the US CPI rates for November are to be released on Wednesday while we also highlight the interest rate decisions of BoC from Canada and the ECB from the Euro Zone on Wednesday and Thursday respectively. We make a start with RBA’s interest rate decision in tomorrow’s Asian session. The bank is expected to remain on hold and AUD OIS imply a probability of 90.3% for such a scenario to materialise. Should the bank remain on hold as expected, we may see the market attention turning to the accompanying statement and RBA Governor Bullock’s press conference later on. The bank may be the only one among its peers keeping rates high, hence should the bank opt to adopt a hawkish tone, highlighting the bank’s readiness to keep rates high for longer we may see the Aussie getting some support as interest rate differentials may favour it. On the flip side should the bank choose to signal that a rate cut is coming, it could take the markets by surprise and weaken the AUD asymmetrically.

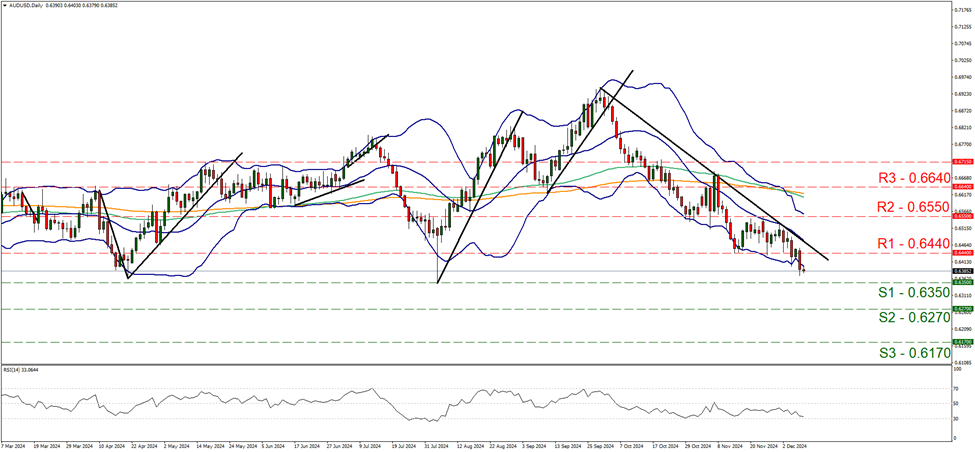

AUD/USD dropped on Friday clearly breaking the 0.6440 (R1) support line now turned to resistance. Given the strong downward trendline guiding the pair lower since the end of September, we maintain a bearish outlook for the pair. Furthermore we note that the RSI indicator is nearing the reading of 30, implying an enhancement of the bearish sentiment of the market for the pair. Should the bears maintain control over the pair as expected, we may see it breaking the 0.6350 (S1) support line and aiming for the 0.6270 (S2) support level. The bar is high for a bullish outlook as for its adoption the pair’s price action would have to break the 0.6440 (R1) resistance line, continue to also break clearly the prementioned downward trendline signaling an interruption of the downward movement and continue to break also the 0.6550 (R2) resistance level.

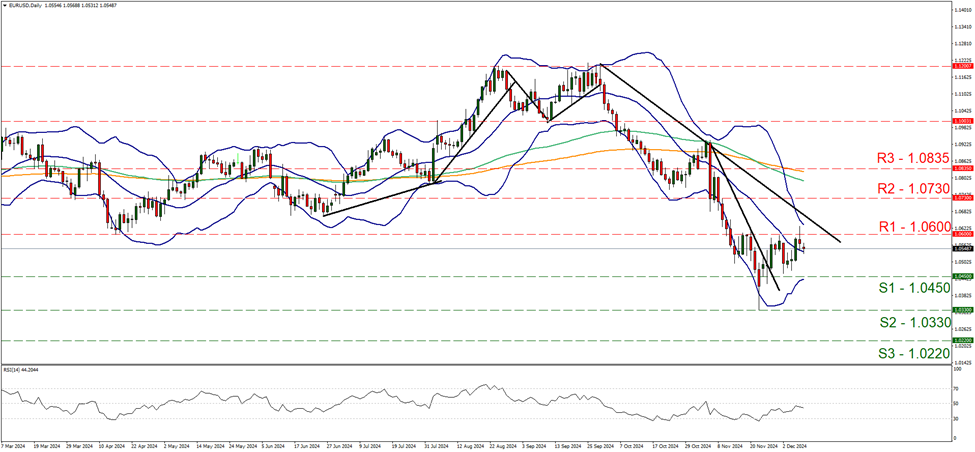

EUR/USD dropped on Friday after hitting a ceiling at the 1.0600 (R1) resistance line. We opt to maintain our bias for a sideways motion, while the RSI indicator currently remains below the reading of 50, implying a slight bearish market sentiment yet nothing convincing for the bears. For a bearish outlook we would require a clear break below the 1.0450 (S1) support level with the next possible target for the bears being the 1.0330 (S2) support line. On the flip side for a bullish outlook we would require a clear break above the 1.0600 (R1) resistance line and starting to aim for the 1.0730 (R2) resistance base.

その他の注目材料

On Tuesday, we get the Czech Republic’s November CPI rates. On Wednesday we get Japan’s Corporate Goods Price growth rate for November, BoC is to release its interest rate decision and we highlight the release of the US CPI rates for November. On Thursday we get Australia’s employment data for November, UK’s GDP rates for October, Sweden’s CPI rates for November, the weekly US initial jobless claims figure and the PPI rates for November while from Switzerland SNB and from the Eurozone ECB are to release its interest rate decisions. On Friday we get Japan’s Tankan manufacturing and non-manufacturing indexes for Q4, UK’s manufacturing output growth rate, Norway’s GDP rates, Euro Zone’s industrial output and Canada’s manufacturing sales and Whole trade growth rates, all being for October.

AUD/USD デイリーチャート

- Support: 0.6350 (S1), 0.6270 (S2), 0.6170 (S3)

- Resistance: 0.6440 (R1), 0.6550 (R2), 0.6640 (R3)

EUR/USD Daily Chart

- Support: 1.0450 (S1), 1.0330 (S2), 1.0220 (S3)

- Resistance: 1.0600 (R1), 1.0730 (R2), 1.0835 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。